Eyeing Up the 2024 Wheat Market

Grain markets ended 2023 on a soft with quiet trading and minimal headlines kept the champagne corked.

Improved forecasts for Brazil put a damper on bidding attempts in corn and soybeans, but one of Russia’s largest attacks on Ukrainian cities, including Kyiv, helped the wheat complex end the year in the green. For the month, Chicago Wheat was the best performer on the futures market, as stronger U.S. export sales helped fuel a bit of a short-covering rally.

This theme of limited rallies will likely continue, as markets have more grain to work through than this time a year ago. A better 2023 harvest than its predecessor has filled the bins, which has weighed on grain prices. As a result, when I think about marketing grain in 2024, I’m cognizant of the tighter margin I’m likely working with, and therein, a need to stay disciplined this year and look for singles, doubles, and possibly even a triple (I believe home runs will be very tough in the current environment).

From a weather standpoint, Mother Nature’s pendulum has swung back to El Nino, so what does that mean for us here at home, but also around the world in markets that compete with us? First, this means that the U.S. Southern Plains are likely to receive above-normal rainfall for the first time in three years, but the Eastern Corn Belt is likely going to trend drier (and it’s already dry there). A similar drier, above-average temperatures forecast is in store for Canada, which doesn’t replenish soil moisture, which most regions desperately need. Many farmers I spoke with at the end of 2023 told me how they’ve received some good snowpack but would prefer to see the rains fall in March and April instead. Regardless, moisture is needed by most Western Canadian farmers (but not all).

While the weather in South America looks to be challenging yield potential, I’m reminded of the tougher growing conditions seen previously in various areas globally, especially in North America, but how better agronomic practices and seed genetics still seem to produce a decent yield. Put another way, the usual weather premiums weren’t built in as heavily as historically seen, and that bet proved correct as good yields did show up at harvest. Soybean production will be less in Brazil than initially thought and what this likely translates to is more soybeans planted in the U.S this spring, given the ROI is better (presently). This also suggests that the heavy volley of U.S. Corn imports coming into Canada should slow down in the coming months and into the 2024/25 crop year.

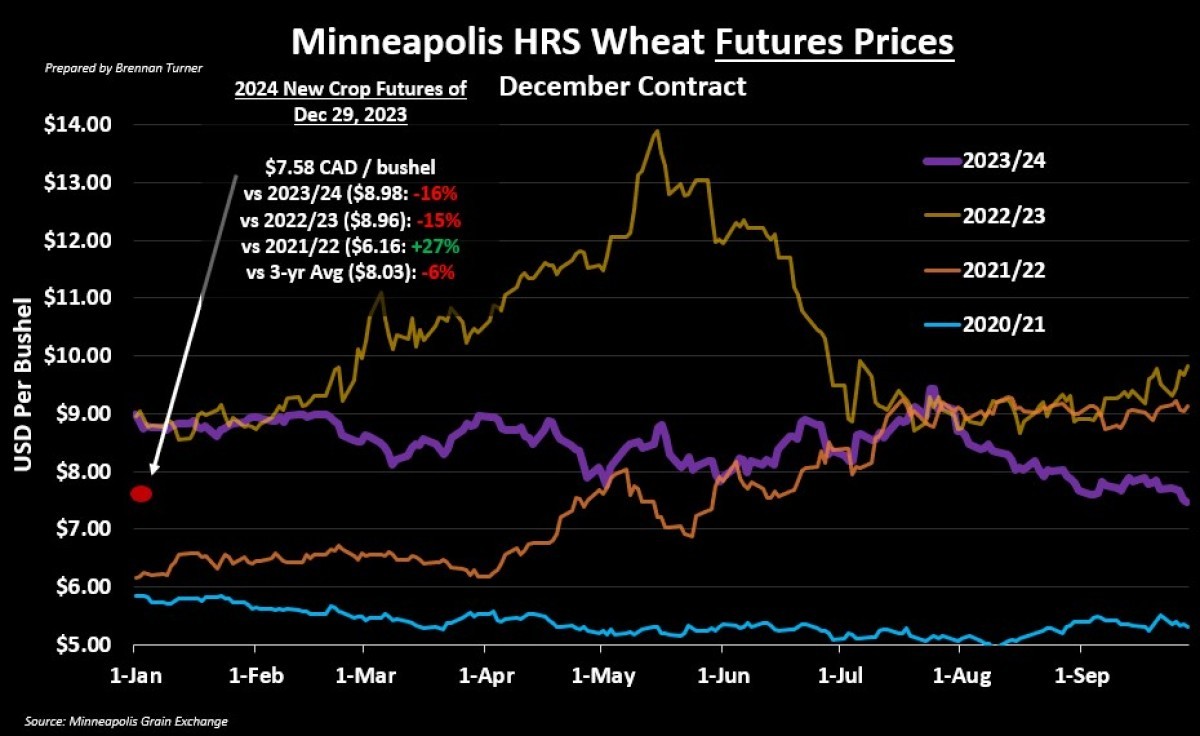

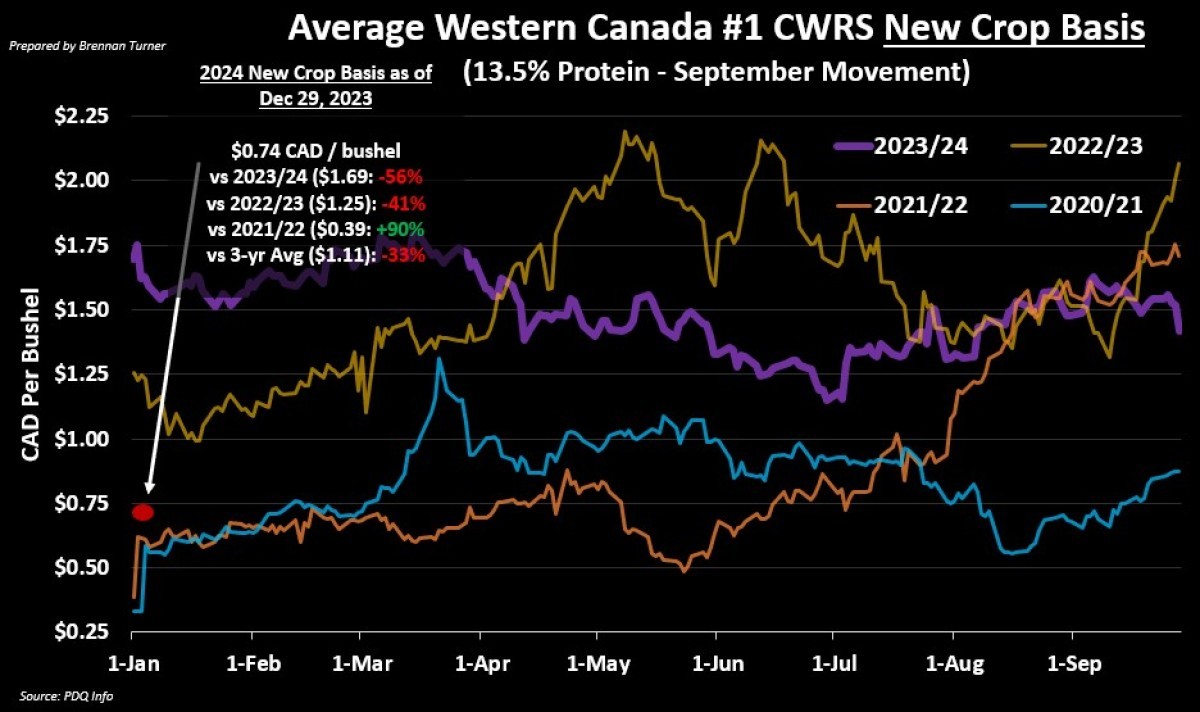

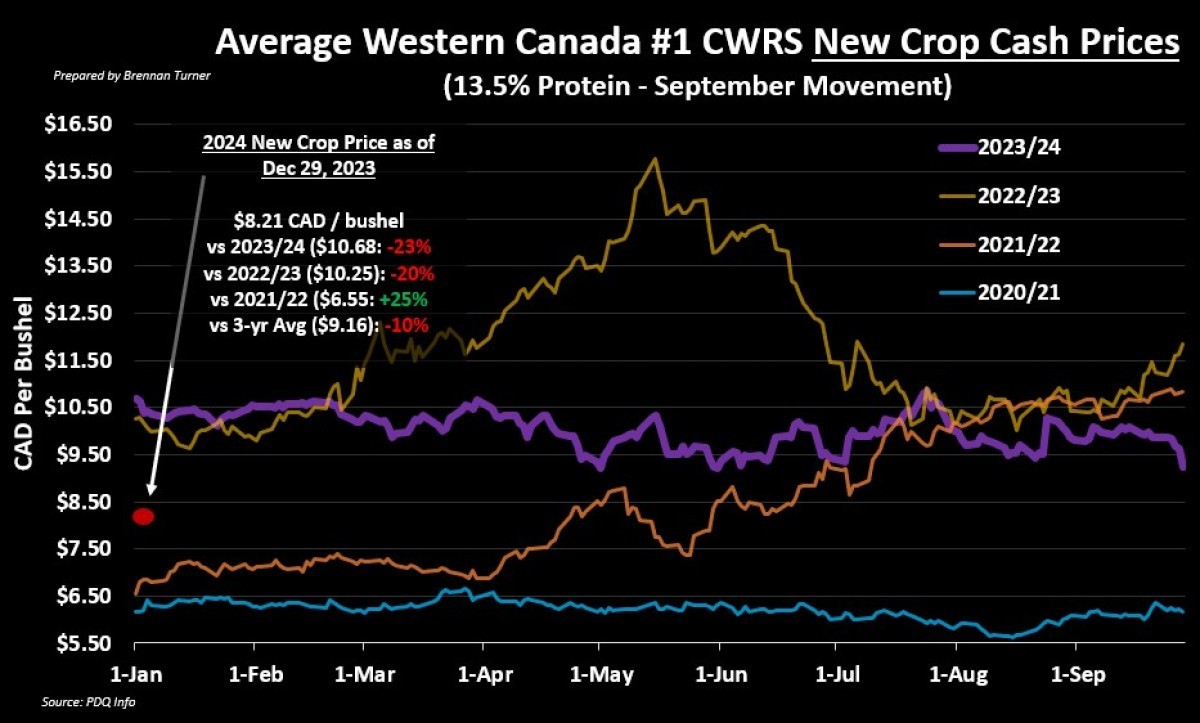

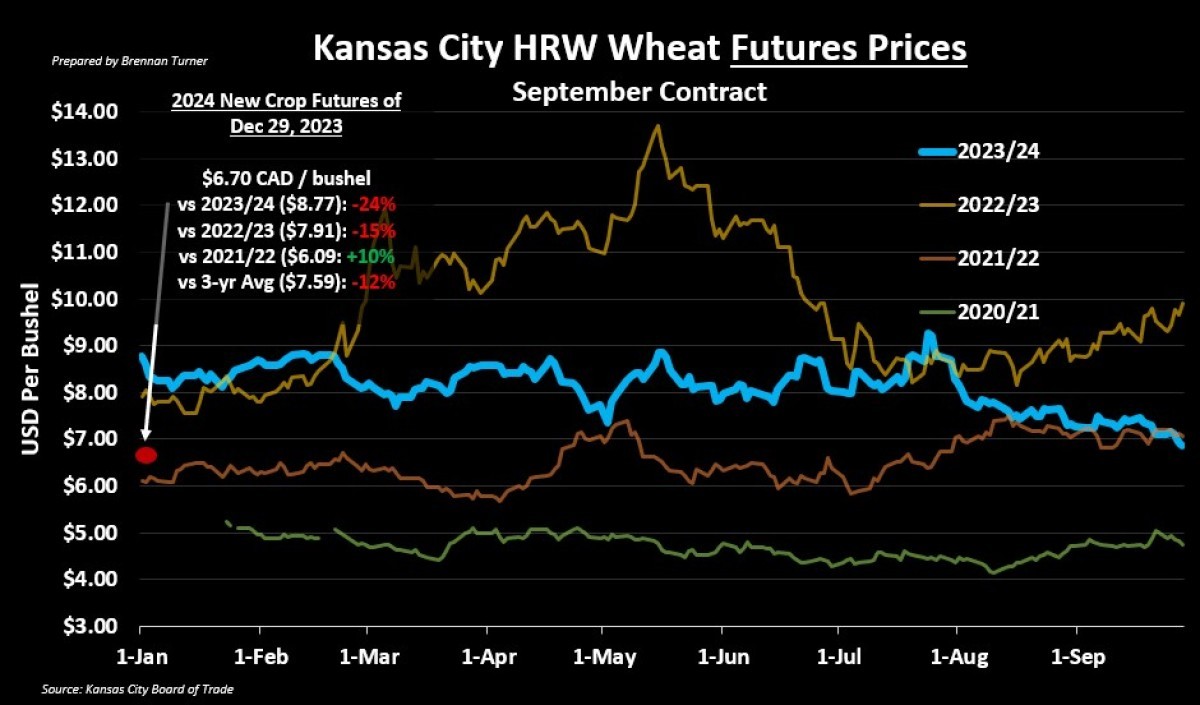

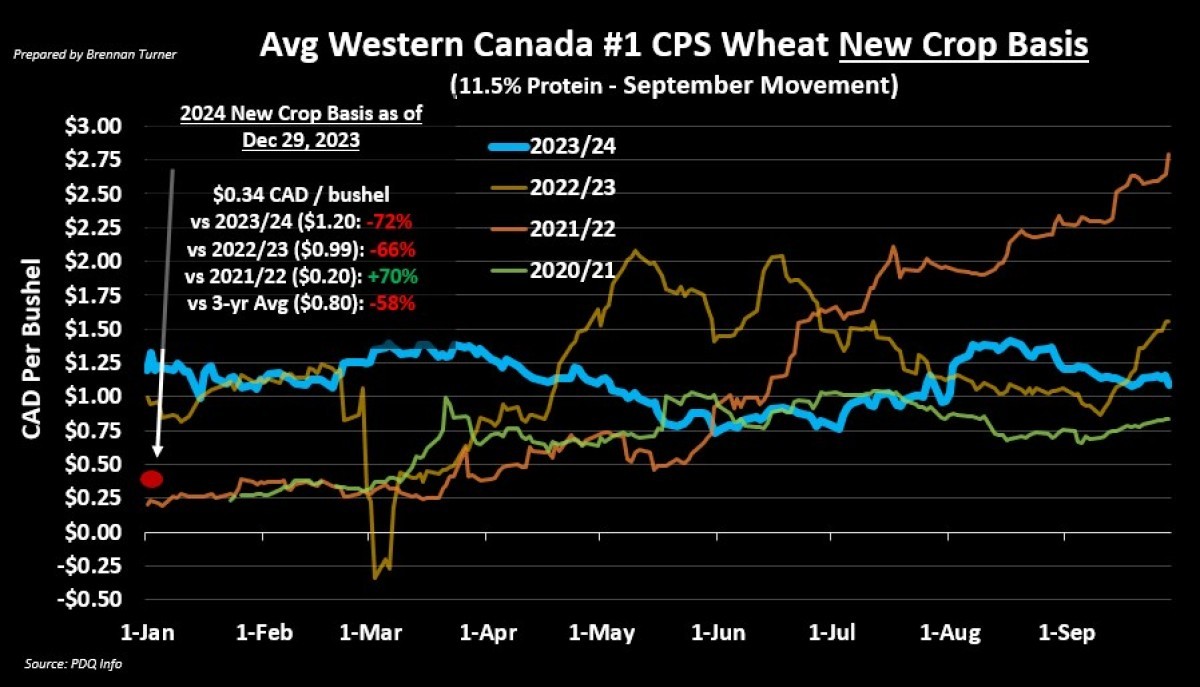

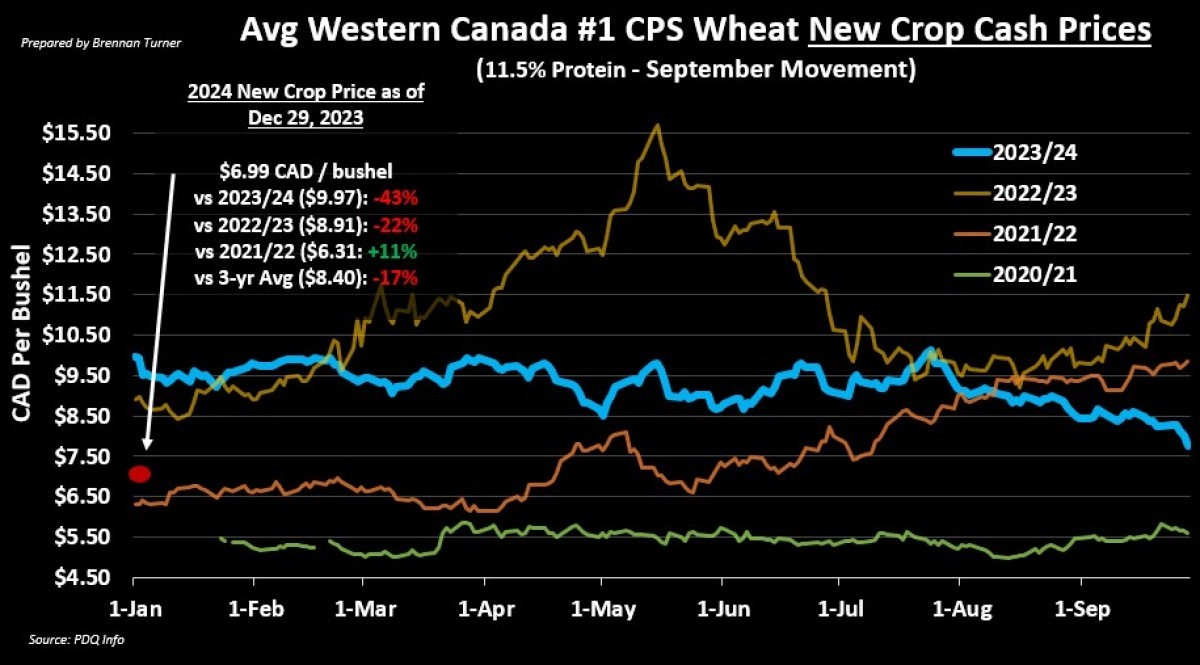

Looking specifically at 2024/25 new crop opportunities, December Hard Red Spring Wheat futures have trended slightly lower, save for two years ago when Russia invaded Ukraine. Year-over-year, the new crop futures contract lost about 16 per cent, but the average cash price for September delivery has fallen 23 per cent, with the basis currently being about half of what it was a year ago. With the basis in mind though, over the last few years, we have seen new crop levels slightly increase (see second chart below) as buyers look to lock in acres.

What could push back on the basis improving a bit? There is a lot of factors, like how much snow and or rain falls this winter, not just in spring wheat-producing regions but any region. In Europe, I’m watching what winter wheat acres got seeded this past wet fall (read: bullish), while Russian cheap exports are likely pushing European wheat stocks up (read: bearish). This was evidenced by the French Ministry of Agriculture bumping up their 2023/24 carryout above 3 MMT, the highest in eight years.

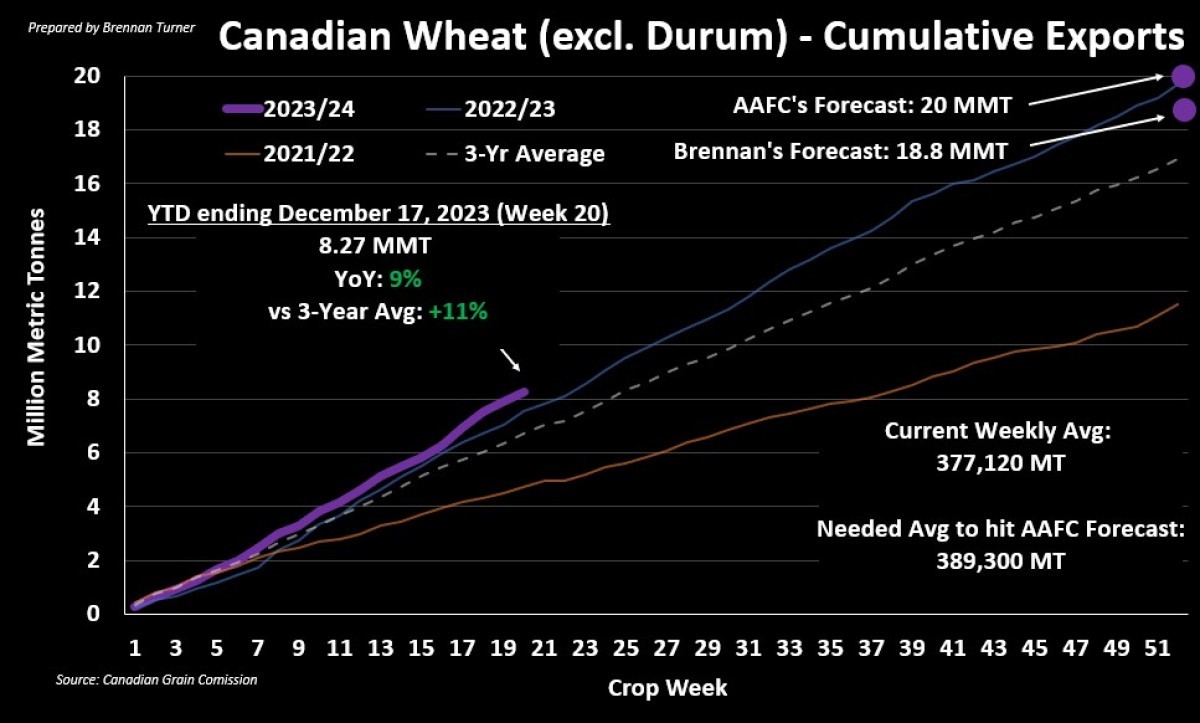

Also, U.S. Wheat futures could be driven higher if the U.S. Dollar continues to decline, and while it would likely impact Chicago and Kansas City wheat futures most, it’ll likely pull Minneapolis futures with it. The flip side is that this would likely strengthen the Canadian Loonie and thereby pressure Canada’s export competitiveness. While the AAFC thinks we’ll ship 20 MMT of non-durum wheat exports this year, I don’t think we’ll go that high, so carryout could be closer to 4 MMT, not 3.5 MMT. This would put pressure on domestic wheat prices, both nearby and fall delivery, all of which is to say that I’m likely locking in a cash price for 10 per cent – 20 per cent of my new crop, Hard Red Spring wheat acres in the next five to eight weeks.

For Canadian Prarie Spring wheat, the best new crop basis play seems to be around the end of March, but that would be contingent on your expectation that Kansas City Wheat futures will go higher. Admittedly, I’m skeptical this will happen, barring some major short-covering, as there is healthy precipitation in the long-range forecast. Thus, like Hard Red Spring wheat, I’m likely looking to price something in the next few months on the cash market for my low-protein wheat acres.

For old crop Canadian Prairie Spring wheat, if you need cash now and/or the limited carry isn’t worth waiting, you could consider a summer or fall call option to capture any Plant 2024 or summer weather premiums. However, as mentioned above, we saw some brutal weather last year, but seeing how yields turned out, traders won’t forget this. Thus, we’re more likely to trade sideways in winter and spring wheat over the next few months as the market continues to digest just how much the world has produced in 2023/24 (looking at you Australia and Argentina!). If a weather premium does show up, it will start getting talked about in April but likely won’t get significant legs until mid-May to early June. If those weather premiums do materialize, this would be when I would likely make any other old or new crop sales.

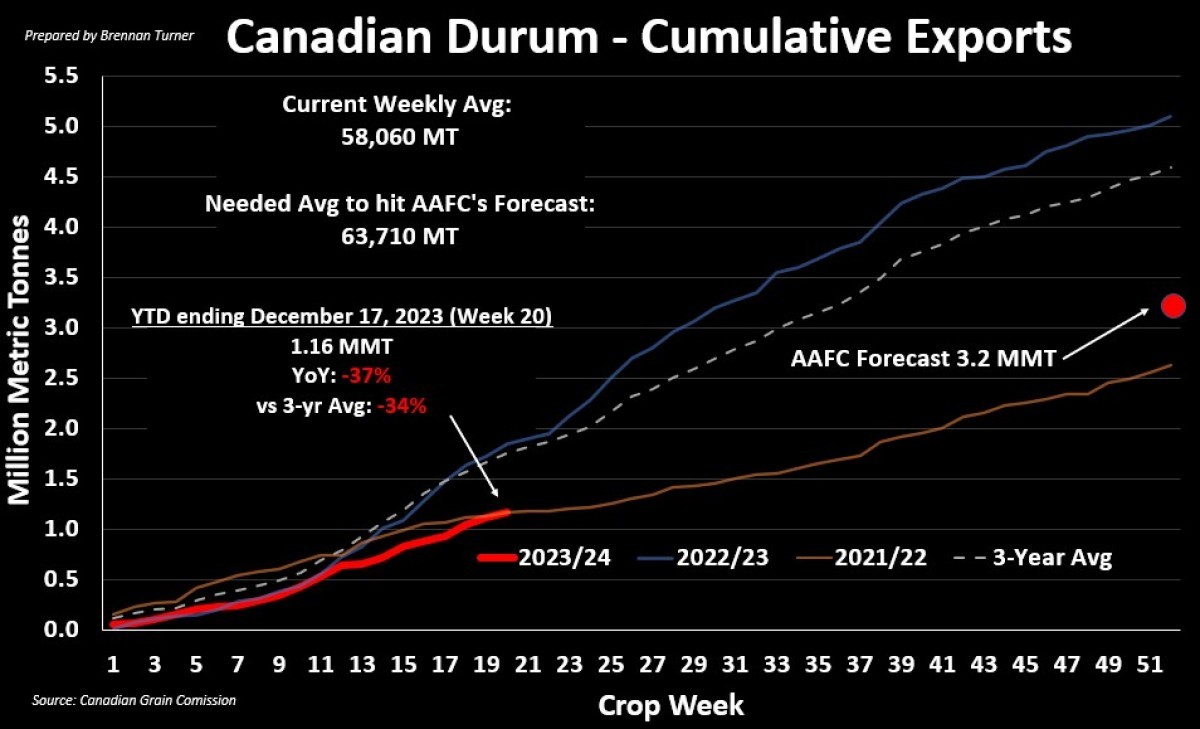

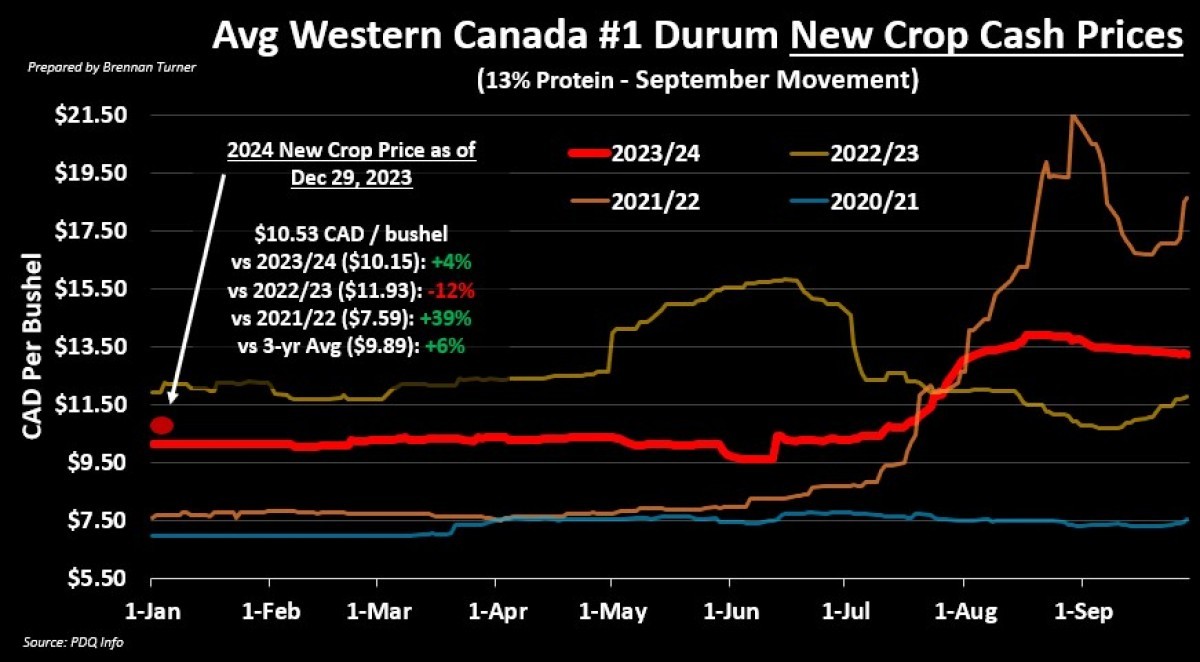

For durum, we are still waiting on exports to pick up, as the 1.16 MMT shipped out through week 20 are more than a third behind both the pace last year and the three-year average. We need to average nearly 64,000 MT in weekly shipments over the next 7.5 months to cover the more than 2 MMT gap to hit AAFC’s forecast of 3.2 MMT. Right now, as the chart below shows, we’re tracking much closer to the pace seen after the drought-riddled Harvest 2021. Both domestic disappearance and producer deliveries through the first 4.5 months are also like what we saw two years ago. My point here is that we may be disappointed in our final year durum export numbers, given the relatively slow start, and that could weigh on both old and new crop prices.

Frankly, though, with new crop durum prices currently sitting above $10.50, I think this is an attractive price even though we’ll likely end 2023/24 at a near-record low carryout. This is mainly because, with some decent moisture in North Africa, the region might produce at least an average crop for the first time in three years. Further, what’s not to say that Turkey and Russia won’t export a decent amount of durum again to start the 2024/25 marketing season? In North America, I’m hearing the potential for similar acreage numbers as Plant 2023, but yields will depend on moisture throughout the growing season. If we trend drier in the key durum-producing areas, prices will likely pop in late July as they did last year and in 2021/22.

Ultimately, 2023 and 2024 will likely be similar in what I call “reset” years. Rallies have been quickly capitalized on with profit-taking, but fund managers remain in a generally short position in the market, with only a slightly long position in soybeans. We will get the final U.S. production numbers in the next WASDE report on Friday, January 12. While weather and the usual supply and demand headlines will garner attention, in 2024, I will also be mindful of the impact of the higher interest rate environment and the trickle of debt needing to be re-financed that I’m seeing. Finally, there’s an elevated geopolitical risk dynamic as, unfortunately, the current military activities worldwide are far from being resolved, in addition to the potential of others starting up. Overall, I’m grateful for the learnings from 2023, and despite the weaker price environment, I am excited for 2024!

Happy New Year!

To growth,

Independent Grain Market Analyst