Patience is a Virtue

Grain markets started strong ahead of American Thanksgiving.

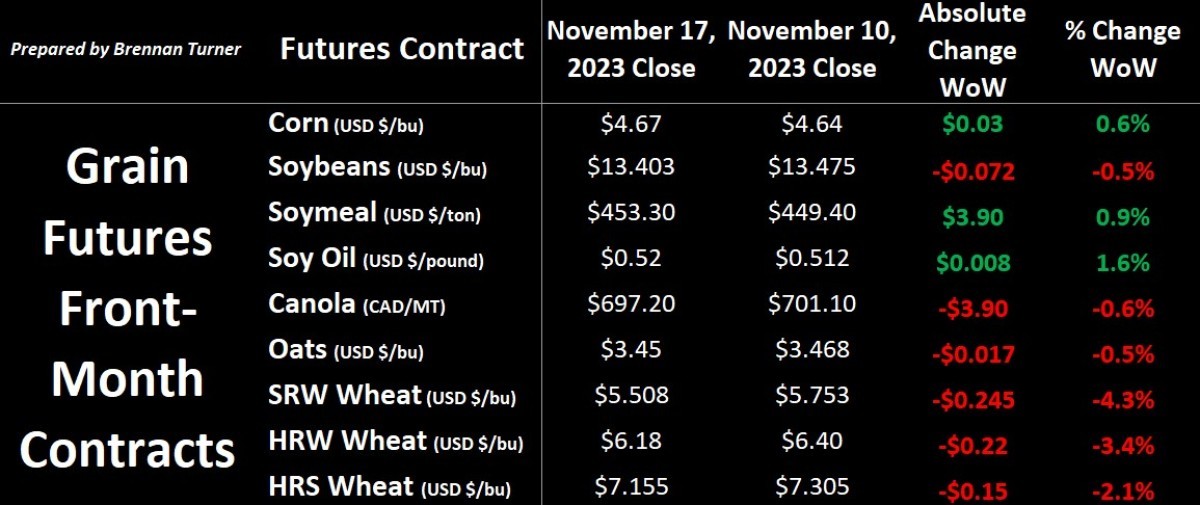

Holiday speculator-driven sell-off ensued, mostly based on the possibility of Brazil getting rain this week. Soybeans were the driver, as a historic week of export sales and the front-month contract hitting a nine-week high on Wednesday, traders took their profits and ran, while corn and wheat followed lower with some heavy technical selling.

The U.S. wheat complex also had another weak week of export sales, which added to the pressure. On top of that, Minneapolis HRS wheat futures saw a new record short position reached this week, which can often be an inflection point a short-covering rally (albeit, to set some expectations, I’m preaching patience here as it usually happens the week after that record is reached!).

On the flipside, if the forecasted rains in hot and dry central and northern Brazil don’t show up, there’s a lot of pundits who believe soybeans will push back above $14. Combined with wet weather in the south, Brazil’s soybean and first-crop corn fields aren’t off to a great start. The same may be said for the country’s wheat harvest as last week, StoneX downgraded this year’s haul from 10.5 MMT to 9.3 MMT (the USDA was at 9.4 MMT in their November WASDE). Considering that the Argentina wheat crop looks to be small again, Brazil and other South American countries might be sourcing from elsewhere.

Speaking of, in Argentina, recent rains are raising the potential of the corn and soybean crops there, but it isn’t exactly helpful in the middle of the wheat harvest, which the Buenos Aires Grain Exchange just downgraded from 15.4 MMT to 14.7 MMT (the USDA is at 15 MMT, while the Rosario Grain Exchange is at 13.5 MMT). Worth noting that over the weekend, Argentina voted in Libertarian, Javier Milei, as their new President who will be tasked with trying to reverse an economy running with 143% inflation and add more jobs.

Coming back to this side of the equator, there’s more optimism for the hard red winter wheat crop planted in the American Southern Plains thanks to good moisture that fields received this fall. The data backs it up as 47 per cent of the crop was rated as good-to-excellent last week by the USDA, up from 32 per cent a year ago. Further, a year ago, over half of Kansas was in some level of drought, while today it’s just 8 per cent.

There are two factors to be mindful of over the coming months: First, there isn’t a very strong correlation between fall crop ratings and what the crop size ultimately ends up as, since the March – May weather period has the greatest influence.

Second, as Kansas farmers likely planted the same amount of winter wheat as last year (8.1M acres), western Kansas hasn’t gotten any rain in 40 days, while for central areas of the state, it’s been 20 – 30 days since a rain. All things being equal, American HRW wheat carryout is pegged at 7.6 MMT, and while that’s well-below the five-year average, it is up from 2022/23’s ending stocks of 6.4 MMT and that’s likely to do with the smaller export program we’ve seen the last two years with the influx of cheap global supplies (hello Russia) compared to an expensive US Dollar-priced option. Not helping things is the expensive nature of American grain movement, especially since low water levels in the Panama Canal has reduced traffic to 24 ships a day (36 – 38 is normal) and is expected to keep falling to 18 this winter. This is important since almost any Gulf of Mexico-loaded boats that head west must go through the Panama Canal.

Overall, heading into the shortened week of trading due to U.S. Thanksgiving, any wheat bulls out there seem to be sitting on the sidelines. Patience only runs so long, as does seasonality in commodity markets. I personally think that a lot of the South American weather concerns are overblown as it’s really the only thing traders can effectively arbitrage when the northern hemisphere growing season is over. Thus, sharing the reminder that rallies need to be rewarded and how many times in your farming career have you seen these levels of current cash prices?

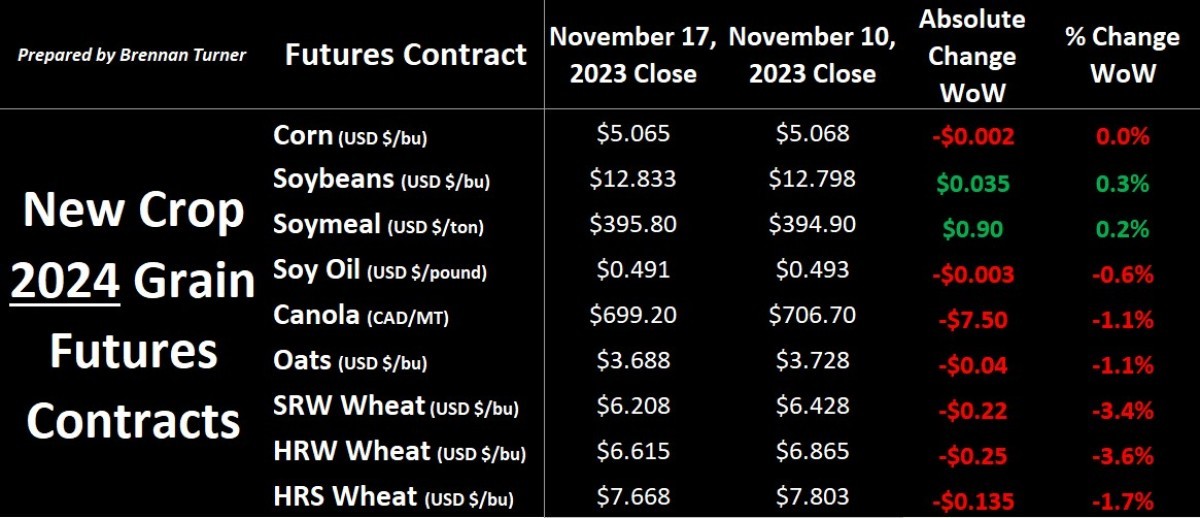

I’m also getting more questions about pricing new crop wheat out, which currently, compared to spot prices, shows a bullish spread on the futures board of ~50¢ USD / bushel but a bearish one on the cash market of ~60¢ CAD per bushel. While there’s more buzz for $9 CAD/bushel HRS wheat contracts, the average bid price is currently in the mid-$8s, and so I would expect the futures and cash market to meet somewhere in the middle. I’m not saying you need to price out any new crop acres right now, but this is the time of year when I start to pay attention to doing so.

To growth,

Brennan Turner

Independent Grain Market Analyst