Will Grain Bears Ever Hibernate?

A short trading week due to American Thanksgiving didn’t help grain markets reach the threshold of Black Friday Cheer. Unfortunately profit-taking and technical-positioning gave the complex an underwhelming red performance.

South American weather continues to drive headlines with growing noise about a potential global recession and how it lead to managed funds moving to safer, less volatile securities.

U.S. Corn is officially the cheapest on the planet but values continued to fall last week on ethanol output spiraling to its lowest level since early October, which in turn, saw higher inventories.

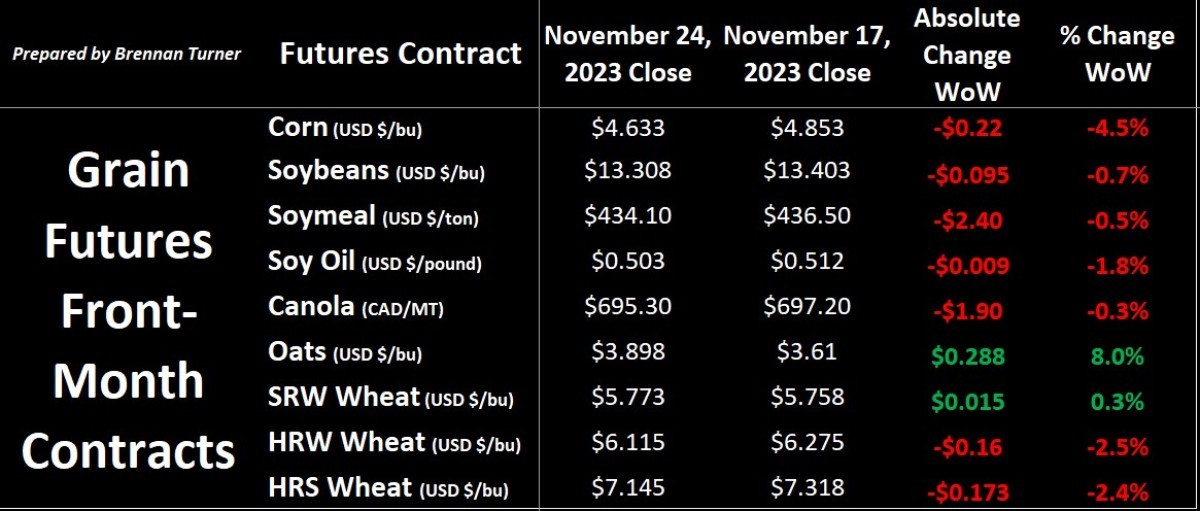

The week started out strong as we saw short-covering in the wheat complex, given recent lower values. However, bearish tones pushed front-month Kansas City HRW and Minneapolis HRS futures at new contract lows. More specific to spring wheat, the expiring December contract on the Minneapolis futures board closed below $7 USD per bushel for the first time since May 2021, albeit that’s more likely a function of volume moving to the new March 2023 contract (and as shown in the table below). Nonetheless, with the heavy cloud hanging over the grain complex, many are wondering if the bears will ever hibernate this winter.

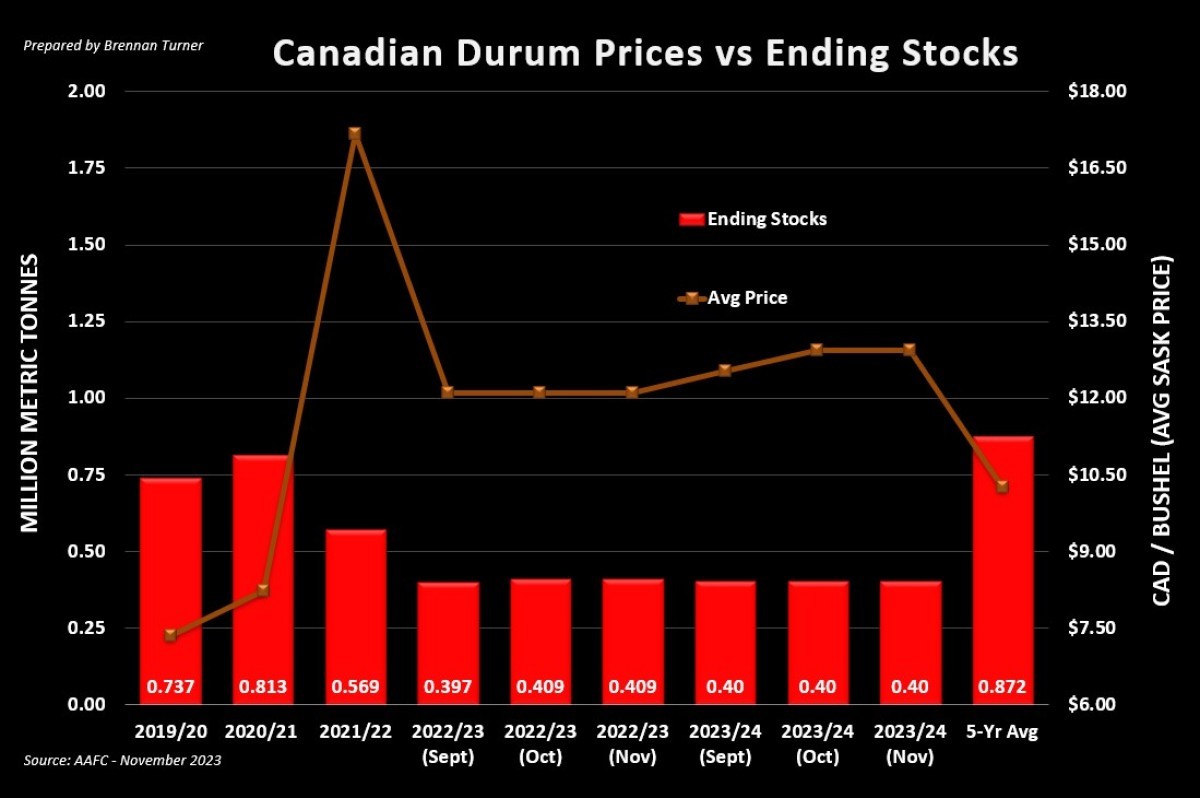

European Union wheat exports continue to be challenged by cheap Russian options, although there is discussion of their export tax ending. Case in point, the French Agriculture Ministry recently said that the country’s 2023/24 ending stocks will be 3.1 MMT, the largest in five years. For durum, the French seeding campaign is considerably behind its normal pace due to wet conditions, while Italian durum importers are turning to more traditional options, including Canada, as Turkish deliveries appear to be slowing. Speaking of durum and rain, some good rains are falling in North Africa just ahead of the regions November - January durum planting campaign, which would help replenish soil moisture in many areas that have been impacted by two years of dry conditions.

In Argentina, good rains are helping corn and soybean crops being planted but it does arrive as the wheat harvest tries to finish. Next door in Brazil, there was some noise created by the USDA regarding the growing size of the country’s wheat export program, but I’m doubtful of its potential to be competitive with Canada’s export program. Wheat harvests in Brazil have virtually doubled in the last decade with exports topping 2.7 MMT in 2022/23, compared to just 80,000 MT 10 years ago.

However most of the wheat crop is grown in the south, which has been receiving heavy rains, which is certainly impacting quality. That said, it’s important to keep an eye on the market, if production does continue to trend higher, especially with new varieties, it would mean less imports from Argentina and others, and thereby, more for the rest of the world.

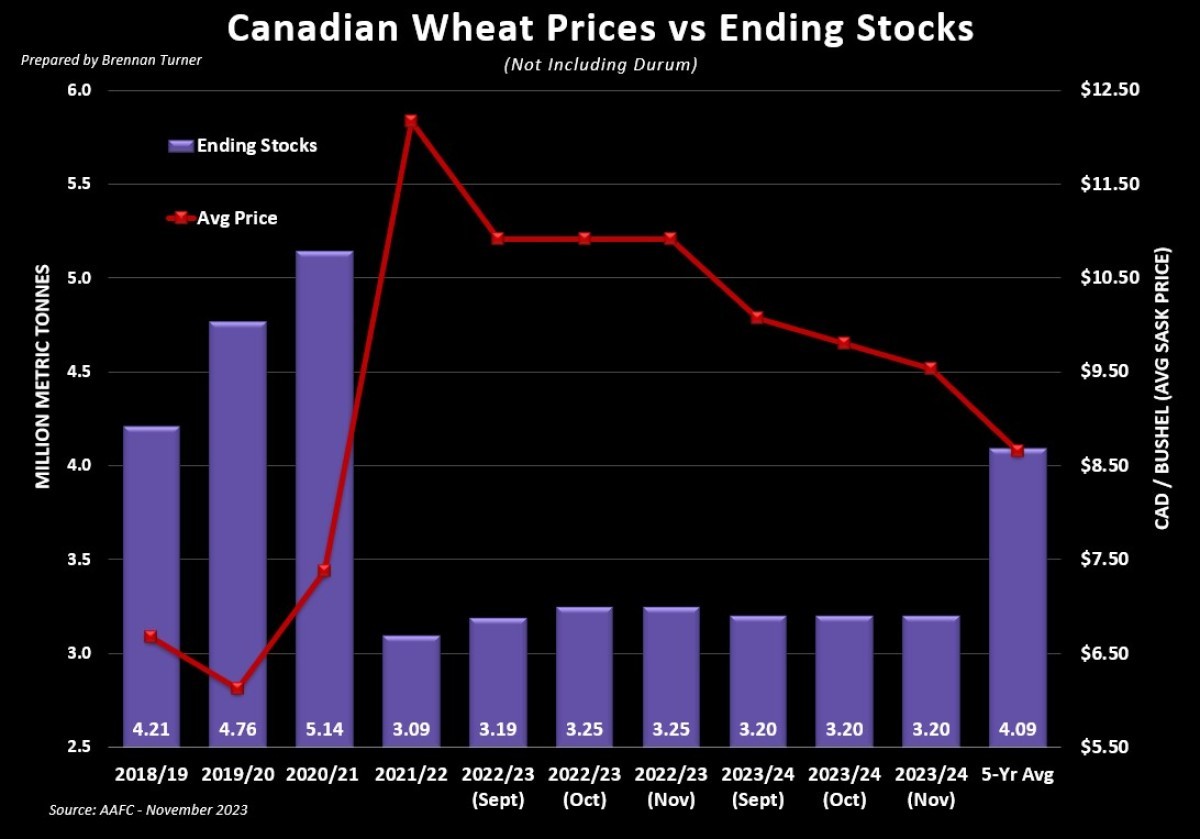

Canada continues to do a excellent job providing non-durum wheat to the world but, Agriculture Canada’s updated supply and demand estimates didn’t properly get updated, with the full year forecast staying at 18 MMT for the third straight month. In fact, the only change on either durum or non-durum wheat’s balance sheet was non-durum wheat’s average price being lowered by $10 to $350 CAD / MT (or $9.63 CAD / bushel). While there may be more Australian competition in the coming weeks as their harvest finishes up, we know that there won’t be as much volume to move out of the Land Down Under as the last three years. Arguably, this has already been priced in, but any shortfalls do likely point to Canadian or American getting the higher quality/protein business.

That said, Canadian farmers are moving a lot of non-durum wheat and we’re seeing a healthy amount of domestic demand through week 16 of the 2023/24 crop year. More specifically, producer deliveries are up about 250,000 MT or 3.4 per cent year-over-year, but more impressive is the domestic disappearance of Canadian non-durum wheat, currently tracking 63 per cent higher year-over-year with 2.14 MMT accounted for.

While we haven’t seen the usual seasonal turnaround on the cash front for grain prices, the demand is certainly there for non-durum wheat (including exports up 5 per cent year-over-year) and so while the bears keep foraging the market, I’m looking at some basis opportunities in the meantime, something we’ll lean into more next week.

To growth,

Brennan Turner

Independent Grain Market Analyst