Agriculture Canada’s First 2023 Forecast

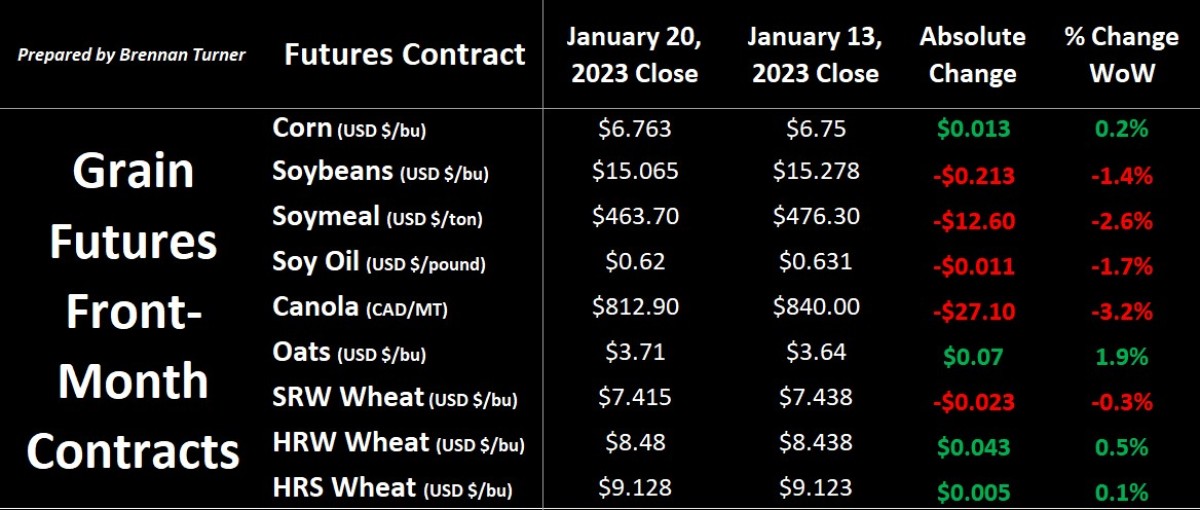

Grain markets were mixed through the third week of January – and the start of the Chinese Lunar New Year – as Argentine rains pressured oilseeds, whereas decent U.S. export numbers helped corn and wheat futures. While Agriculture Canada came out with its first estimate of the 2023/24 new crop balance sheets, the trade’s focus continues to be on South America. A Brazilian soybean crop of at least 150 MMT is likely, but the market remains in debate about how much of it will offset Argentina’s ongoing production drawdowns. Eventually, there is a time where the crop’s potential stops dropping, and more fingers are pointing to the moment as now (or at least “soon”). On the geopolitical front, rumours are increasing that Russia is preparing for a new offensive in Ukraine, which would likely complicate the third extension of the Black Sea Grain Deal, whose renewal comes up in mid-March 2023.

U.S. wheat export sales and actual shipments remain behind last year and their seasonal averages, but some decent purchasing last week helped keep two out of the three wheat futures markets in the green. The complex remains cognizant of a strong U.S. Dollar, but also the uncertain Harvest 2023 production potential in America and Ukraine. Should Russia ramp up its military Ukraine again, how will wheat exports be impacted not just in the Black Sea, but elsewhere? Quite simply, if one origin can’t deliver, then buyers must look elsewhere.

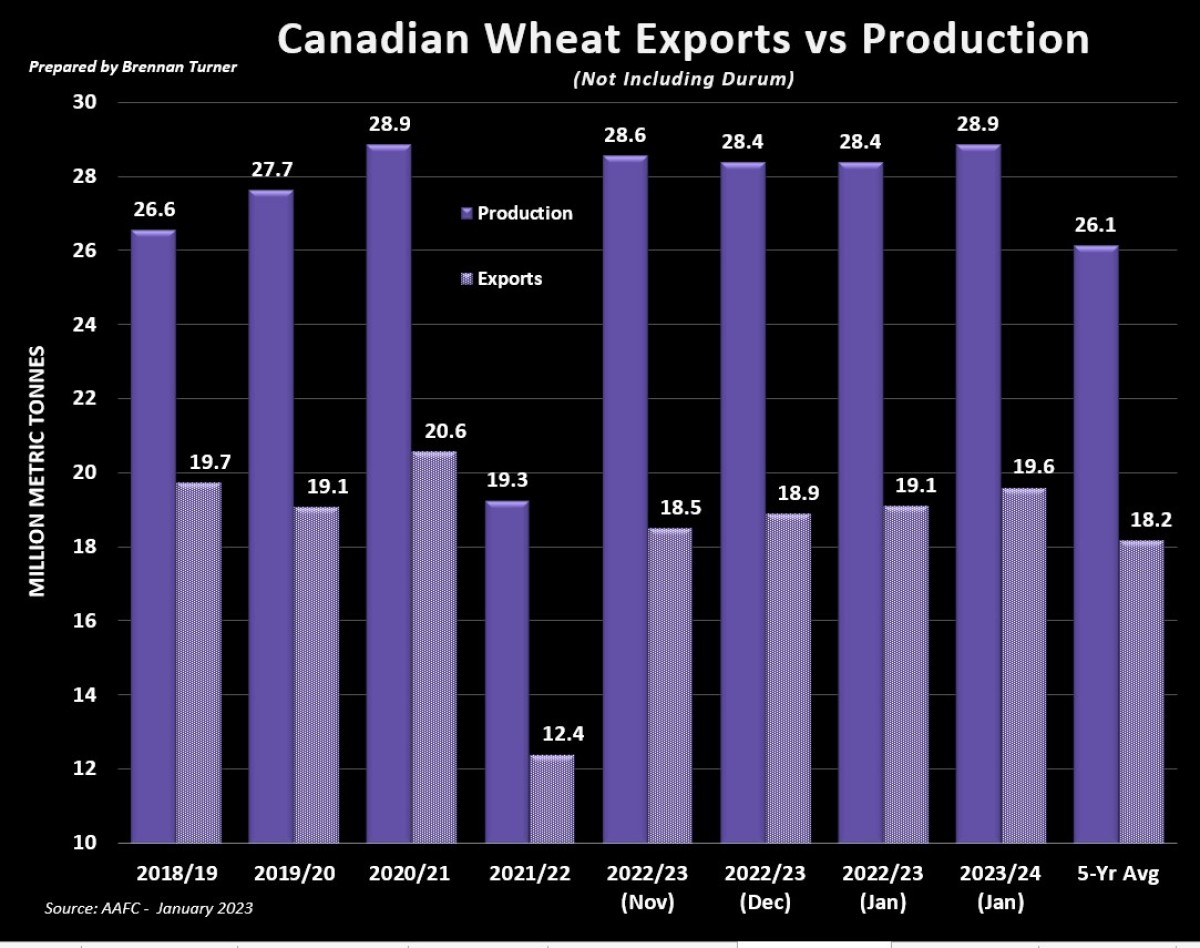

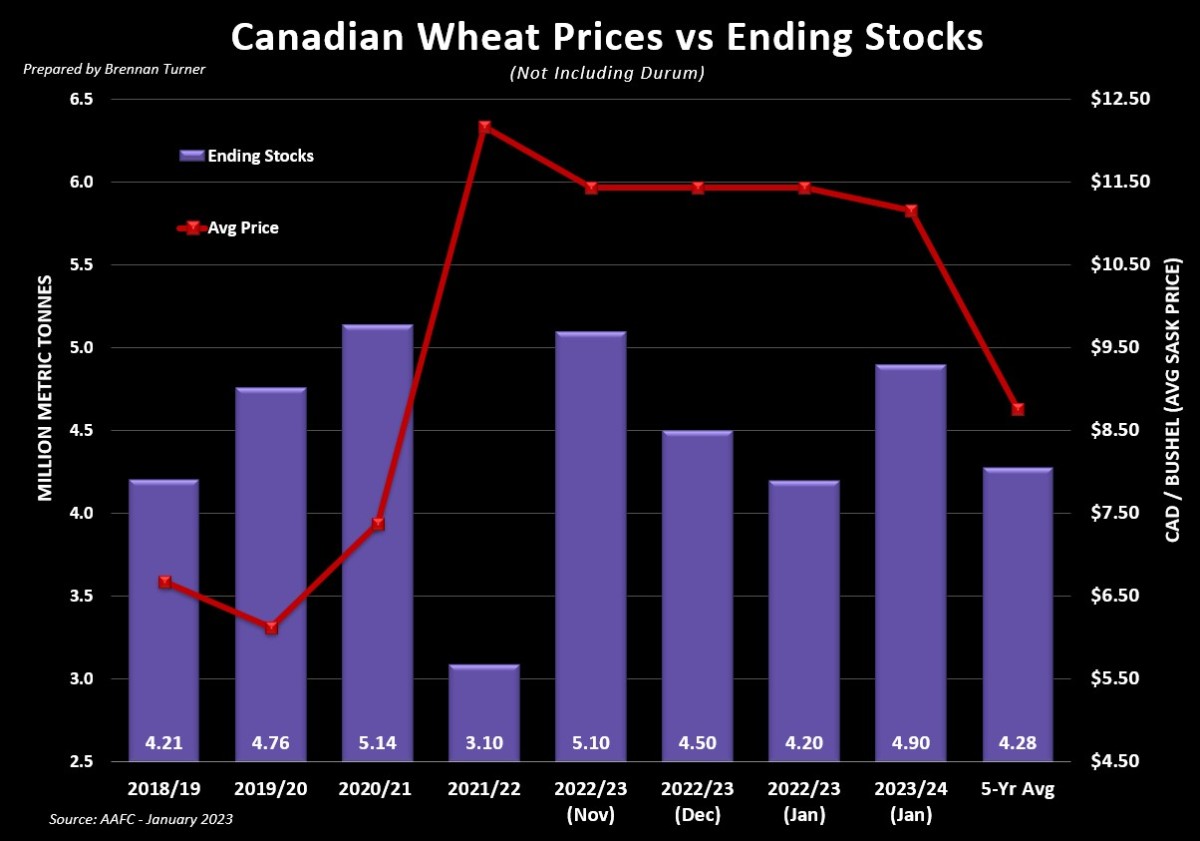

Maybe this is why Agriculture Canada continues to increase its forecast for 2022/23 Canadian non-durum wheat exports, raising them for the fifth straight month to 19.1 MMT. The 200,000 MT month-over-month increase, combined with domestic use in 2022/23 also increasing by 100,000 MT, tightens the Canadian non-durum wheat carryout by 300,000 MT to 4.2 MMT. While the ongoing strength of Canadian exports could be supportive for domestic wheat prices until after Plant 2023 is complete, the market will eventually start to price in the expectation of more wheat acres this year. That’s because, in their first estimate of the 2023/24 crop year, AAFC pegged non-durum wheat planted acres at 20.2M, the largest in a decade since Plant 2013.

If realized, the area seeded to Canadian wheat (non-durum) would be a nearly 800,000-acre, or 4.1%, increase year-over-year. Combined with a trendline yield of 54.7 bushels per acre, Canadian farmers are expected to produce 28.9 MMT of non-durum wheat, which would also be the largest since the 2013/14 crop year. Agriculture Canada expects that the current wave of international demand will continue into the new crop year, pegging 2023/24 non-durum wheat exports at 19.6 MMT, and combined with 5%, or 405,000 MT increased in domestic demand, this will put 2023/24 ending stocks 4.9 MMT. While the stocks-to-use ratio would be a relatively comfortable 17%, the ongoing tight global wheat balance sheet should keep Canadian wheat prices in the double digits in 2023/24.

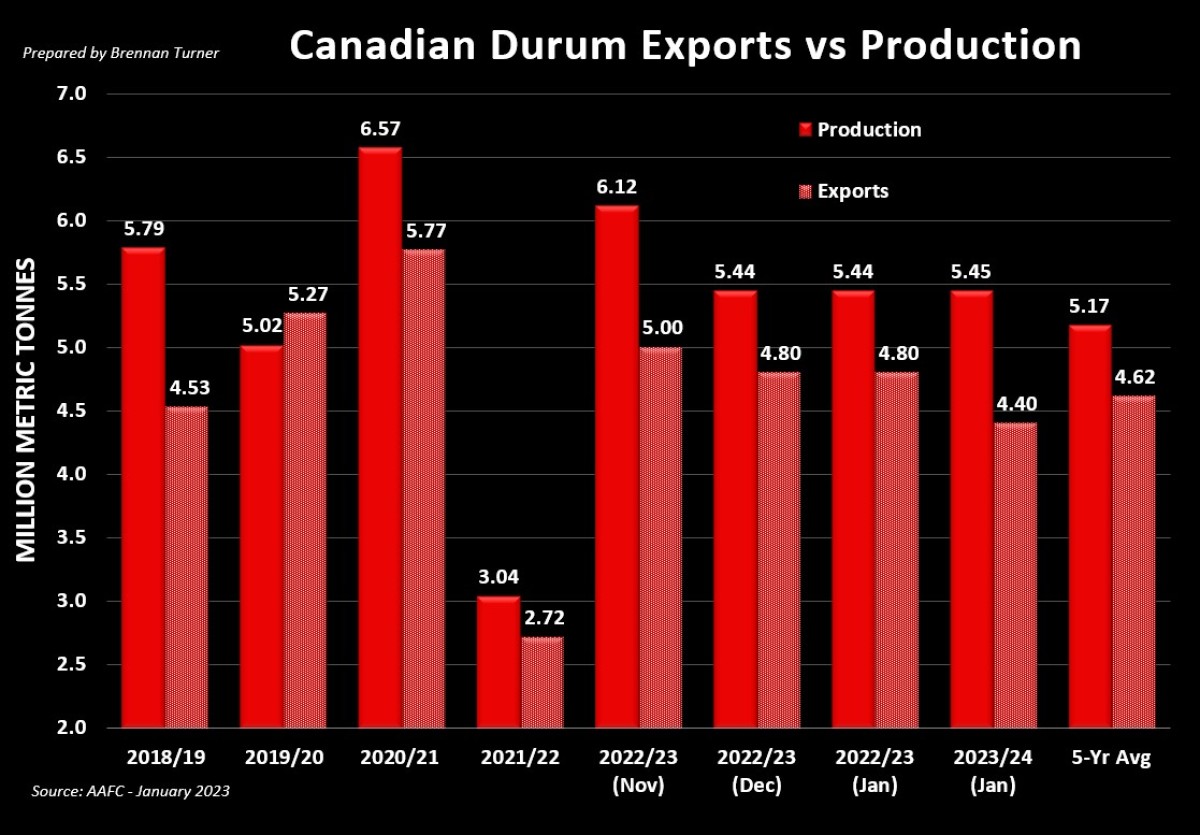

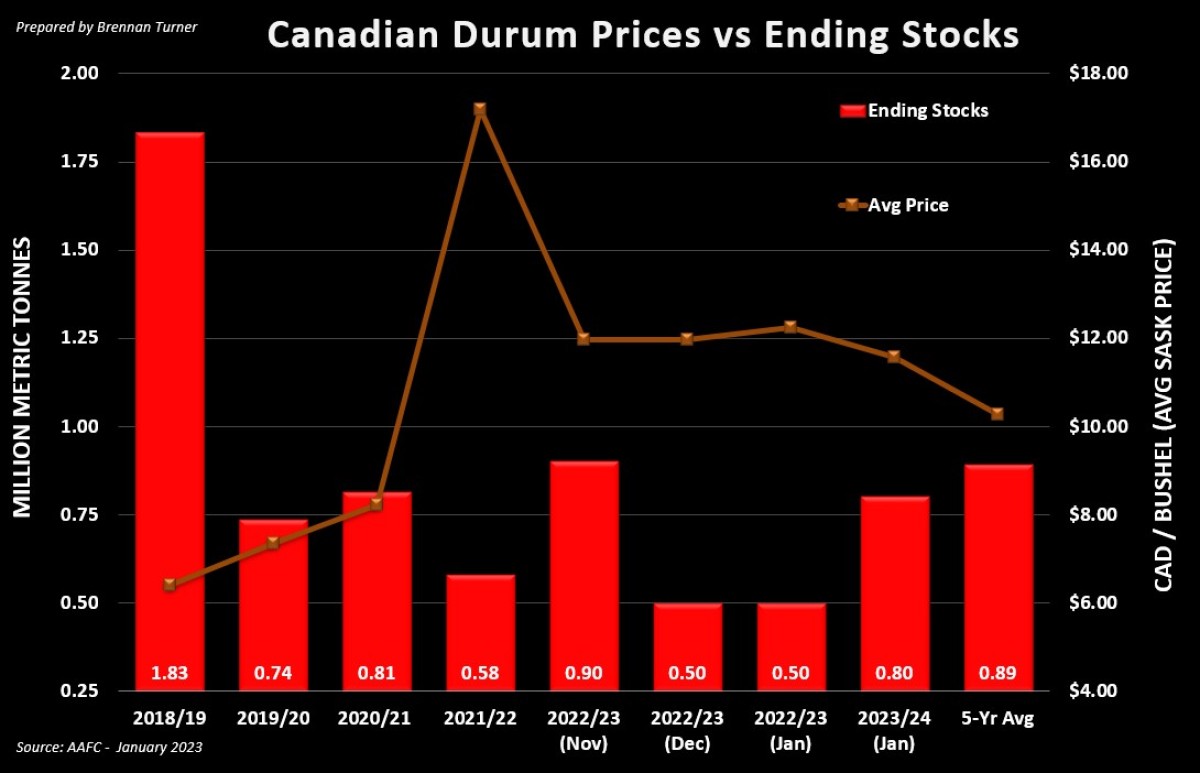

It’s a similar sentiment for Canadian durum: Agriculture Canada expects prices to also remain in double digits as the pasta-making input continues to recover from back-to-back droughts in Canada & US and then Europe & North Africa, respectively. While nothing changed on durum’s old crop, 2022/23 balance sheet, Agriculture Canada is speculating that seeded acres in Plant 2023 will fall by 334,000, or ~6%, down to 5.7M acres. Assuming a return to trendline yields, pegged at 36 bushels per acre this year, Harvest 2023 could produce nearly 5.45 MMT of Canadian durum, which would be almost identical to Harvest 2022’s take home. However, with expectations of Europe’s durum crop rebounding in 2023 – up 1.2 MMT year-over-year to 8.3 MMT – Canadian durum exports should decline, by 8% or 400,000 MT, to 4.4 MMT. Net-net, the Canadian 2023/24 crop year should end with 800,000 MT of durum carried over, a 300,000 MT increase year-over-year but still slightly below the 5-year average.

Overall, with the rumours about the military conflict in Ukraine increasing again, the market could start to price in some premium as it relates to Ukraine’s reliability as a wheat exporter (amongst other commodities). Meanwhile, it’s been suggested that North American millers have their needs covered until at least the spring, as they wait to learn a bit more about the winter wheat crop coming out of dormancy and the potential of Harvest 2023. That said, with wheat prices and interest rates remaining elevated, buyers won’t be likely purchasing more than what’s needed. Thus, the window to price in some old or new crop wheat may close for a few months, before reinvigorating in April / May again. However, how far down any seasonal lows take the wheat complex is a fool’s guess, but that bottom is also where any springtime rally would have to start from.

To growth,

Brennan Turner

Founder | Combyne Ag

Independent Markets Analyst