Already Settling into Summer Grain Markets

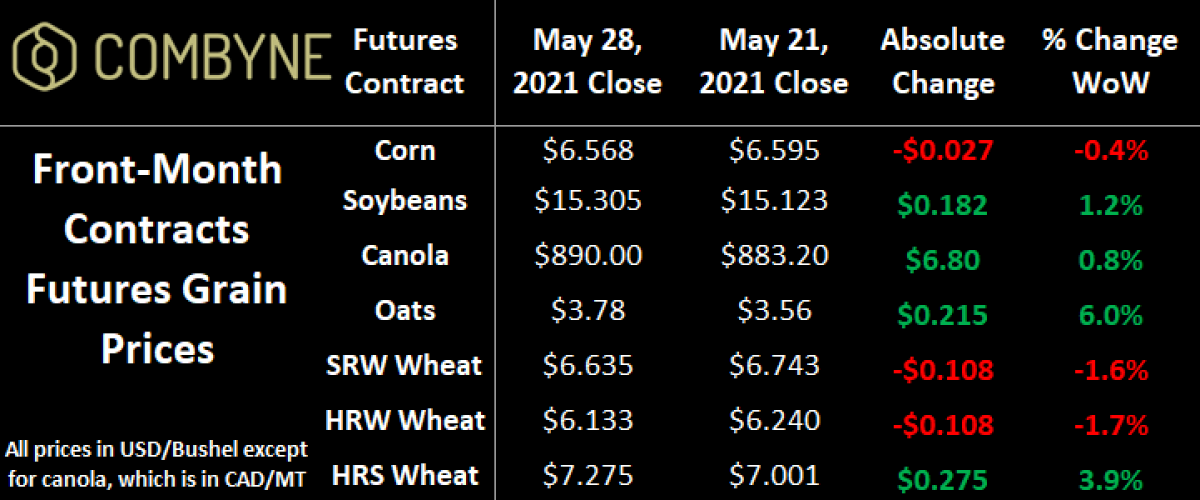

Grain markets finished the last trading week of May 2021 mostly mixed as weather, export sales, and crop conditions influenced traders ahead of the U.S. Memorial Day long weekend. After going limit up on Thursday last week because of drought concerns in Brazil, corn prices finished the week a bit lower than where they began, whereas oilseeds and Canadian cereals (read: oats and HRS wheat) were able to find green on the screen. Likewise, winter wheat futures dropped as a wide portion of the U.S. wheat belt received some moisture last week.

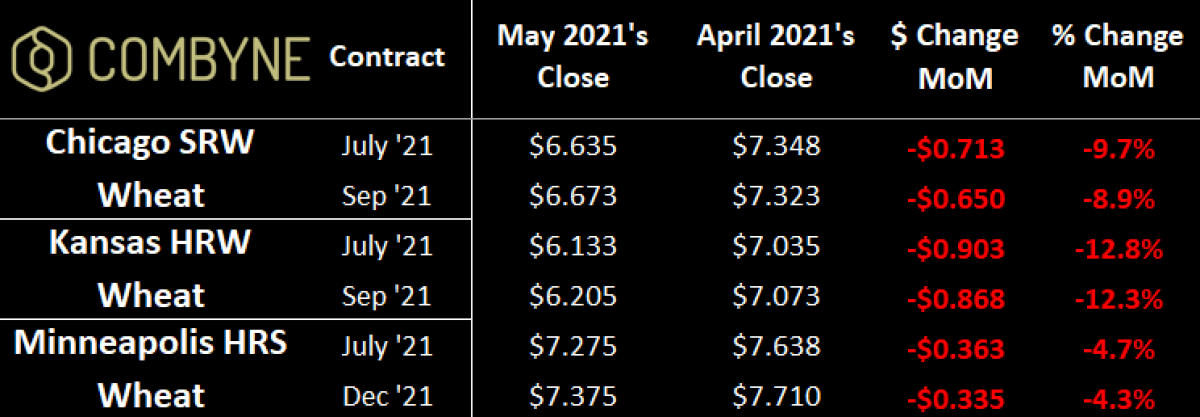

From a monthly standpoint, the complex ended the month of May much where it started, as speculative money that piled into the market in the first half of May, has now exited. However, given the tight inventories and a lot riding on the 2021/22 crop, canola prices were the lone positive performer for both old AND new crop contracts on the futures board, gaining 2.5% on its front-month and 0.6% on its new crop. Specific to the wheat complex, the springtime/weather premium highs have now passed, and we’ve started to see a resettling of the bears and bulls going into the new crop year, which in many places around the world, including Europe, Russia, Ukraine, etc. starts on June 1.

Specific to Russia, we’re starting the 2021/22 crop year with new export taxes that are reset weekly by the Ministry of Agriculture there. Up until now, the export tax was set at $61 USD/MT (or $73.75 CAD/MT or $2 CAD/bushel if converting metrics tonnes to bushels), but with a large wheat harvest expected, Russian officials have dropped the levy to $28.10 USD/MT (or $34 CAD/MT or $1.54 CAD/bushel). International wheat traders will be closely watching volumes being moved and the changes in export taxes, as it might price some countries out of the market and look elsewhere for product.

One of those substitutable markets is the EU, where government AND private estimates continue to increase the size of the wheat crop there. Another potential origin would be Australia who produced a record wheat crop of 33 MMT last year but is expected to see above-average rainfall going into their 2021/22 crop year (which technically starts on October 1). After a few years of drought, Australian farmers are getting their fair share of moisture, which to me means that the USDA’s current production estimate of 27 MMT in 2021/22 could be a little low.

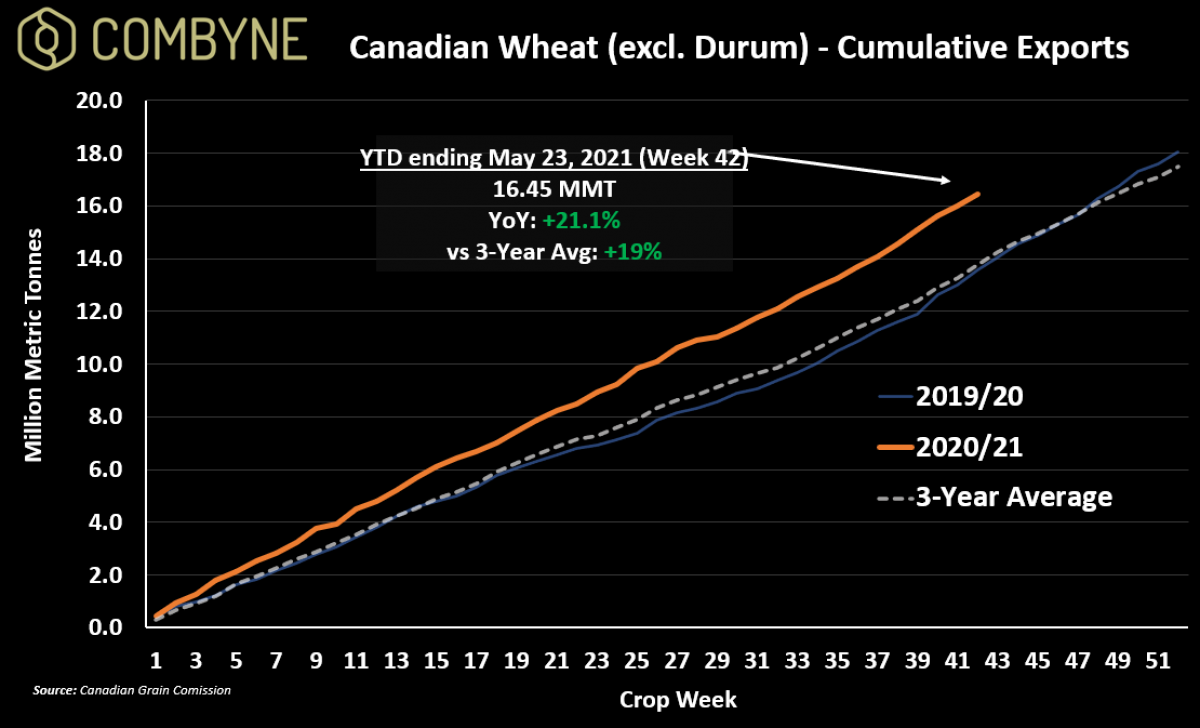

The implications of these large crops are that there will be more competition for Canadian wheat on the international markets in the 2021/22 crop year. That’s largely why, I think, Agriculture Canada dramatically lowered its forecast for Canadian non-durum wheat exports to 17.1 MMT. As I mentioned in this column last week, I think this number is a little too low, and we’ll likely end up somewhere closer to 18 MMT. Of course, the final number will hinge on what’s actually combined this fall, but a good indication of success this year has been the number of weeks with more than 400,000 MT moved out of country (17 so far, compared to 14 in all of 2019/20!).

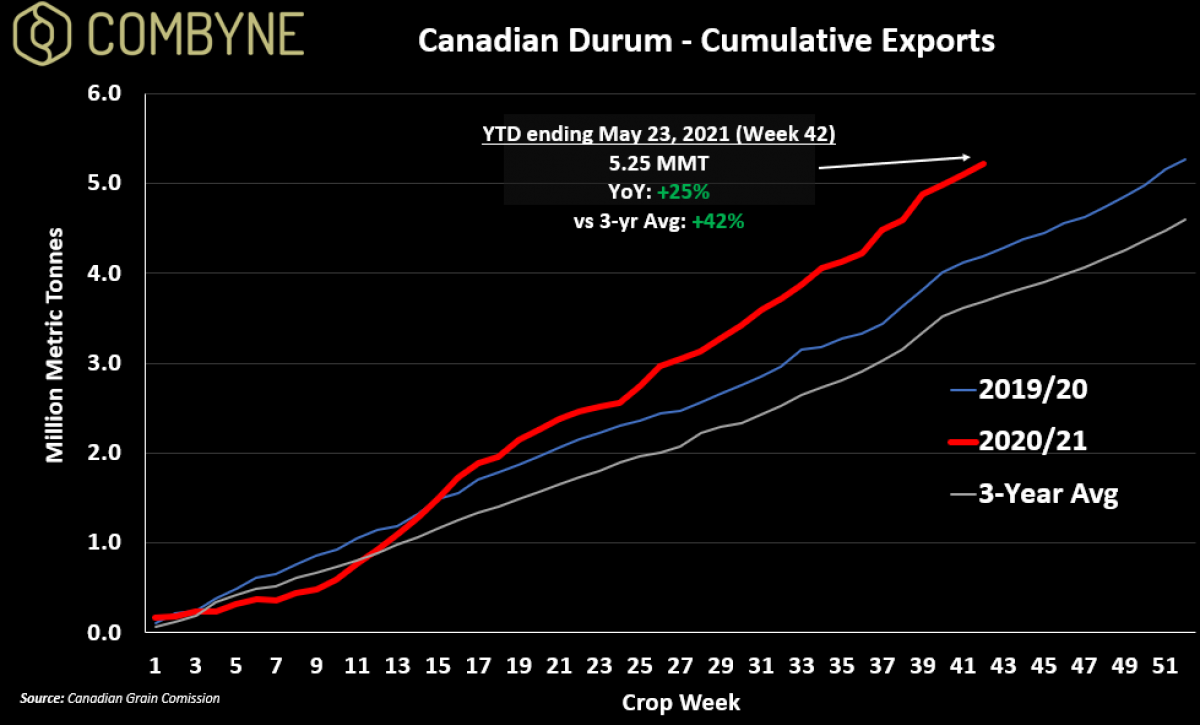

It’s a similar dynamic in durum exports, in that there have been 14 weeks so far in the 2020/21 crop year that we’ve seen more than 150,000 MT sailed in a single week, compared to just 6 weeks of sailings above that level in all of 2019/20. So while there should be a rebound in durum production in 2021/22 (namely from Europe), Canadian durum exports should stay elevated – at least when compared to past years – in the coming crop year.

Ultimately, as we flip the calendar into June and into the heart of the growing season, grain markets tend to move into a bit of a lull as the complex already has a rather good understanding of the supply potential for the pending harvest. As mentioned, Mother Nature has the final say, but traders are playing the market based on what is expected to be produced and not just one-off events. Therein, while you could see a one-to-two-week rise in the markets thanks to a crop tour or weather headline, markets, especially for new crop supplies, tend to drift lower until the combines start hitting the fields.

To growth,

Brennan Turner

CEO | Combyne Ag