Are the Grain Market Lows In?

Grain markets were mixed last week as weather and Black Sea premiums crept back into the market to finish the week, however, wheat wasn’t able to make up for its earlier losses. More hot temperatures – above 90 degrees Fahrenheit and 100 degrees Fahrenheit in some places – are forecasted for the Midwest again, right in the thick of the annual ProFarmer crop tour. The heat over the last two weeks of August could nullify the healthy rains seen earlier in the month. The impact will likely be most felt in soybeans, which are in or moving into the critical podding stage. The heat likely won’t hurt the U.S. corn crop as its development is largely set, but if soybeans start to take off with more weather premium, then corn, and then wheat will likely follow, especially if the rally the U.S. Dollar has been on starts to fade. In fact, we did see this on Friday as Chicago SRW wheat futures finally broke an eight-day losing streak, thanks to some short-covering on the hot weather and fresh concerns over military activity in the Black Sea.

On Wednesday last week, Russia landed air strikes on grain handling and storage infrastructure on part of the Danube River. This is significant to the market as before the Black Sea Grain agreement was not renewed on July 17, that location handled about a quarter of all Ukrainian grain exports, but now it’s the main option with the Black Sea being a “go at your own risk” route. On the flip side, despite its suggestion of the contrary because of Western economic sanctions, Russia is still the world’s largest wheat exporter and it is looking to increase business with India, which needs to shore up supplies and reduce food inflation ahead of next year’s national elections. After facing its driest August in over 120 years, domestic wheat prices have rallied over 10 per cent to a seven-month high as India will likely need at least 4 MMT of wheat imports this year. It’s also rumoured that Russia will sell India wheat at a $25 - $40 USD/MT discount.

Speaking of discounts, September 2023 corn futures posted a contract low on Tuesday, but traders saw a bargain and helped finish the week with three straight days of higher closes, something not seen since the middle of June. Usually, this is the time of year when corn tends to post a seasonal low, but weak U.S. export business continues to weigh on the U.S. grain futures complex. For U.S. wheat exports, export sales are tracking seven points behind the five-year average, while soybean and corn bookings are 44 per cent and 24 per cent behind last year, respectively. The bullish upside narrative is strongest in soybeans though as acres are notably lower than last year, so any yield downgrades would carry more weight for traders as inventories could quickly turn very tight.

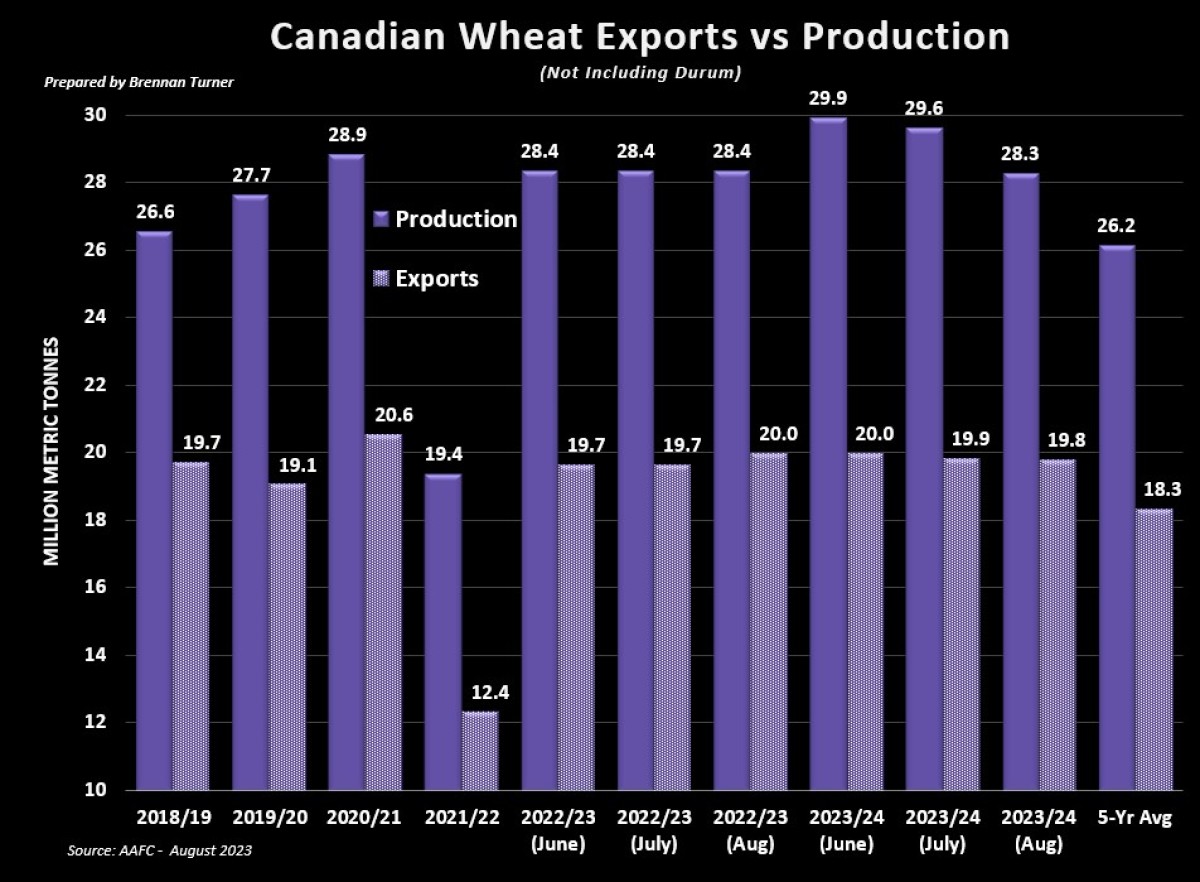

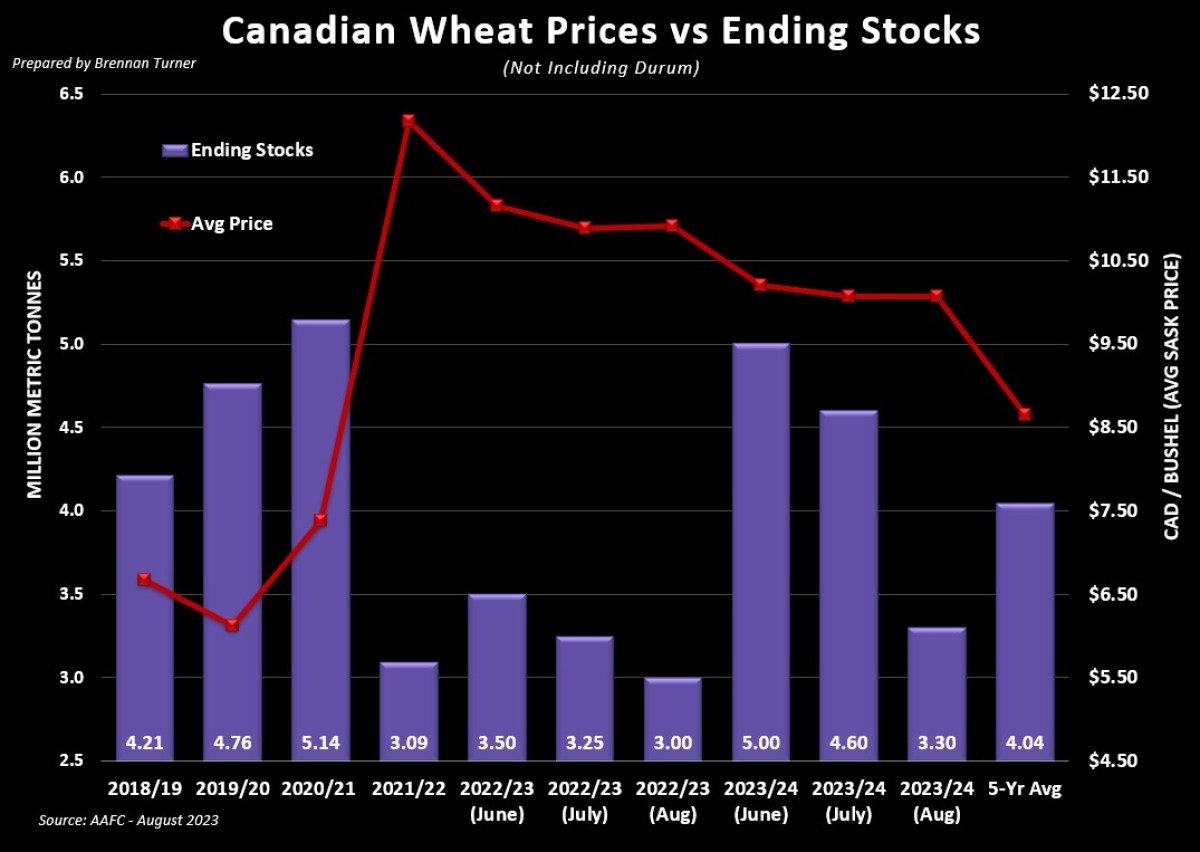

What also is having a tight carryout is Canadian wheat, which after a strong flurry of exports to finish the 2022/23 crop year, will bring just 3.24 MMT into the 2023/24 crop year, a record low according to Agriculture Canada. This is largely because AAFC raised old crop durum exports by 120,000 MT for a crop year total of 5.12 MMT, while non-durum wheat shipments jumped 350,000 MT month-over-month to 20 MMT. This would be the second time in three years that Canadian non-durum wheat exports top the 20 MMT mark and it doesn’t appear to be slowing down as the first two weeks of 2023/24 show 624,000 MT already shipped out, up 15 per cent year-over-year.

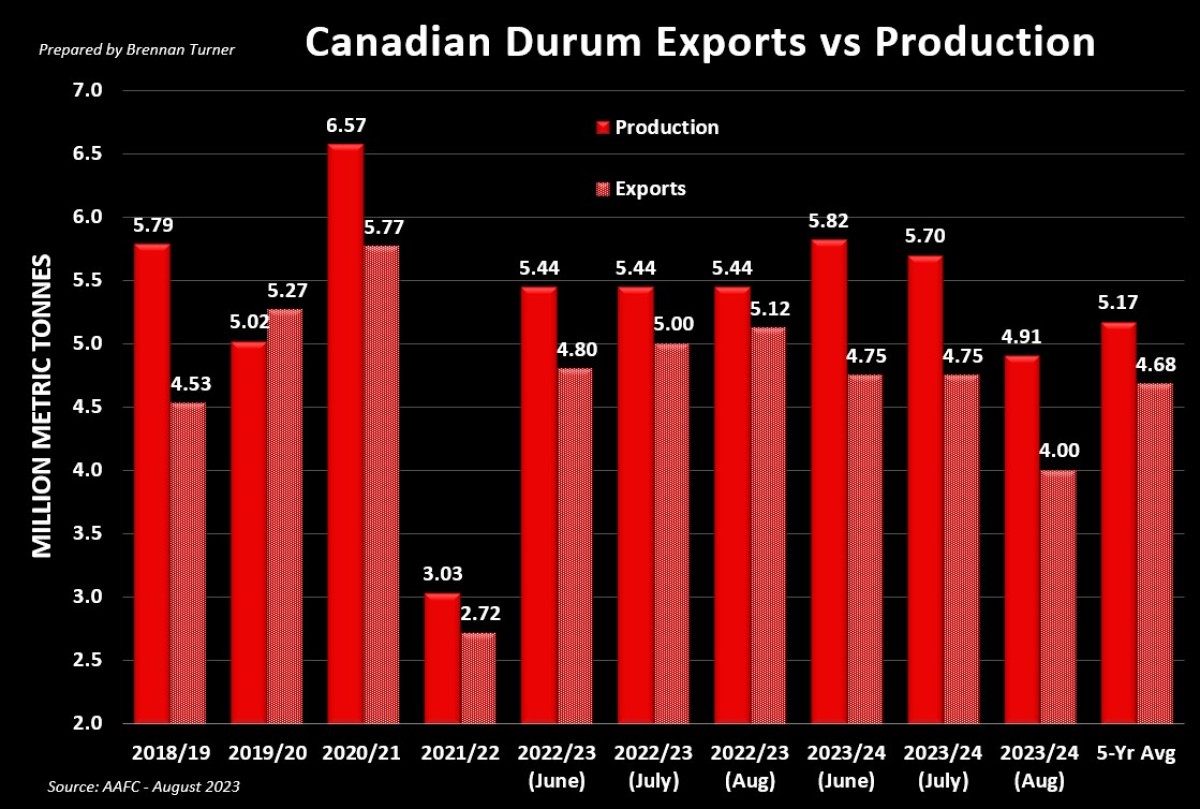

However, Canadian wheat exports in 2023/24 are likely to pull back a bit due to the expected smaller harvest, given the dry growing season most of the Prairies have experienced. In its monthly update last week, Agriculture Canada lowered their durum yield forecast by nearly five bushels per acre (bu/ac) to 30.5 bu/ac while non-durum wheat yields were lowered by about two and a half bushels to 50.6 (not as significant of a drop due to winter wheat offsetting spring wheat downgrades). Net-net, according to AAFC, this means a durum harvest of just 4.9 MMT (for comparison, Harvest 2021’s drought yielded just 3.03 MMT off 20 bu/ac average yields), while non-durum production is forecasted at 28.3 MMT (2021 was just 19.4 MMT off 41.3 bu/ac yields). While we are obviously not talking about a 2021-like harvest, the impact of that smaller harvest is still being felt today from an inventory and price standpoint.

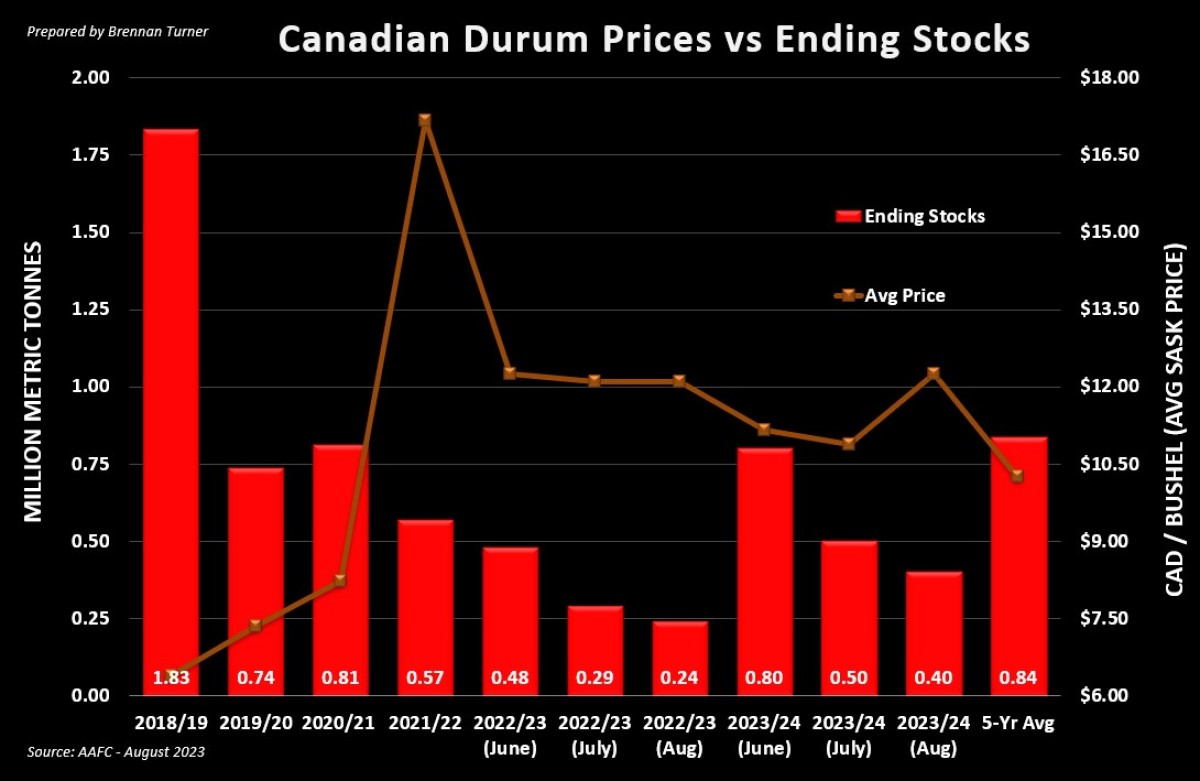

With such strong domestic and international demand for Canadian wheat these last few years, it’s understandable how the balance sheet continues to be precariously tight. 2022/23 durum stocks are now pegged at just 240,000 MT, a record low. Even with AAFC suggesting this month 750,000 MT in fewer 2023/24 exports for a total of 4 MMT, they’re expecting a 2023/24 carryout of 400,000 MT, the second-lowest carryout on record and 52 per cent below average. Globally, the IGC is now suggesting that durum inventories at the end of the 2023/24 crop year will add up to 3.5 MMT, the smallest carryout in over three decades. While AAFC’s price forecast for non-durum wheat did jump by 13 per cent to $450 CAD/MT (or $12.25/bushel), I think this is still on the low side of the possible range for 2023/24 Canadian durum prices.

For non-durum wheat, Agriculture Canada’s price forecast stayed flat at $370 CAD/MT (or $10.07/bushel), despite carryout being lowered by 1.3 MMT month-over-month to 3.3 MMT, our third smallest carryout in history. While we will get an official yield and production update from Statistics Canada on Tuesday, August 29, it will be their model-based forecast using July data, so I expect some discounting to that report. The print I will be more interested in will be StatsCan’s Thursday, September 14 report as those estimates will be based on August data and the conditions being experienced now. That said, harvest operations are underway and while we’re definitely not seeing 2022 yields, results have been mixed and so the market is trading accordingly.

To growth,

Brennan Turner

Independent Grain Markets Analyst