Are the Harvest Lows In?

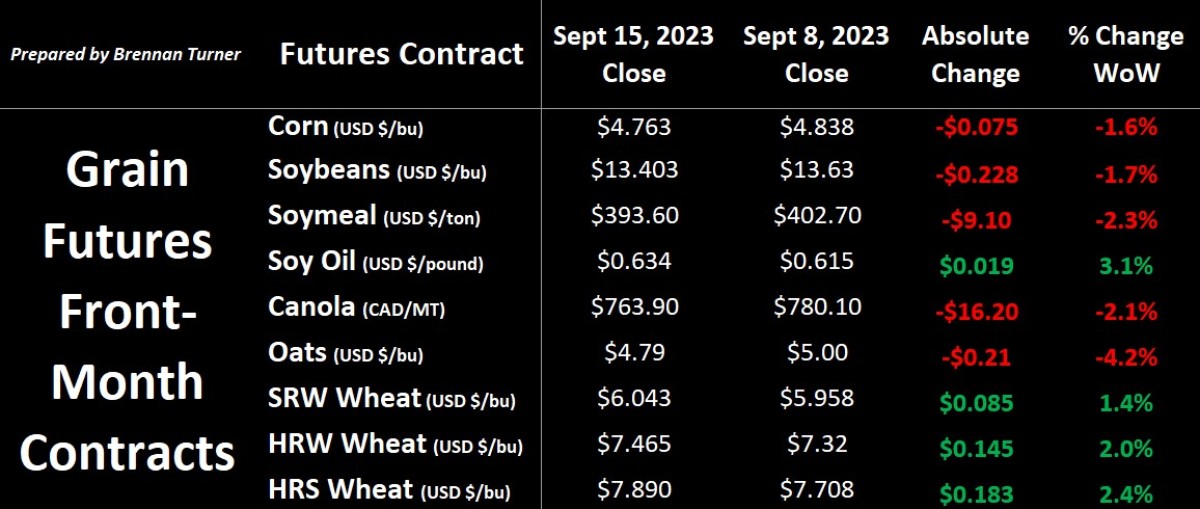

Grain markets were mixed through the middle of September as the complex took mostly bearish news from this month’s WASDE report in stride, but wheat won the week on reduced global supplies suggested by the USDA. Supporting wheat was some technical buying, as well as confirmation from Statistics Canada that the size of this year’s wheat crop is well below-average. Also, the EU decided to not extend the ban on Ukrainian grain imports by the likes of Poland, Slovakia, Bulgaria, Romania, and Hungary, albeit all but Bulgaria have committed to imposing their own national-level bans.

In the USDA’s WASDE report, the market seemed to be disappointed by the USDA not lowering yields more than they did, and basically keeping demand at weak levels. While average corn yields were dropped by 1.3 bushels per acre (bu/ac) to 173.8, they raised harvested acres by 800,000 (a lot of it was in North Dakota), basically nullifying the yield downgrade. Meanwhile, average U.S. soybean yields were lowered by 0.8 to 50.1 bu/ac – which was at the high end of pre-report trade guesstimates, but, like corn, demand remains sluggish. The skeptics from the bullish camp believe that this report didn’t account for the extreme weather seen earlier this month and so expectations are set that we’ll see further downgrades from the USDA.

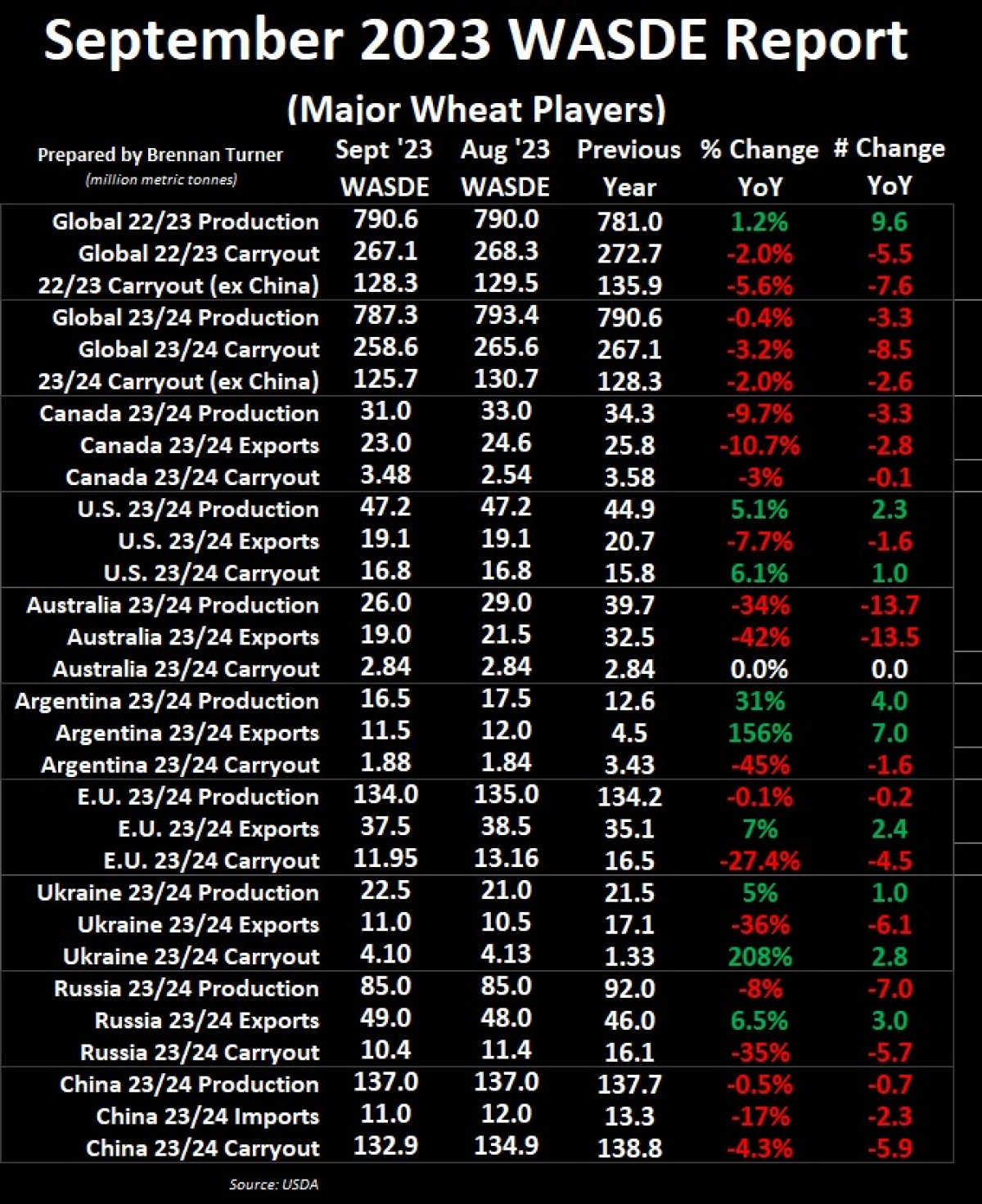

On that note, nothing on the American wheat balance sheet changed, as those are usually reported in the Small Grains report later this month. Globally though, there were a lot of updates, including the reality that, for the first time in five years, the world will produce less wheat than the previous year. Australia’s harvest was lowered by three MMT to 26 MMT, largely because of the dry weather they’ve experienced as Mother Nature swings back into an El Nino phase. However, Argentina will need more rain from said El Nino oscillation, as the USDA downgraded their wheat crop by one MMT to 16.5 MMT on account of lingering dry soils.

On the flipside, the USDA said there will be more feed wheat to go around this year because of wet harvest weather in China and the EU. Further, despite the economic sanctions, Russia’s wheat exports were raised by one MMT to 46 MMT, which, if realized, would mean they own about 23 per cent of the entire global wheat trade, up from 21 per cent last year (and as pointed out by the Western Producer recently). Obviously, part of the reason for Russia’s expansion in exports is their increase in production, but also because there’s less Ukrainian wheat making it to market.

On that note, on Friday last week, all but one of the five neighbouring countries to Ukraine is looking to impose its own national ban of Ukrainian grain being imported (they can still be transited through to other export markets though). This means only Bulgaria will allow Ukrainian grain imports, citing the benefit of reducing food prices at a time when the public is pushing back on inflation, whereas the other countries are facing farmer strikes if they see Ukrainian grain sold into their markets at prices below domestic levels. Meanwhile, earlier this month, Romania approved a $156M USD project to upgrade their port and road infrastructure, which is great because about 60 per cent of Ukraine’s grain exports currently flow through the shared Danube River system. The downside? It will take three years to complete the project.

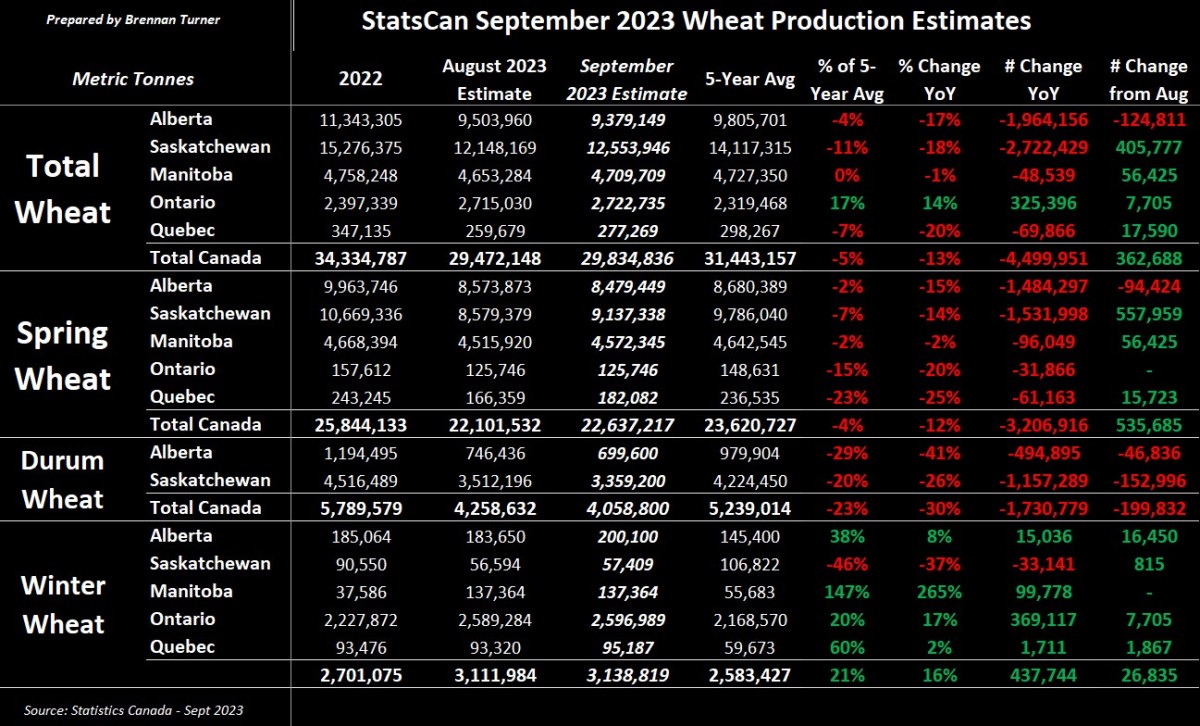

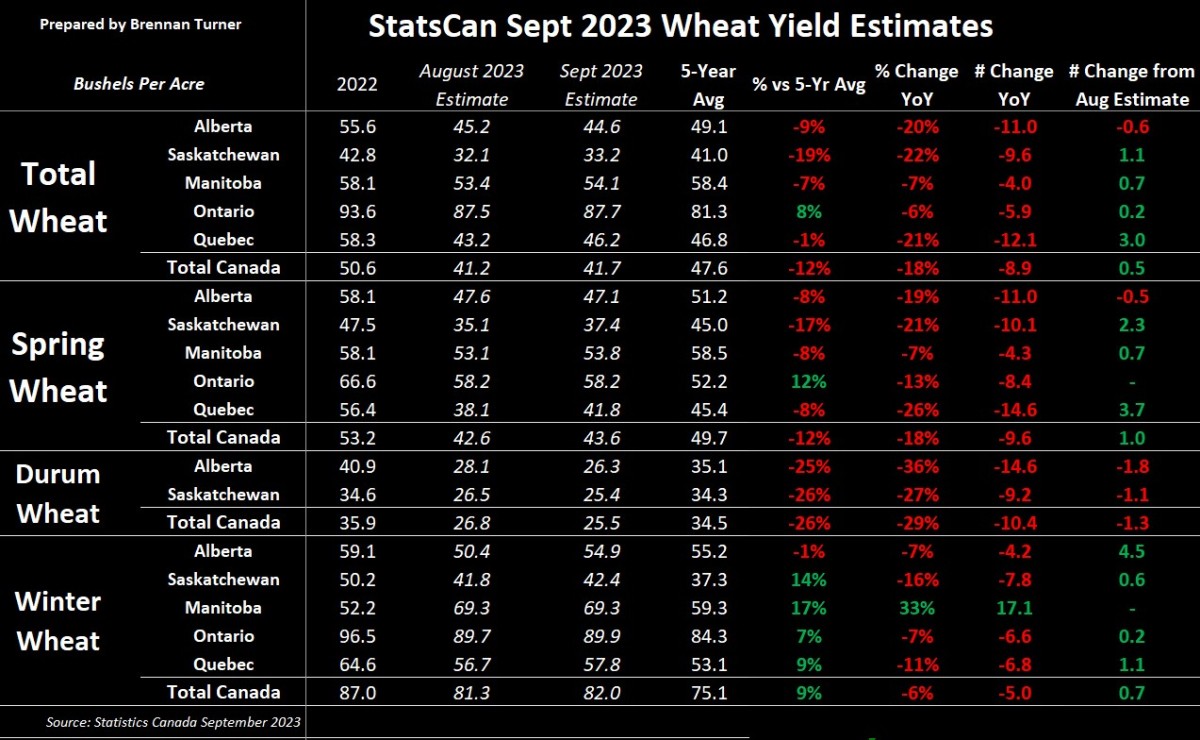

Coming back to the September WASDE, the USDA decreased the Canadian wheat harvest by two MMT to 31 MMT, and lowered exports by 1.6 MMT to a new estimate of 23 MMT (this includes durum). Also, thanks to the extra grain they found from the 2022/23 crop year, new crop 2023 ending stocks were raised by about one MMT. That’s where the other major report from last week, the StatsCan updated production estimates, came into play as the Canadian government disagreed with the USDA, suggesting a total wheat crop of just 29.8 MMT. Compared to the August forecast from a few weeks ago, this is up about 360,000 MT, mainly because average spring wheat yields were raised by one bushel from that report to 43.6 bu/ac. Conversely, the durum crop got smaller this go around, by about 200,000 MT to now sit at just over four MMT. Historically-speaking, StatsCan has increased the size of the durum harvest by its final report in December, with only the drought harvest of 2021 being the asterisk in the usual upgrades in recent memory.

Ultimately, wheat prices were trying to put another bottom in this week as Harvest 2023 rolls on. Most nations and traders continue to watch the large volume of Russian wheat that’s getting dumped on the market, and how that’s weighed on prices the last few months. That said, while their wheat doesn’t always compete in the same international destinations as Canadian wheat, it does weigh on the broader complex. As you’ve heard in this column the last few weeks though, with more grain coming to market, I’m not interested in making new sales on the harvest lows, and instead, focusing on the contracts already signed and that need to be delivered on.

To growth,

Brennan Turner

Independent Grain Market Analyst