Bullish Wheat Now or Later?

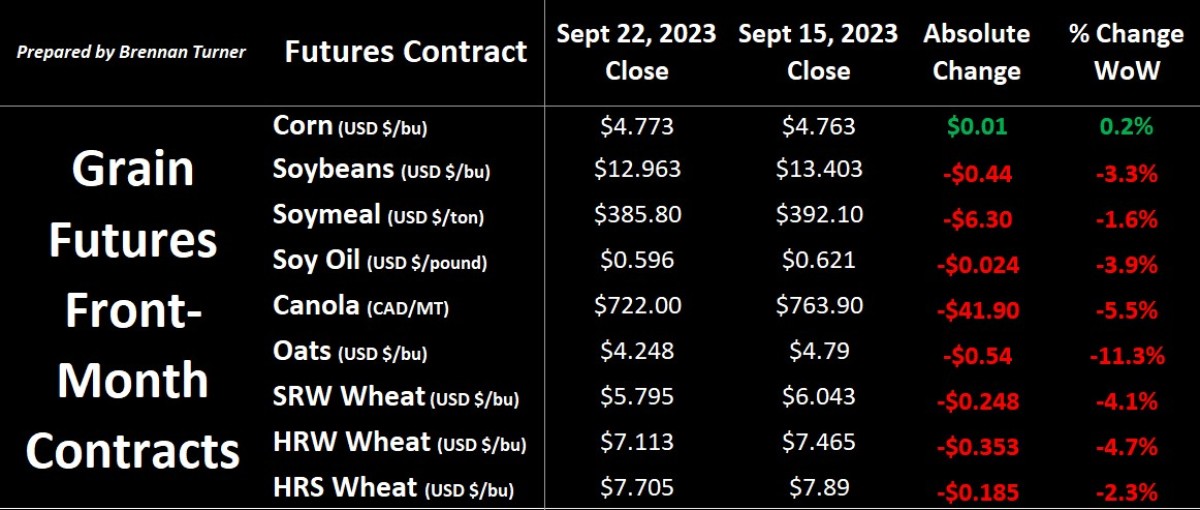

Grain markets headed into the last week of September with ongoing harvest pressures as the complex tries to find its seasonal bottom, accelerated by a broader market sell-off. The stock market lost about three per cent last week as the U.S. Federal Reserve left interest rates unchanged but not without hinting at another hike possibly later this year and that higher rates are here for the foreseeable future. Corn futures made new contract lows in the front half of last week, but the higher close for the week was considered a victory as managed money’s net short grew to its largest since August 2020. The wheat complex saw heavy selling on the possibility of higher U.S. winter wheat acres and the weakest export sales numbers in two months.

According to a recent Farm Progress farmer survey, U.S. farmers will plant 38.7M acres of winter wheat this fall, up about five per cent or nearly 1.9M acres year-over-year, and the largest since 2015! Despite it being the largest area in nine years, this would also be the ninth-smallest area sown to winter wheat and comes at a time when 47 per cent of the American winter wheat area is in some level of drought. The farmer survey also suggested that more spring wheat would be planted for a total wheat area of 52.7M acres, a 2.9M acre jump from Plant 2023, and an obvious catalyst for the bears this week.

On the bullish side of things for wheat, the Australian weather bureau said last week that El Nino is making its way into Australia, and a dry season is expected. This obviously comes on the heels of three straight years of bumper crops off Australian paddocks, and so you would think there would be lots of grain to go around, but stocks remain tight as global demand for food has been so strong. This is part of the reason why we continue to hear more bullish talking heads mention their concerns about how we’re one country’s crop failure away from things getting extremely tight.

One of those in the bullish camp is CoBank, who believes that the tidal wave that’s been Russian wheat exports “may have created a false sense of security in the world wheat market” said Tanner Ehmke, CoBank grains and oilseeds economist. Cheap Russian wheat has been making its way into the Middle East and Africa, thanks to increased military and economic relations in these areas, but mainly because Russia’s currency was devalued by about 30 per cent, compared to the U.S. Dollar. CoBank argues that global wheat stocks-to-use ratios are among the tightest on record when excluding Russia and China. That said, we would likely need to see some appreciation of the Russian Rouble for wheat values to rocket higher in the near term, as CoBank believes they can.

On a separate thread, Russian durum is also making its way into European Union markets, not because it’s cheap, but because the market desperately needs it. The EU’s July import data suggests about 100,000 MT of Russian durum has been brought in after the smaller harvests in France, Spain, and Italy. On the eastern end of Europe, Turkey had a bumper harvest and has sold about 300,000 MT of durum so far, with total crop year shipments forecasted between 500,000 MT and 1 MMT (dependent on government approvals). Nonetheless, the Turkish export campaign is expected to dwindle down before the end of the calendar year, which should temper any current impact on Canadian durum prices here at home. At the end of the day, with global durum production at a 22-year low, and worldwide stocks at their tightest in 30-plus years, there’s a healthy bullish narrative shaping up again for durum.

Ultimately, though, we live now and today. One would argue that this week’s price activity suggests the usual seasonal tendencies of grain markets: they find their lows in September and October. Most agree that wheat is probably close to the bottom, but corn and soybeans usually find it when the U.S. harvest is about 30 per cent complete (as of last week, it was just nine per cent and five per cent, respectively). The Canadian spring wheat harvest is basically complete, with only about 10 per cent of the crop left to take off across the three Prairie provinces. Specific to Alberta, the last crop report from the provincial Ministry of Agriculture suggests yields continue to surprise to the upside, which matches up with my commentary in last week’s Wheat Market Insider column as to how the size of the spring wheat harvest tends to get bigger over time. I hope yours has been safe and efficient and that you’ve been able to take good samples!

To growth,

Brennan Turner

Independent Grain Market Analyst