Canadian Wheat’s Start to 2023/24

Grain markets were mixed in the September long weekend-holiday shortened trading week, with weather, harvest pressures, and logistical concerns – both domestically and internationally – driving the complex. Volatility dropped to a one-month low this week as end-users seem to have moved exclusively to a hand-to-mouth buying pattern and traders position themselves ahead of this Friday’s September WASDE report from the USDA.

The wheat complex traded higher this week on Russian President Putin pushing away any olive branches offered by Turkish President Erdogan related to Black Sea trade. Meanwhile, Slovakia, Romania, Poland, Hungary, and Bulgaria all remain in favour of extending the EU’s current ban on importing Ukrainian grain from this Friday, September 15, to the end of the year (Note: these countries still allow transit of Ukrainian grain through their countries to other export markets). Keeping a lid on any rally sentiment is U.S. wheat exports, which is experiencing its slowest start to the new crop year in terms of commitments and purchases since 1990, which is when this type of data started to be collected. Conversely, Canadian wheat inventories as of the end of July were historically low, according to a StatsCan report last week, while Canadian wheat exports are starting the new crop year pretty strong!

Going into Friday’s WASDE report, the trade’s average guesstimate is for corn yields to fall by 1.6 bushels to 173.5 bushels per acre (bu/ac) for a total production number of just above 15 MMT. For soybeans, the market’s expectation is that the USDA will decrease yields as well, down 0.7 bushels to a 50.2 bu/ac national average, for a total harvest of 4.16 MMT. To be clear, the market is pricing in today, and so any numbers below this could catalyze the bulls to help us get off these harvest lows. However, countering the potential of yield revisions is the rising U.S. Dollar (which hit its highest level since March) and low water levels in the U.S. inland river system. Consider that a year ago, when the Mississippi levels were also this low, river barge traffic basically slowed to a trickle, helping the slowdown in U.S. grain exports that we’re still seeing today. With the low volatility in mind, any extended malaise in the grain markets have, historically-speaking, usually resulted in a pop to the upside.

Looking more inward, in Alberta, last week’s provincial crop report shared its first quality estimates with 61 per cent of the spring wheat crop rated a number one, which is in line with the seasonal average. However, with 52 per cent of durum rated number one, that’s about nine points below the five-year average. Furthermore, only 23 per cent of Alberta’s barley is getting rated as malt, which is down 10 points year-over-year. From a harvest standpoint, 36 per cent of Alberta’s spring wheat crop and 79 per cent of durum fields are now combined but yield estimates for all types of crops have dipped a bit as the large majority of the province’s farmers are reporting below-average yields (the exception is in the Northwest).

In Saskatchewan, spring wheat harvest is 50 per cent complete as of last week, as is 73 per cent of the durum harvest, and similar to Alberta, yields are pretty variable but mostly below-average. More specifically, the Saskatchewan Ministry of Agriculture is estimating spring wheat yields at 42 bu/ac, and durum at just 23 bu/ac; compare this to StatsCan’s print last week of 35.1 bu/ac and 26.5 bu/ac, respectively. Keep in mind, however, that Statistics Canada’s numbers were using data as of the end of July, but on Thursday this week, September 14, we’ll get their August-based estimates.

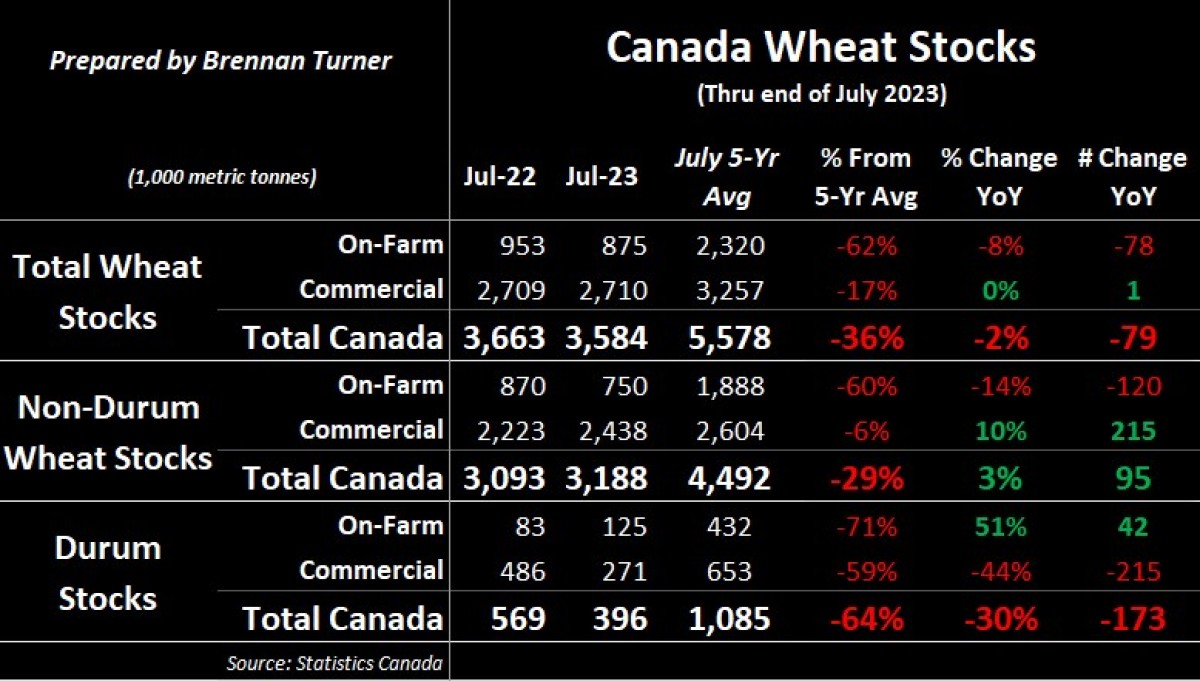

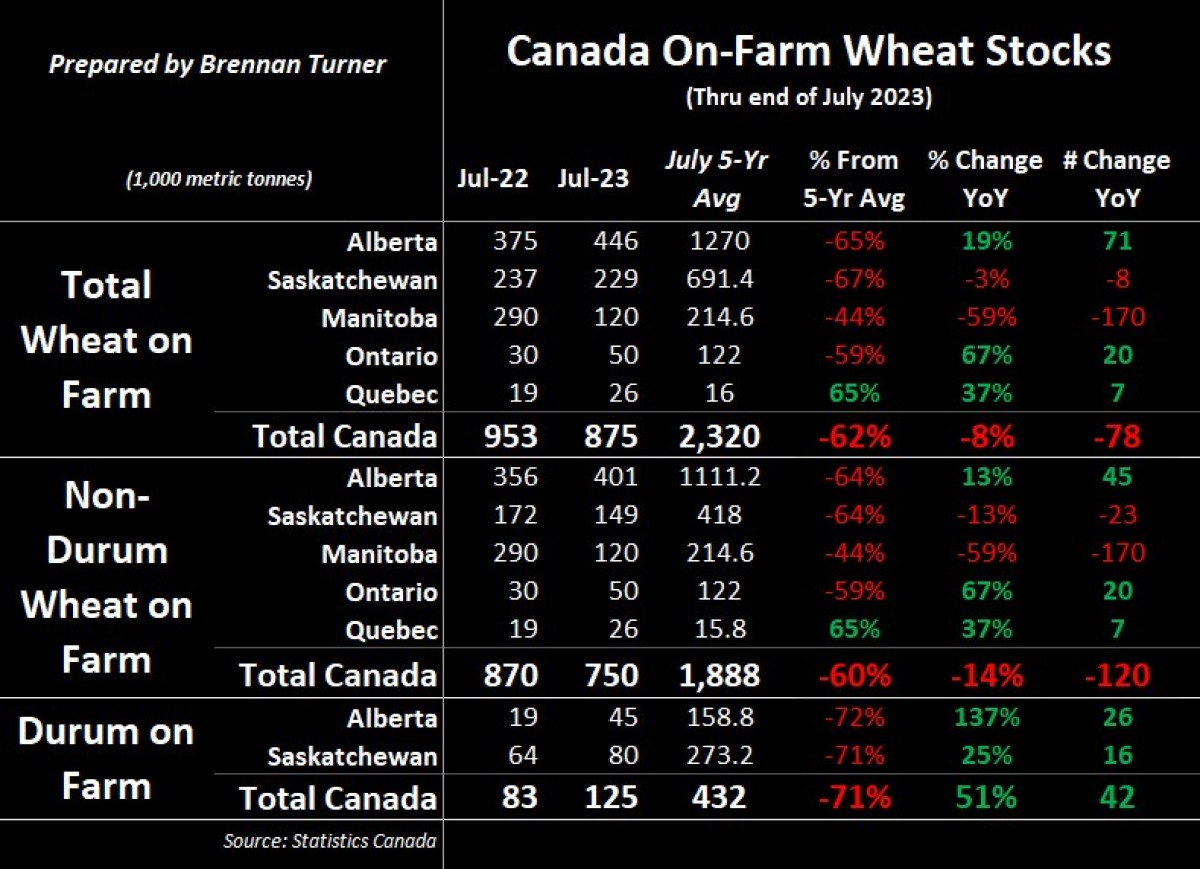

In the meantime, last week Statistics Canada served up its estimate of grain stocks held in Canada, through the end of July (or the end of the 2022/23 crop year for all but corn and soybeans). For the wheat complex, total inventories held on farm and by commercials totalled 3.6 MMT, down 2.2 per cent year-over-year but still 36 per cent below the five-year average. This includes just 396,000 MT of durum, which is down 30 per cent from July 2022 and 64 per cent below the five-year average. Compared to Agriculture Canada’s current estimate for 2022/23 ending stocks of 240,000 MT for durum and 3.24 MMT of all wheat, StatsCan’s numbers are obviously higher so one should expect AAFC to add more carry-in supplies to the 2023/24 balance sheet than what they’ve previously been forecasting (read: bearish). Provincially, only Quebec has bigger inventories than its five-year average, which to me is really a reflection of the strong demand function for Canadian wheat over the past year.

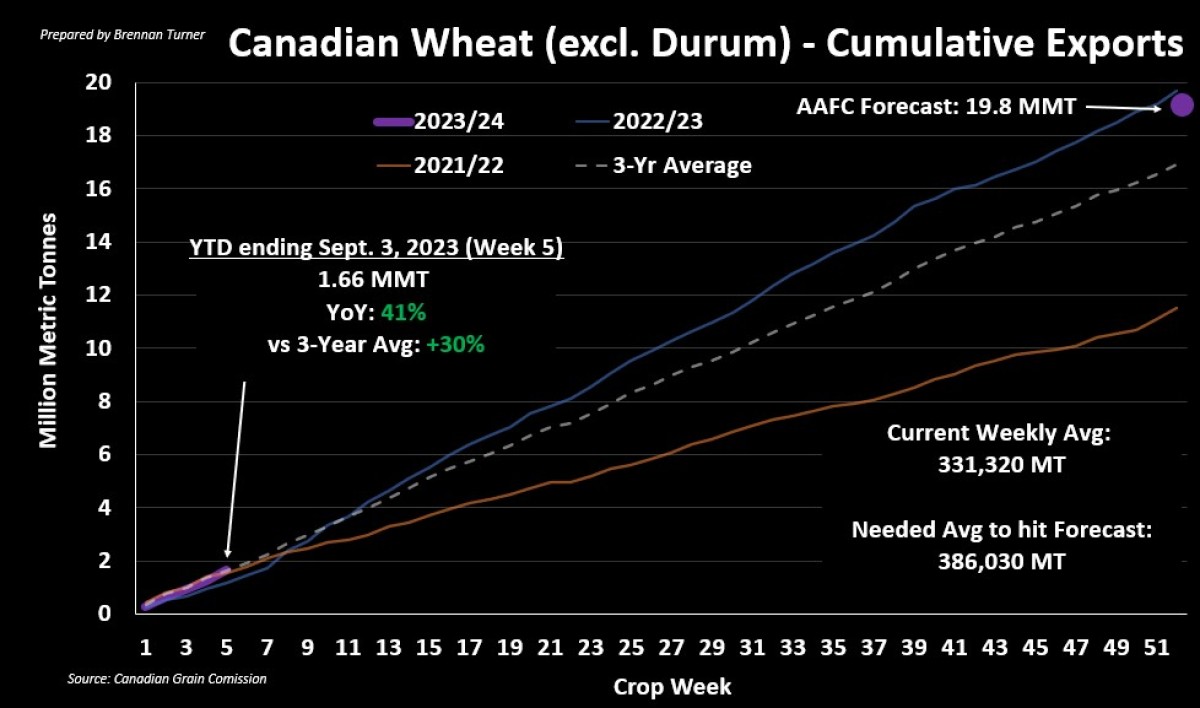

It’s no secret that Canadian wheat has seen healthy international demand, and it’s continuing through the first month of this new crop year as 1.66 MMT of non-durum wheat has left the country. That’s a 41 per cent bump year-over-year and even 30 per cent better than the three-year average, but worth noting is the comparison to the 2021/22 crop year. That year, at this point, 1.54 MMT had been shipped out, with a weekly average of 307,100 MT through the first five weeks; this year, we’re cruising along at 331,320 MT/week. Moreover though, for the full 2021/22 crop year, the weekly average of Canadian wheat exports ended at 221,540 MT and volume totalled 11.52 MMT. I’m not saying that we’re going to be that low, because this year’s crop is much better than Harvest 2021’s, but it’s hard to see a world where AAFC doesn’t drop its current Canadian non-durum wheat export forecast of 19.8 MMT.

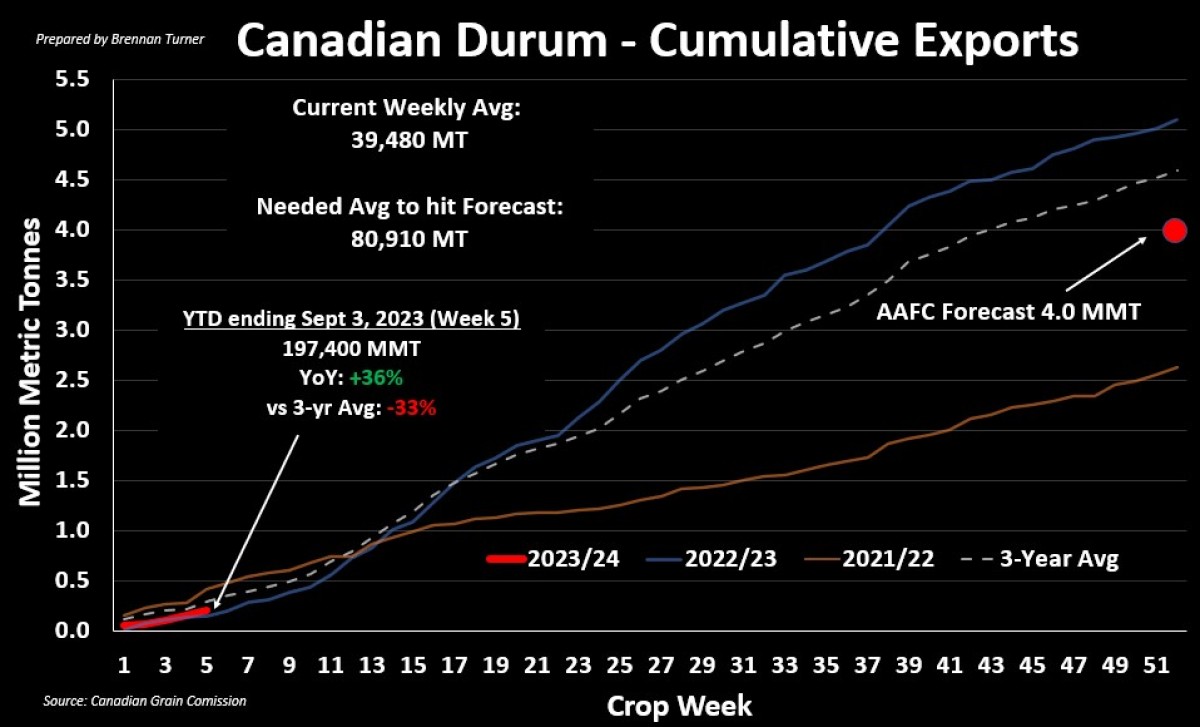

For durum, just under 200,000 MT has left our borders so far, which is up about 36 per cent year-over-year, but 33 per cent below the three-year average. At a weekly average volume of a little under 40,000 MT, we’ll have to see a weekly average of 81,000 MT to meet Agriculture Canada’s current forecast of 4 MMT of durum exports. Is that do-able? Well, last year, after a decent rebound in production, we were averaging 98,100 MT per week throughout the full crop year, but two years ago, it was just 50,640 MT every week in 2021/22. For reference, two years ago at this time AAFC lowered their durum export forecast from 4.7 MMT in their July report to 3.1 MMT in August; the year ultimately ended at 2.72 MMT in exports. Even though there remains a strong underlying demand function for Canadian durum, as prices climb through the fall, there will likely be a limit when international buyers step back, which my guess will be around the new calendar year.

Thus, I continue to reiterate that that are better wheat prices ahead and that today is the time to fulfill existing contract obligations and remain focused on a safe harvest and good sampling. However, if you have to sell right now to satisfy any cashflow requirements, my suggestion would be to look at call options or other ways to stay long the futures.

To growth,

Brennan Turner

Independent Grain Market Analyst