China Opens up Wheat Trade with Russia

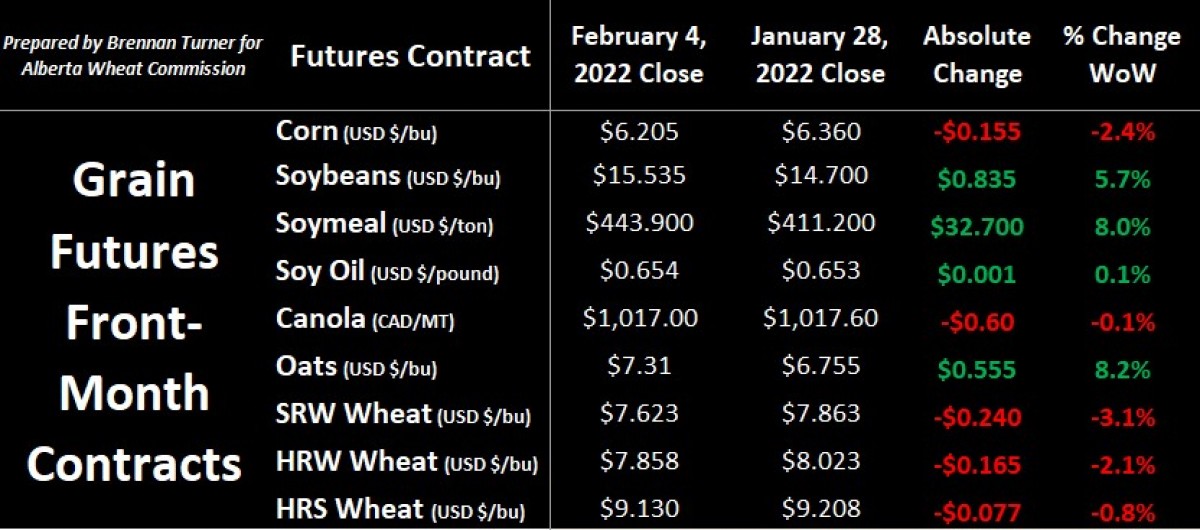

Grain markets flip flopped their way into February as South American production concerns supported oilseeds, and despite some buying on Friday, weakening geopolitical risk pressured the bullish participants of corn and wheat. While a healthy portion of the Russian army is still at the Ukrainian border, any risk premiums built into wheat and corn prices have now subsided. As mentioned in previous weeks in this column, I believe the likelihood of a Russian invasion is quite small, but as was discussed last week, if a skirmish did break out, these risk premiums will return very quickly. For the month of January though, only the wheat complex ended lower, which I think is understandable, given the heights it started the month at and its seasonal trends of moving lower at this time of year!

Staying with Russia, this past week, Russia introduced a ban on exports of ammonium nitrates for the next 2 months, which will surely continue to complicate the fertilizer market. A bigger headline though last week was that China lifted its restrictions on importing Russian wheat and barley, creating a notable opening for trade between the world’s largest wheat exporter and the world’s 4th-largest wheat importer. Over the past few years, China has filled its needs – usually low-protein wheat for feed purposes – with supplies from Australia, Canada, the U.S., and the EU, notably France. There’s also talk that Russian peas will also start to make their way to China.

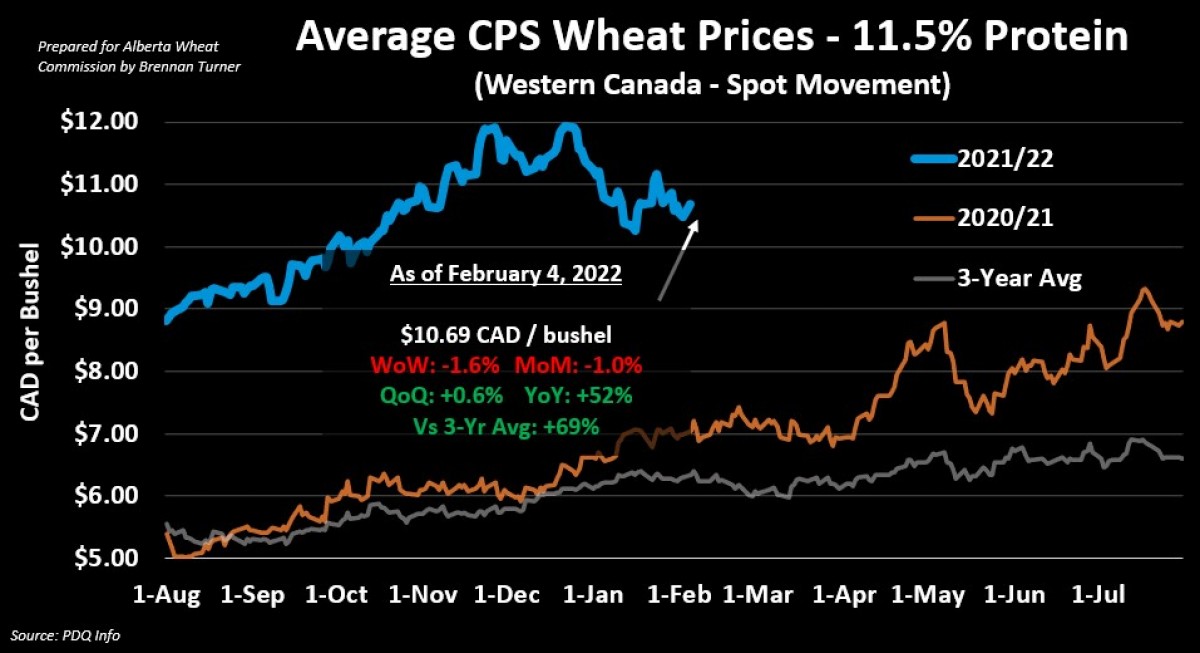

We’ll look a little more deeply into this next week as this could certainly put pressure on Canadian wheat exports. However, I remind myself of the reality that Russian 2021/22 wheat exports are down over 40% this year, largely thanks to their smaller crop and the ongoing export tax. Average wheat prices for 12.5% protein at Russian Black Sea ports are trading around $320 USD or $407 CAD per MT (or $8.70 USD and $11.08 CAD per bushel). For comparison, average in-country Western Canadian prices for #1, 11.5% protein CPS wheat are sitting around $10.70 CAD/bushel as of last week, basically suggesting China is just looking for some cheaper options.

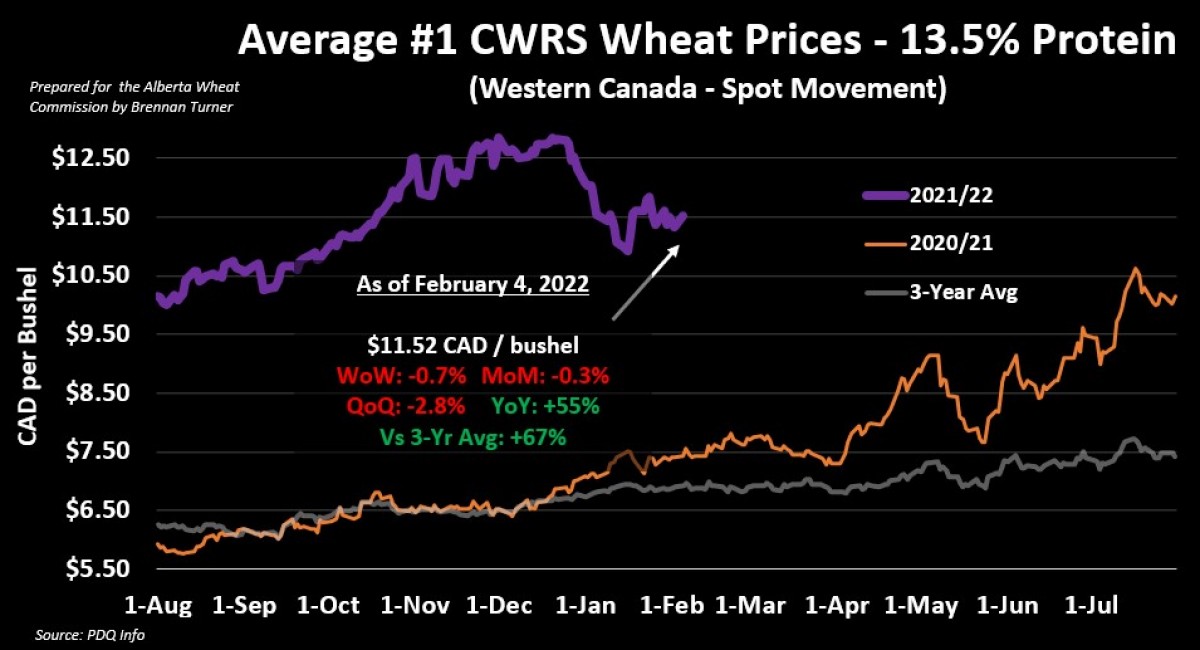

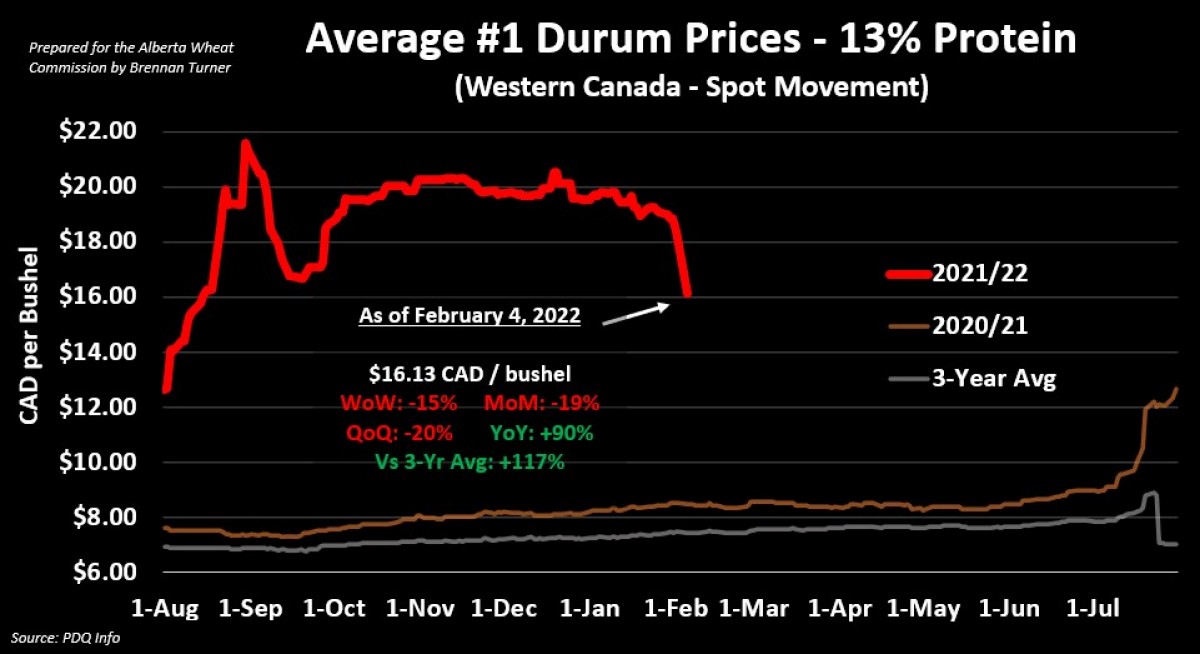

As the charts above and below show, average prices for wheat across the Canadian Prairies have been subsiding, mirroring wheat futures, and over the coming weeks and months, we’ll continue to see old and new crop wheat prices diverge onto one another. In the near term, I’m watching the dry conditions in the major wheat-growing areas of North America, notably the U.S. Southern Plains, where 78% of Oklahoma, 69% of Texas, and 62% of Kansas are experiencing some level of drought. This is a significant drop from where the drought levels in these 3 states were on November 30, 2021: 16%, 17%, and 19%, respectively. On that note, the U.S. winter wheat belt received a small shot of snow and rain this past week, but traders are starting to talk more about moisture potential in March and April, as this is when the crop re-starts its growth.

Finally, this Wednesday, on February 9th, we’ll get the USDA’s monthly WASDE report, which is expected to be neutral for corn and wheat (read: no significant changes to the balance sheet), while soybeans will likely see smaller production and carryout numbers. Most eyes are on South America, where private estimates continue to lower production potential on a weekly basis thanks to drought in southern Brazil, northern Argentina, and Paraguay, and heavy rains on the crop ready to be harvested in northern Brazil.

Overall, the sell-off in the wheat complex seen over the past few weeks should temper out a bit, unless new bearish headlines emerge (i.e. significant rainfall in production areas). Therein, wheat prices are more likely to trade sideways until a better understanding of the 2022/23 crop potential is known, as we already know that demand is pretty constant.

To growth,

Brennan Turner

Founder | Combyne Ag