Colours are Starting to Change

Grain markets saw some heavy selling/profit-taking on Friday to end the week mixed, but the wheat complex was able to stay green, thanks to both European and Chicago wheat futures hitting two-month highs this past Thursday. While most of the wheat trade is focused on activity in the Black Sea, the Brazilian soybean planting campaign is underway and so there’s going to be more attention paid to South America in the coming weeks by the broader complex, with expectations that volatility could be similar to that during North America’s May seeding run. With that said, it looks like about half of Argentine wheat and corn crops remain on the dry side, but northern Brazil is expected to receive some rain, which will help those freshly seeded beans get going. On this side of the equator, Mother Nature continues to provide good opportunities to get the crop off in most areas, while traders continue to be aware of the impact of inflation and rising interest rates might have on grain demand.

Staying in the Black Sea, in the two months since the “grain corridor” deal was signed, 4.7 MMT of grain has left Ukraine. For context, this pace is about 40% – 45% of what Ukraine was able to ship out before the Russian invasion in late February. Somewhat ironically, the Russian wheat harvest continues to get bigger, as SovEcon just raised its production estimate by 5 MMT to a whopping 100 MMT (of course, a new record). Ultimately, as Citibank noted last week, with the ongoing military conflict, namely the mobilization of more Russian troops, there is a disruption risk for grain markets. However, if the door remains open for Ukrainian grain to get exported, grain prices are more likely just keep an eye on the region than the price in said additional risk.

In nearby France, independents Arvalis and FranceAgriMer said last week that the average quality of this year’s soft winter wheat harvest is below-average, mainly because of the hot summer. Average protein for France’s wheat crops is sitting at about 11.4%, down from last year’s average of 11.9%, but still above the 11% that most millers require (Note: there are a few millers who require 11.5%, but allowances are expected in a year where supply is short). That said, it’s estimated that about 73% of the crop has at least 11% protein, down from the 5-year average of 92%, while 42% of the crop owns at least an 11.5% protein rating, but again, this well below the average of 72%. On the flip side, test weights were up, and so markets are expecting some blending.

On this side of the Atlantic, the Canadian Prairies’ Harvest 2022 continues to speed up, with fields combined sitting above their seasonal average in Saskatchewan (73% vs 68%) and Alberta (77% vs 51%), while steady rainfall has slowed activity in Manitoba (40% vs 71% usually completed by the time of year). Therein, with the calendar soon turning to October, there are obvious concerns about quality in Manitoba, especially in cereals where, as of last week, 65% of the spring wheat, 74% of barley, and 64% of the province’s oats had been binned.

Ultimately, this might push quite a few more truckloads of Manitoba grain into the feed use column, but Agriculture Canada is unlikely to update that until later in the year. They did, however, update their supply and demand tables last week, noting that we’re starting the 2022/23 crop year with total grain stocks at the lowest level since the government started publishing their estimates in 1980! That said, the government found an extra 288,000 MT of total wheat supply from the 2020/21 crop year (yes, two years ago), which has trickled its way into this 2022/23 crop year.

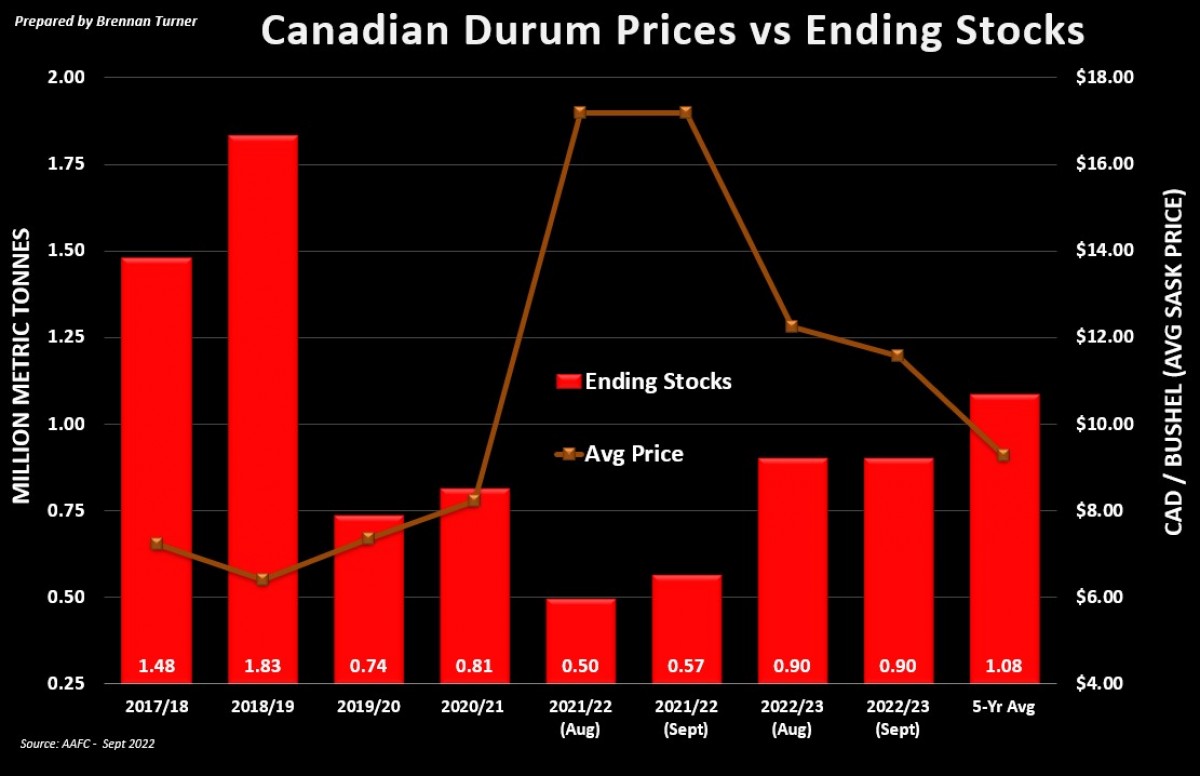

For the durum balance sheet, thanks to the extra 60,000 MT in carryout found in 2020/21, Agriculture Canada raised starting inventories for 2022/23 by 81,000 MT, but that was basically offset by StatsCan lowering its production estimate the previous week. Despite the smaller durum crop than initially thought, exports stayed at 5 MMT, and combined with average domestic use, ending stocks for the current crop year are now pegged at 900,000 MT, a 60% or 335,000 MT jump year-over-year. This has led AAFC to lower their price estimate by another $25/MT, but I should note that their September forecast tends to be on the low side. Maybe 2022/23 could be different, but the government agency’s September estimate was 10% below the final season “average price” in 2019/20, 11% below in 2020/21, and because of last year’s drought, 60% below where average prices were tallied for 2021/22.

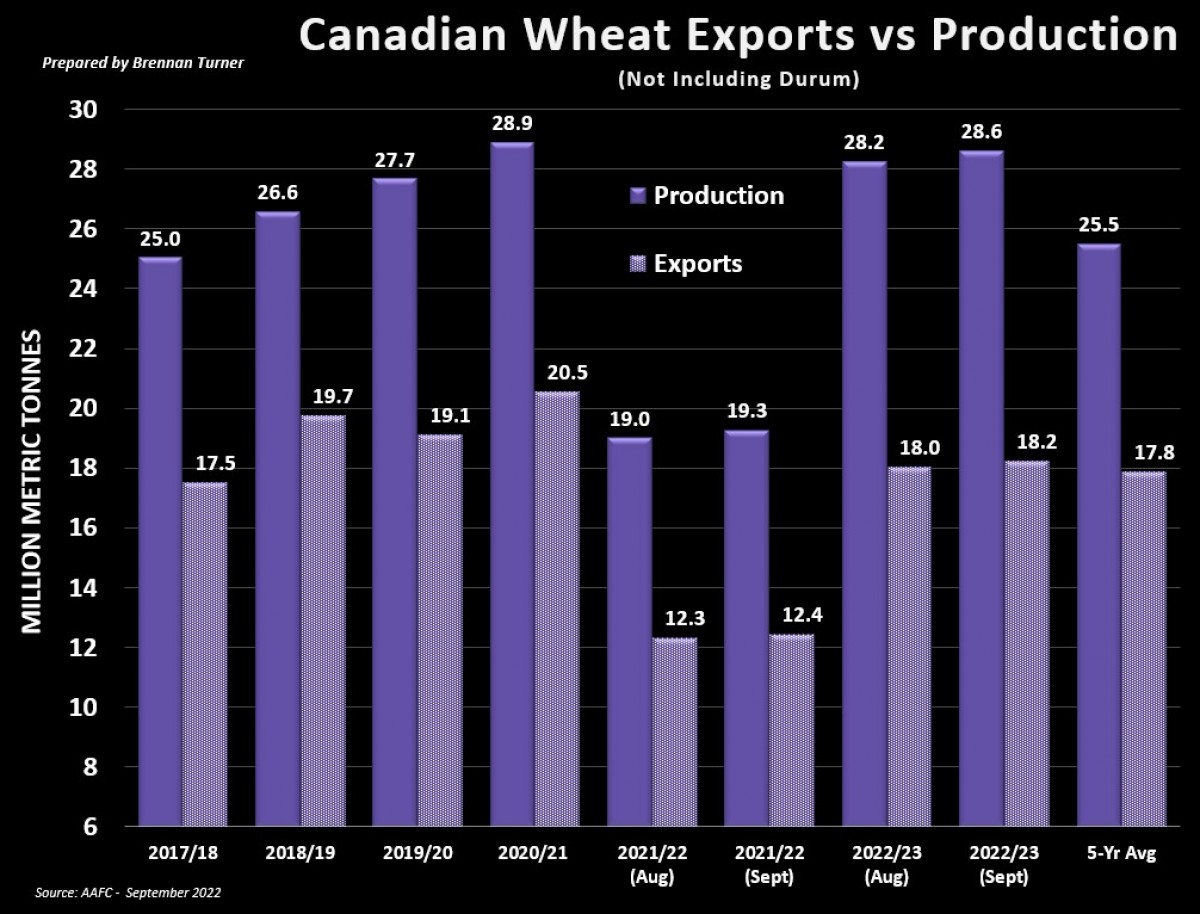

For non-durum wheat, Agriculture Canada’s balance sheet estimates for 2022/23 again got help from an extra 228,000 MT in the 2020/21 crop year’s ending stocks. While production was increased (as per StatsCan’s most recent print), and exports were raised by 200,000 MT from the August estimate, domestic feed use was lowered by nearly 350,000 MT, which meant that 2022/23 carryout was actually raised by 400,000 MT to now sit at a relatively comfortable 5.4 MMT.

As a result of food export restrictions put in place by some nations, there’s a growing chorus of analysts who believe that the 18.2 MMT forecast for Canadian non-durum wheat could be on the low side. The argument against this, however, is that Australian and Russian wheat crops are not small, and because of logistics, may win the business of those nations in need of more wheat imports. This principally includes India, Pakistan, and Bangladesh, as India has put various restrictions on exports of wheat and rice, while the latter two nations can’t rely on India, and are having some production issues of their own. Nonetheless, spring wheat prices are expected to stay in double digits, and just like the fall colours, it’s a pretty sight for this time of year.

To growth,

Brennan Turner

Founder | Combyne Ag