Does Poor US Winter Wheat Mean Better Prices?

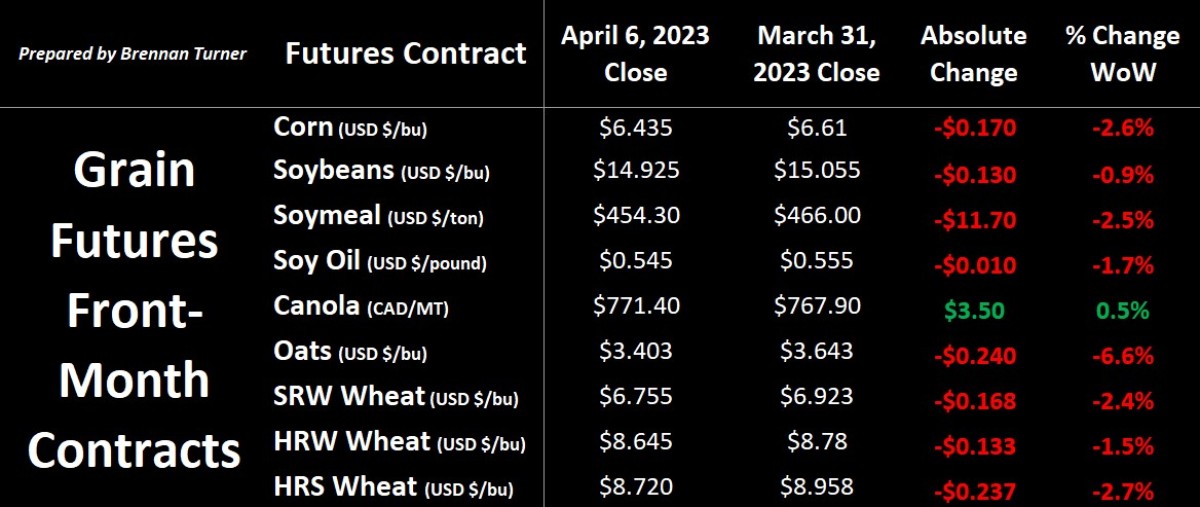

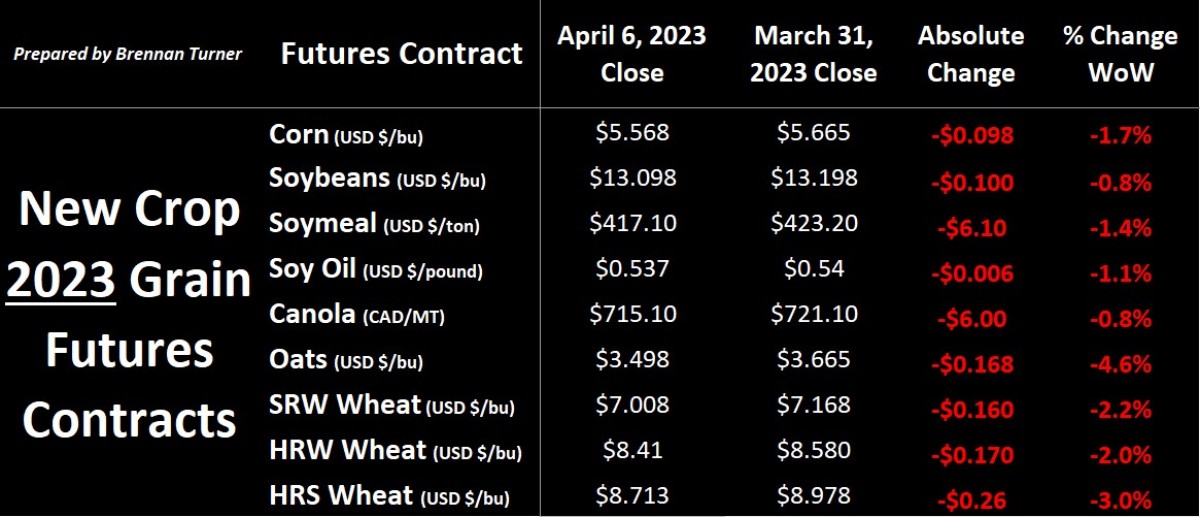

Grain markets pulled back before the holiday-shortened trading week and this Tuesday’s WASDE report, as favourable weather forecasts and profit-taking took grain markets’ driver’s seat ahead of Good Friday. Corn was pressured by the potential of good weather and concerns about how China might react to the U.S. and Taiwan meeting last week. Meanwhile, soybeans saw their huge premium to South American soybeans fade a bit on stronger Brazilian farmer sales and Argentina’s government reintroducing its “soy dollar” preferred-currency exchange to incentive more sales so said government can make some money. Despite more negative talk from the Black Sea, all three wheat futures markets pulled back as well, but more interesting to me was the USDA’s first crop progress report of the 2023 calendar year. In it, the USDA showed a winter wheat crop good-to-excellent (G/E) of just 28%, its worst rating for this time of year since 1996 and 2 points below last year’s first crop rating.

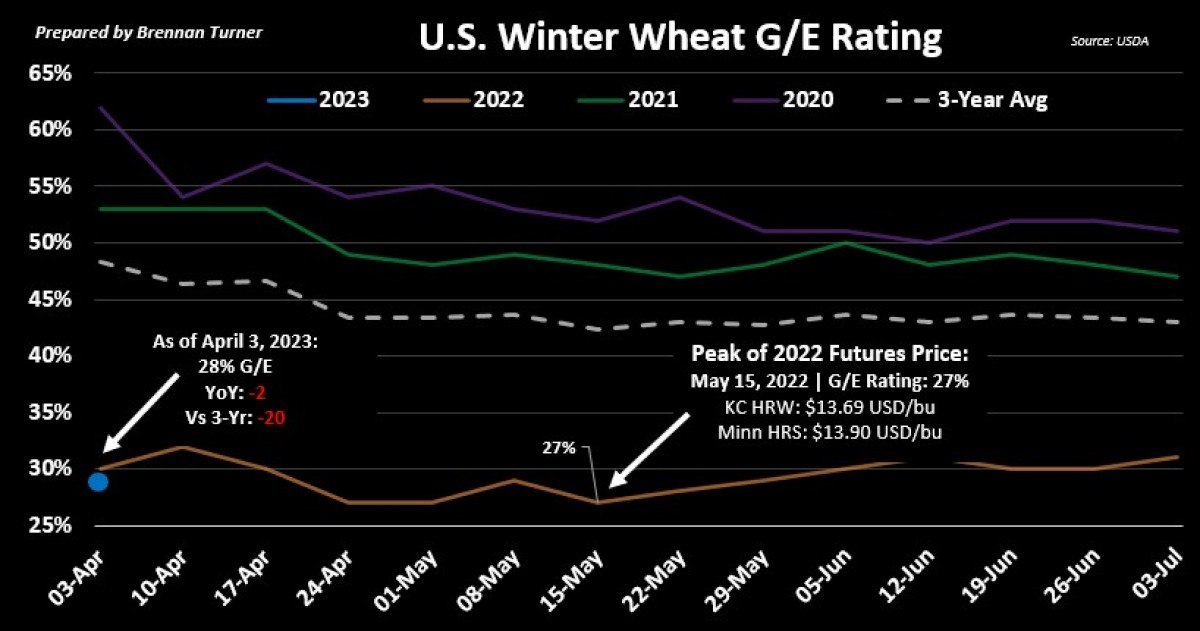

On the flipside, the first official crop progress report of the year from the USDA showed 36% of U.S. winter wheat crop to be in poor-to-very poor (P/VP) shape, literally identical to a year ago. As I’ve mentioned many times in this column, the production total of the U.S. winter wheat crop (and therefore prices) has been largely dependent on spring rains. Currently, the USDA is estimating an average U.S. winter wheat yield of 49.2 bu/ac, which would be a healthy jump from last year’s 46.4 bu/ac final tally (and when the final G/E crop rating for winter wheat was 31%). Interestingly, Karen Braun of Reuters noted last week that, in nearly the last 4 decades, U.S. winter wheat yields have always ended up below average if the first ratings of the season are below 40% G/E.

As the chart above shows, the highs of last year’s spring wheat rally were seen at the mid-way point of May (and the Plant 2022 campaign) when the USDA suggested a season-low 27% G/E rating for the U.S. winter wheat crop. Of note in that same progress report last May 15th, was another season-low of a 24% G/E rating for Kansas’ winter wheat crop, and the state has some weight, given its role as the largest winter-wheat producing state in America. As it stands today, Kansas winter wheat crop’s G/E portion is just 16%, half of the 32% G/E rating it got a year ago, with 57% of the crop rated P/VP, or nearly double the 30% we saw at this time last year. This is a bullish variable that I’ve been talking about for a few months now, but the next few weeks of rain (or no rain) will be obviously critical for the direction of production potential (and wheat prices).

The other variable that could spark wheat prices over the next few weeks is Russia talking up its unwillingness to explore another extension of the Grain Corridor Deal in the Black Sea without economic sanctions lifted. The Kremlin continues to talk tough about re-integrating Russian businesses into the SWIFT financial clearing system and access to other financing and insurance (or else!) but the reality is that they are still likely to export 44 MMT of wheat this year. Further, despite a forecasted Harvest 2023 total of 85.3 MMT according to SovEcon (down from this year’s 100+ MMT haul), they also believe Russia will export 43 MMT in 2023/24. For reference, most of Russia’s wheat is going to the Middle East, namely Egypt, Turkey, and Iran.

While the Black Sea waterway is critical for Ukrainian grain exports, farmers from their European land neighbours in Poland, Romania, and Bulgaria have been protesting of late that the sudden rise in Ukrainian grain imports since the war have depressed domestic grain prices. Some reparations for farmers in these affected nations has been made, with more to come, but Poland has gone so far as to ban imports of Ukrainian grain in the near-term (but will still allow transit of grain through the country).

In a similar dynamic, six countries, including the U.S., Canada, and Australia, recently filed a complaint with the World Trade Organization that India is subsidizing its wheat exports. The consortium claims that India’s wheat subsidies account for 81% of its market price, whereas India has previously agreed to limit its price supports to 10% of the wheat crop’s value. To be clear though, any action/ruling by the WTO likely won’t happen for 2 – 3 years so this likely has no impact on wheat markets today.

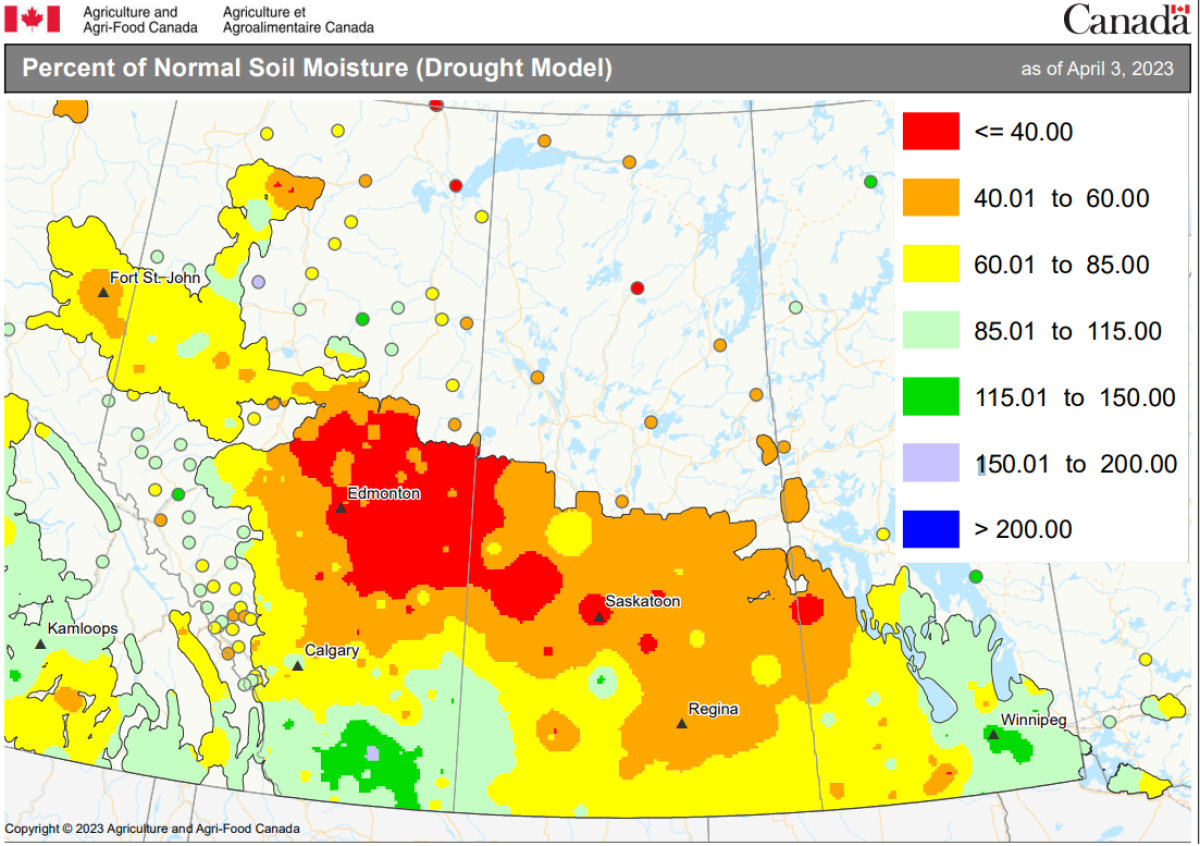

Coming home, with the flip of the calendar to April, the itch to scratch dirt starts to get worse and there’s a lot more conversations I had last week with producers about pulling drills out of snowbanks and getting geared up. While most places are likely 3 – 4 weeks away from getting into their first fields, much like the U.S. Southern Plains, there’s more than a few places across the Prairies that could use a few extra shots of moisture before any wheels roll. As the most recent soil moisture map from Agriculture Canada below shows, the northern half of Western Canada seems to be sitting a bit short, relative to what’s normal, with the driest areas being in NE Alberta.

Ultimately, the start of April also is usually the start of more weather-related (or at least “weather-sensitive”) premiums, and last week’s dip puts us at a bit of a weaker starting point. In addition to the usual Mother Nature-related trading in wheat, likely amplifying volatility will be the aforementioned factors of drought facing the U.S. winter wheat crop, and what’ll happen to Ukrainian Black Sea grain exports in a few weeks. Amidst this is the foundational reality that money managers are sitting on a huge short position, and if, for whatever reasons, that starts to get covered, all of these factors could converge on one another to catalyze values higher. That said, I believe that the market has already built in a fair amount of risk premium for the Black Sea and U.S. winter wheat events, but I’m also reminded that spring rallies don’t happen in a few days, but over a few months.

To growth,

Brennan Turner

Independent Market Analyst