Double-Digit Wheat Prices Are Here

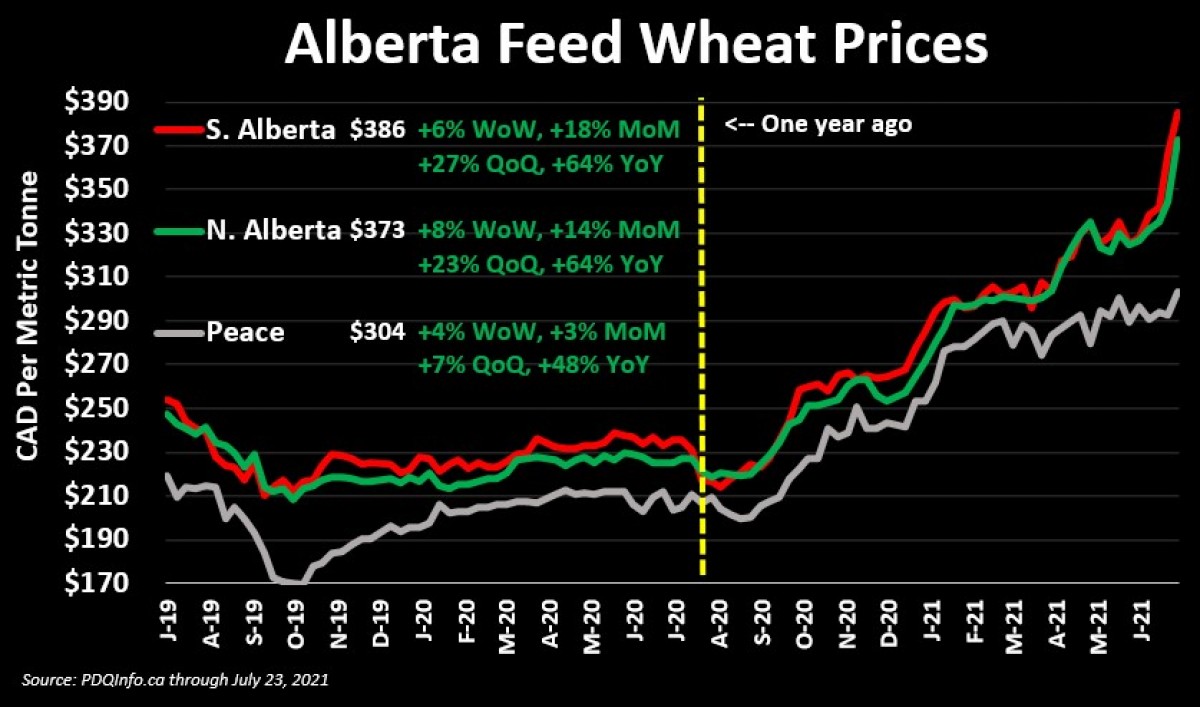

Grain markets saw another pullback last week as more favourable weather for the Midwest corn and soybean crops pushed over into the wheat complex, which continues to have very bullish undertones. Putting further bearish pressure on the grain futures complex was commentary that Chinese soybean imports are likely to slow in late 2021 while Russia’s wheat harvest is looking quite promising with average yields above 51 bushels per acre. However, add in even more heat and some hail across Western Canada over the past week, and new crop cash wheat prices are moving into double-digit territory.

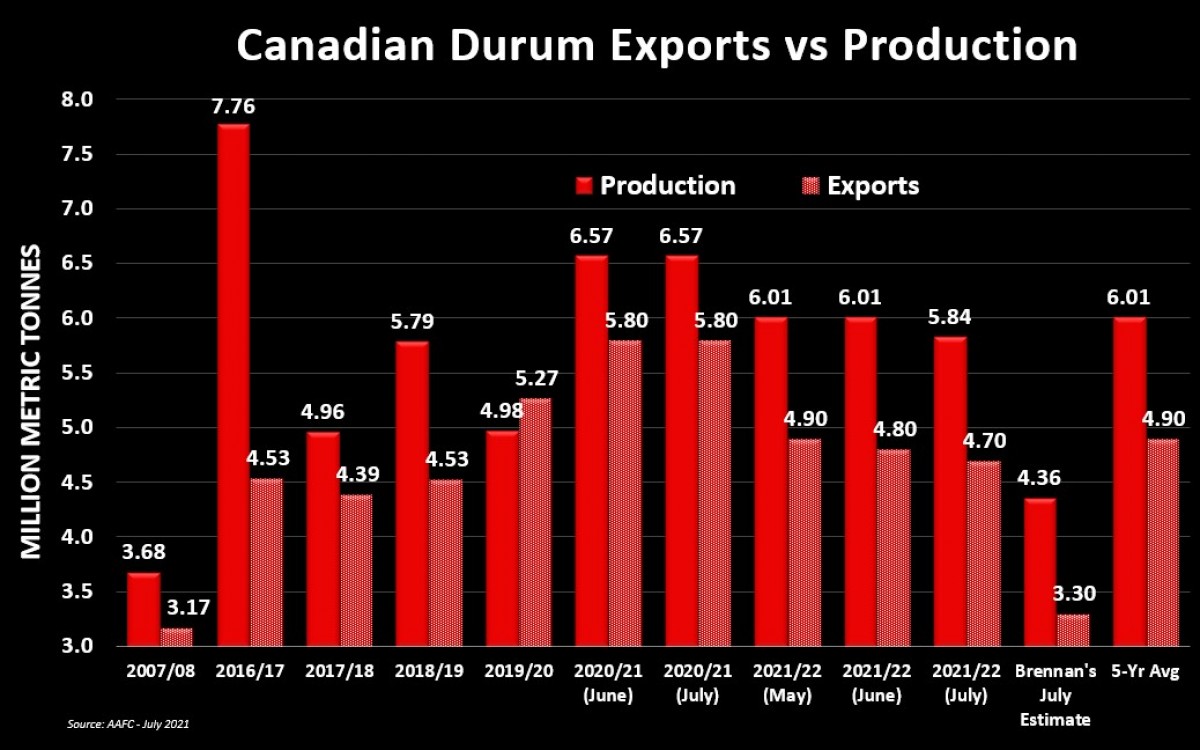

Put bluntly, major durum-producing areas of North America have seen some of the toughest growing conditions this year. Being conservative, I think average Canadian durum yields will fall from the current estimate of 39.6 bushels per acre down to something closer to 30 bu/ac or about 2 MT/ac (For perspective, average yields in 2007/08 were 28.7 bu/ac or 1.93 MT/ac). As shown in the chart below, this would mean that production will be 1.5 MMT less than Agriculture Canada’s July estimate.

Therein, with more of the crop going into feed (because it can’t make milling grade) and exports dropping significantly, I believe that ending stocks could drop down to something around 400,000 MT, which would be a record-tight carryout. Unless exports pull back significantly (which I don’t think will happen), this basically means that durum prices will stay in double digits for a fair amount of the 2021/22 crop year. In fact, we’re already seeing new crop durum bids above $12 CAD/bushel but, before the end of the 2021 calendar year, I think it’s more than likely we could see $15 or $16 handles.

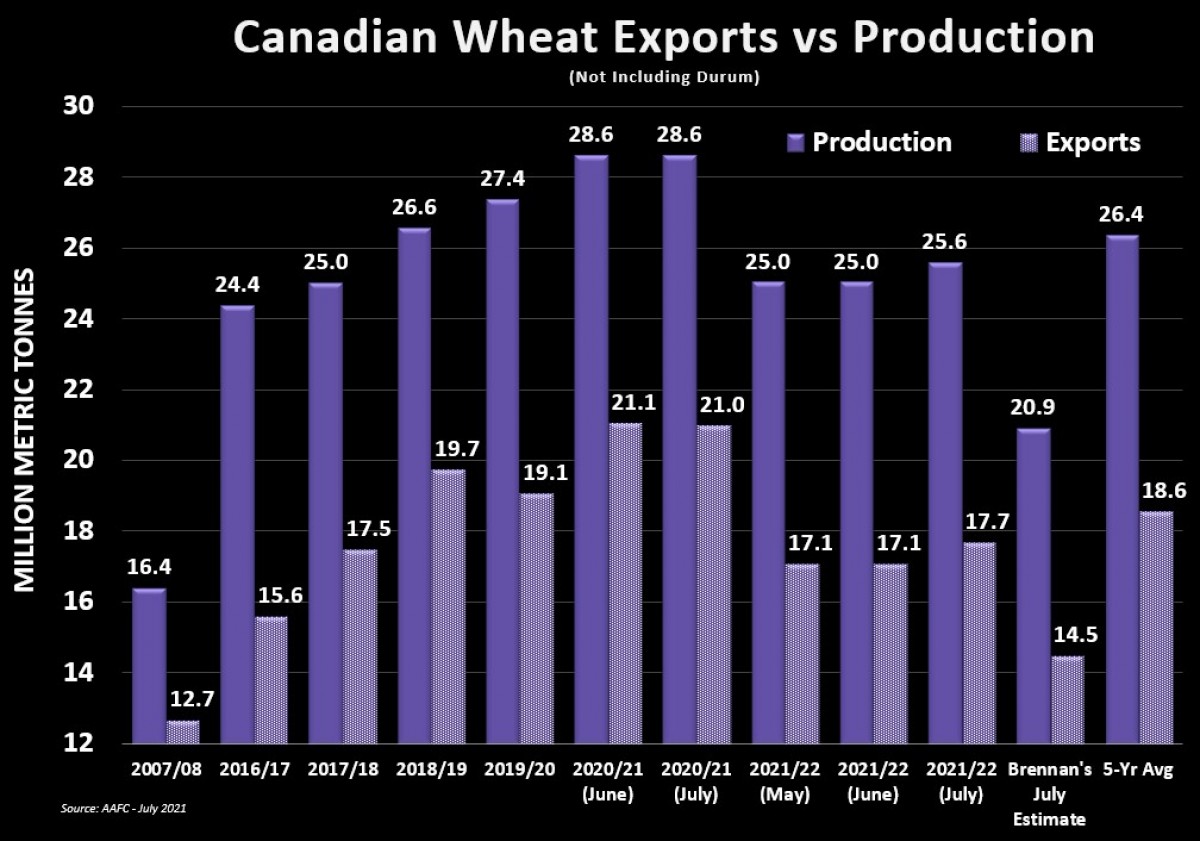

For non-durum wheat, it’s going to be a slightly more positive story in terms of production, given that some northern areas in Western Canada have good-looking spring wheat crops, in addition to a decent winter-wheat crop in Eastern Canada. However, with fewer acres being harvested and yields probably dropping from the current 53.5 bu/ac AAFC estimate to something closer to 46, I think that the total non-durum Canadian wheat harvest could come in something closer to 21 MMT.

This is especially important as this year’s U.S. winter wheat harvest has lower average protein, meaning that high-protein wheat will be in high demand this year. In fact, the USDA said in their monthly WASDE report that the U.S., to meet its domestic milling needs, will need to import about 626,000 MT more durum and 653,000 MT more spring wheat than it did last year. Thus, Canadian spring wheat exports should stay relatively strong, but like durum, it’s quite possible that a healthy percentage of this year’s harvest will go into the feed category. Logically, with feed prices going parabolic over the last few weeks in many areas, many farmers may opt to sell to livestock operations versus dealing with discount schedules at the elevator that we’re sure to see this fall.

Overall, I think there’s a scenario where Canadian non-durum ending stocks could drop below 3 MMT, and prices easily stay in double-digits until demand is rationed (likely in early winter once the Australian harvest comes to market). At this point in the growing season, more rainfall to help fill what’s left of the crop and produce something is probably the only thing that could make me eat my words (which, for the record, I’d be happy to if it meant more farmers got a better crop off than what we’re seeing right now). On the flip side, without any significant rain to help, even my “conservative” guesstimate may prove to be too optimistic.

To growth,

Brennan Turner