Durum Prices Hitting a Standstill?

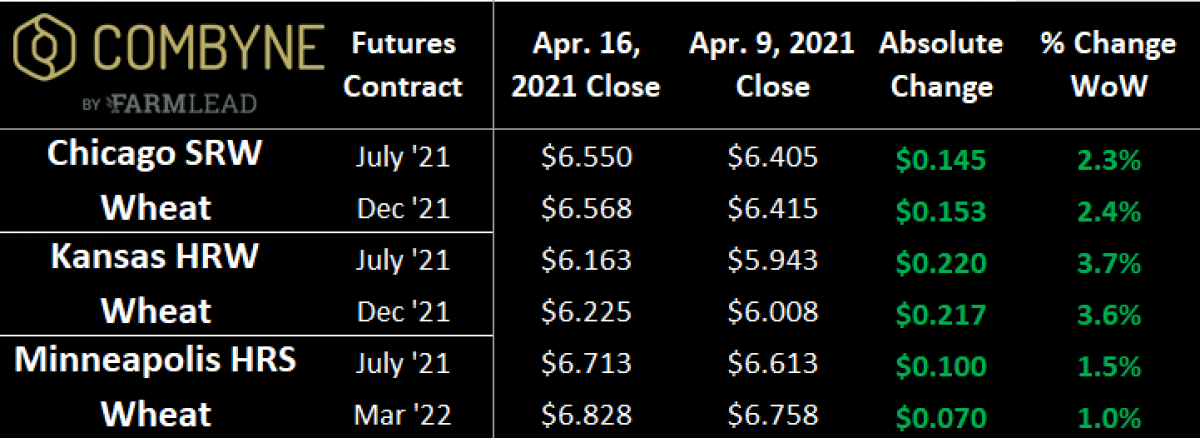

Wheat prices found the green on the futures board for the second week in a row as moisture concerns across North American wheat-growing regions continue to be top of mind. While U.S. winter wheat rated as good-to-excellent stayed at 53% for the 3rd straight week, drought conditions in Texas and Oklahoma are keeping traders in Chicago (SRW wheat) and Kansas City (HRW wheat) on edge. Similarly, while U.S. spring wheat seeding is tracking a bit ahead of schedule (19% of acres seeded vs the 5-year average of 12%), some rain helped parts of the U.S Northern Plains, but Minneapolis (HRS wheat) traders continue to watch worsening drought conditions across the region.

Following last week’s slightly bullish wheat WASDE report, it’s expected that because of higher corn prices, China could use up to 40 MMT of feed wheat in the current 2020/21 crop year! In addition to being a decent substitute for corn, it’s also getting traded in for soymeal, given the high price of that oilseed-based feedstuff as well. Therein, anyone who can buy wheat instead of corn seems to be doing it. As it stands, the Black Sea is largely out of the supply picture for China, whereas Australia, Argentina, the U.S., and Canada are all gunning for the opportunities. Worth noting, however, is that France gets a frost a couple of nights last week, but it’s a bit early to tell the final impact. Meanwhile, SovEcon raised its estimate of the Russian wheat harvest yet again, this time by 1.4 MMT to 80.7 MMT.

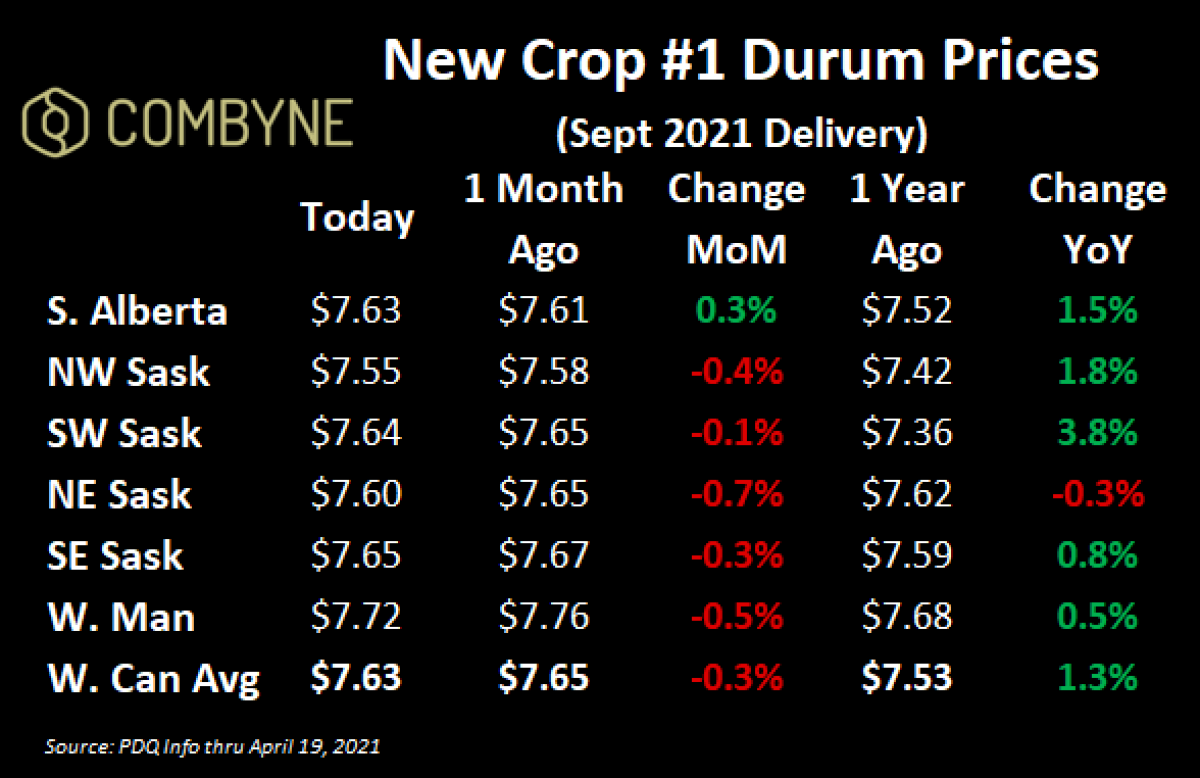

Looking elsewhere abroad, a USDA update from Morocco suggests that good rains and subsidized seed supplies are pointing towards a good-sized harvest. More specifically, 2.3M acres of durum were planted, up 4% year-over-year, but the more impactful data point is average yields rebounding 147% over last year’s drought-riddled crop to 31.8 bushels per acre. Therein, total durum production in Morocco should amount to just over 2 MMT, up 155% year-over-year. It is a similar dynamic with other cereals, and accordingly, expectations are that the country will import fewer cereals, namely wheat, durum, and barley.

On that note, new crop durum bids have been largely stagnant for the past month across the Canadian Prairies. Based on the coverage I’ve heard thus far, it seems that there are quite a few buyers who are waiting to hear how the first few fields getting planted go. However, when you offset some of the aforementioned slowing demand, we’re likely going to be sitting slightly below/around $8 CAD/bushel until a new headline shows up.

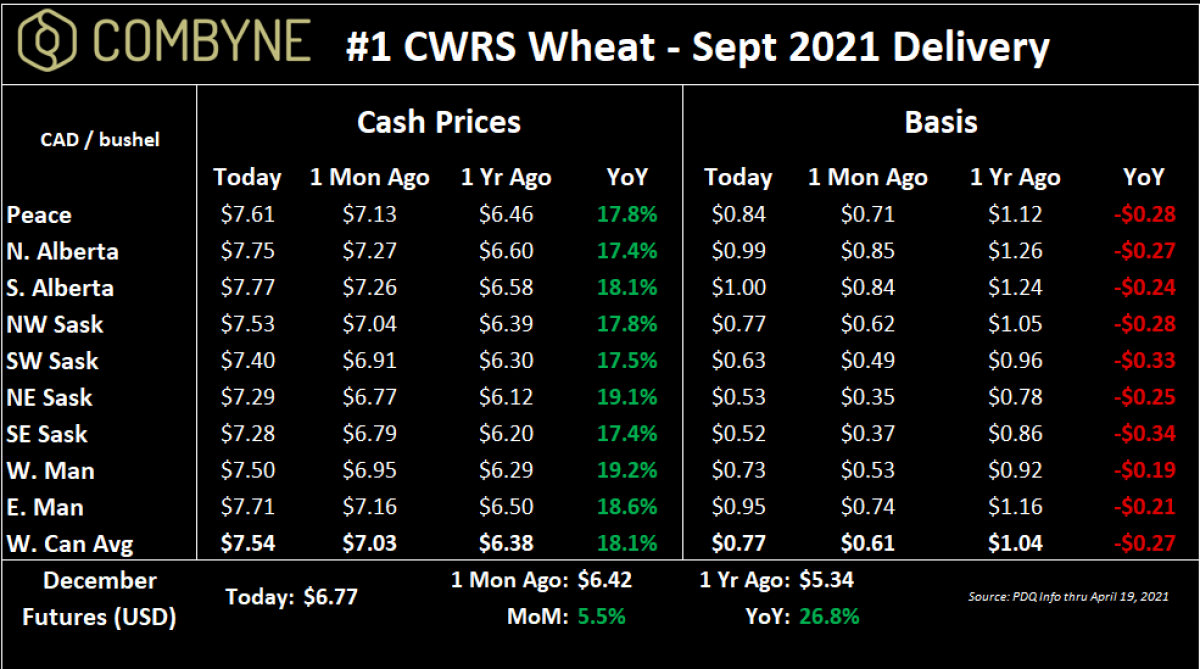

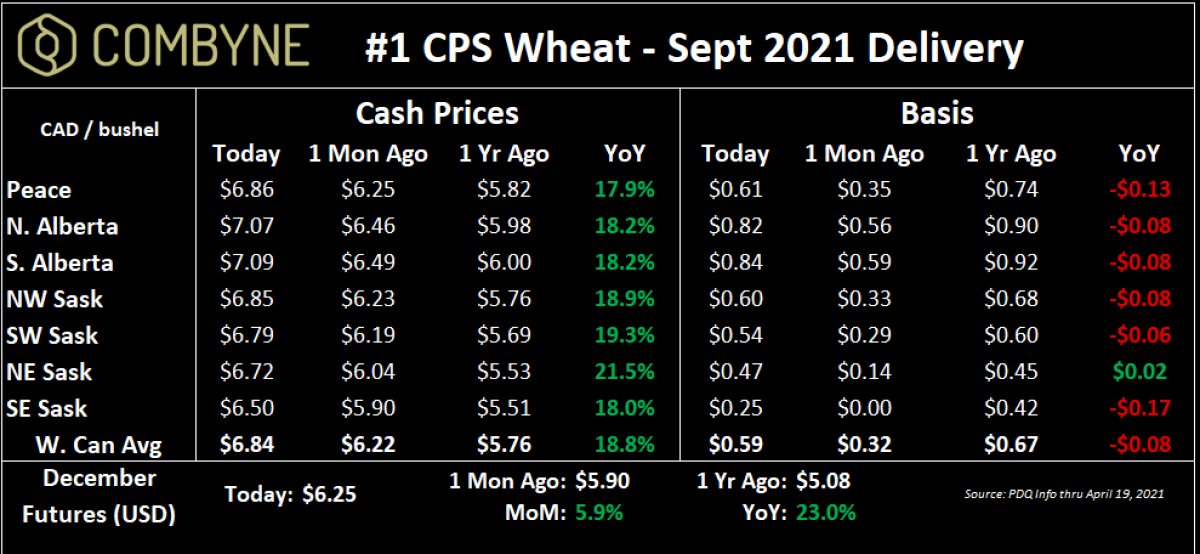

Conversely, HRS wheat and CPS wheat continue to find some better bids, thanks to not just the futures market appreciating, but also the reality of good prices for many other crops that are competing for acres (i.e. canola, oats, peas, or feed barley). Just two years ago, we were amazed to see $7 CAD/bushel handles for low-protein / CPS wheat, and yet here we are seeing its bid for new crop contracts in a few places! The key differentiated factor here though is that HRS wheat basis hasn’t appreciated as much as that of CPS wheat, which is just a clear indication of much demand there is for low-protein wheat, namely that which is going into the feed market.

To growth,

Brennan Turner

CEO | Combyne Ag