Finding a Fall Foundation

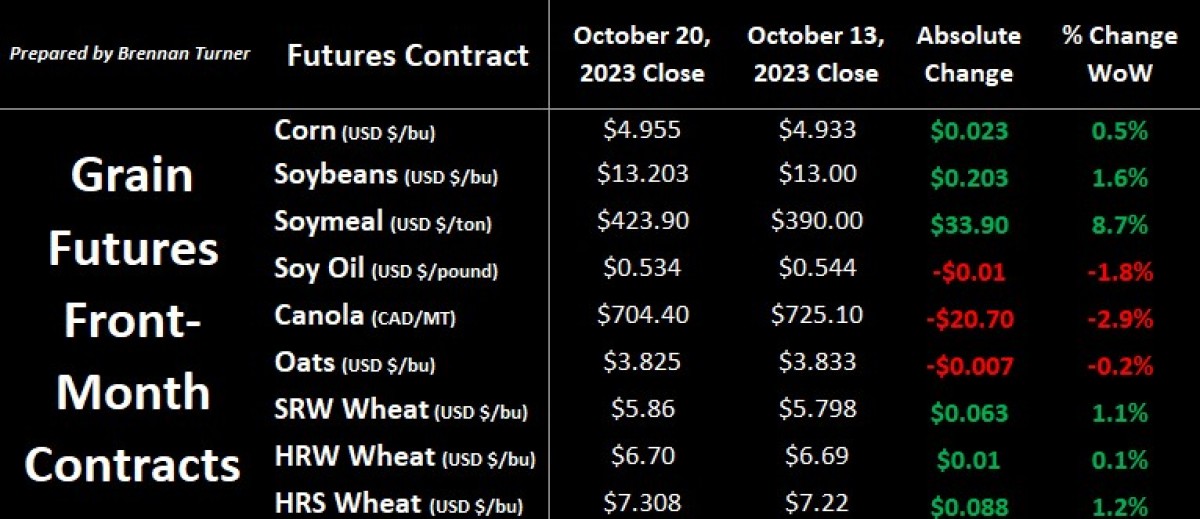

Grain markets were mostly green through the third week of October as bargain buying and healthy export sale activity lifted futures throughout the week before profit-taking on Friday. December corn futures closed on Thursday above $5 USD / bushels for the first time since August, despite healthy farmer selling as the harvest of America’s largest crop ramps up (now at 45 per cent complete). Soybean prices climbed on some weather challenges in South America. There is speculation that U.S. yields will continue to be downgraded, further contracting an already tight balance sheet. The wheat complex saw some bargain buying and a green performance for the week, but strong selling on Friday limited any major gains like other grain futures.

Down in Brazil, some buzz is building for areas of the Amazon River, where water levels are sitting at their lowest in over 100 years. This is causing some grain shipments from the newer terminals built along the river system to be halted. Further political reaction has resulted in the Brazilian government committing $20M USD for emergency dredging services. Low water levels on America’s Mississippi River system are expected to last until January, even with ongoing dredging. More broadly, with Mother Nature’s pendulum currently swinging back to an El Nino, drier conditions remain in Brazil. While some rains have fallen recently in neighbouring Argentina, delaying the planting of their corn crop, the Buenos Aires Grain Exchange says that about half of the country’s wheat crop is rated fair to poor because of persistent dryness for the second straight growing season.

Fall weather in Western Canada has also been dry, a concern given the soil moisture deficit most regions still sit in after this growing season. A typical winter El Nino brings less snow and milder winter weather but tends to bring more spring storms. Therein, Mother Nature’s impact on local grain prices will likely be more pronounced come the spring, as it’s just speculation until then. On the other side of the world, Australia has had some fresh rains recently, causing StoneX and IKON to upgrade their estimates of the wheat crop there to 26 MMT and 28 MMT, respectively. The USDA is currently estimating a 24.5 MMT harvest in Australia).

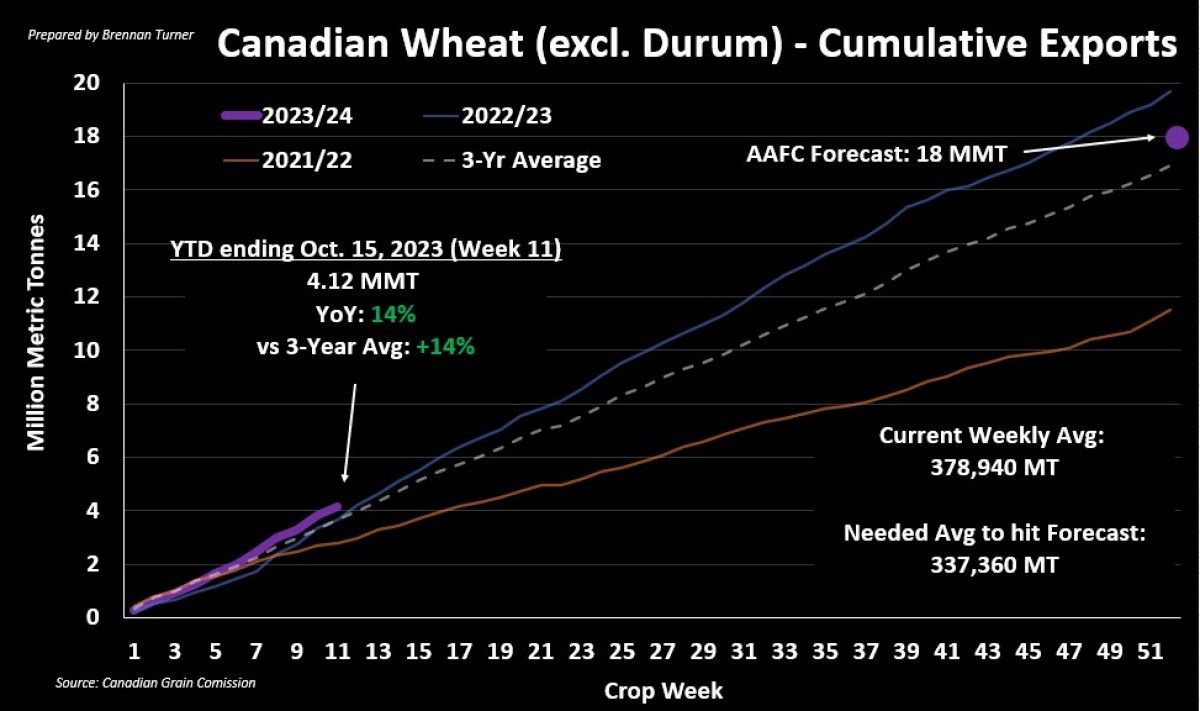

In this column last week, I mentioned the discrepancy between the estimates from the USDA and AAFC for Canada’s wheat production and exports. Each column is separated by 1.16 MMT and 1.7 MMT, respectively. I find this quite significant, considering the limited amount of high-protein wheat available globally, but I’m going to side with the USDA, which owns the larger production and export forecasts, as we know that Canadian wheat crops tend to get bigger by the final December report from StatsCan. Australia may have a bigger crop and compete with Canada for business from Asian higher protein wheat buyers, such as China and Indonesia. In fact, these two countries owned about one-quarter of all Canadian wheat exports last year at nearly 3 MMT and 2.14 MMT, respectively. Canadian wheat exports are trending well, with 4.12 MMT shipped out in the first 11 weeks, up 14 per cent year-over-year and from the 5-year average.

Currently, the USDA estimates China will import 11 MMT of wheat in 2023/24, while Indonesia will bring in 10 MMT. However, some market participants believe China’s import numbers may be on the low side, given the quality challenges of the harvest this year. The USDA’s office in Beijing believes that at least 22 MMT of the country’s 136.5 MMT output this year (or 16 per cent of the harvest) was sprouted, and so it’s expecting 37 MMT of wheat will go into the People’s Republic feed category, up from 31 MMT last year.

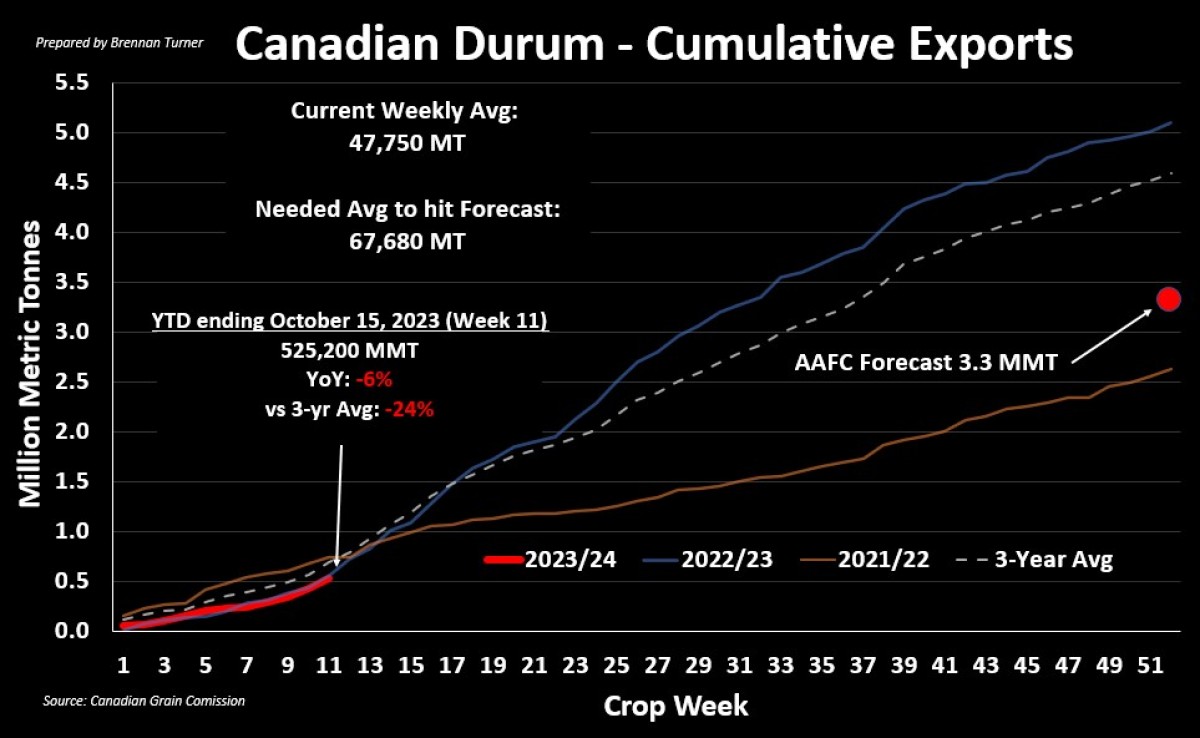

This past week, Farm Credit Canada also came out with its forecasts for the 2023/24 crop year, noting that except for feed barley, durum, and spring, most Canadian crop prices should drop, but will still stay above their 5-year average price. Regarding non-durum wheat, FCC is pointing at Russia as one of the main bearish variables, while the unexpectedly strong exports are squeezing durum values from Turkey. In fact, Canadian durum exports are tracking slightly behind last year’s pace and about a quarter behind the 3-year average. With just over 525,000 MT shipped out, the weekly pace will certainly need to pick up, and I, like most of the market, expect that to happen in the coming months. As a reminder, 2021/22, the orange line in the chart below, is from the drought harvest two years ago when just 2.7 MMT was shipped out.

With the US corn and soybean harvest reaching the halfway point, the market feels like it’s finding a foundation for the rest of the fall and winter months (or at least until more is known about the southern hemisphere’s potential crop size). Historically, when corn futures have topped $8 USD / bushel, it’s taken 18 – 24 months to find a low. We’re now entering that window since corn futures were last over $8 in May 2022. That said, I’m cognizant of how the market has had a tough time holding onto sustained rallies, as there always seems to be some underlying bearish theme limiting the pull from any bullish headlines. Thus, the focus now should be rewarding yourself by selling incrementally (5 per cent to 15 per cent of your total harvest) into the seasonal rallies expected. To execute, you’ll need to know exactly how much volume these portion-sales amount to, your quality, and if it’ll meet your cashflow needs over the next 6 - 12 months.

To growth,

Brennan Turner

Independent Grain Market Analyst