Finding a Winter Bottom

Grain markets continued to push lower towards the end of February with Kansas City HRW wheat futures the only commodity finding the green for the past week. Lower corn prices continue to bring wheat with it, and for reference, the last time U.S. corn ending stocks were forecasted this large, front-month corn futures were trading around the $3.50 mark.

Looking forward, the USDA, in their annual February Outlook Forum, said that U.S. farmers will seed 91M acres of corn, 87.5M of soybeans, and 47M of all wheat in Plant 2024. For soybeans, it would be a nearly 4M acres increase compared to last year’s 83.6M. For corn and wheat, this is a drop of 3.6M and 2.6M acres respectively, but for the cereal, they’re expecting better average yields, and therefore, higher production than last year, thanks to improved moisture prospects in the Southern Plains winter wheat region. With the bigger harvest, the forecast is interpreted as bearish for wheat.

Farmer Frustration Boiling Over

Geopolitical factors continue to have a near and long-term impact on wheat prices.

• Farmers in India are protesting over not being paid the government-assured prices, as well as a variety of proposed policy changes.

• European farmer protests in many European cities continue to push back on stricter environmental regulations (Sweden, Finland, Denmark, and Austria are the only countries whose farmers have not joined the protests).

• Eastern European farmers are specifically protesting against cheap Ukrainian grain coming into their countries.

• Last week, the U.S. and Europe introduced 100s of new economic sanctions on Russian financial, energy, and defense-related industries, but many doubt just how much of an impact it’s having on the Russian economy.

France lowered their forecast of soft wheat area seeded this past fall to just under 10.8M acres, which would be nearly an 8% reduction year-over-year.

• Currently, nearly 70% of the crop is rated in good-to-excellent health, which is a 4-year low

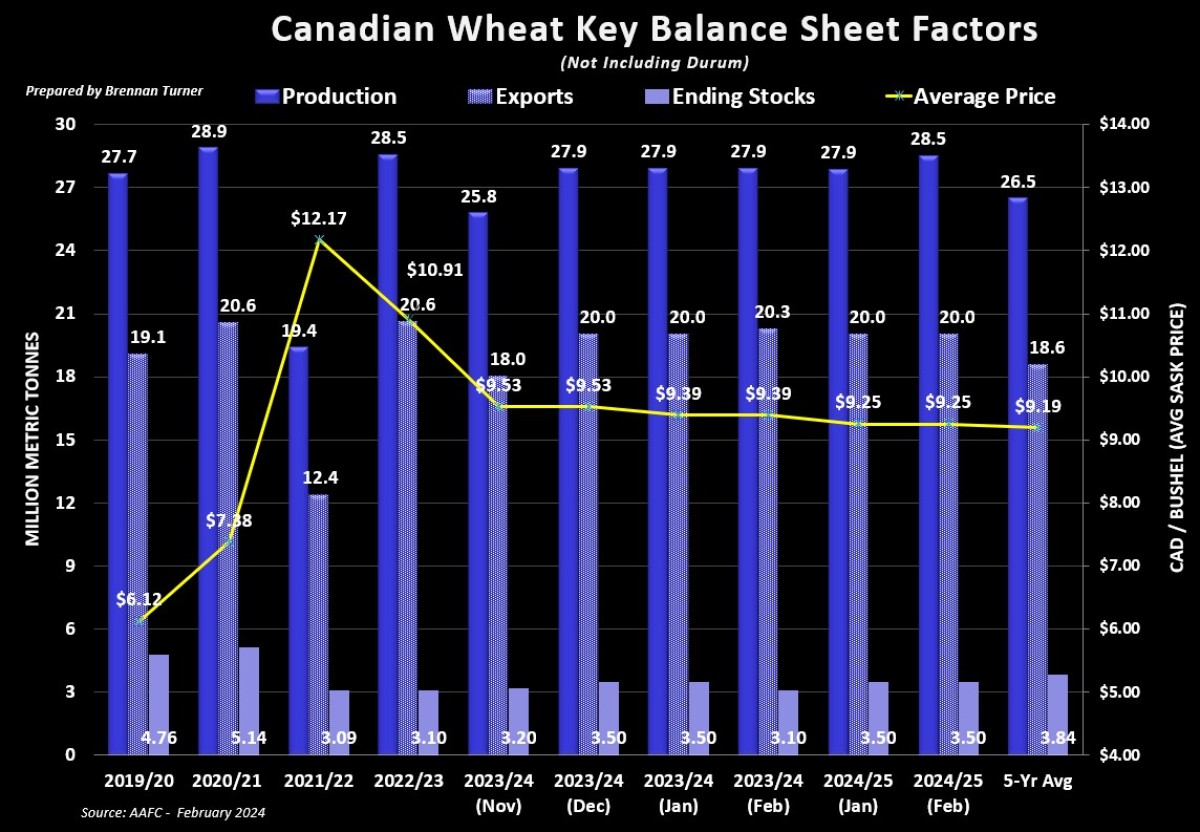

AAFC Wheat Balance Sheet Update

In their February update, Agriculture Canada lowered 2022/23 ending stocks by about 150,000 MT. Coupled with 250,000 MT of more exports in the current 2023/24 crop year, this pushed their ending stocks estimate lower by 400,000 MT to 3.1 MMT.

• 2024/25 harvested acres were raised by nearly 450,000, to bring production up by 630,000 MT. This was offset by the lower carry-in from 2023/24, and larger domestic demand to keep 2024/25 ending stocks at 3.5 MMT.

Through the end of December, more Canadian wheat is finding its way to the United States (+45% year-over-year), Indonesia (+33%), and Japan (23%)

• However, wheat exports to China are down 34% compared to the same time frame last year, while business with Bangladesh is down 13%. These 2 countries still represent 13% and 6% respectively of Canadian non-durum wheat exports.

Regional spot prices suggest that the weight of extra supply (and likely some logistics) are having the biggest impact in eastern Saskatchewan and Manitoba.

• At $8.07 CAD/bushel, average Western Canada HRS wheat prices are now their lowest since May 2021

• At $7.06, average Western Canada CPS wheat cash prices are now their lowest since April 2021

• Noting a spread of $1.50/bushel between Manitoba and Alberta, average feed wheat prices are their lowest since April 2021.

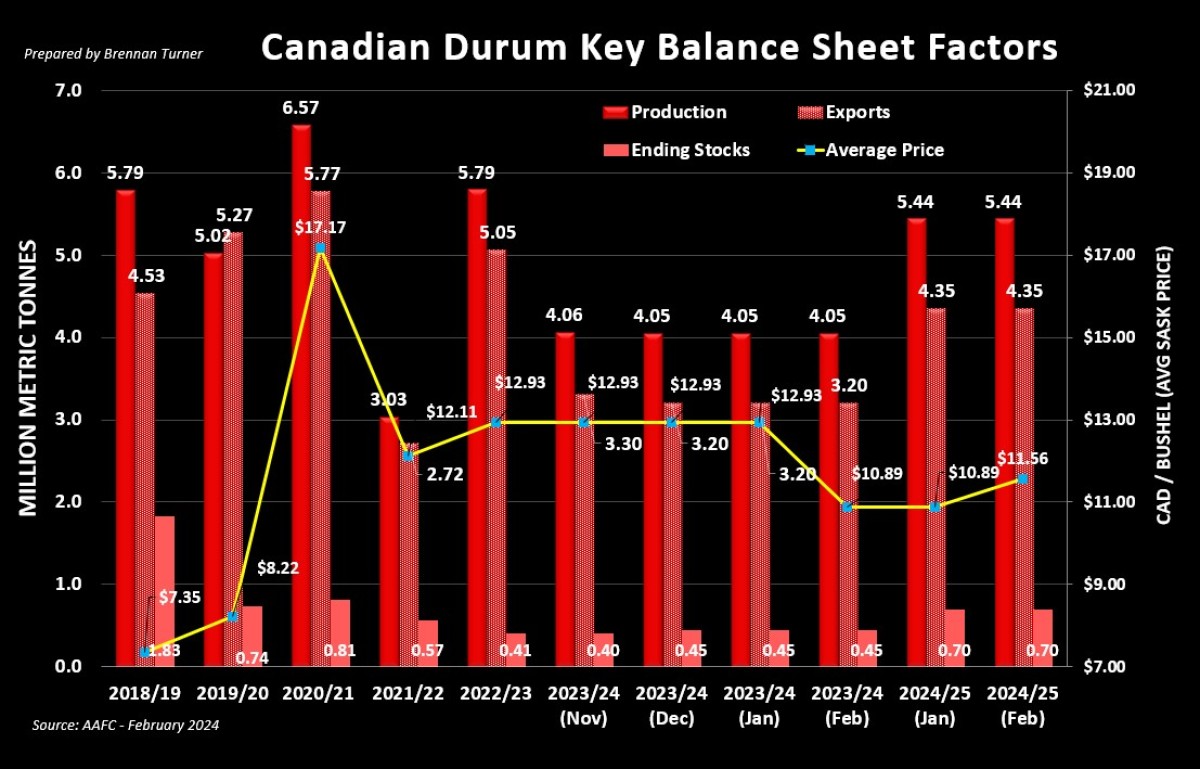

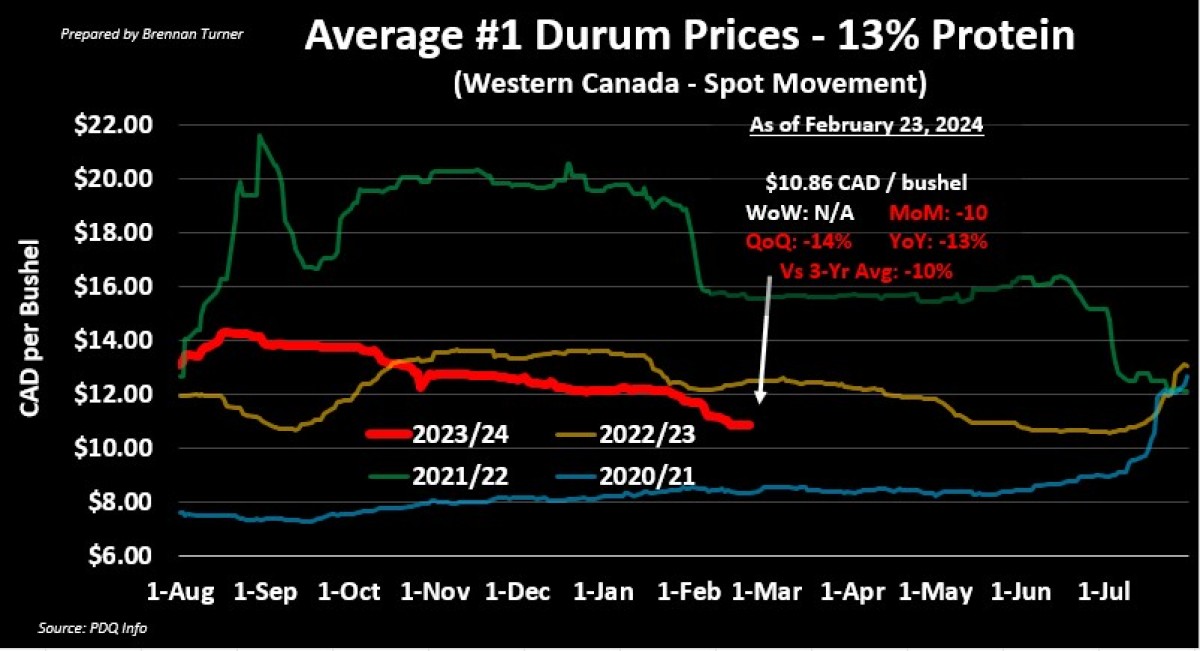

Mixed Durum Outlook

Globally, the forest of 2023/24 durum ending stocks at 5 MMT would be the tightest in over 3 decades.

• Drought conditions remain Italy, Spain, and even Algeria, suggesting more imports by these countries in 2024/25

• France, Europe’s largest durum producer, also seeded 10.5% less durum this fall than the previous year. The crop currently has a good-to-excellent rating of 74%.

No changes were made by the AAFC to any part of the durum balance sheet.

• Certainly a healthy amount of supply but the key question is on the export front, namely if we can hit the AAFC’s targets of 3.2 MMT for 2023/24, and 4.35 MMT in the 2024/25 crop year.

• Trade data through December shows significantly less Canadian exports to Italy (down 71% year-over-year) and the United States (-14%). Shipments to Algeria, however, are up 12%.

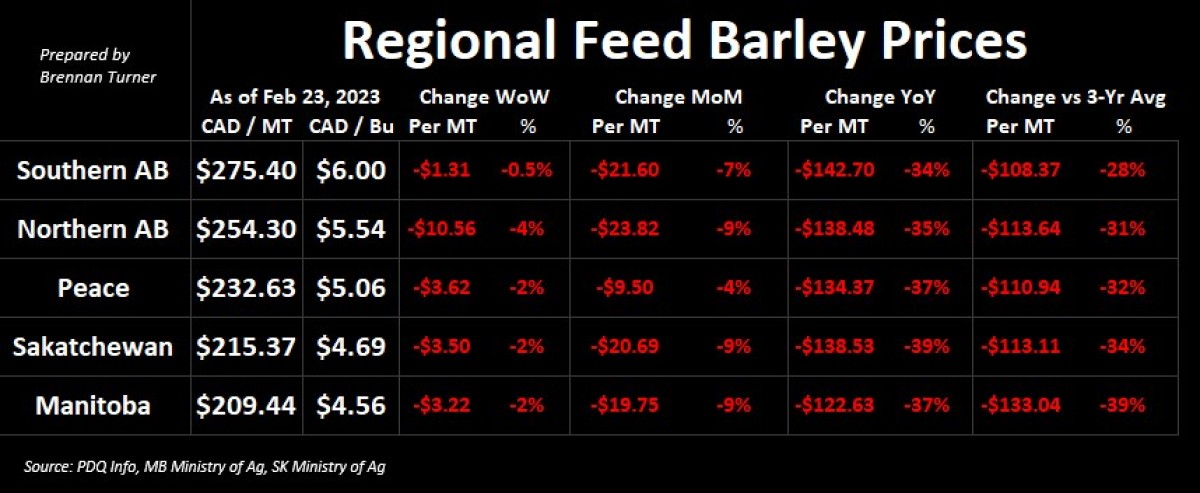

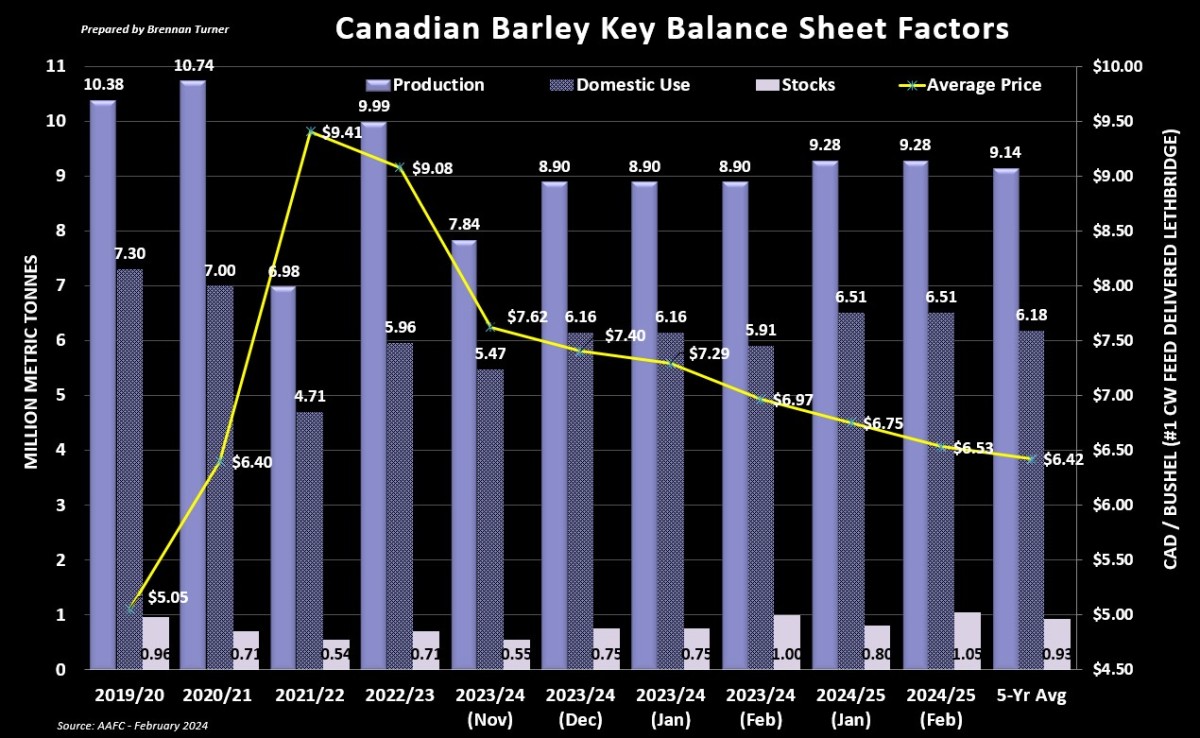

Barley Pressured by Corn, Smaller Cattle Herd

Canadian feed barley values move to the lowest price since November 2020 as the feedstuff remain challenged by cheaper corn imports and a smaller demand draw.

• Canadian cattle herd of 11.1M on farms would be its lowest level since 1989; this mirrors the United States, whose cattle herd of 87.2M is the lowest since 1951.

• Movement periods are pushing into the summer months as a lot of corn contracted over the past few months is still making its way into feed rations. This trend is expected to continue as corn values remain in decline.

Domestic demand destruction confirmed by Agriculture Canada who noted in their update that total use from August to December of 2.9 MMT is down “sharply” year-over-year.

- In the same period, corn imports totalled 1.24 MT, nearly triple the 465,000 MT imported in the August-December 2022 window. 90% of this imported corn went to Western Canada.

- The heavier competition with corn had AAFC push barley domestic use down by 250,000 MT, which, in turn, increased 2023/24 ending stocks by the same amount to now sit at 1 MMT. This would be the largest Canadian barley carryout in 6 years (or 2017/18).

- More corn and soybeans are competing with Canadian barley in the Chinese feed market, and barley shipments to the People’s Republic are down 45% year-over-year to just under 800,000 MT. The Chinese market still accounts though for nearly 90% of all Canadian barley exports.

Globally, the USDA announced this month their estimate that global demand for animal feed in the 2023/24 crop year will be the lowest in 5 years.

• Barley exports from Australia and Ukraine are expected to increase, meaning more competition for Canadian supply.

• World ending stocks are still set to close at an all-time low, largely because of a rebound in food, seed, and industrial use.

On the malt front, we’re seeing new crop bids around the $6.00 CAD/bushel range (includes Act of God)

• There’s the usual seasonal buzz out there that old crop malt barley in the bin is not meeting spec, which is sometimes just an indication of the price differential from last year’s contracted price and/or the bearish state of current market demand. One thing’s for certain: it would mean more feed barley supply.

• More broadly on the demand front, craft brewers are worried about another significant increase in the excise tax for beer sales, as it’s based on inflation. This could further hurt demand from the portion of the market responsible for nearly ¼ of all beer production in Canada.

To growth,

Brennan Turner

Independent Grain Markets Analyst