Flash Drought Equals Flash Buying

Grain markets rallied hard on Thursday and Friday last week as updated forecasts and drought monitoring maps suggest more of the same hot, dry weather. I’ve heard and read more talking heads using the term “flash drought” last week, which you could argue was translated by traders as “flash buying”, with November soybeans climbing by more than $1 USD / bushel in two days, and December corn up more than 50¢ USD / bushel over the same timeframe. The wheat complex got in on the party, and while gains weren’t as substantial, all three new crop wheat contracts (Chicago SRW, Kansas City HRW, and Minneapolis HRS) had their highest weekly close since mid-April. While short-covering and further downgrades to the crop in Argentina also supported the rally, one other variable is that Monday, June 19 is the Juneteenth holiday in the U.S., and so grain futures markets are closed for another three-day weekend.

The buying frenzy was mostly fueled by Thursday’s updated U.S. Drought Monitor report, which showed 57 per cent of U.S. corn, 51 per cent of soybeans, and 50 per cent of wheat fields are facing drought conditions. For the Corn Belt specifically, things are currently trending to be the fourth-driest June since 1960, and the second-driest Q2 (April – June) in the last 60 years as well. While the algorithmic traders are just skimming and acting on headlines like “two-thirds of Iowa is in a state of drought”, the NOAA’s latest forecast suggests some improvement for the Western Corn Belt (which includes western Iowa, western Missouri, and Nebraska) but that the moisture-free weather may continue until the end of the month for the other half of the Corn Belt.

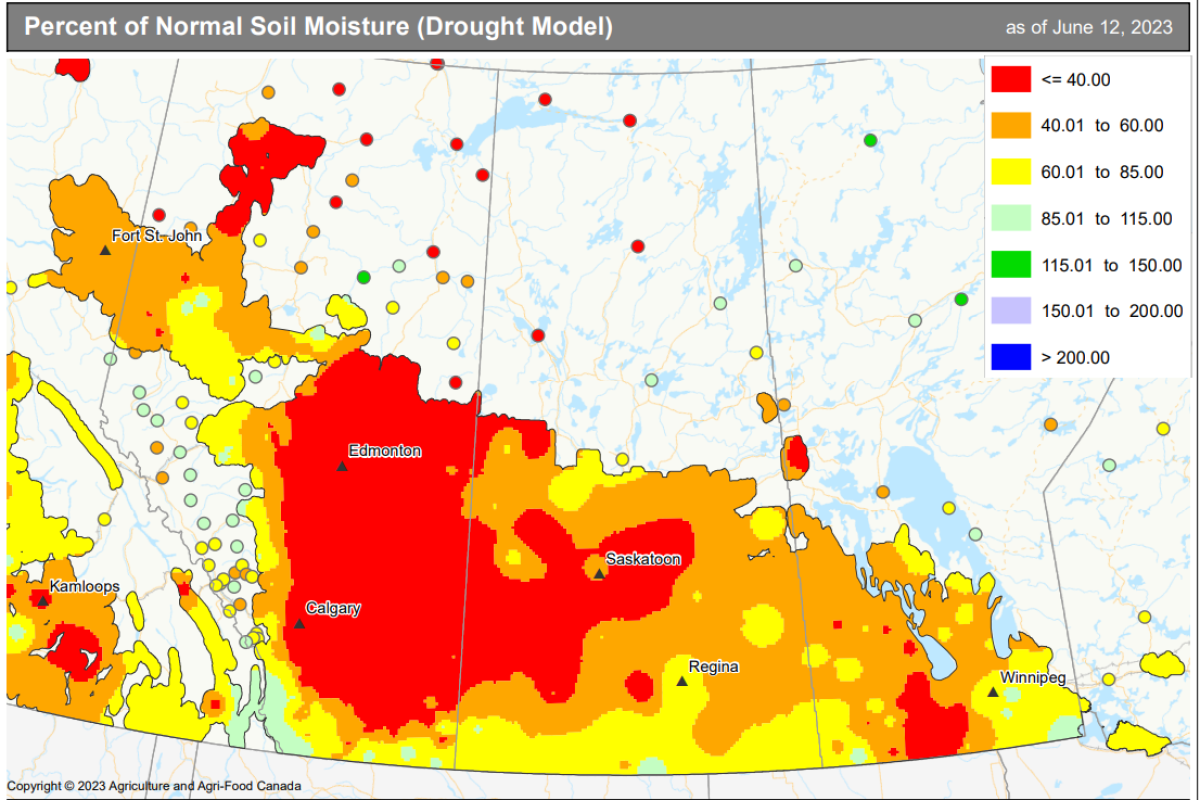

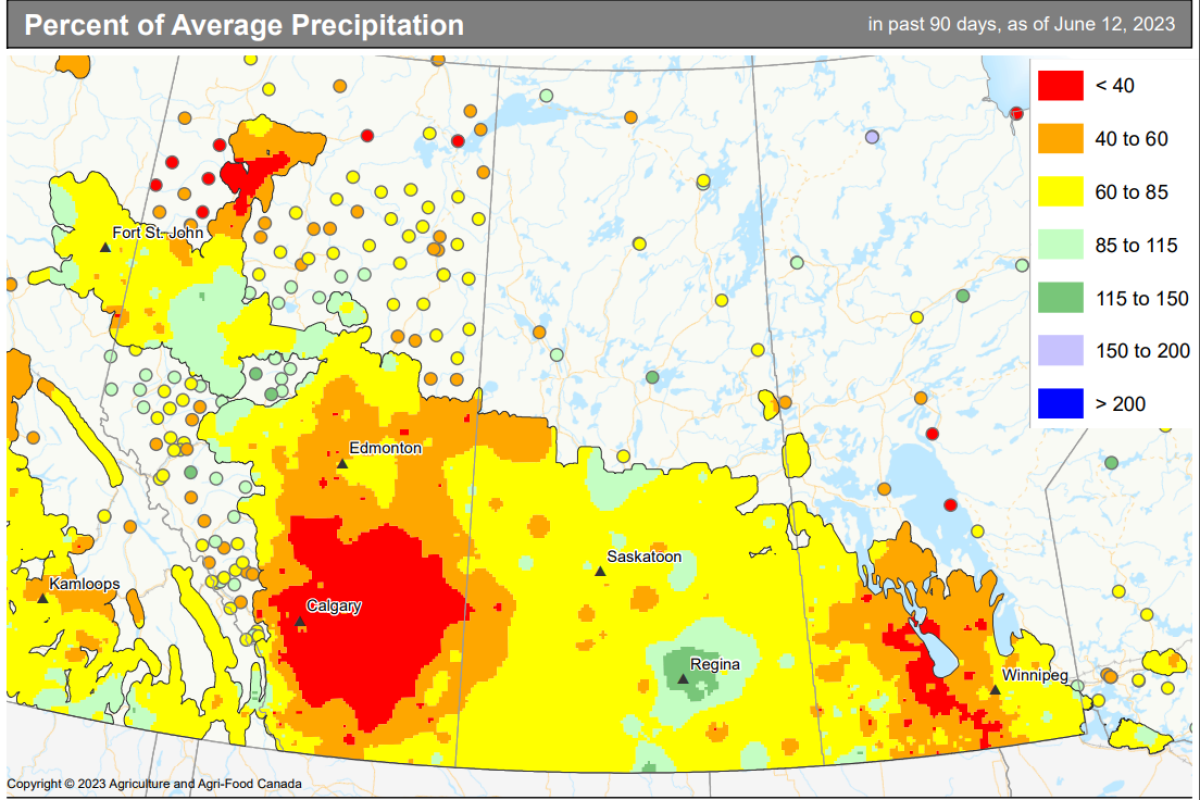

The drier conditions aren’t specific to just the U.S. as areas of Manitoba and Alberta have also been experiencing some hot, abnormally dry weather for the last few weeks. In Manitoba, this has certainly supported rapid crop development and all, but the last-seeded fields remain in relatively decent condition. In Saskatchewan, showers have been very localized and so, provincially, soil moisture profiles have declined a bit, albeit we are not yet seeing much cause for concern. For Alberta, soil moisture conditions have continued to deteriorate over the last four weeks now as limited rainfall events – save for the Peace region – have led to fields starting to show some stress. Thus, as the AAFC charts below indicate, Alberta’s production is likely the most at risk right now, albeit there is some precipitation forecasted for this week before the weather turns hot again.

Looking more internationally, Russia continues to complicate the Black Sea Grain Corridor Deal as they interrupt inspections and/or ship approvals as part of their ongoing disapproval of the terms of the deal not being honoured. More Russian politicians are talking about how the West’s economic sanctions on insurance, logistics, and banking continues to challenge their ability to move fertilizer and grain products, albeit shipment data suggests otherwise. They also continue to point to wanting more poor countries to get Ukrainian grain exports, which is accurate as only about 3 per cent of total exports from the region in the last year have gone to low-income nations. Therein, on Friday, when asked about extending the grain deal a month from now in July, Russia’s Foreign Minister, Sergei Lavrov told reporters, "How can you extend something that doesn't work?”

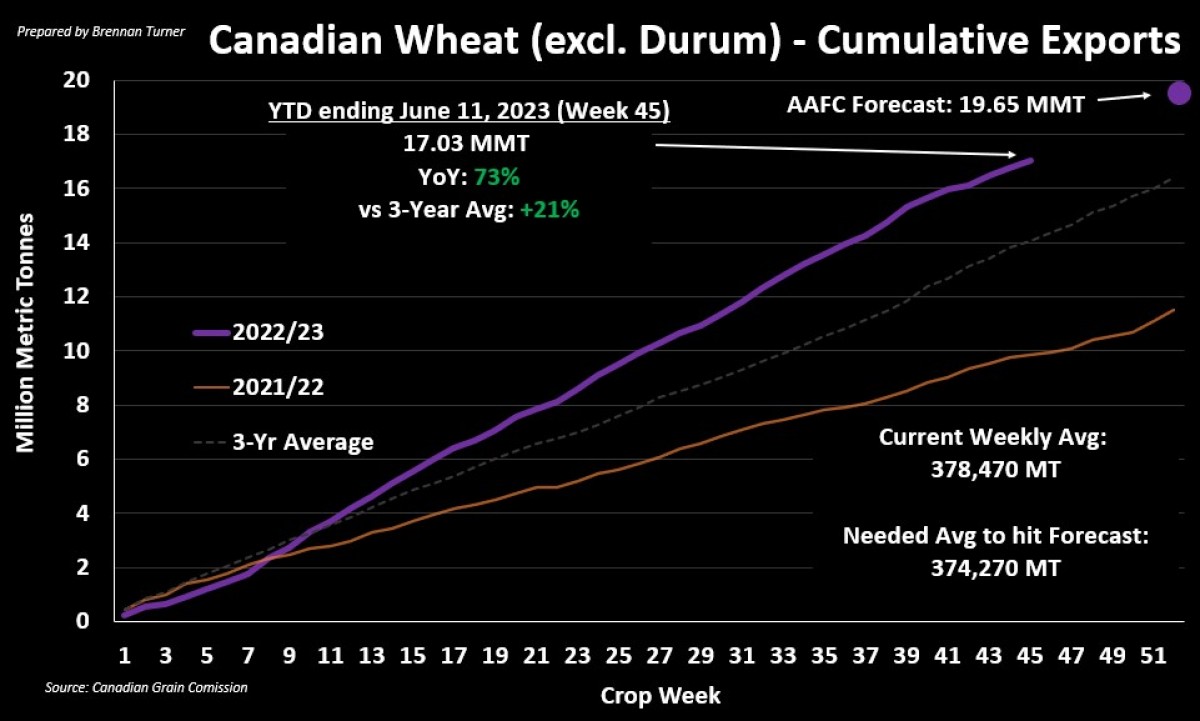

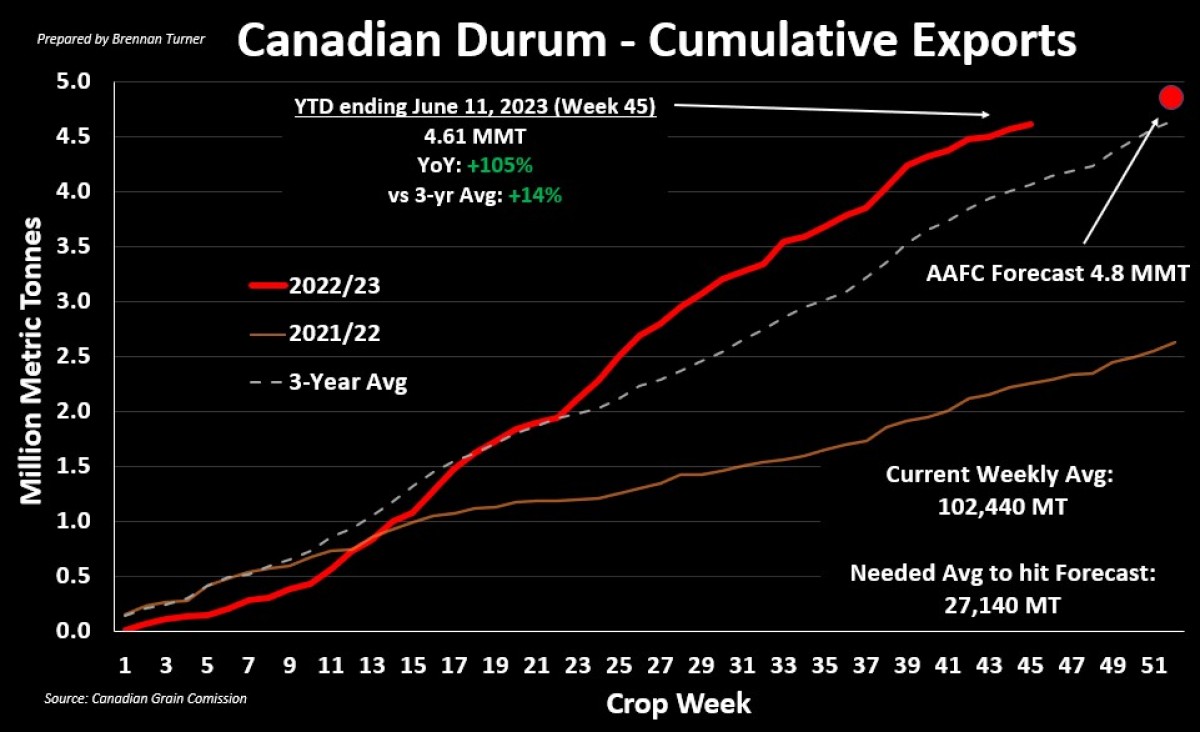

What is working – or at least it feels that way – is Canadian wheat exports, as it’s likely durum shipments will hit Agriculture Canada’s target in the next few weeks, while non-durum wheat isn’t far behind. With the persistent trade issues in the Black Sea, and quality concerns in China’s wheat crop, there continues to be sentiment that the current pace of Canadian wheat exports will easily overlap into the 2023/24 crop year, which starts August 1, 2023. This, despite the elevated nature of Canadian grain prices, which some people believe are just the new norm, whereas I’m in more of the camp that originators are not just looking for a safe, quality product, but also reliable movement.

Rounding things up here, most agronomists and traders are finding consensus that the USDA’s record yield projections for U.S. corn and soybeans this year won’t be realized, as we’re now at a point in some areas where some crops just won’t be able to recover. Therein, yield expectations are likely to continue to fall until the hot temperatures subside and/or rainfall shows up. If no one’s getting either (let alone both), then the upside potential for grain futures is strong, likely lifting wheat prices alongside corn and soybeans, given the large short positions, especially in corn and wheat However, the drought headlines are the only thing that’s really supporting the market at this time, and if a wetter forecast shows up, the premiums getting built-in will be erased in short order. Thus, if you’re playing in the cash market, consider making sales in the next few weeks, whereas, if dabbling in the futures, puts are an inexpensive option to protect yourself against the downside reversion.

To growth,

Brennan Turner

Independent Market Analyst