FOMO for Food Continues Post-WASDE

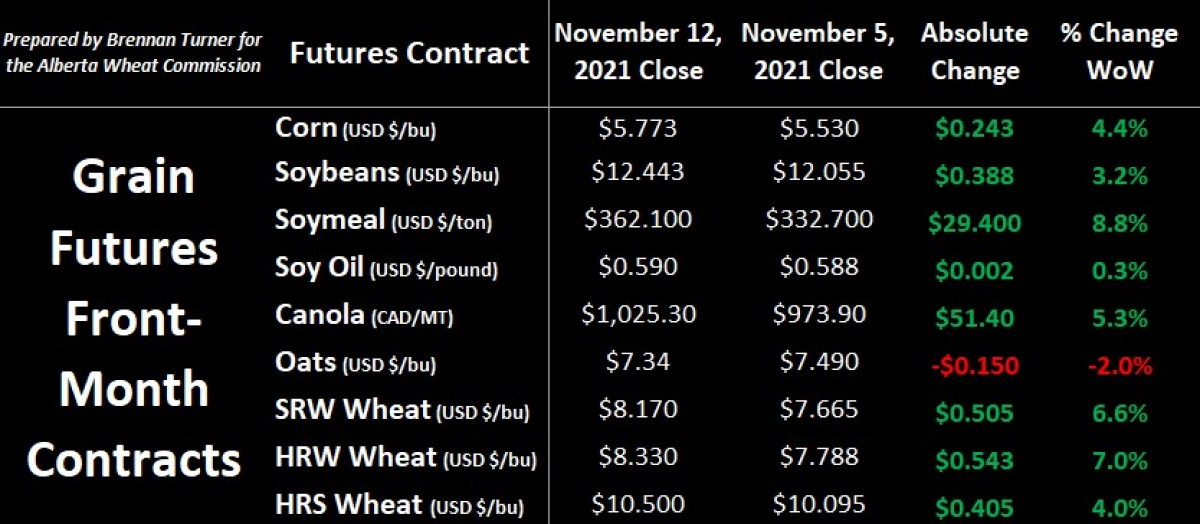

Wheat markets pushed higher through the second week of November as a relatively mute WASDE report was offset by bullish soybean yields, funds jockeying their positions, and corn prices getting help from strong export and ethanol demand. In fact, calendar-year-to date, ethanol prices are up nearly 50%, as COVID concerns and restrictions are softening, encouraging consumers are starting to get out and about and drive again. This is supportive of wheat prices, but only to a point, as certain countries can’t pencil in the higher wheat values into their livestock feed rations. A case in point is China, which seems to be opting for more corn this year over wheat (after record volumes of the latter were used in 2020/21).

Leaning into the WASDE, the USDA raised average U.S. corn yields by 0.5 bushels per acre (bpa) to 177 (which would be a new all-time record), while soybean yields were dropped by 0.3 to 51.2 bpa (the current record is 51.9 bpa set in Harvest 2016). However, because of slighter weaker exports to date – something the USDA acknowledged by lowering their expectations by 40M bushels – U.S. soybean ending stocks were raised by 20M bushels to 340M (or 9.25 MMT, if converting bushels to metric tonnes). Ultimately though, most of the market is expecting to see lower yield and production numbers by the time the final report is released on Wednesday, January 12, 2022.

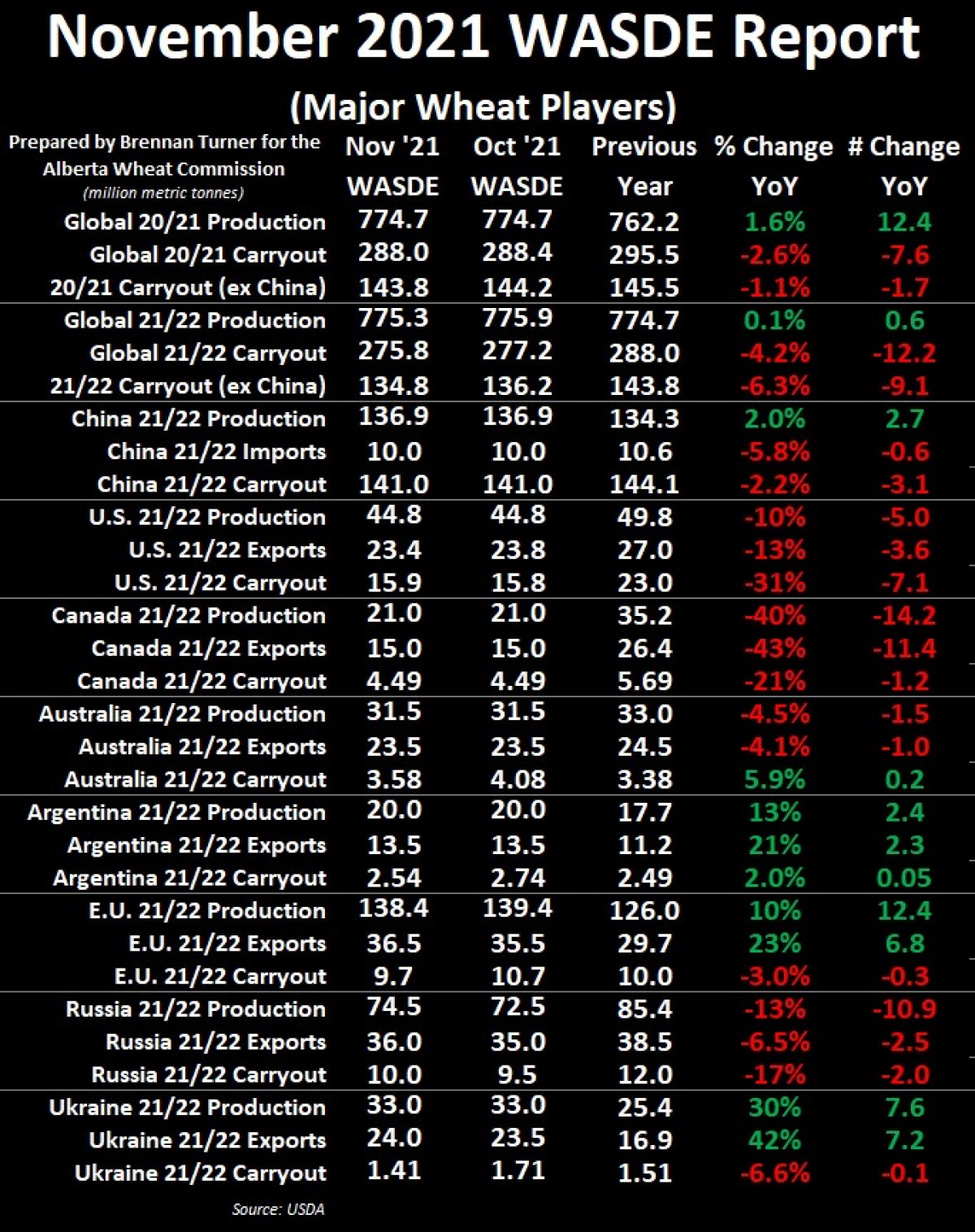

For the wheat market, the November WASDE didn’t provide much to write home to the bears or bulls about, with little change on the global balance sheet. Australia saw its old crop 2020/21 exports raised by 500,000 MT, which lowered carry-out by the same amount. As for 2021/22 new crop, Australian wheat exports are cruising, and although the USDA thinks they’ll ship out 23.5 MMT of wheat, Rabobank is more bullish, estimating 24.5 MMT, which would match the record by exporters from the Land Down Under just last crop year (2020/21). Combined with Argentina’s forecasted record of 13.5 MMT in wheat exports, it’s estimated that these two southern hemisphere nations will account for nearly 1/5 of all global wheat exports.

Some of the wheat buyers that are interested in this southern hemisphere wheat are in the Middle East, where food security is a major issue. In my opinion, wheat is easily the most political commodity, beating out oil (since no one can eat oil), and this gets exacerbated in short-supply years like the one we’re in. Governments do not want to see a repeat of the bread/wheat shortages that the region – especially Tunisia and Egypt – saw in the early 2010s, as it led to riots, the Arab Spring, and a change in political power. It’s worth noting that the UN’S Food Price Index is now currently at its highest level since July 2011. Should food prices remain elevated, we could see more geopolitical risk, which would likely add to even more volatility within the commodity trade (with a notable spotlight on wheat)!

Coming back to the WASDE report, Russia’s harvest was raised by 2 MMT to now sit at 74.5 MMT, which made it easy for the USDA to increase their expectations for the country’s exports by 1 MMT to 36 MMT. If realized, Russia’s wheat exports would be less than 7% below 2020/21’s shipments, but there continues to be skepticism this number will be achieved, as long as the Kremlin is inserting itself in the market. More specifically, the unpredictable export tax was the main reason Russia only exported 3.2 MMT of wheat in the month of October, a drop of 30% year-over-year and the lowest volume for the month in the last 5 years.

That said, wheat’s biggest and most bullish news this week came again from Russia as Putin and Co. are planning to set a grain export quota for the first 6 months of 2022 (January – June). While no details have been shared yet, just the fact that the Russian government is doubling-down on its market intervention is being translated by the market as less wheat is available for the world market.

As I’ve mentioned in past Wheat Market Insider columns, European wheat exports are making up for slower Russia sailings, with shipments through last week up 15% year-over-year, and the USDA is noticing, as they raised their estimate for EU wheat exports by 1 MMT to 36.5 MMT. Further, the USDA lowered EU wheat production by 1 MMT, thanks to downward harvest revisions in France and Germany, who are the two largest-wheat producing and exporting countries in Europe. Thus, EU wheat ending stocks were pushed back below 10 MMT.

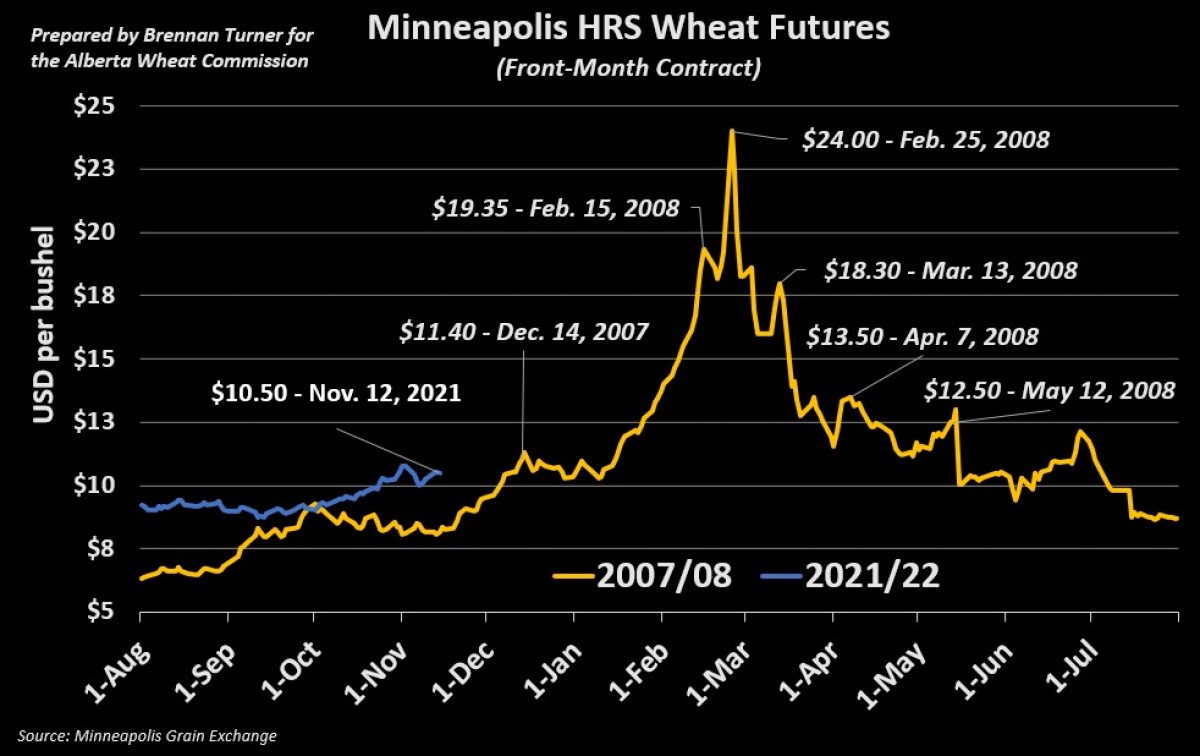

Overall, without any bearish headwinds to slow the bullish push from both the supply and the demand side of the equation, the wheat market is likely to trade sideways to higher for the next few weeks. Next, I’m watching for the updated production report from StatsCan on Friday, December 3rd for Canada’s Harvest 2021, and then Australia’s own production report from ABARES on Tuesday, December 7. Worth noting is the next WASDE report, which will be published on Thursday, December 9.

Playing the “what if” game, should ABARES provide any bullish datapoints about the Australian wheat harvest, and StatsCan and USDA continue to admit the strong demand / short supply situation. The volatility and, quite possibly, the price levels the wheat market saw in 2007/08 could be in play for this winter. On the flip side, if there are bearish numbers from any of these reports, I would expect wheat prices to retract a little before leveling out. Therein, if the winds are trending a bit more bearish going into early December, I might consider making a 10 – 15% sale to offset the potential of downside risk from these current multi-year highs.

To growth,

Brennan Turner

Founder | Combyne.ag