Gobble, Gobble

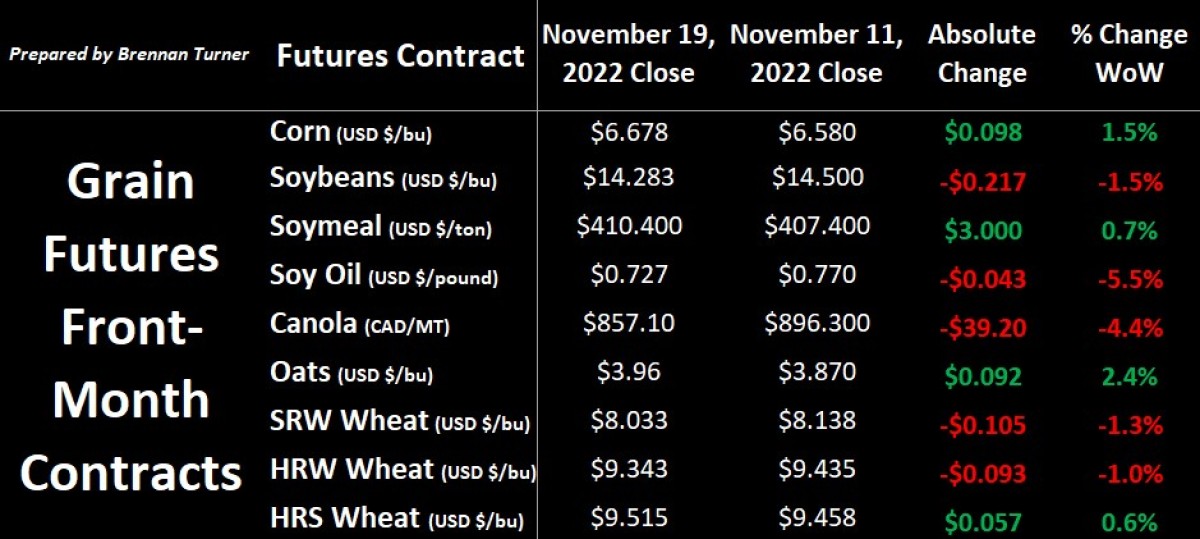

Grain markets settled mostly lower to finish the third trading week of November, as Russia’s official renewal of the grain deal tempered any lingering bullish sentiment from missiles that landed in Poland earlier in the week. That said, wheat prices were supported by another downgrade of the Argentine wheat harvest, with the Buenos Aires Grain Exchange dropping its estimate by another 300,000 MT to 12.4 MMT (their forecast at the beginning of the year was 20.5 MMT). Also moving grain markets is the ongoing subdued pace of U.S. exports, amidst the strength of the U.S. Dollar and the Mississippi River’s low water levels.

Despite the low water levels, U.S corn export weekly sales last week reached its highest levels since April. But now the question comes down to execution: The Mississippi is usually responsible for about two thirds of all U.S. corn exports, as well as more than half of soybean shipments, and about 10% of wheat. With the low water levels limiting both barge traffic AND how much grain is loaded on said barge, demand could start to soften. With lower demand, corn prices could weaken, and have a bit of a spillover impact on wheat. The broader ripple effect is the demand for more cost-effective commodities, that can be successfully transported, making their way to other countries.

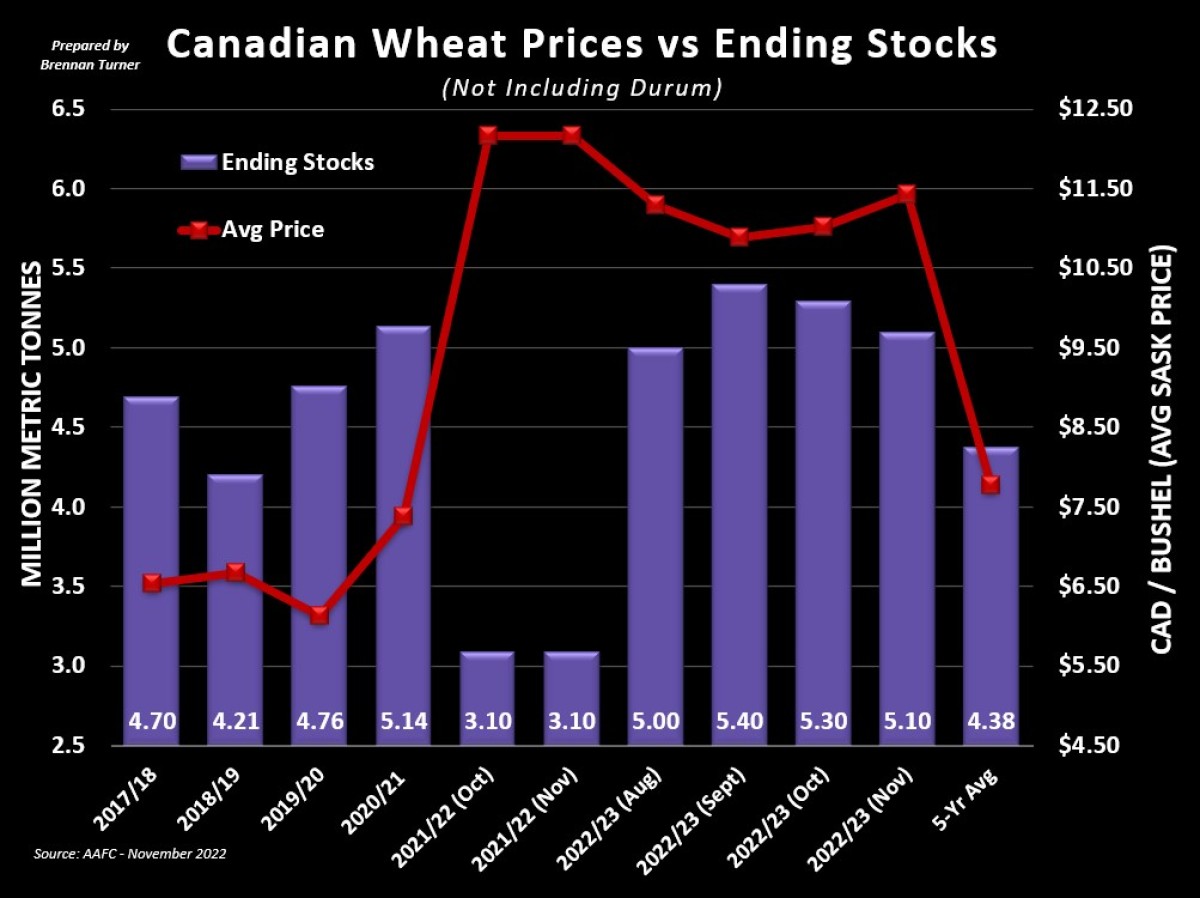

Obviously, Canada is on the list of potential benefactors, especially as it’s unlikely that the Canadian Loonie will strengthen any time soon against the U.S. Greenback. As Export Development Canada pointed out last week in a report, with ongoing concerns about the global economy, investors are flocking to safe investment havens like the U.S. Dollar, keeping it strong (lots of buyers = strength). This is probably why, in their most recent balance sheet update, Agriculture Canada raised its forecast for Canadian non-durum wheat exports by another 200,000 MT to 18.5 MMT, the 4th straight month of increases for international demand. Accordingly, AAFC also raised their average price forecast, while also reducing ending stocks by the same 200,000 MT.

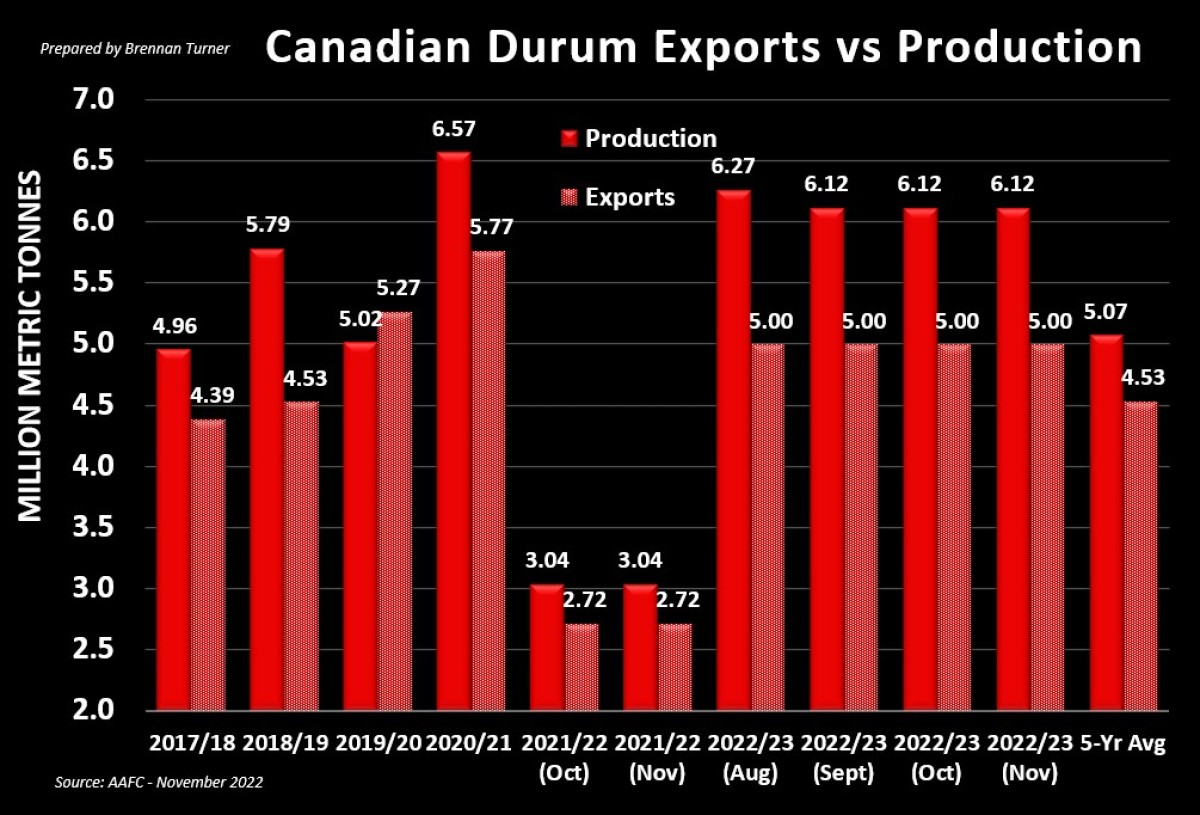

In their durum estimates, Agriculture Canada may have hinted that we’re going to see a production downgrade in the coming months as they explicitly referenced the private market’s more bullish estimates of 5.6 – 5.9 MMT (versus StatsCan’s September forecast of 6.12 MMT). While the Canadian durum harvest may drop below 6 MMT, exports were stayed at 5 MMT. I think this is the right level as we’ve had a slow start to export campaign, the but there continues to be strong need for durum from the likes of Italy and North African countries. In fact, through the first 2 months of the 2022/23 crop year, the former has accounted for about 40% of Canada’s durum shipments, while all of North Africa is in need of supplies to make up for their smallest durum crop since 2016.

Coming back to what we know for certain today, wheat prices didn’t drop all that much despite this important milestone to help keep grain flowing out of Ukrainian ports, through the Black Sea, and into the world’s hungry stomachs. Thus, one would argue that the market has been expecting the grain deal to be renewed (which explains the large pop back on October 31st after Putin pulled out of the deal for 4 days). With the UN-backed grain deal in place for another 4 months (120 days), will we see more Russian and Ukrainian grain make it to market?

Apart of the transportation risk, why not? With some rumours that cheaper European wheat is being sold into the likes of China and even the United States, American wheat remains relatively uncompetitive in the global marketplace. The market is obviously not enjoying this reality and so, heading into the U.S. Thanksgiving holiday-shortened trading week, there are some key support levels for the U.S.-based futures contracts that aren’t far below current price levels (and the bears would be happy to gobble those up).

To growth,

Brennan Turner

Founder | Combyne Ag