Grain Markets Reset Amidst the Heat

Canola futures were limit up on Friday, largely thanks to gains in palm oil and soy oil prices, but traders are watching rainfall forecasts, moisture profiles, and crop conditions very closely to help guesstimate just how small of a crop the 2021 Canadian harvest will be. Worth noting that new crop cash canola prices are now tracking 85% higher, year-over-year, while the November 2021 futures contract is trading 76% higher than what the November 2020 futures contract was trading at this time a year ago.

Soybeans provided support as some flooding in parts of the Cornbelt after heaving rains has spurred some concerns. Conversely, the wet weather is appreciated by corn stalks, as it’s now directly in its pollination period and the moisture will help the crop at this crucial stage. Thus, weather risk premiums were taken out of the corn market last week and that trickled into the winter wheat market, which was also pressured by the pace of harvest accelerating. With crop development for U.S. spring wheat so uneven, some are already taking about the HRS wheat harvest starting early.

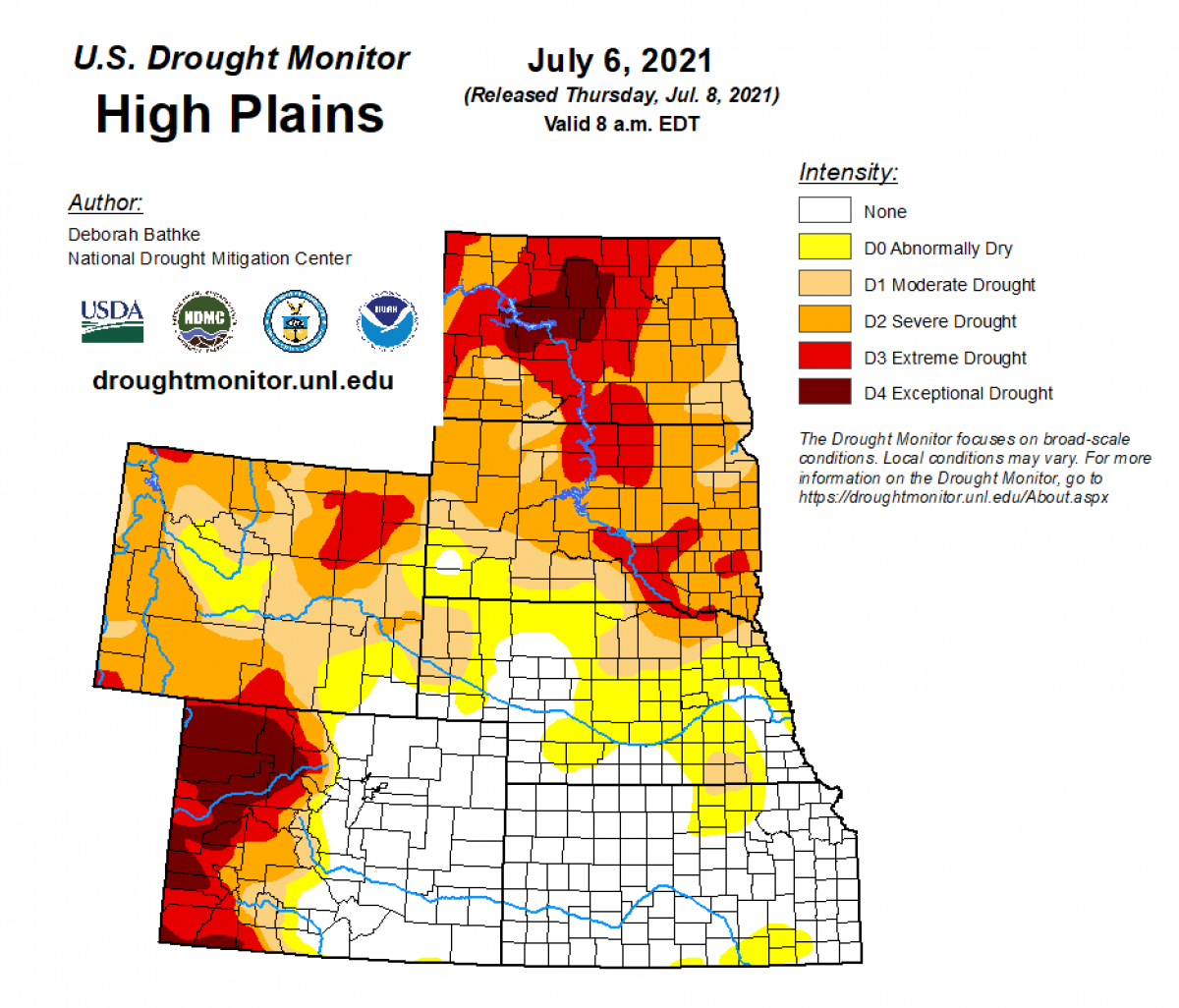

On that note, as of last week, just 16 % of the U.S. spring wheat crop is considered to be in good-to-excellent (G/E) condition, and that’s understandable when you look at the drought monitor map below. In North Dakota and Montana, 47% and 40% of durum crops there are rated G/E. Quite simply, these U.S. wheat crop ratings are amongst the worst they’ve been in decades and a far cry from this time a year ago (for the U.S. HRS wheat specifically, a year ago, 70% of the crop was rated G/E). The U.S. Wheat Associates note, however, that the U.S. durum crop is faring better than the spring wheat crop, largely because it was planted later and received more favourable moisture. Nonetheless, yields are still going to come in below average.

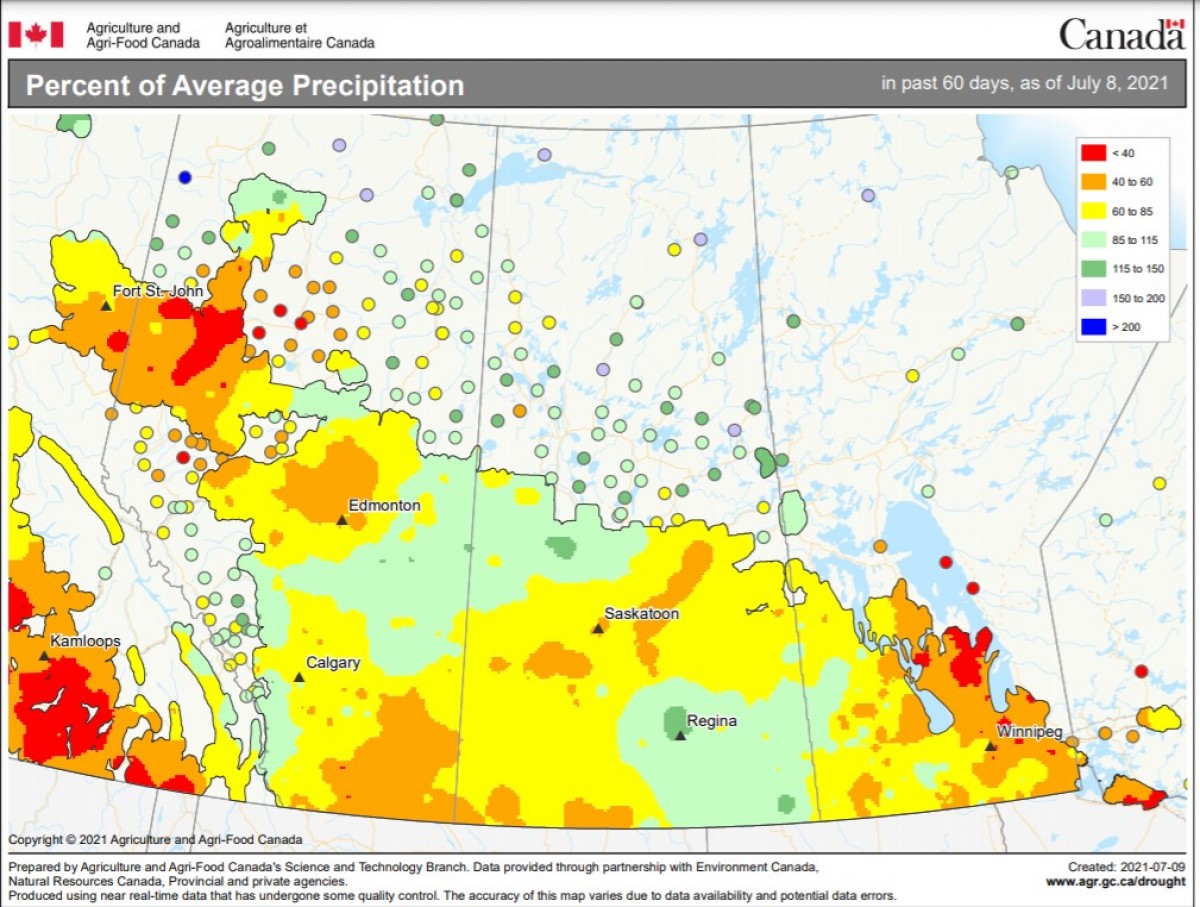

Much like the American Plains, there are plenty of areas in Western Canada still looking for moisture, especially after a few weeks of some really hot weather. Last week’s Manitoba crop report said fittingly, “Many crops are maturing faster than normal and grain and pod filling on cereals, canola and peas will be affected by heat and lack of moisture this week.” Put another way, at this point in the growing season, any new moisture will be unlikely to help a fair amount of fields.

In Saskatchewan, 58% of the spring wheat crop is in G/E condition, while 45% of the durum crop is rated G/E. That’s well below the 76% and 78% G/E ratings of the province’s spring wheat and durum crops a year ago but that’s largely because of some areas who have been receiving rains. In Alberta, we’ll get an updated report this week after a 2-week break, but in the last week of June, the province’s crop watchers were pegging 71% of the spring wheat crop as G/E, while just 48% of durum in the Wild Rose province was rated as G/E (they were pegged at 82% and 84% G/E, respectively, a year ago).

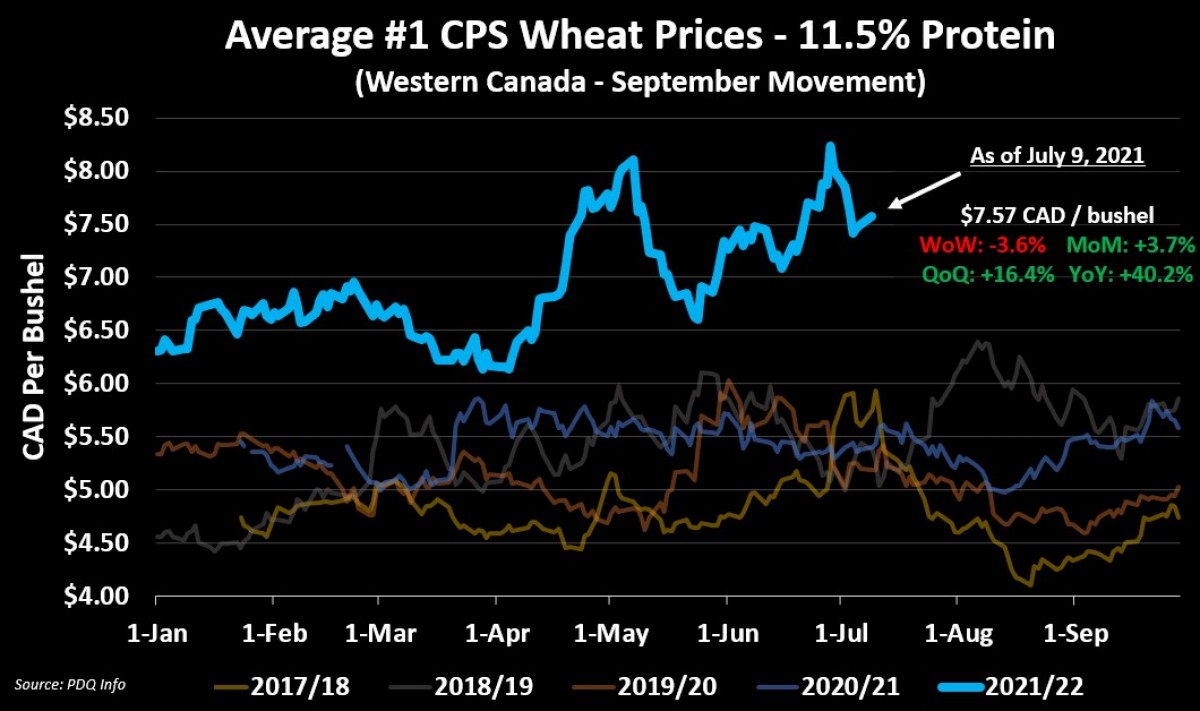

From a cash market standpoint, new crop wheat prices continue to appreciate. CPS trades off the Kansas City HRW wheat contract, and despite the futures values falling by nearly 7% over the past month, over the same timeframe, average basis values in Western Canada for new crop CPS wheat is up nearly 70¢ CAD/bushel (not to mention new crop cash values trading 40% higher year-over-year!).

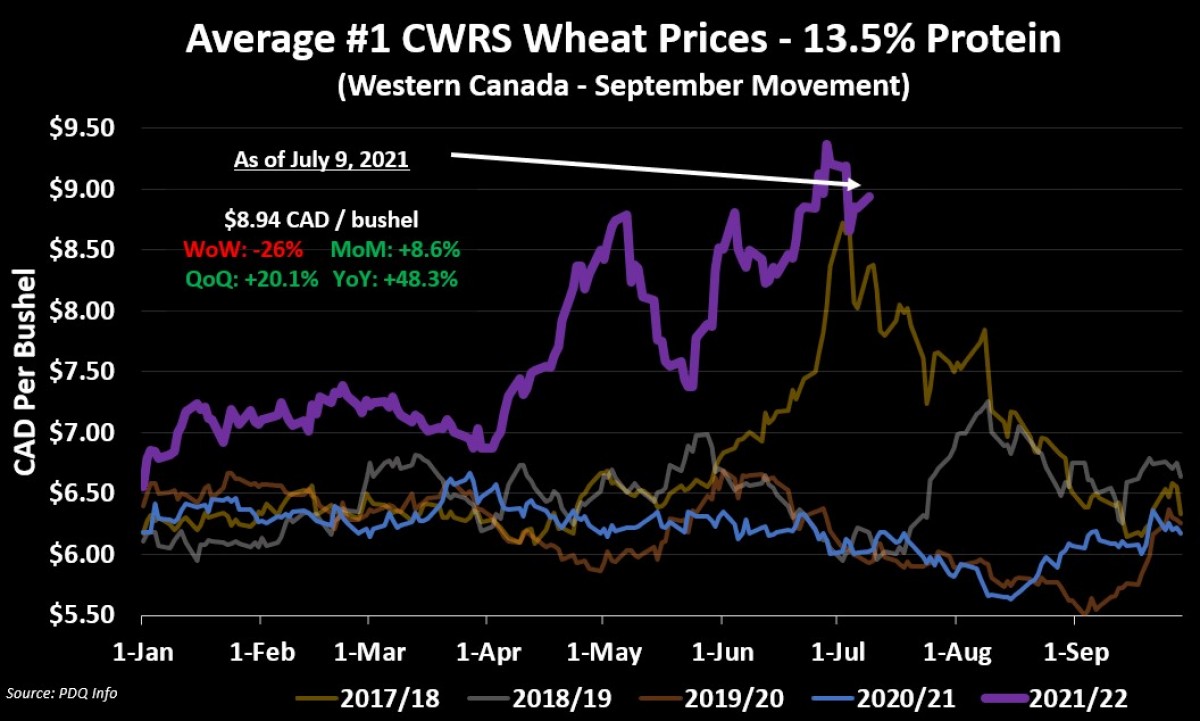

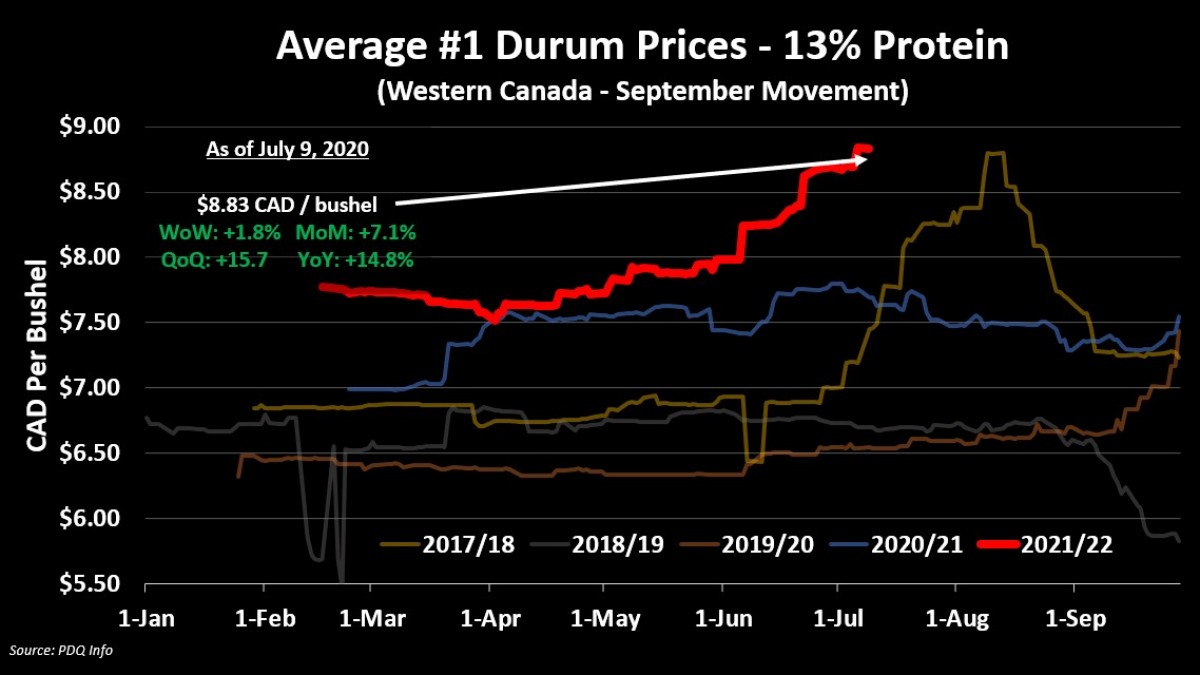

For HRS wheat, $9 CAD/bushels has been seen a few times over the last couple of weeks, but most of the appreciation has been reflected in the futures market (futures up 59% year-over-year, whereas cash values have climbed by 48%). Meanwhile average new crop durum values are inching closer to $9 CAD/bushel, and have topped it in the areas that are driest.

Ultimately, be it in a coffee row or in the media, we’re hearing mostly about the bad crops that are out there, but there are definitely more decent fields than we think. Accordingly, over the next month, I would expect volatility in the grain markets to continue until more about the crop is known. What’s for sure is that we won’t have a bumper crop in 2021/22 and what traders are having to contend with is just how much smaller the crop will be (compared to original estimates) and how much impact that will have on an already tight global balance sheet. This week’s July WASDE report will likely provide a few clues and, in next week’s column, I’ll be sharing the impact of the USDA’s updates estimates. Worth noting is that the July WASDE will include the USDA’s first forecasts of the U.S. wheat crop and a better understanding of how the wheat harvest is going in the EU and Black Sea.

To growth,

Brennan Turner