Grains Fade Their Weather Premiums

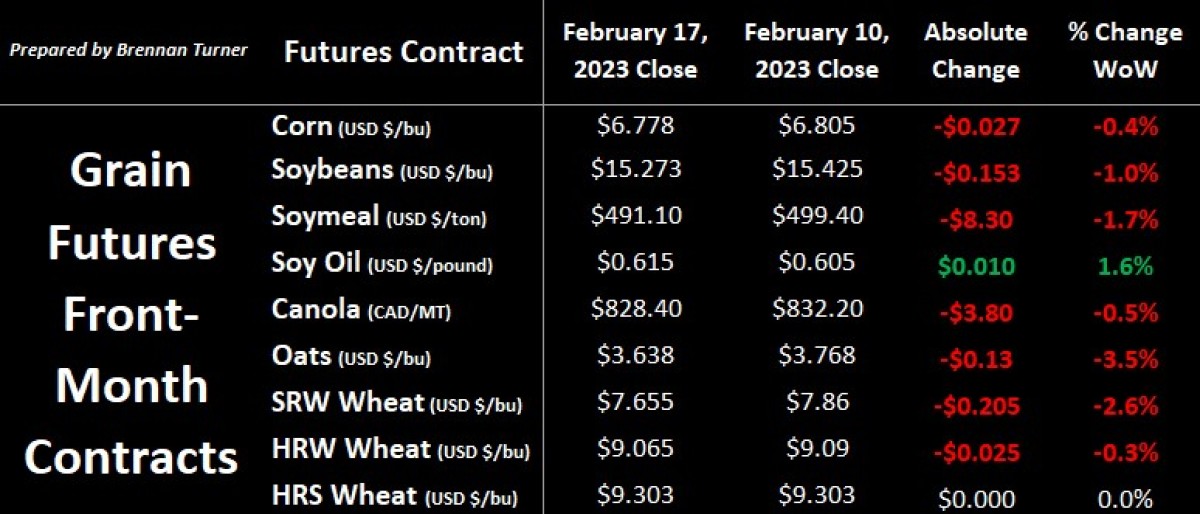

Grain markets pulled back last week as selling pressure earlier in the week could not be recouped with weather premiums in North and South America fading. Soybeans were pressured this week by news out of Brazil that farmers are hoarding their soybeans, according to the country’s largest farmer co-op. Coamo says that forward contracts for this year’s harvest are just 5% of the expected crop, well below the seasonal average of 25% - 30%, meaning there’s lots of beans that aren’t yet spoken for and could flood the market at any time. While HRS wheat futures were quiet, winter wheat futures fell on the large harvests in Australia and India regularly coming to market, with the Indian government notably releasing an extra 3 MMT of state reserves. As always these days, keeping things volatile is the Black Sea, as negotiations are starting up again in the next week for an extension of Grain Corridor Deal, which was re-agreed to back in November but is up for renewal come mid-March.

As seems to be the norm, Russia has suggested they’re unhappy with the current deal, continuously asking for sanctions against their country to be lifted and refusing Ukraine’s request to increase the minimum tonnage allowed on ships leaving their Black Sea ports. This comes as Ukraine has repeatedly accused Russia of slowing down boat inspections, and the UN’s ongoing concerns of cheap Black Sea grain not making it to Africa, where they estimate an additional 50M people are on the brink of starvation. My feeling today is that, similar to what we saw in late October/early November during the last negotiations, there’ll be a lot of hooping and hollering, but a deal will be made. This time around, however, an increase in military activities by Russia could seriously complicate the negotiations, and so we could see some short-lived premium come back into the market as negotiations play out.

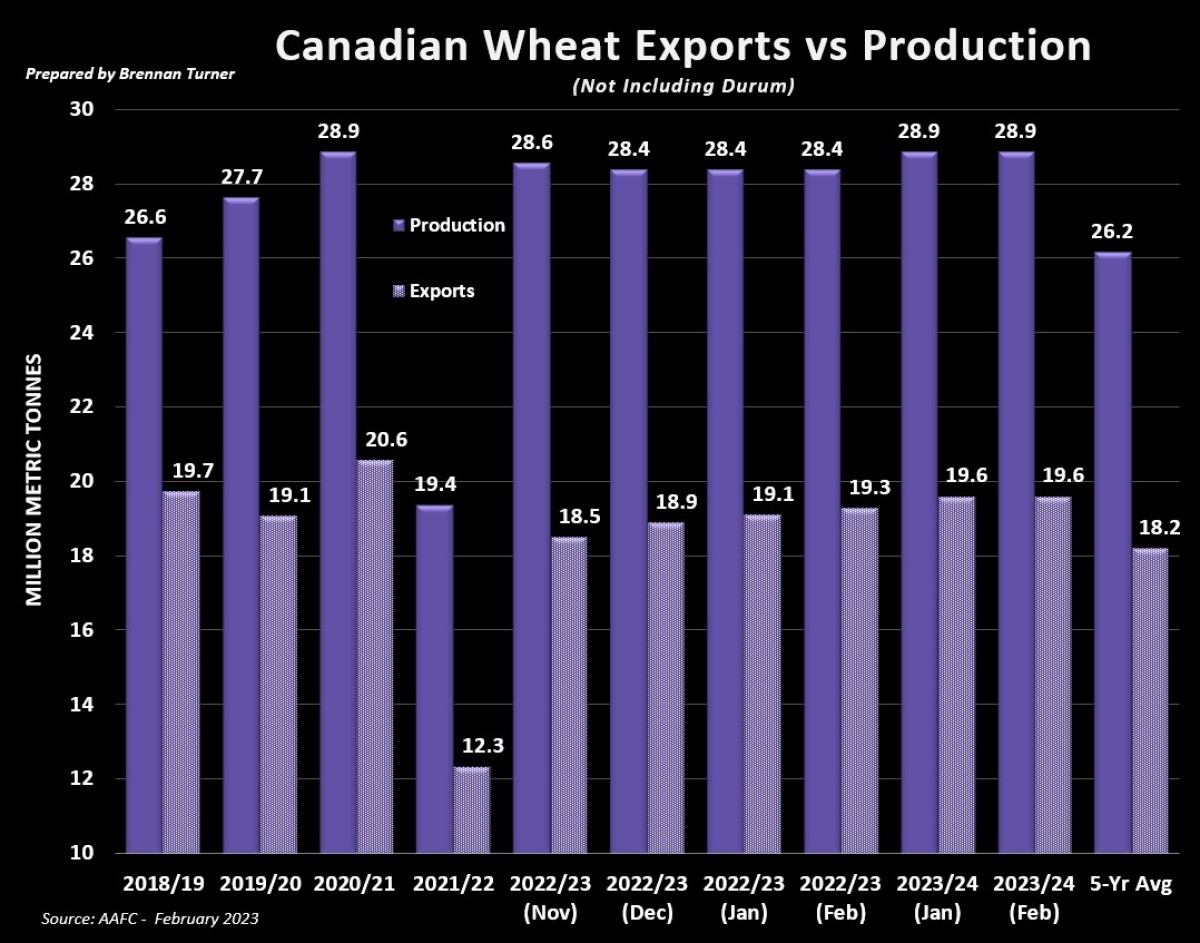

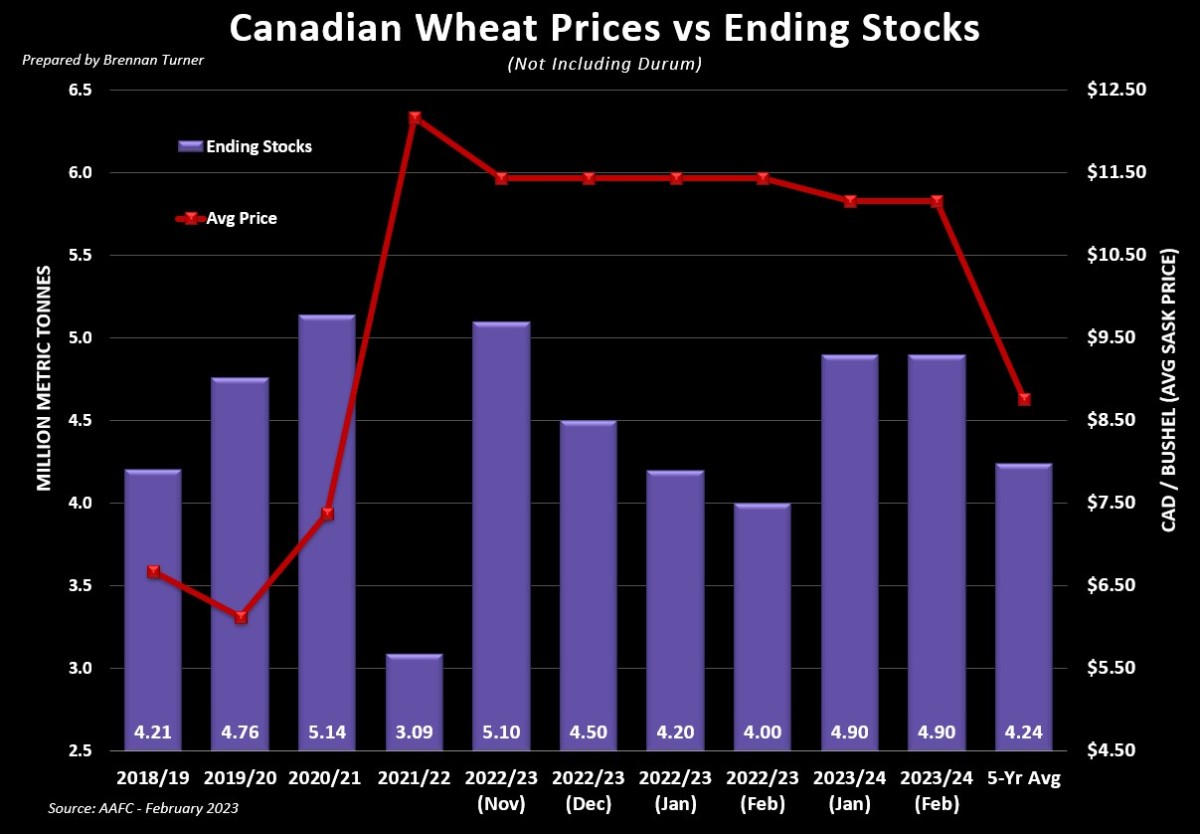

With the uncertainty of the tradeflows, importers are looking to sure suppliers like Canada for their foodstuffs, which is probably why the AAFC, in their February estimates released last week, increased Canadian wheat exports yet again. Agriculture Canada raised their forecast for Canadian non-durum wheat exports for the sixth straight month, this time to 19.3 MMT, which is 1.3 MMT more than their estimate from as recent as August. The extra 200,000 MT wasn’t replaced anywhere else on the balance sheet and so ending stocks were lowered to 4 MMT. Despite the tighter carryout, forecasted average prices were stayed at around that $420 CAD /MT (or $11.43 /bushel) average price, reflecting the broader value decline in the global wheat marketplace.

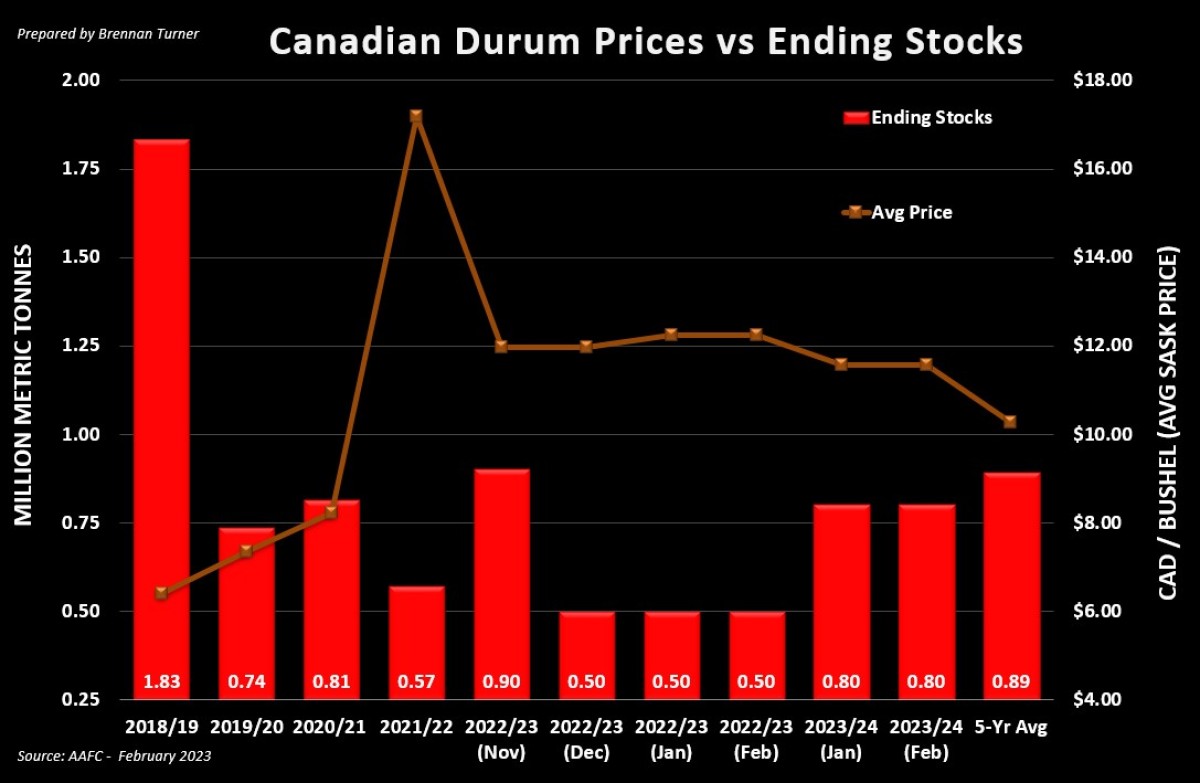

Nothing was changed on Canada’s durum balance sheet by AAFC, keeping exports at 4.8 MMT and ending stocks at 500,000 MT, basically matching the record low set back in the 1984/85 crop year of 499,000 MT. It’s worth noting that Agriculture Canada increased production from the 2021 harvest (2 years ago) for almost all grains, but lowered them for almost all oilseeds and pulses. While most of these production changes were massaged into the last 2 crop years to keep the 2022/23 balance sheet relatively unchanged, there were a few crops with some big updates. The largest updated was in flax, which saw its 2022/23 exports drop by an astounding 60%, or 225,000 MT, month-over-month to just 150,000 MT, due to new phytosanitary requirements being imposed by EU regulators that will likely curtail some movement. Elsewhere, 2022/23 Canadian oats exports were lowered by 200,000 MT, which, combined with more feed use, raised ending stocks by 100,000 MT to 1.25 MMT, more than double what Agriculture Canada was estimating back in August.

Ultimately, as drought concerns are weakening with La Nina fading to El Nino, the more “average” weather that materializes, it’s likely to incentivize traders to move out of their long positions. While we’ll get more crop rating updates in a few weeks, more analysts are feeling comfortable with U.S. winter wheat prices as is. With the potential for drought risk to ease up, there’s still an extra 2.5M acres the USDA announced last month that no one was initially considering. Without more of a weather scare, or a bullish headline from the Black Sea, any additional premiums will also start to fade from the market.

To growth,

Brenna Turner

Independent Grain Market Analyst