Gratitude Amidst the Economic, Geopolitical Risk

Grain markets made it into the Canadian Thanksgiving long weekend with increased momentum as half the screen was green for the week, but Friday profit-taking and the forecast for good harvest weather in the U.S limited further gains.

Chicago Wheat lead the complex as concerns related to Black Sea shipping lanes climbed on a Turkish cargo ship hitting a mine. Thankfully, risk premiums were scaled back after it was revealed the boat only had minor damage. That said, the wheat complex had some nay-sayers join the party last week and money raised their net shorts in all three exchanges, including Minneapolis Wheat, whose net short position is the strongest it’s been since August 2020. Frankly, there’s not much bullishness for wheat expected in this month’s World Agricultural Supply and Demand Estimates (WASDE) report published this Thursday, so perhaps the fund managers are front-running the report.

We saw over the holiday weekend the terrible impact of increased military activity in Israel and Palestine-based Hamas. The impact on grain markets may be limited, but likely most felt in wheat as this region is a net-importer of the cereal. The stock market may be more conscious of the conflict as, after the United States and China, Israel has the greatest number of worldwide public companies. Elsewhere, the U.S. added substationaly employment, compared to what was expected in September, which weighed on the stock market as rising wages are not helping slow inflation down, and that in turn means the U.S. Federal Reserve is more likely to raise interest rates yet again. The Bank of Canada is feeling the same pressure as average hourly wages in Canada grew 5% year-over-year in September. More concerning to me though is that household credit card debt in both countries is at record highs (or is that just because our population continues to grow?).

Looking abroad in the world of wheat, this past week there was more than just a mine causing headlines in the Black Sea as Ukraine’s Agriculture Minister said that they’ll likely sow less winter wheat this fall because of dry conditions. Dry conditions are also a concern in the Land Down Under, especially western Australia, which has become more of a bullish variable than originally thought compared to a month ago. Of the 26 MMT of wheat that’s expected to come off Aussie paddocks this season though, only about 3 MMT of it is expected to be high protein wheat (more on this later).

Finally, Argentina continues to be challenged by this last drought cycle, it’s worst in the last 60 years. Limited rains again this growing season has biased farmers into forwarding contracting just 1.51 MMT, or 71% less wheat than they did at this time a year ago, and a seven-year low. Farmers last year got burned on contracting a crop that never materialized, but this year there’s also a Presidential election on October 22, and two of the three candidates are pledging to eliminate wheat export taxes, which are currently set at 12%. Currently, the Rosario Grain Exchange is estimating this year’s wheat harvest at 15 MMT, while the Buenos Aires Grain Exchange is pegging the crop at 16.5 MMT, which is the same as the USDA’s estimate from September, but we’ll get an update from the latter on Thursday in the October WASDE.

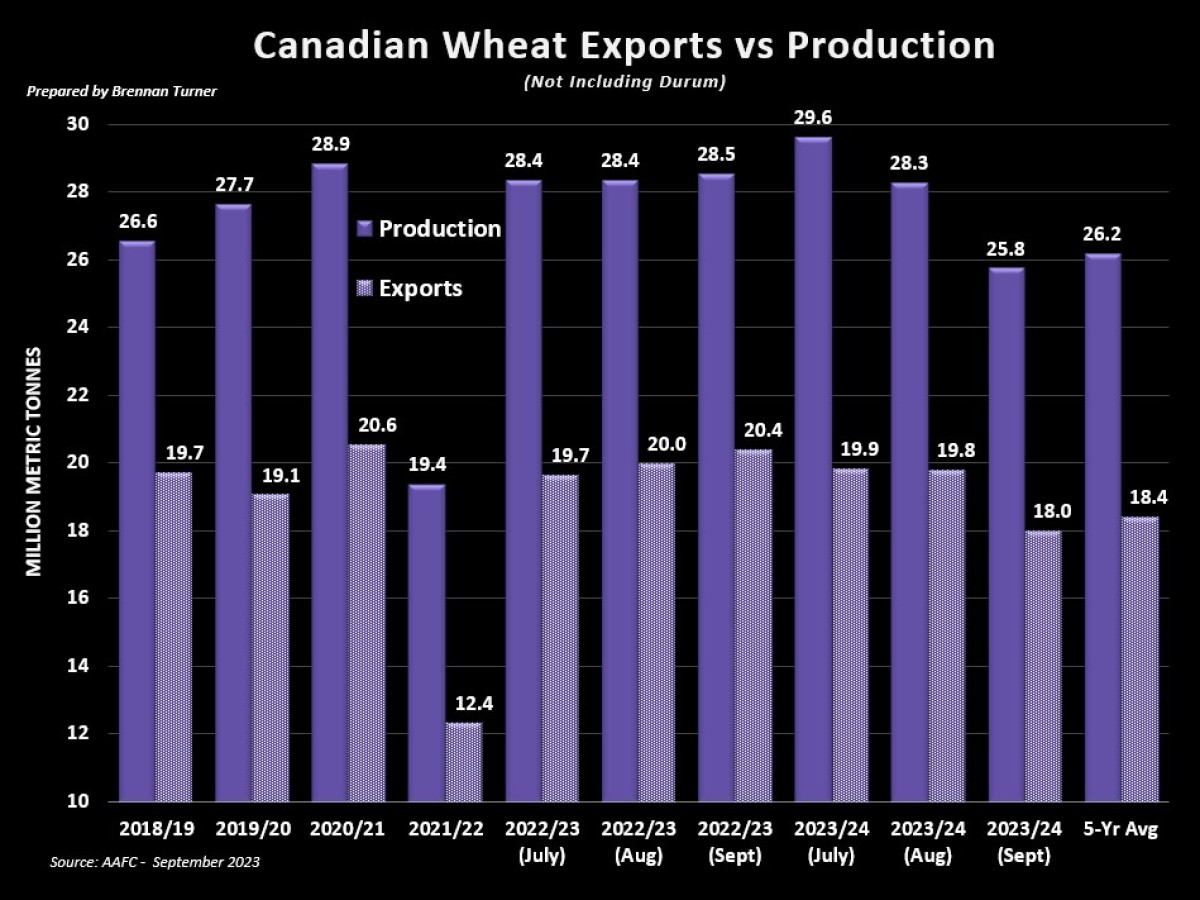

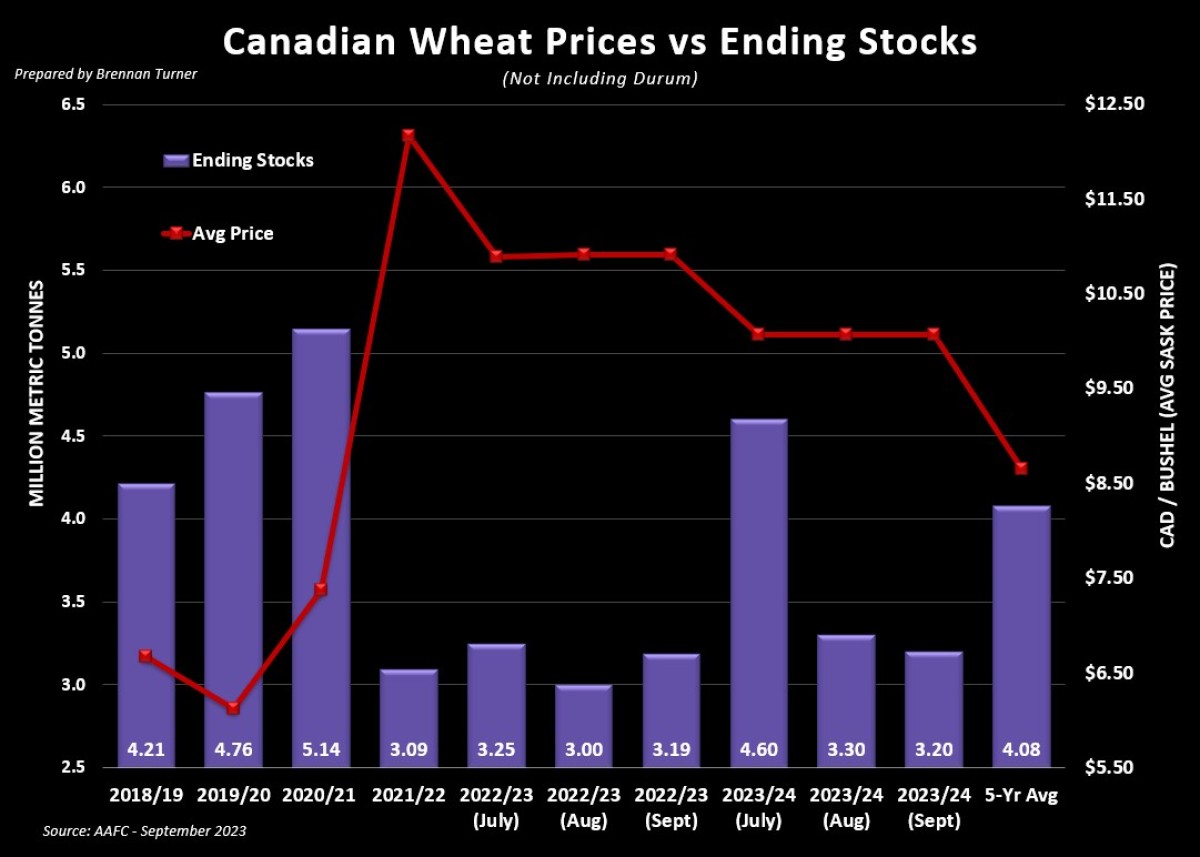

In that report, we’ll likely see the USDA adjust their Canadian wheat production numbers to the downside, getting closer to what Statistics Canada said last month about this year’s crop. Therein, Agriculture Canada provided an update of their supply and demand tables, using those StatsCan figures, and apart from non-durum wheat production falling to 25.8 MMT, exports were lowered month-over-month by 1.8 MMT to now sit at 18 MMT. Frankly, I think this number is still too high but many are pointing to the strong international demand for high protein wheat. Some talking heads are looking at Europe for more business, as pointed out by Mercantile Consulting, as “the region is oversupplied with feed wheat and is short on high-protein wheat” and so “quality spread (are) the widest they’ve been in over a decade” Canada will have some competition though as the dry growing season in the U.S. southern plains has pushed the average protein of the American hard red winter wheat crop up to 12.6%, a full point higher than the five-year average!

On the domestic side of things, non-durum wheat usage in Canada was lowered by 439,000 MT to 7.86 MMT, including 3.84 MMT of feed, the lowest since the 2018/19 crop year. Quite simply, feed wheat has been one of the more expensive feedstuffs and we’re seeing more operations switch in cheap U.S. corn, with expectations that over 2 MMT of it will make its way into Western Canada over this winter. Therein, local feed wheat prices try to find a seasonal low but remain pressured by ongoing weakness in U.S. corn prices, and strong competition from the export market.

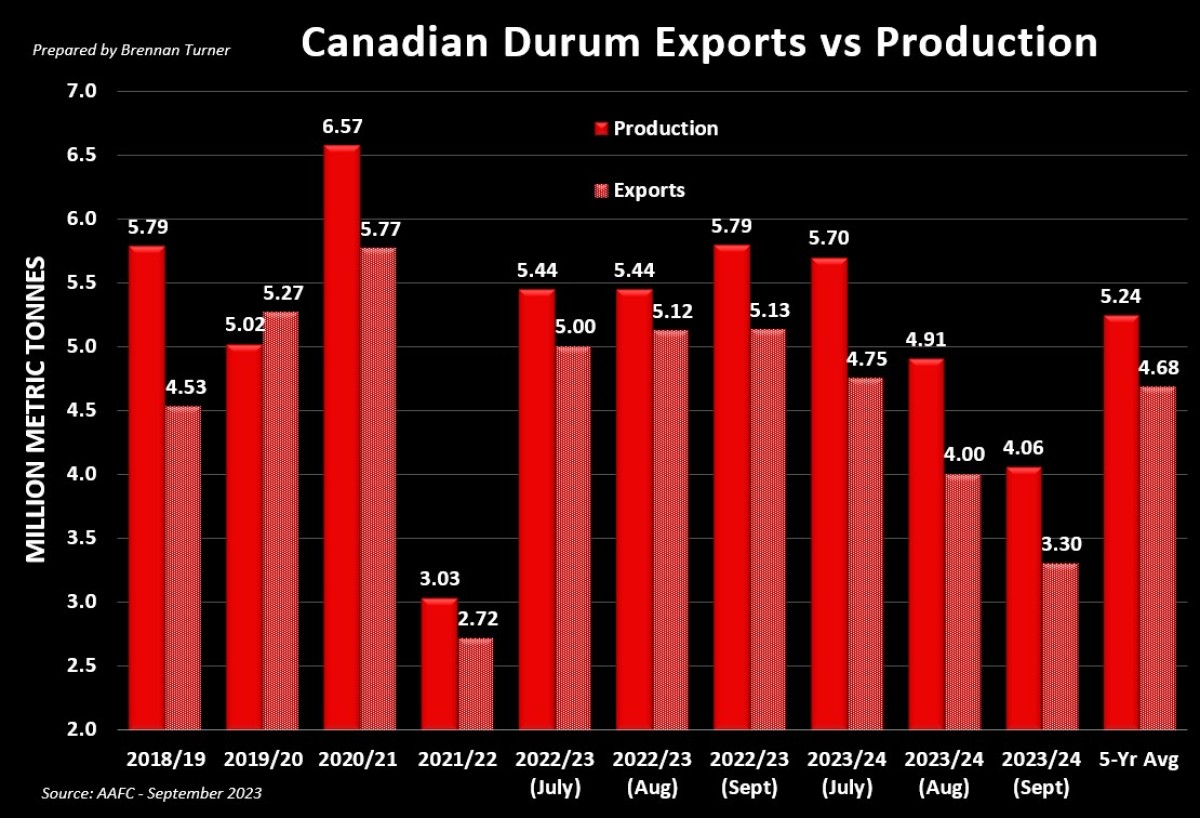

For the durum complex, Agriculture Canada had to also update its supply and demand tables using the 4.06 MMT production number that StatsCan provided earlier in September. Therein, AAFC’s forecast for 2023/24 durum exports was lowered by 700,000 MT from the last forecast to 3.3 MMT this go around. While North Africa will certainly need more durum this year, especially thanks to Algeria’s smaller crop, they are not expected to be as big of buyers in 2024/25 as World Weather Inc. is forecasting better moisture for the Mediterranean region this winter. Of note is that Algeria and Italy were Canada’s two largest durum customer in 2022/23, importing 1.21 MMT a piece, but we know it won’t reach this high in 2023/24.

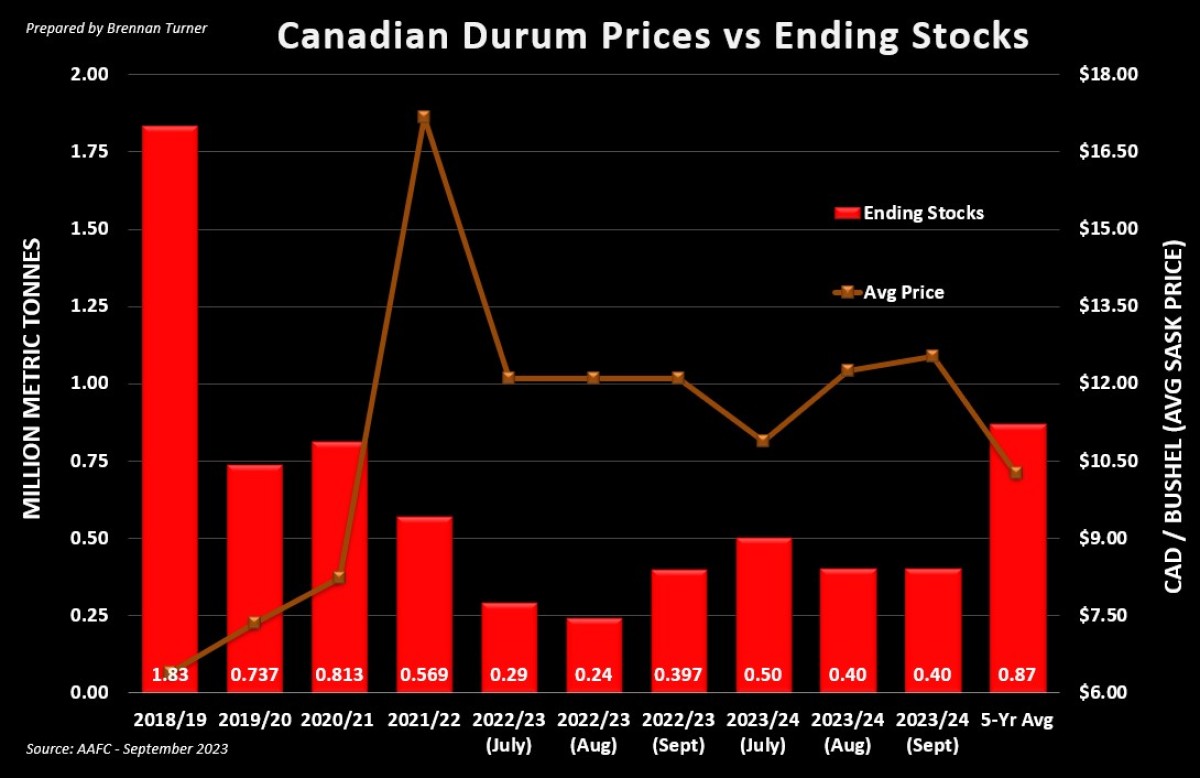

Why? Apart of the smaller Canadian crop to pull from, more Turkish durum is making its way into the market after a 4.1 MMT harvest of its own (yes, the Turkish durum crop was bigger than Canada’s). Further, Turkey is using less durum, and in some cases for African, Middle East, and South American countries, none at all, as more soft wheat is substituted in to make short-cut pasta products, thanks to new Turkish government legislation introduced after the limited supply made available in the 2021 drought-riddled crop. This is helping Turkey ship more unprocessed durum to Europe, who working through their smallest durum harvest since 2010 at just 7.11 MMT. Low test weights in Italy are also supporting the need for more imports to blend with. Therein, it makes sense that Canada should end 2022/23 at a record low level of ending stocks (just 397,000 MT) and the 2023/24 season at the second-lowest level of 400,000 MT.

Overall, Agriculture Canada is forecasting the Canadian wheat complex (including durum) to finish the 2023/24 crop year with 3.6 MMT which would be 2nd-tightest carryout on record. Which crop year was the tightest, you ask? That would be last year, 2022/23, which AAFC pegged at 3.58 MMT (technically, this is up 345,000 MT from their last report, thanks to StatsCan finding more wheat from Harvest 2022).

That said, between the conflict in the Black Sea, and now the increased tensions in Israel and Palestine, geopolitical risk seems to creeping higher. Perhaps, more related to this time of year in Canada, we are incredibly fortunate and blessed to not have to be living in the chaos, injury, and death that millions are currently experiencing. In talking about the conflict this past weekend with a friend (much smarter than me), they left me with a reminder from Ghandi: “When I despair, I remember that all through history, the way of truth and love has always won. There have been tyrants and murderers, and for a time, they can seem invincible, but in the end, they always fall. Think of it – always.”

To growth,

Brennan Turner

Independent Grain Market Analyst