HRS Wheat Continues Climb on Smaller Acres

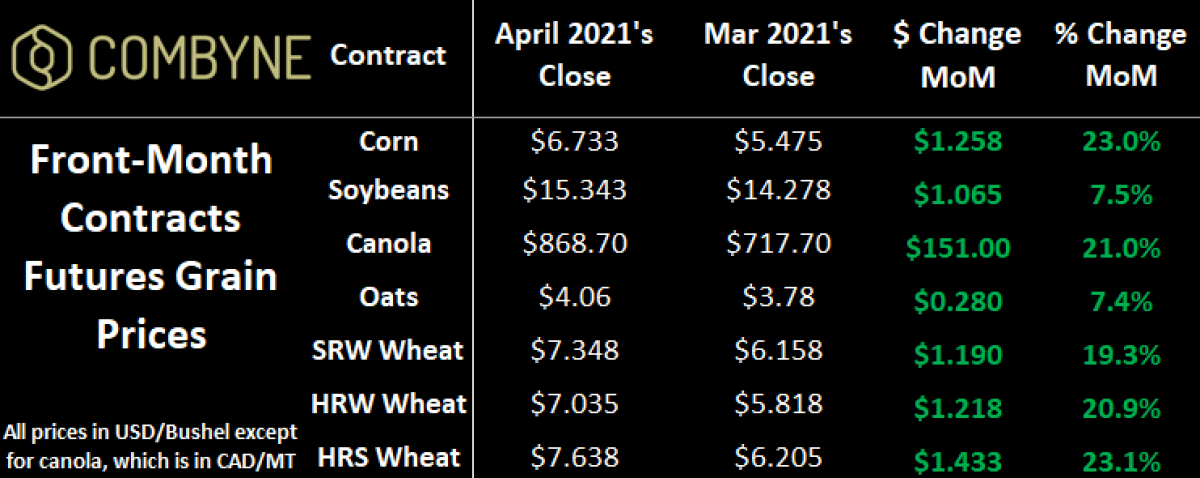

Grain markets continued their impressive climb in April, with corn, canola and HRS wheat all posting impressive weekly gains on continued strong demand (especially for feed grains) and weather/moisture concerns. The April moves made in the grain futures markets for old crop certainly display how supplies are really tightening up. On that side, while the likes of corn and soybeans are at 8-year highs, HRS wheat is only sitting at 3-year highs, but given the moisture AND lower acreage realities, the high-protein crop might have the most upside over the next few weeks.

Keeping new crop prices elevated are the aforementioned dryness concerns and limited carryover, meaning every potential bushel will be watched more closely than usual. As soil temperatures are starting to warm, Plant 2021 is going to hit full tilt this coming week, barring any wet (but probably appreciated) weather. Damp conditions haven’t been seen for a while in the Southern Plains, and accordingly, U.S. winter wheat good-to-excellent (G/E) ratings dropped 8 points in one week, down to 49%. Conversely, more than 1/3 of the U.S. HRS wheat could be in the ground by the time you read this, well ahead of the seasonal average.

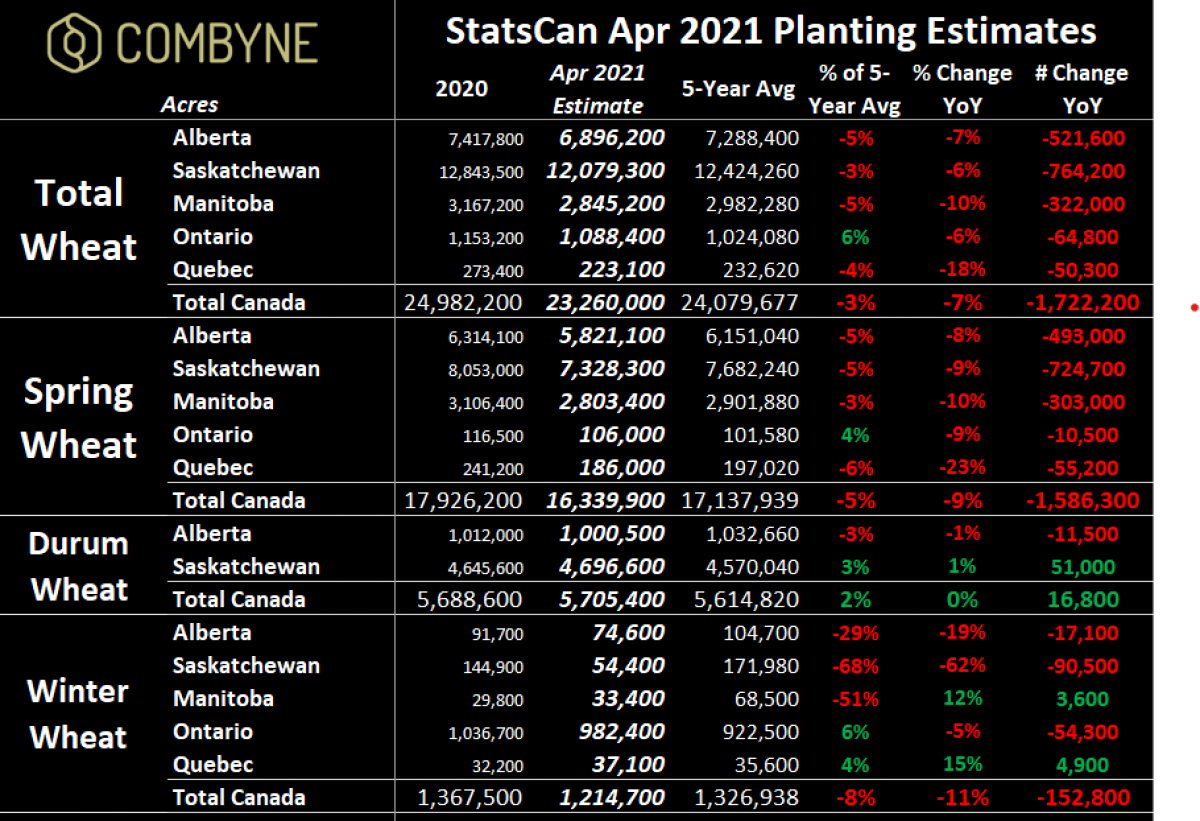

In Canada, last week we got Statistics Canada’s first acreage estimates, and it showed a lot less wheat and oats, more of other cereals (especially barley), more oilseeds, and a similar amount of pulses. Digging into the wheat complex, durum acres are expected to be largely flat, winter wheat acres are mostly lower in Western Canada, meaning that almost all the decrease in Canadian wheat acres is attributed to spring wheat.

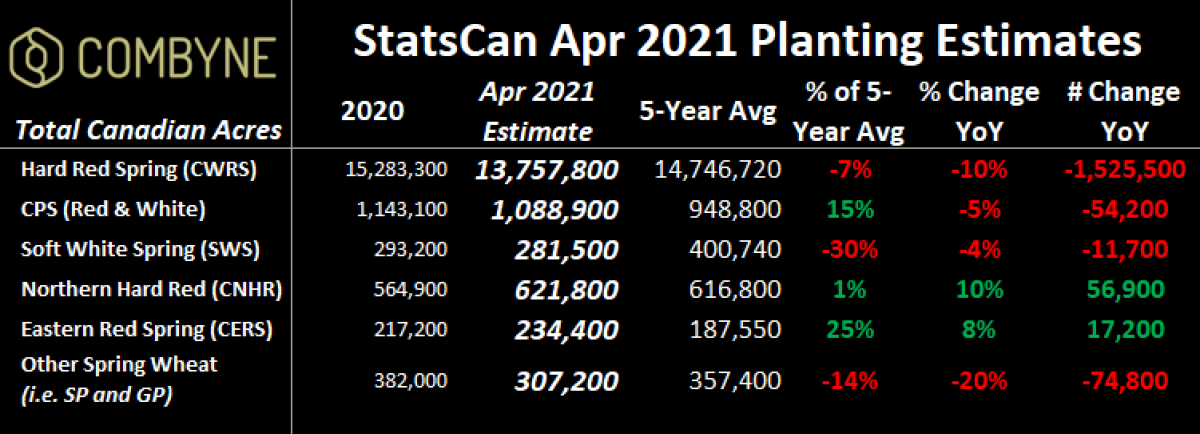

In fact, farmers across the 3 Prairie provinces are expected to plant 1.5M fewer acres of the crop this spring. Digging into specific classes, CWRS is accounting for almost all of this downgrade, other classes of low-protein wheat are gaining acres, notably CPS wheat in Alberta (+5% YoY), SP/GP wheat in Manitoba (+3x YoY), and CNHR, HWS, and SWS all up in Saskatchewan.

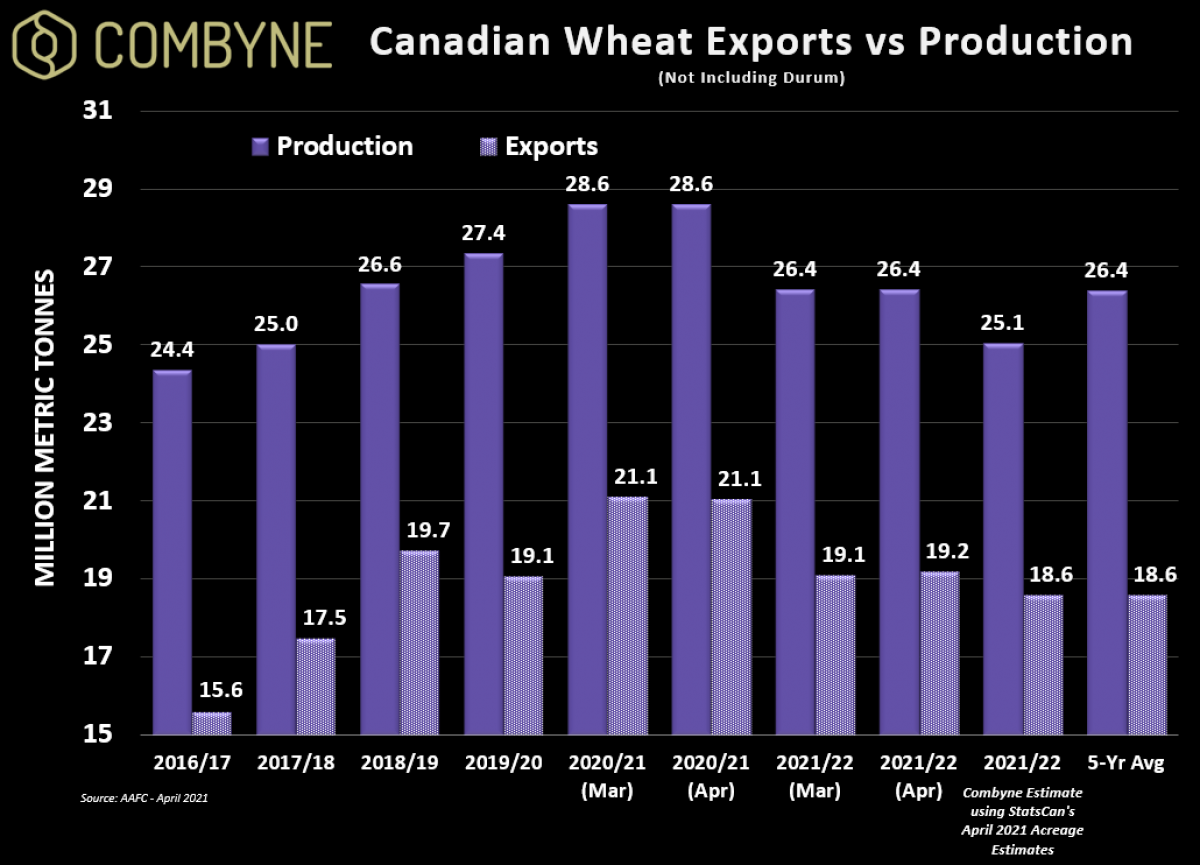

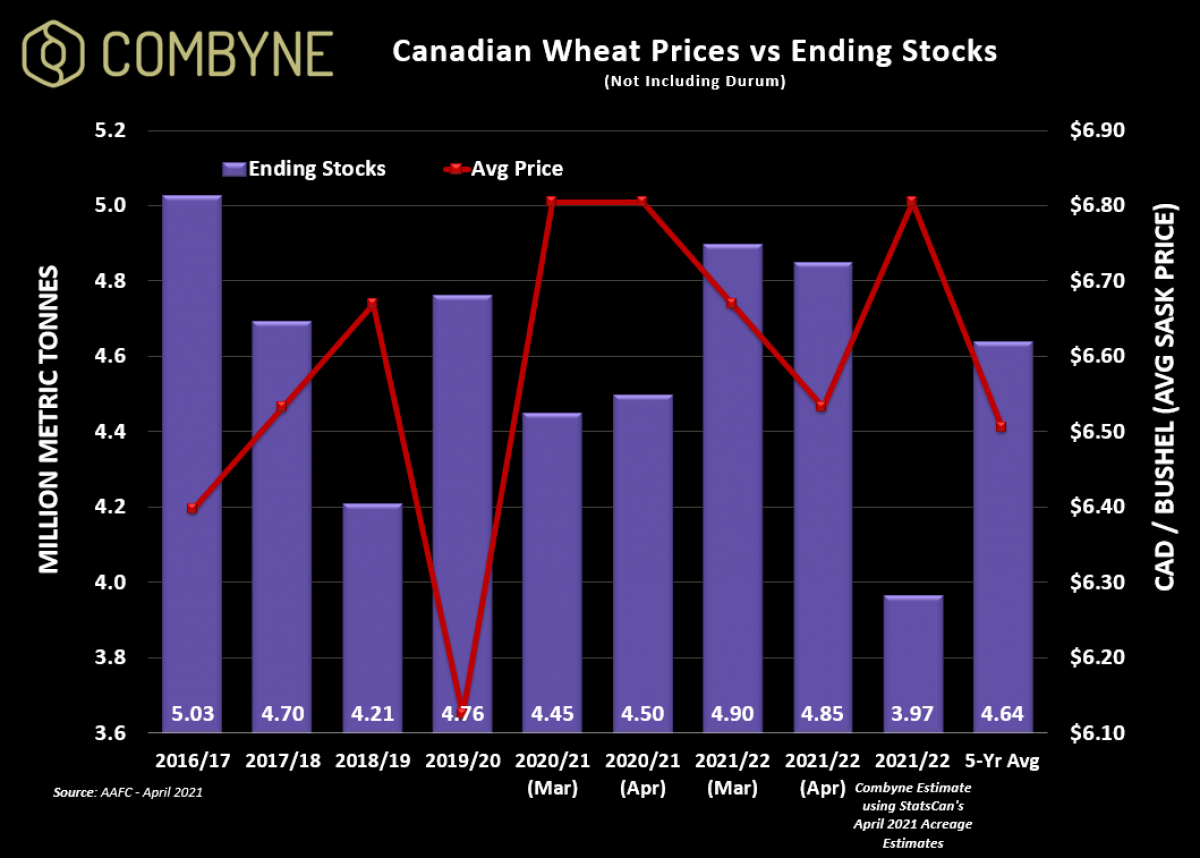

What the smaller non-durum acreage results in is a smaller production number. As promised in last week’s Wheat Market Insider column, I incorporated StatsCan’s acreage numbers into Agriculture Canada’s supply and demand tables. Fundamentally, with less production, the price of Canadian wheat should theoretically rise. However, with higher prices come origination substitution as price-sensitive markets opt for cheaper options elsewhere, most likely Europe and Australia. For the EU, a decent rebound in wheat production is expected after last year’s smaller crop, albeit the European Commission did just lower its estimate for the soft wheat harvest by nearly 2 MMT. Further, the most recent estimate from the USDA’s attaché in Australia says the 2021/22 wheat harvest will still be big at 27 MMT, albeit not as big as last year’s surprise of a new record haul of 33.3 MMT.

Therein, I expect Canadian non-durum wheat exports to drop at least 600,000 MT from the current AAFC forecast of 19.2 MMT, but keep in mind that this is still one of the largest export campaigns in the history of Canadian wheat trade. Therein, with the small harvest but demand still quite high, non-durum wheat ending stocks should fall below 4 MMT, which, in turn, should support prices into the 2022/23 crop year.

Of course, Mother Nature has the final say but markets are clearly telling us that there are both strong demand and supply concerns. Until more about this year’s crop potential is known, I’d expect to see volatility continue, and thus, it’s important to use all your marketing tools to your benefit – be it target pricing tools like Target Offers on Combyne or using put options as a futures hedge against your cash contracts.

Be productive AND safe in the fields this week!

To growth,

Brennan Turner

CEO | Combyne Ag