It All Starts with Acres Planted

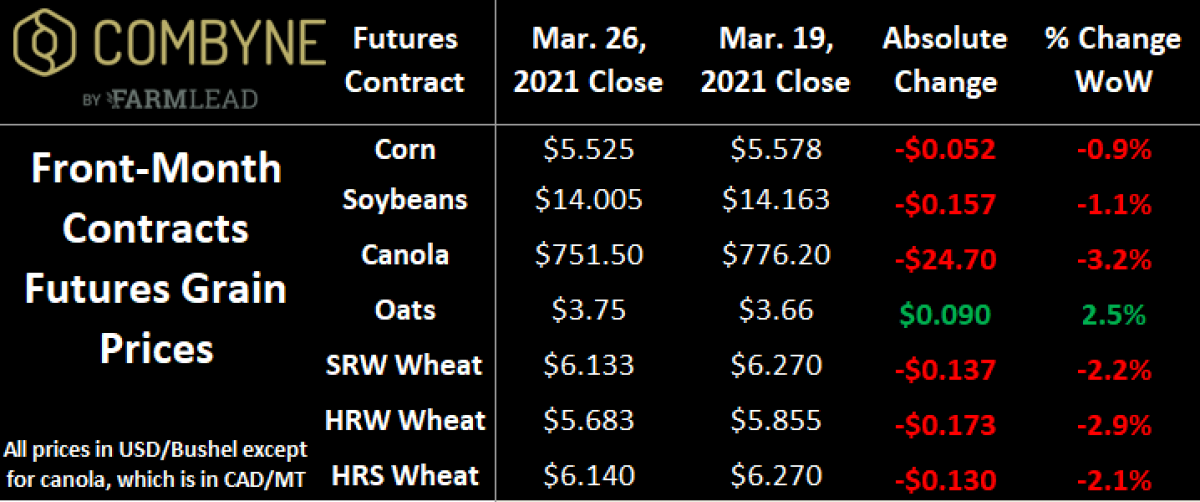

As we near the end of March, grain markets dipped again as the see-saw of demand vs supply headlines continues to dominate the market. Most of the supply factors are leaning on increasingly better-looking growing conditions in the northern hemisphere (basically North America, Europe, and the Black Sea). From an overall trade perspective, there’s a lot of attention being paid to the container ship stuck in the Suez Canal. Every year, ships representing about 12% of all global trade, including 15% of global rice and wheat exports, sail through the 120-mile long canal instead of taking the long way around the southern tip of Africa. Ship logs suggest about 4 MMT of grain is being held up right now waiting to go through the Suez.

Usually, the trade disruption would cause a few headaches for Black Sea exporters, but they’re at the time of year where shipments usually slow down. Further, Russian wheat demand has dropped dramatically since they introduced a wheat export tax a few weeks ago. This also applies to new crop sales for future delivery as, starting in June, the export tax will start to “float”, meaning that anyone trying to sell a new crop today has no idea what their actual port export price will be.

What this means is that there could be a lot more spot sales coming out of Russia this summer, meaning demand could get “jumpy”, which should support wheat prices a bit. As a reminder, the Kremlin introduced export taxes on many agricultural commodities including corn, barley, sunflower seeds, and obviously wheat, to get a handle on inflation, which was running at nearly 6% as of mid-March! It could be worse though: Argentina’s inflation is currently clipping along at about 48%!

All things being equal, decent conditions and a bigger area seeded this fall suggests another Russian wheat harvest above 80 MMT in 2021/22 (which would be the 3rd in the last 5 years!). In that vein, France’s wheat crop conditions are also looking promising with 87% of the crop rated good-to-excellent, a 24-point improvement year-over-year. More broadly, there are some issues in Hungary, Italy, and Germany, but, barring any significantly negative weather over the next 2 months, the EU wheat harvest is looking fairly large.

Coming back to this side of the Atlantic, most of the focus this week in grain markets will be on the USDA’s Prospective Plantings and Quarterly Grain Stocks reports, published every on March 31st. Many market analysts agree that if corn prices are able to maintain the current ratio of 2.6 against soybean prices, more corn than currently expected will get planted this spring, given the incremental marginal revenue at these levels.

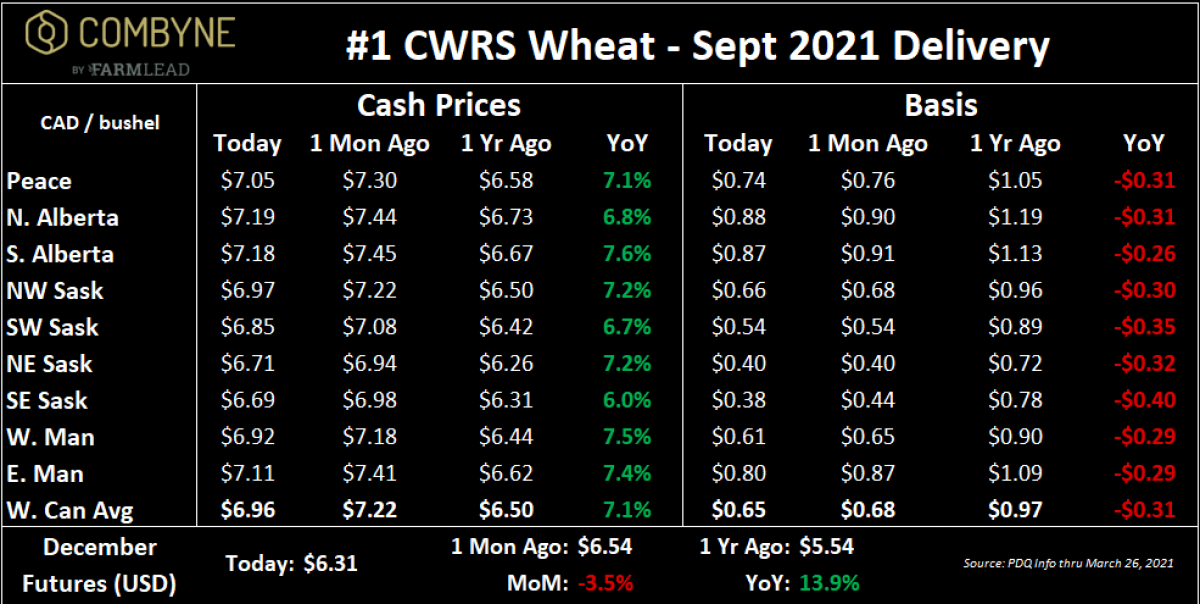

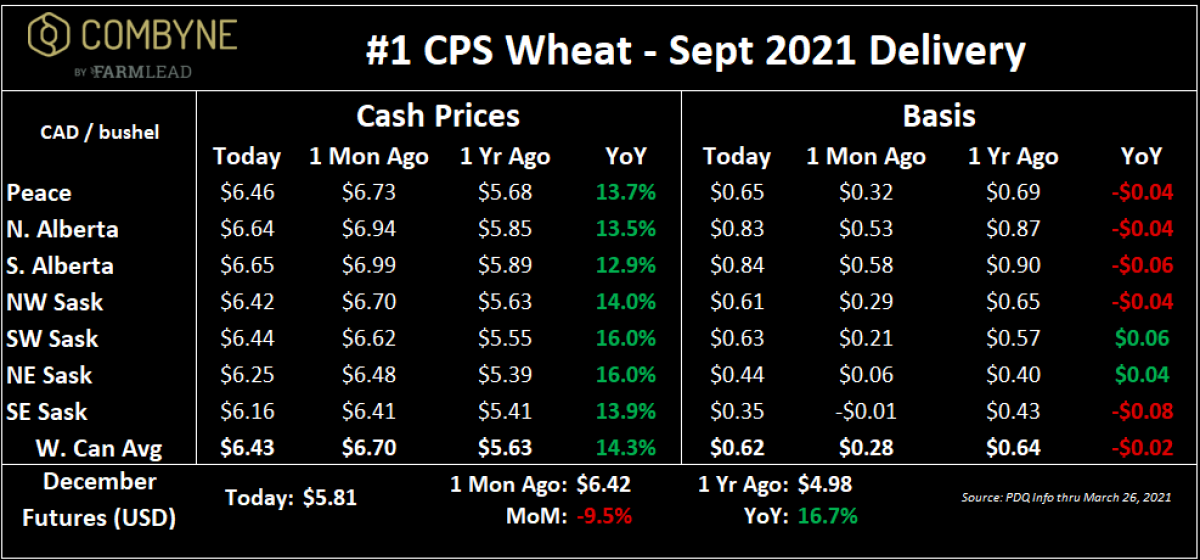

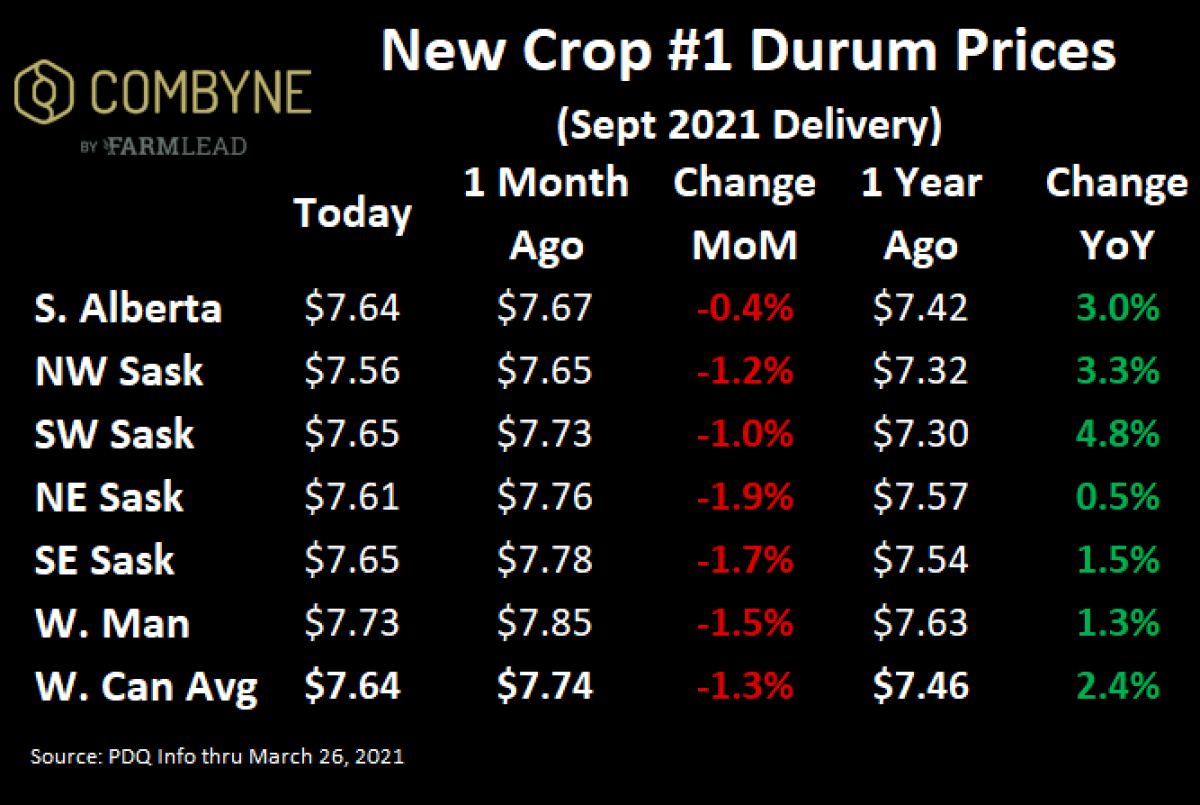

As for wheat acreage, expectations are that we might see slightly higher spring and durum wheat acres than what the USDA said in their February Outlook Forum. However, a private poll of farmers by Farm Futures actually suggested way more durum (+30% year-over-year to nearly 2.2M acres) and way less spring wheat (-7% YoY to 11.4M). While there are some drought concerns in HRS and durum areas, wheat traders seem to be generally ignoring it, as evidenced by not only where the futures price is, but also the cash market. Put another way, they know that wheat is a weed and that there seems to be enough new crop supply already bought that prices have pulled back a bit from where they were a month ago.

To growth,

Brennan Turner

CEO | Combyne Ag