Kansas Troubles and Black Sea Bubbles

Grain markets finished the second week of May in a sea of red, as improving planting conditions (and pace) and a two-month extension of the Black Sea Grain Corridor Deal fueled heavy selling. More cancellations by China for U.S. corn purchases and the reality that now even Mexico is looking to Brazil for supply pushed the Chicago corn front-month contract to its lowest level since December 2021. Similarly, front-month soybean contracts hit their lowest level since January 2022 on the same Brazilian competition, and healthy Plant 2023 activity. Also of note, Kansas City HRW wheat futures touched fresh contract highs on Wednesday ahead of the announcement from Ukraine and Russia, but then saw a hard and fast sell-off in the subsequent days. Amidst the geopolitical tension easing, supporting the wheat complex earlier in the week was a crop tour through Kansas wheat fields, which suggested the smallest wheat harvest in the state since 1957.

The bearish pressure from the Black Sea Grain Deal renewal though won the week, pushing traders to take profits and move to the sidelines. Put another way, the market was pricing in some risk premium to the agreement not being renewed, and so that’s why we saw wheat futures fall sharply in the days after the announcement. The Kremlin capitulated to extend the deal as they were given “certain hopes” that economic sanctions – namely financial, logistics, and insurance barriers – would be relaxed. Therein, for the first time since May 4th, ships started traveling again to Ukrainian port positions to be loaded with grain.

Ultimately, the wheat market whipsawed back to business-as-usual trading last week, erasing the geopolitical risk premium built up to this point, but there are 2 hard facts lingering the background. First, there is the reality that Ukraine will produce just half the wheat it normally does, even with perfect growing conditions. Second, Ukrainian grain exports, be it west to Europe or out of the Black Sea ports are far from being on cruise control, thanks to opposition from neighbouring countries and touch-and-go ship inspections at the Black Sea, respectively. Thus, as Russia and Ukraine are re-negotiated every 2 months (mark July 18 on your calendar!), there’ll inevitably be some premiums added back in over the next few weeks.

Coming back across the Atlantic, similar to Ukraine, Kansas won’t produce a normal wheat crop this year either. The U.S. Wheat Quality Council’s crop tour wrapped up on Thursday, suggesting an average yield of 30 bushels per acre (bu/ac), a far cry from the 5-year average of 45.6 bu/ac, but slightly above the USDA’s own estimate of 29 bu/ac earlier this month. For reference, Karen Braun from Reuters pointed out that, since 2005, the USDA’s May estimate for Kansas’ winter wheat yields has always been lower than the crop tour’s estimate in all but 3 years (2010, 2018, and 2019). Overall, the USDA is expecting a 191.4M bushel harvest (5.2 MMT) in what’s supposed to be America’s largest wheat-producing state, while the crop tour results suggest just 178M bushels (4.8 MMT). Accordingly, plenty of end-users are already starting to look at substitution options outside of Kansas wheat, 69% of which is rated poor-to-very-poor as of the USDA’s last crop progress report on Monday, May 22nd.

With the northern hemisphere winter wheat crop relatively known and starting to get harvested in the coming weeks, the attention turns to weather and Mother Nature’s pendulum swing from La Nina to El Nino. With ocean waters between California and Hawaii warming, the NOAA says that there’s a 90% chance that we’ll see El Nino-related weather by the summer. Nutrien’s Eric Snodgrass noted this week that favourable growing conditions would likely be see in in the Midwest, but that’s also increased risk for damaging storms. Nonetheless, Snodgrass knows the data doesn’t lie: since 1970, there’s been 17 El Nino summers and 14 of them had above trendline average yields for the corn belt. On the flipside, Drew Lerner and the World Weather Inc. team see a wetter early start to summer in the Northern Plains and Great Lakes, but that Kansas and the western corn belt could trend drier into July (not great for the region’s corn pollination phase).

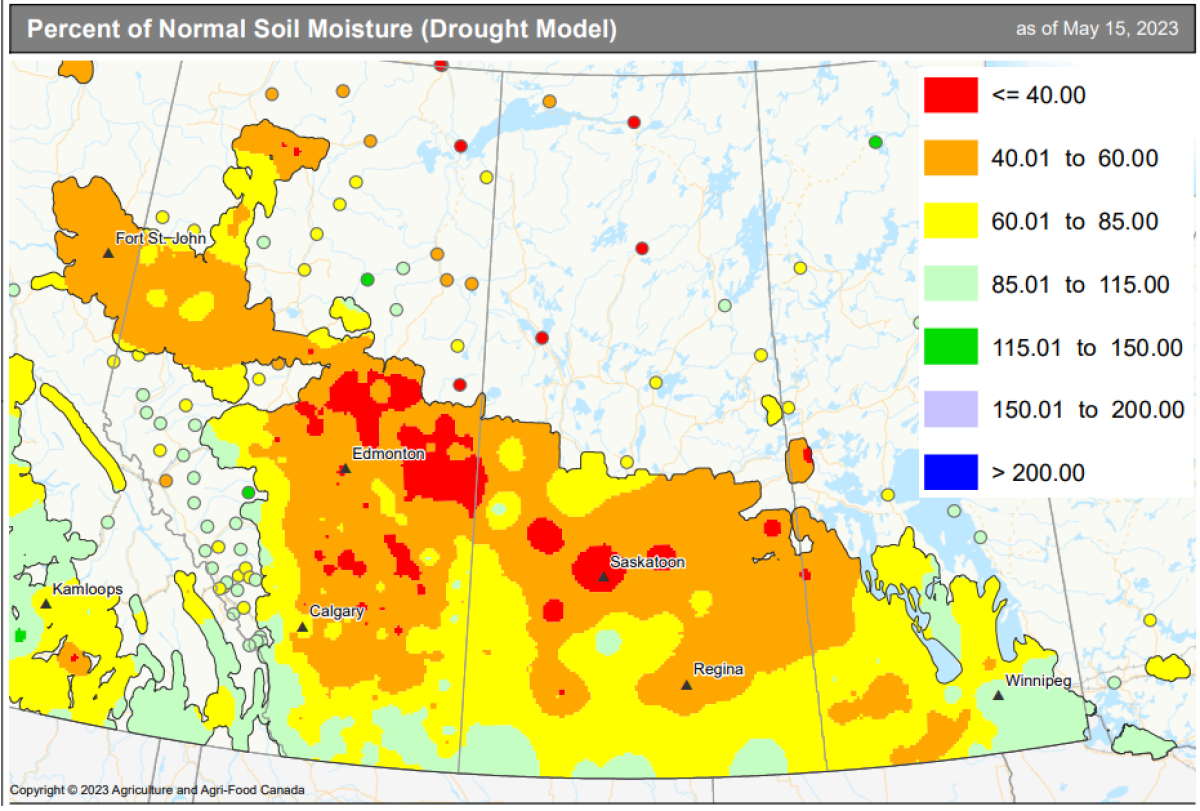

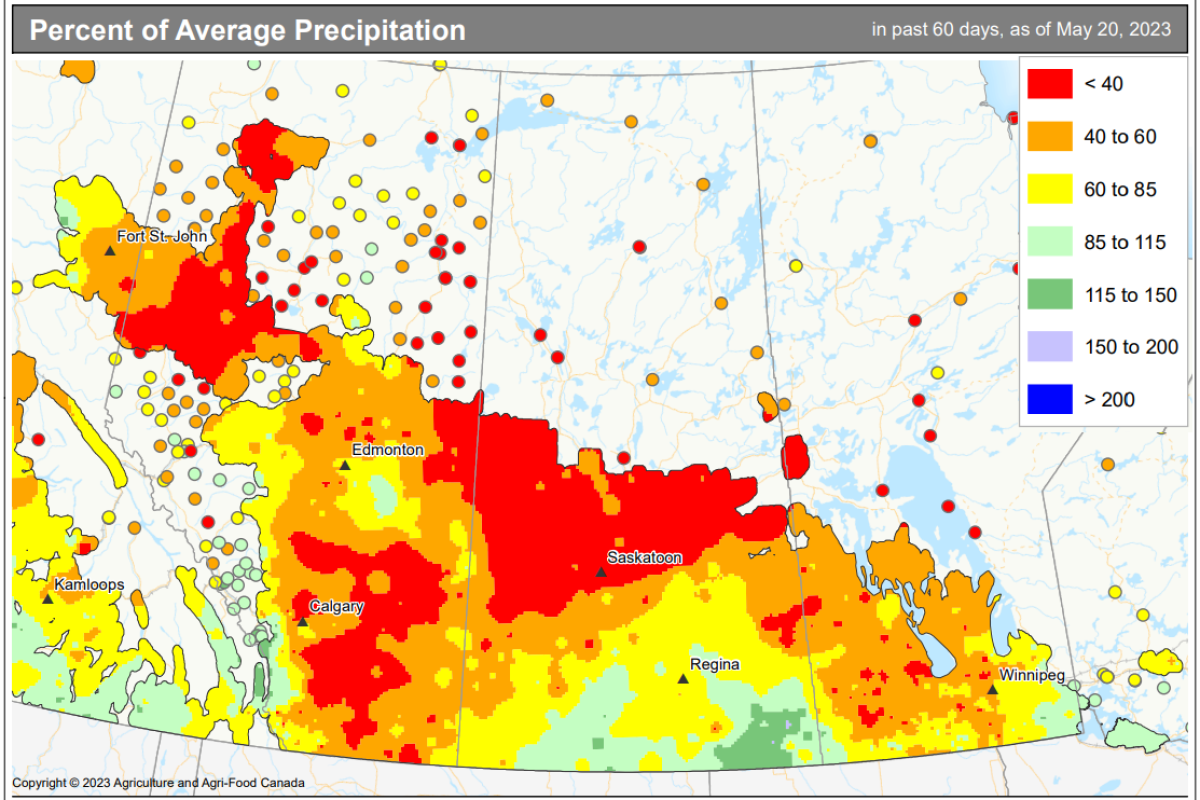

Looking across the 49th parallel, some hot weather was enjoyed by most of the Canadian Prairies over the May long weekend, a trend that has helped accelerate seeding efforts across the region. In Manitoba, 25% of crops had been seeded, way behind the 5-year average of 63% as rain kept farmers out of the fields last week. In Saskatchewan, 38% of fields have been planted, and while that’s well below the 5-year average for mid-May of 53%, producers I’ve spoken with aren’t too worried about where they’re at. And in Alberta, 55% of Plant 2023 is complete, right in line with the 5-year average thanks to the hot weather. However, the dryness is starting to get a little worrisome as soil moisture levels, especially in the top two-thirds of the Wildrose province, are below normal. As per the 60-day precipitation map below, the same region hasn’t seen the good rains it normally gets to start the growing season.

The rain would be welcome for not just farmers’ fields, but also the growing wildfire situation. That said, the fires, which have ripped through over 1M acres so far in western Canada, might be a saving grace from a crop potential standpoint, as the smoke is creating a bit of a barrier from the heat stress. With as much talk as there is, this feels like 2015 when there was a lot of concern about yield potential due to heat that summer, but the smoke from the Western Canadian wildfires then likely saved a lot of crops from significant damage. Nonetheless, absent a couple moisture events, a weather premium may start getting baked back into grain prices but until then, end-users are going to remain reluctant buyers. That’s not to say they’re going to be just as hand-to-mouth as what we saw last June at $24 canola and $15 spring (per bushel), but with high interest rates, they’re also not looking to hold onto anything for too long either.

To growth,

Brennan Turner

Independent Grain Market Analyst