Less Wheat (But Still Lots?)

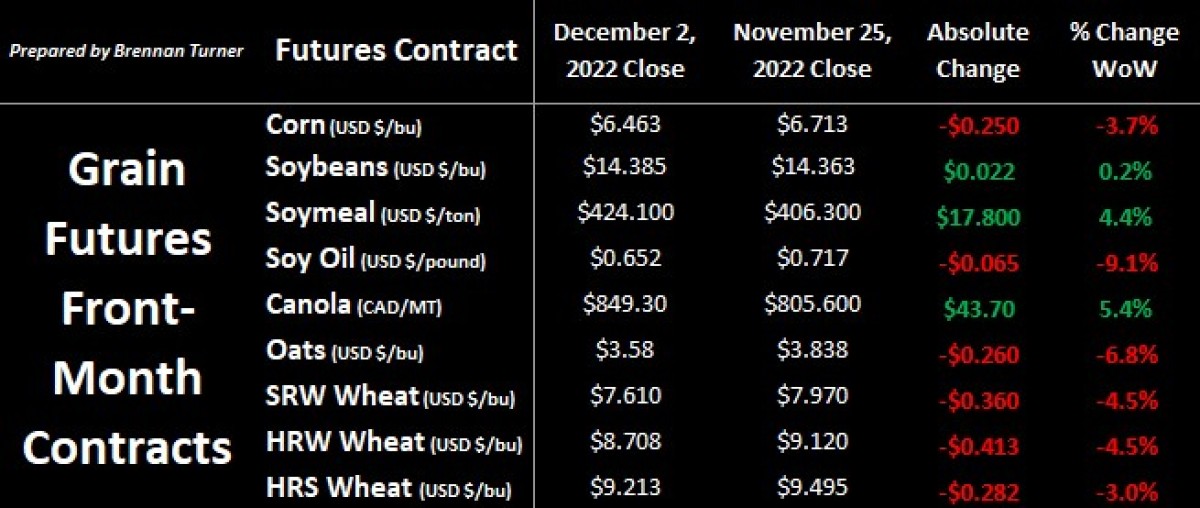

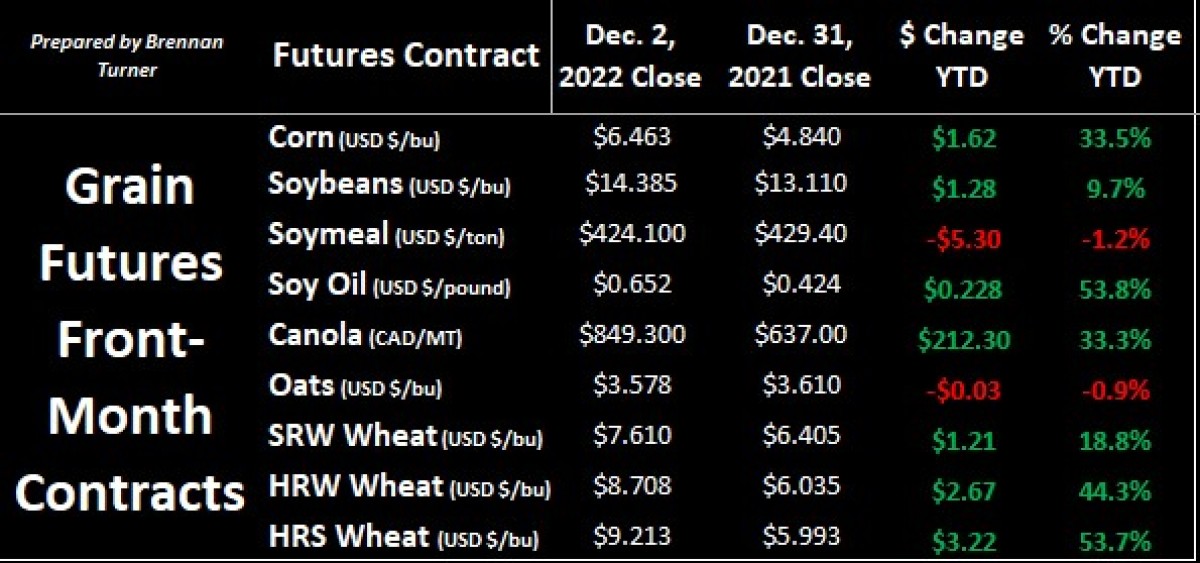

Following the U.S. Thanksgiving holiday, grain markets took a bit of a tumble into the month of December, lead by corn, wheat, and soy oil, while oilseeds found some bullish footing. Corn futures dropped to their lowest since last February on ongoing weak exports, which are now tracking behind where they usually are by this time of year, by almost 50%. On the flipside, U.S. soybean exports remain strong, but soy oil was the big loser on the week, thanks to the EPA’s 3-year targets for renewable fuel volumes being smaller than expected, in addition to canola oil being approved for use in making renewable diesel and other biofuels. This obviously helped canola futures, which were also supported by StatsCan’s Friday announcement that Canada’s Harvest 2022 volumes were almost 1 MMT smaller than previously thought. Canadian wheat production was also lowered by the government agency (more on this in a bit) but it couldn’t make up for some bearishness from slower U.S. wheat exports and more rains in the forecast for their winter wheat region.

On that note, 34% of the U.S. winter wheat crop is currently rated as good-to-excellent (G/E), up 2 points week-over-week but below the 44% at this time a year ago, and the 2nd-worst rating for this time of year in the last 35 years! Drought conditions continue to plague fall-planted fields in the Southern Plains, but the worst conditions are seen in western Nebraska, eastern Colorado, and western Kansas, the last of which hasn’t even seen much winter wheat emerge. That said, the market doesn’t truly price in a drought until yields have basically materialized, and we’re a few months away from any combining, let alone knowing how much survived the winter.

For example, the best U.S. winter wheat crop rating for the end of November was 76% G/E back in 2004, and that subsequent summer’s harvest yielded an average of 44.3 bushel per acre, in line with trend line. The worst conditions ever recorded was in November 2012 at just 33% G/E, but Harvest 2013 averaged 47.3 bu/ac, also in line with trend line estimates! Suffice to say, winter and springtime moisture have a greater impact on what sort of crop develops, than what crop conditions look like going into the winter hibernation period!

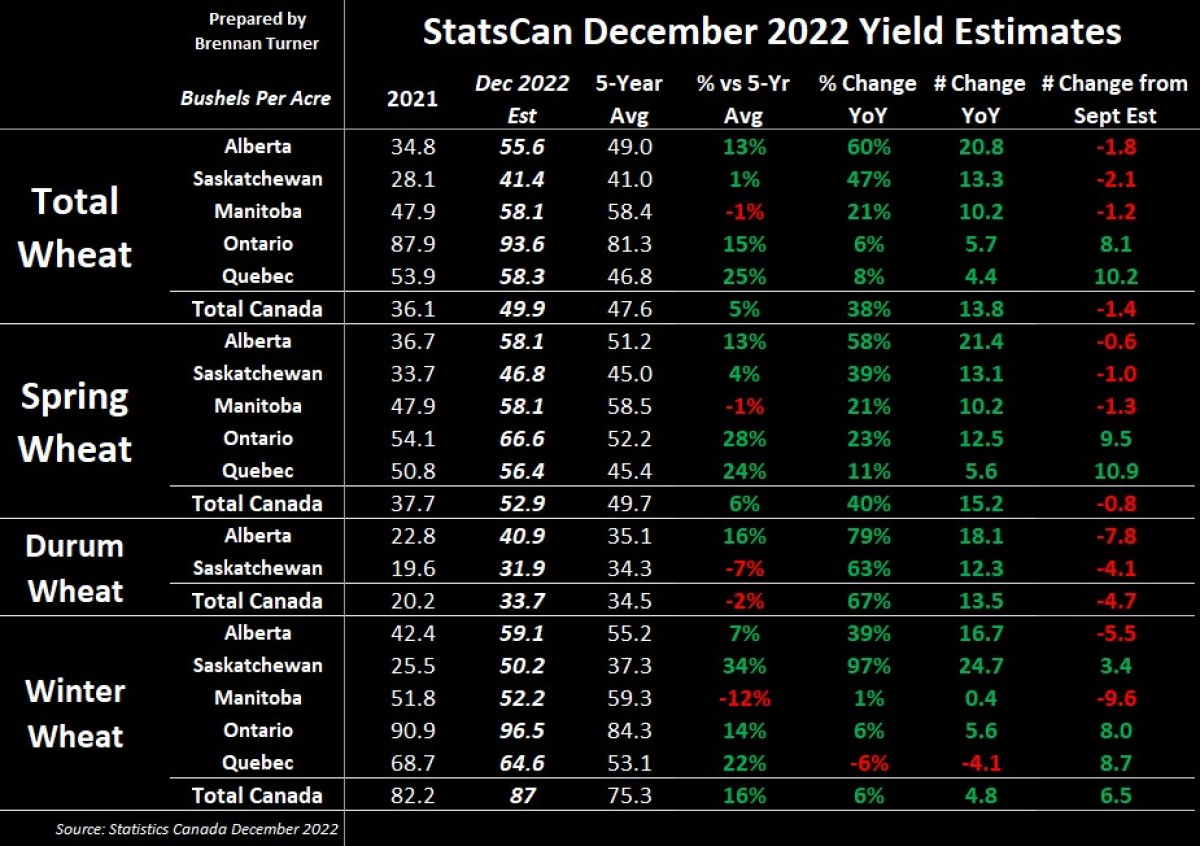

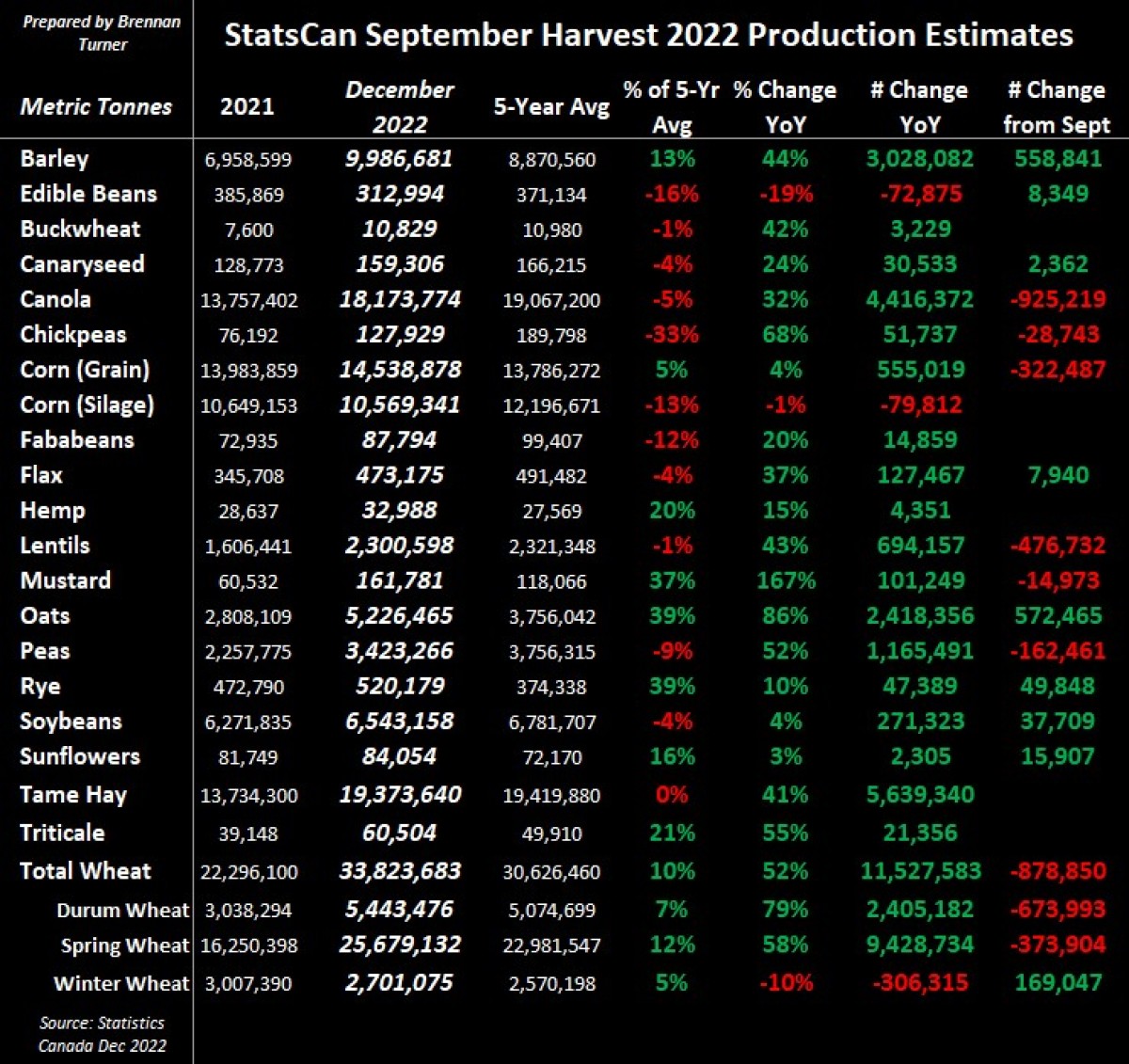

Heading north, Statistics Canada published its final estimate of the country’s Harvest 2022 volumes, suggesting way more barley and oats that what they forecasted back in September, but significantly less canola, lentils, peas, spring wheat, and durum. Specific to durum, average yields in Alberta and Saskatchewan both saw major reductions, down 7.8 and 4.1 bushels per acre respectively, pushing the average back below the 5-year average to 33.7 bu, a far cry from the 38.4 estimate in September, and even further from the 40.6 bu/ac forecasted back in August! Meanwhile, spring wheat yields were lowered across all 3 prairie provinces, but the losses were somewhat offset by much better yields than once thought in Quebec and Ontario (albeit they only added ~71,000 MT to the spring wheat balance sheet).

It’s worth remembering that this is the first production estimate from StatsCan that’s based on farmer surveys, while their reports in August and September were based on satellite imagery and data models. Therein, with a total durum crop of 5.44 MMT, this came in below even the smallest pre-report estimate from analysts (5.6 MMT) and so there’s much less volume available to the world’s buyers than once though, which should be supportive of prices over the next few months. For spring wheat, the biggest drop compared to September was in Manitoba, which saw its harvest lowered by over 383,000 MT for a total of 4.67 MMT (and accounting for most of the drop in Canadian spring wheat production). Overall, at a total wheat output of 33.8 MMT, this is more than 50% higher than last year, 10% above than the 5-year average, and the 3rd largest wheat harvest in Canadian history!

Ultimately, with the smaller crop and the strong demand dynamics seen for most Canadian crops, like I mentioned for durum, this will likely support prices, but I’m very cautious of last year’s record values been re-touched. For example, with the larger barley and oat production numbers, this will likely weigh on feed values, as there’s a bit of a limit on the malting and milling capacity domestically, suggesting more bushels will head to the feed trough. Combined with more corn coming up from the U.S., feed wheat prices will face some pressure in the coming weeks. On the flipside, with almost 1 MMT less canola than first thought, this will likely continue to support similar-to-higher canola acres for Plant 2023, especially with Canada’s Clean Fuels Mandate coming down the pipe (read: more demand). Despite some of the bearish headwinds felt through November, as we head into the month of December and holiday season, I expect some rebounding in values to occur. As a reminder though, grain prices are still looking much better than a year ago.

To growth,

Brennan Turner

Founder | Combyne Ag