Lower Starting Point for Spring Rally?

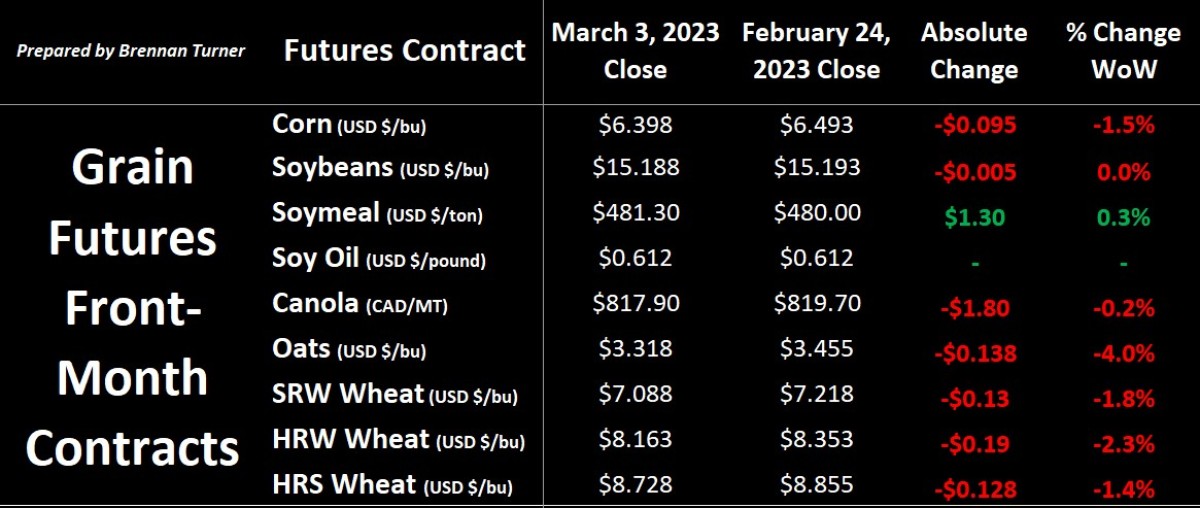

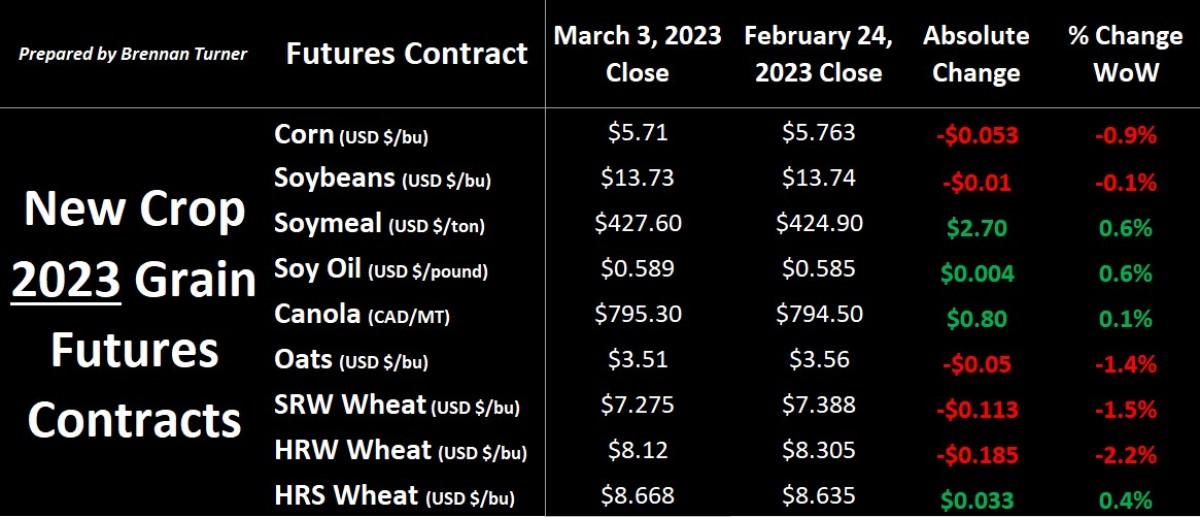

Grain markets continued to see selling and fund liquidation to end the month of February, before some bargain buying to start March. The end of week buying was supported by rumours of China buying more American corn, soybeans, and wheat, but no data was published by the USDA supporting this. There’s also growing expectations that the USDA will make some major revisions to Argentina’s harvest in their next WASDE report, published this Wednesday. The wheat complex lost ground on ongoing speculation that a renewal agreement will be made on the Grain Corridor deal before its March 18th expiry. However, Russia and Ukraine both have made fresh demands for a new deal that may complicate things and keep the selling to a minimum (if not, add a bit more risk premium to prices).

South of the equator, Argentine soybean and corn crops have had a tough growing season, with Rosario Grain Exchange calling it the worst drought in 60 years, and a consortium of the country’s agribusiness expecting $20 billion in losses. The dry weather, combined with the mid-summer frosts, has the latter group, the CREA, calling for 38.6 MMT of corn production and a soybean harvest of 31.2 MT. Slightly more optimistically, the Buenos Aires Grain Exchange cut their estimate of the Argentine corn crop by 3.5 MMT to 41 MMT and their soybean forecast by 4.5 MMT to 33.5 MMT. While we’ll get a fresh update this week, the USDA’s last estimate in the February WASDE was for 47 MMT of corn and 41 MMT of soybeans so yes, a reduction is expected. All of this contrasts the record soybean crop currently being harvested next door in Brazil (currently at 43% complete), which traders are aware of the cheaper origination costs being very competitive with American supplies.

Also worth noting is that Brazil just approved the same GMO wheat that Argentina approved last year. While the regulatory approval doesn’t mean it will go into commercial production tomorrow, it is worth noting that the HB4 wheat variety is already approved for food and feed use in Nigeria, South Africa, Australia, New Zealand, Columbia, and the United States! Inherently, the approval comes as perhaps food security is becoming a bit more top of mind, given the uncertainty of the war in Ukraine and the aforementioned weaker supplies from Argentina (who is usually the world’s #1 soymeal exporter and #4 soybean exporter).

Speaking of exports, Russia is expecting to ship a record volume of grain in the second half of the marketing year, which is possibly why the Kremlin is talking up prices by publicly stating their demands need to be met or else there’ll be no renewal. Moscow said last week that they’ll only agree to an extension if sanctions are lifted on its own agricultural products, namely payment, insurance, and shipping barriers. On the flipside, Ukraine is asking for not just another multi-month extension, but one that lasts a year, in addition to two more ports being added to the list of ports that grain can be shipped out of. Amidst the fresh demands is the seemingly nonchalant market sentiment that a deal will get done, which is principally why the wheat market closed lower again, just 2 weeks out from the renewal deadline.

Looking beyond just mid-month, Harvest 2023 from the Black Sea are expected to be smaller than last year’s haul, with production expected to drop 15% in Russia (from a record output), and at least another 20% in Ukraine. Therein, it’s likely that their share of the world wheat export market may drop from the 27% it was forecasted to be in 2022/23, as wheat producers around the world chase high prices. After all, American winter wheat acreage expanding by 11% year-over-year surprised the market, but there are still some production concerns with the recent Southern Plains crop ratings suggesting the crop needs help. In the largest-producing state Kansas, the portion of the crop rated good-to-excellent at the end of February was 19% (down two points from the end of January, and down six points from the same time a year ago). Further, 51% of the crop was rated in poor-to-very poor, up from 38% a year ago and the worst P/VP rating so far this winter.

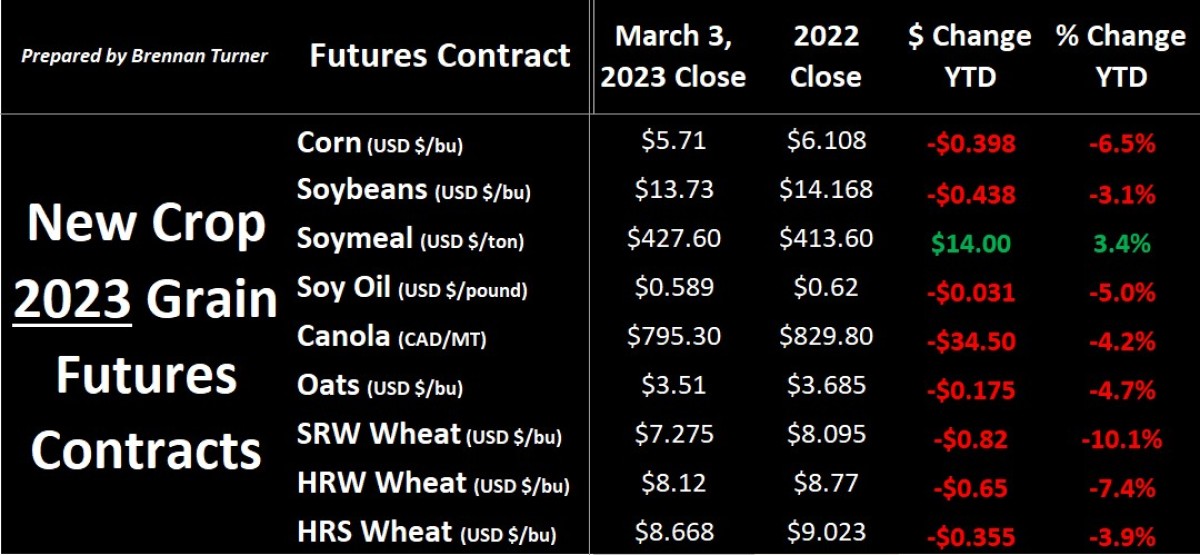

While Oklahoma and Texas’ winter wheat crop ratings improved, the market is moreso looking at the healthy rain that the region has been receiving of late. As such, the Chicago SRW wheat front-month contract touched its lowest level since September 2021 (1.5 years ago), well down from the $13 handle seen one year ago after the Ukraine invasion. Many technical analysts are wary of the contract falling below $7 USD / bushel, as it’d be a psychologically significant level that would nullify much of any current bullish biases. As such, while a spring rally is certainly possibly, I’m cognisant of the fact that we could be starting it from a much lower level than what we’re seeing today (let alone at the beginning of the year, as the table below indicates). Of course, wherever the technical charts point could be also nullified if no Grain Corridor deal is extended.

To growth,

Brennan Turner

Independent Grain Market Analyst