Making Friends with Volatility (and Holidays!)

Grain markets saw profit-taking to end the third week of June as renewed weather forecasts included some moisture relief for a lot of dry areas across North America. More weather premium continued to get built into futures values as many areas of the American Corn Belt are likely going to experience their driest June on record, especially in Illinois where totals of less than half an inch of rain is a significant deviation from the average of three to four inches. The wheat complex found some legs at the beginning of the week, largely thanks to nearly 30,000 short positions getting covered in Chicago SRW wheat contracts, and the growing sentiment that it’s unlikely Russia will renew the Black Sea Grain Deal again on July 17. While corn and soybeans dropped dramatically on Thursday and Friday, the three wheat boards did not, making them the winners of a very volatile trading week just ahead of the Canadian and American birthday parties.

Supporting the wheat complex is the accelerated crop development in parts of the Canadian Prairies and Northern Plains as well as the U.S. winter wheat harvest of just 15 per cent completed last week, slightly behind the five-year average of 20 per cent, mainly because of the slow start in Kansas, Oklahoma, and even California. There’s more optimism for rain falling around the Great Lakes and Northern Plains this week, which should help durum and spring wheat crops, but especially the latter who have seen poor-to-very poor crop ratings jump in the last two weeks by 16 points in Minnesota, 10 points in North Dakota, and 24 points in South Dakota. Simply put, the heat stress of the last few weeks hasn’t really helped the crop in these areas, especially after their late start.

Frankly, it’s a bit of a similar situation in Manitoba as the hotter-than-usual weather has rapidly accelerated crop development, with the provincial government in their weekly crop report saying that many fields “remain in good condition except later planted fields with uneven and thin stands due to dry topsoil.” In Saskatchewan, the crop conditions are a bit better, especially in the east where more moisture was received in the spring, while the west side of the province is trending drier. That same dryness is being experienced just west in Alberta, as now just 51 per cent of the spring wheat crop is in G/E shape as of last week, as fields from the southern to central parts of the province are continuing to deal with a lack of moisture events.

Coming back to the dryness situation in the U.S., 64 per cent of corn crops are facing some level of drought, up seven points week-over-week, while 57 per cent of American soybean fields are also facing drought, up six points from last week. The worst of it is being seen in Kansas (no surprise there), almost the entire eastern half of Nebraska, and Missouri. I mentioned Illinois above because only one-third of the corn crop there is rated good-to-excellent (G/E), and considering their weight of production relative to the entire country, a five to ten bushel drop statewide could equate to one to two bushels knocked off the national yield.

There’ll likely be a lot more jockeying of positioning this week as amidst the weather, it’s the month’s and calendar quarter’s end for traders looking to clean up their books. Both Canadian and U.S. governments are publishing updated acreage estimates, on Wednesday, June 28 and Friday, June 30, respectively. Between the heat stress and these updated acreage numbers, are we likely to get an update from the USDA in their next WASDE print on Wednesday, July 12? For corn and soybeans, the answer is probably no because the USDA doesn’t survey fields until the August WASDE, but we will definitely get the first detailed forecasts of the entire American wheat crop, class by class.

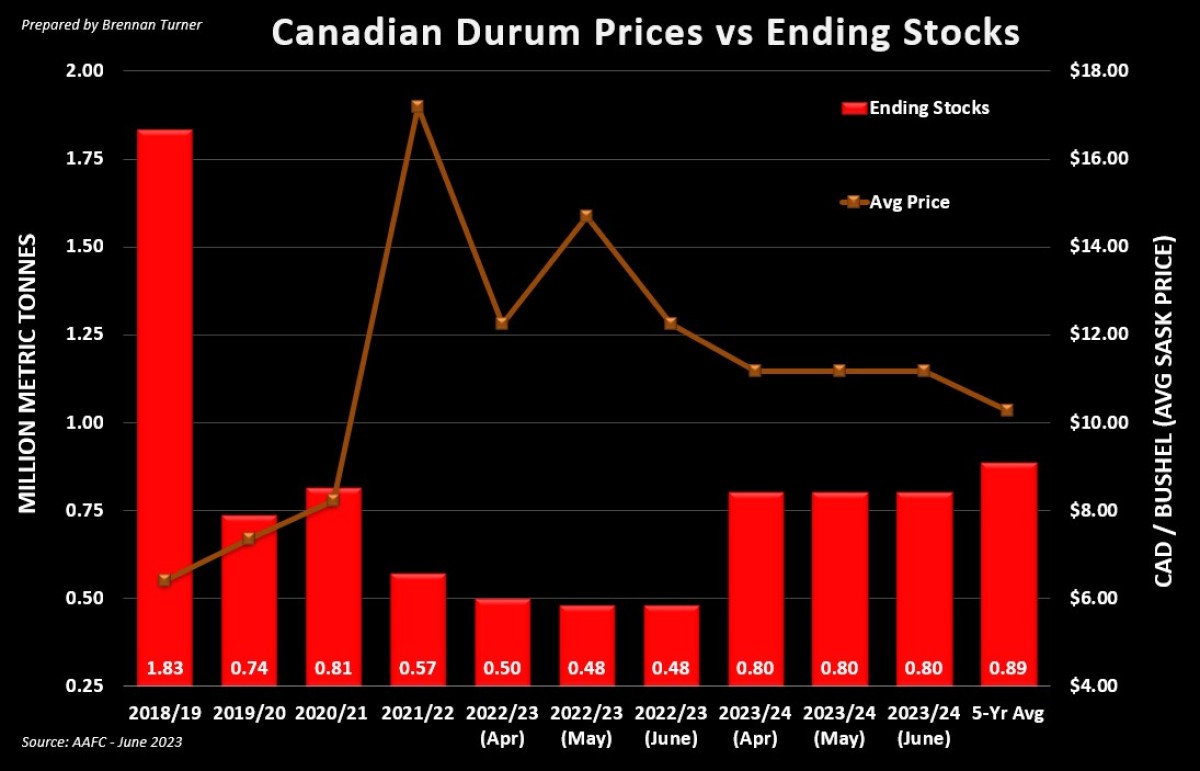

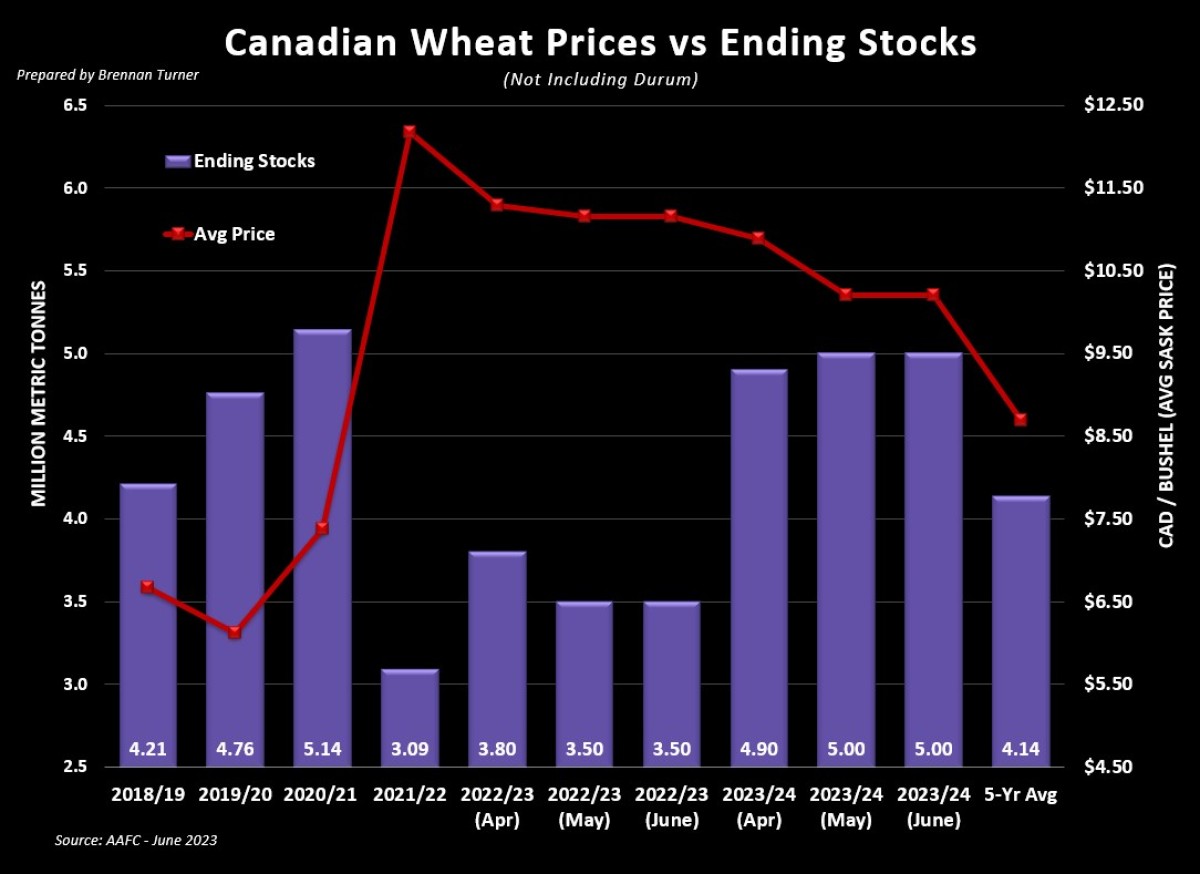

Across the 49th parallel, Agriculture Canada updated their own supply and demand tables this week, but frankly, it wasn’t much of an update with nothing changing except for prices being downgraded for old crops. Like many other forecasters, AAFC highlighted dry conditions in Spain and North Africa, which is likely supportive of durum prices and exports. Put another way, with available inventories from major durum exporters at multi-decade lows, there’s not a lot of wiggle room for a decline in production. It’s not too dissimilar for spring or high protein wheat as Canadian ending stocks continue to be pressured by the ongoing strong pace of exports.

If there’s a lesson here in June, it’s that volatility can be our friend when it comes to grain marketing. When looking at the longer view of things, grain markets have been trending lower basically since last fall, and just over a month ago, new crop corn had a $4 in front of it, soybeans an $11 handle, and Minneapolis spring wheat was trading below $8. The last two weeks of higher highs have largely been a function of trading forecast to forecast, which is relatively standard for this time of year. That said, weather premiums, as the end of this week showed us, can vanish quickly and so the old adage of selling into any summer rally in June or July is still proving to be correct. Whether that’s with a target with your local merchandiser or buying put options to protect against the downside on the futures board, the bottom line is that at this time of year, volatility is really your friend.

Happy Canada Day!

To growth,

Brennan Turner

Independent Grain Market Analyst