Mudslides Muddy Expectations for Exports

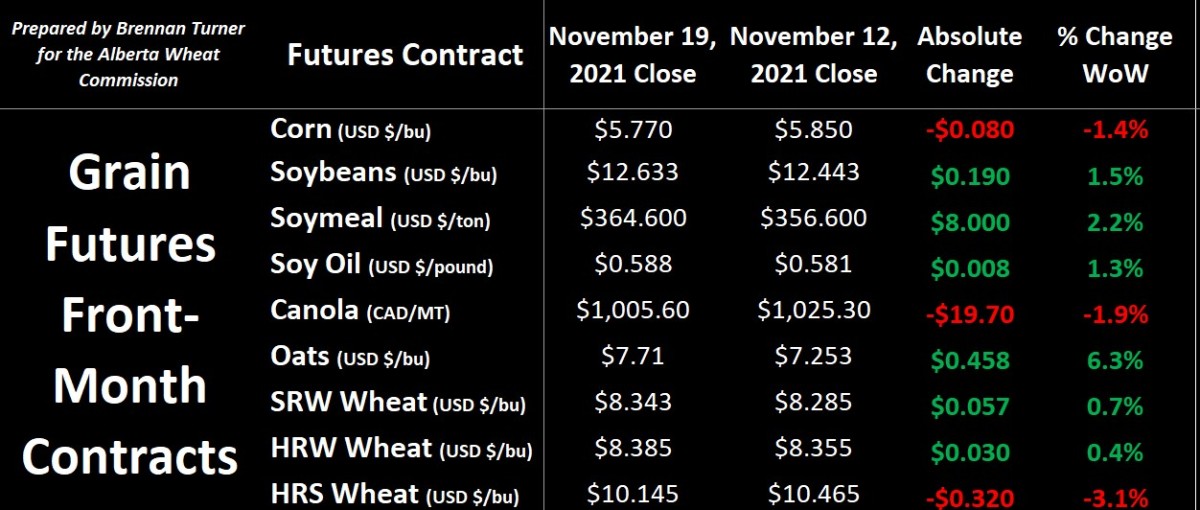

Grain markets were mostly green last week as traders factor in new logistics challenges as Harvest 2021 wraps up and Americans prepare for U.S. Thanksgiving (NOTE: grain futures markets are closed on this Wednesday night, all day Thursday, and close 90 minutes early on Friday). Corn and soybeans are getting pressured by positive South American growing conditions, but the latter was supported by weaker canola values.

The big headline this week for Canadian agriculture was the mudslides in British Columbia, as exports and imports out of the Port of Vancouver have basically come to a halt. With highways and railroad tracks washed out, the timetable to get trucks and railcar loads of grain into the port (and other goods out) is a bit unknown, although CP Rail suggests they might get some loads moving by the start of December.

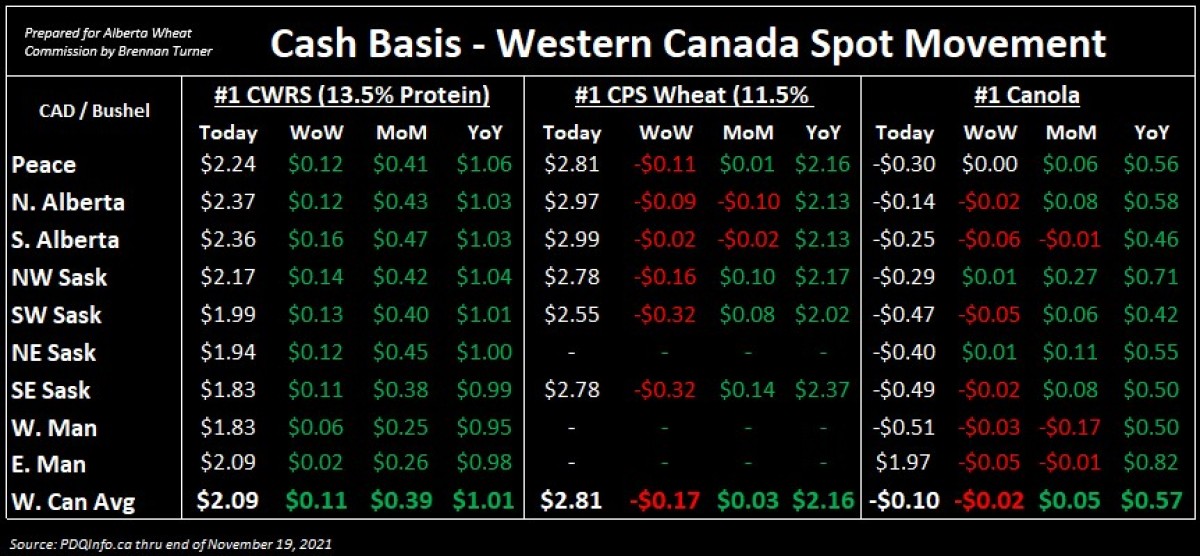

Canola and HRS wheat futures took a dip for the week, reflecting the importance of the Port of Vancouver for the movement of these two commodities. However, while the futures market pulled back a little bit (read: speculative investors pulling out of positions, given some of the uncertainty going forward), basis levels across Western Canada for HRS actually improved a bit, while canola was a mixed bag, as shown in the table below. Basis levels worsened most in CPS wheat as any price-sensitive international buyers who were buying low-protein wheat out of Vancouver are now headed to other origins until grain movement into Canada’s west coast returns to normal.

Where else can Western Canada’s commodities go, if not through the Port of Vancouver? The best alternative is probably Prince Rupert, BC, but the terminal there – jointly owned by Richardson, Viterra, & Cargill – is already clocking along at nearly full tilt, with the Western Grain Elevator Association saying there’s not much capacity to bring in more grain as is. On the flipside, grain could move down into U.S. Pacific Northwest ports (i.e. Portland, OR, Tacoma, WA, Vancouver, WA, or Seattle, WA), or all the way east across Canada, via train, or boats navigating the Great Lakes.

Most contacts I’ve spoken to suggest that we will not get back to the same level of grain shipments seen before this disaster – not just to the West Coast, but for all of Canada - until the start of 2022. Therein, I have two thoughts. The first is that if I have a contract that’s supposed to be moved in December or January, I’m calling my buyer to get some sense of how this infrastructure holds up in B.C. is going to affect my movement.

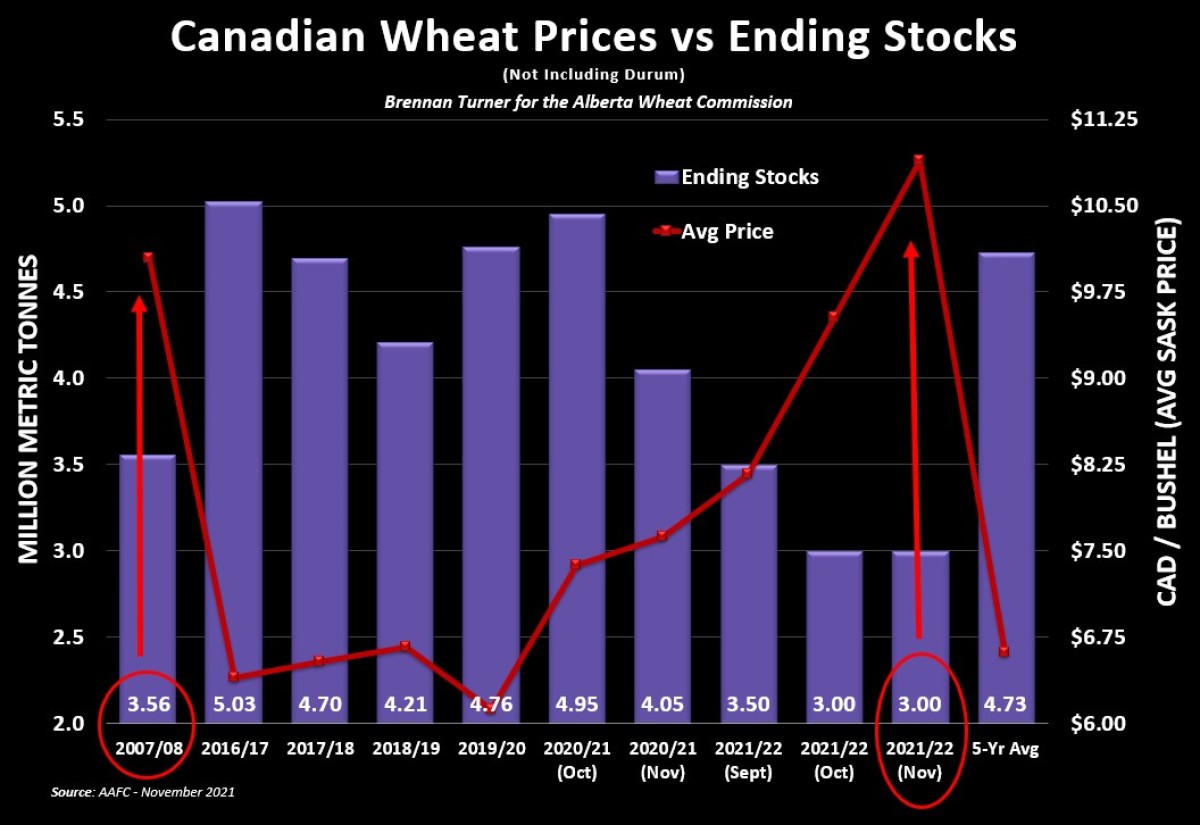

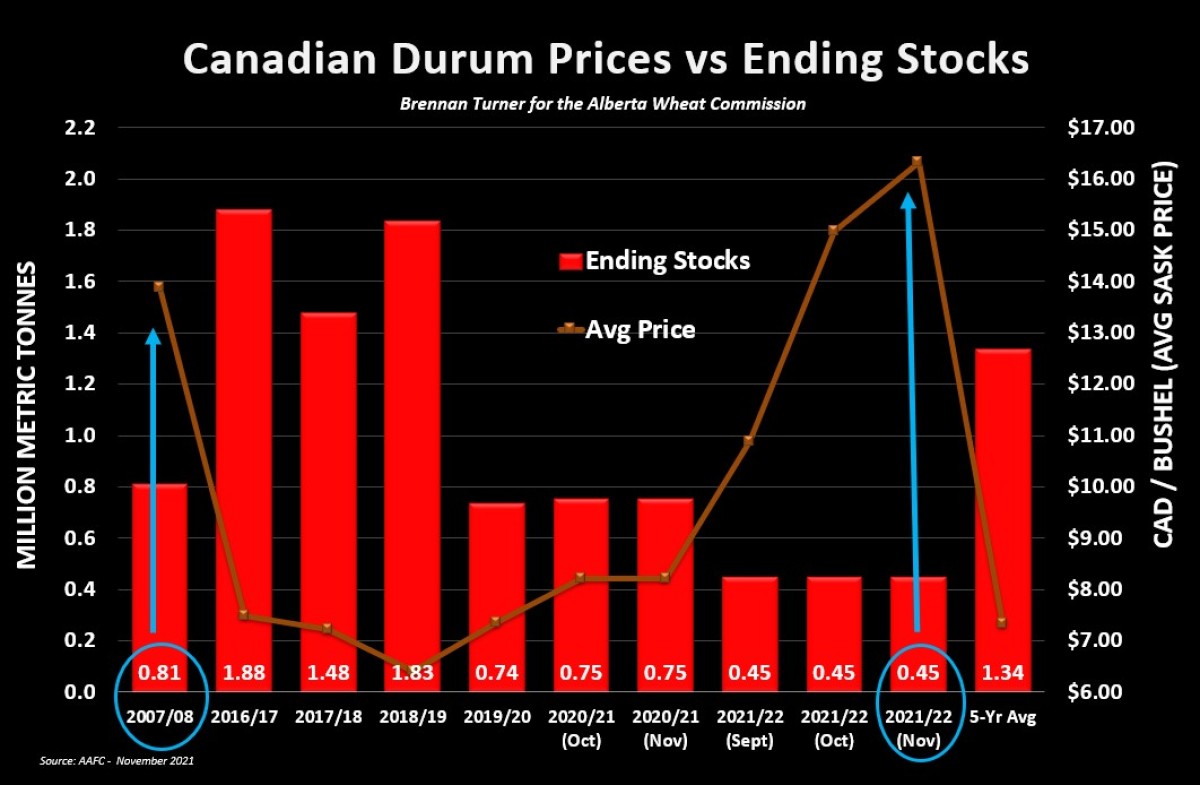

The second thought is that some of the current forecasts for grain exports might have to pull back a bit. While Agriculture Canada didn’t change anything in their monthly supply and demand report released last week, we could see ending stocks climb by a couple of weeks worth of normal exports in their next report. For non-durum wheat, this could be ~500,000 MT higher than the current estimates (shown below) and for durum, as much as ~100,000 MT higher. However, once the railroads are back up and running, there could be a flurry of shipping activity, assuming that companies are willing to pay the demurrage fees for boats sitting around another month or so (maybe insurance will cover it?!).

Overall, global supplies of both canola and HRS wheat remain limited, whereas low-protein Canadian wheat competes with ample inventories elsewhere in the world. Therefore, CPS / GP / SP wheat values could continue to be pressured in Western Canada in the form of basis, while HRS and canola push sideways. That said, if Western Canadian wheat and canola start making their way to U.S. or Eastern Canadian ports, one should expect that increased shipping cost to be reflected by weaker basis levels.

To growth,

Brennan Turner

Founder | Combyne.ag