Playing Export Musical Chairs

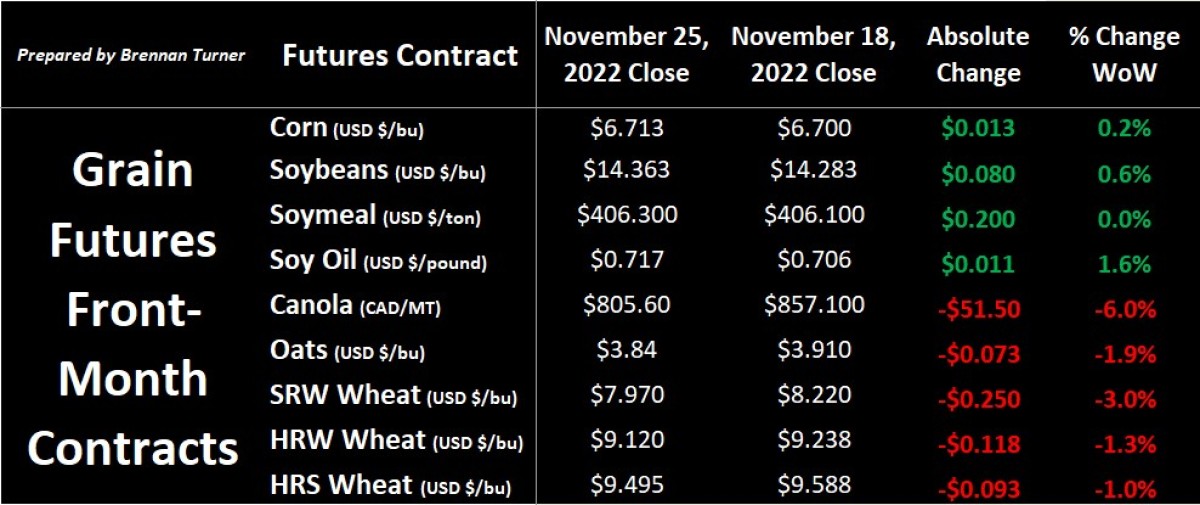

Wheat prices lost some legs during the shortened U.S. Thanksgiving trading week, with the Chicago front-month contract dipping to its lowest since August as forecasted rains and lower Russian values weighed on the market. News that the Argentine government would re-establish a better currency exchange rate for soybean exports will likely accelerate available supplies going into the international market, pressuring other oilseeds a bit. Soy oil had a weak Friday and that spilled over into canola futures, which fell for the 8th straight session, and is now in oversold position as it nears the technically and psychologically relevant level of $800 CAD/MT. Coming back to wheat, it was somewhat supported by ongoing poor U.S. winter wheat conditions (just 32% good-to-excellent) and execution concerns of the extension of the Black Sea grain deal.

More specifically, since Russia chose to renew the grain deal a few weekends ago, a maximum of 5 ships per day have left Ukrainian ports, about half the volume that was being done before the extension. Some blame is being put on Russia’s denial to increase its inspection teams to more than the 3 currently working, but also on slower port activity on the basis that international buyers were waiting to see what Russia would do with the grain deal, before committing to doing more business. Quite literally, there are some players who just don’t want to deal with Ukrainian or Russian grain (and the baggage that comes with it), and so instead, are opting to purchase grain elsewhere, namely other European options.

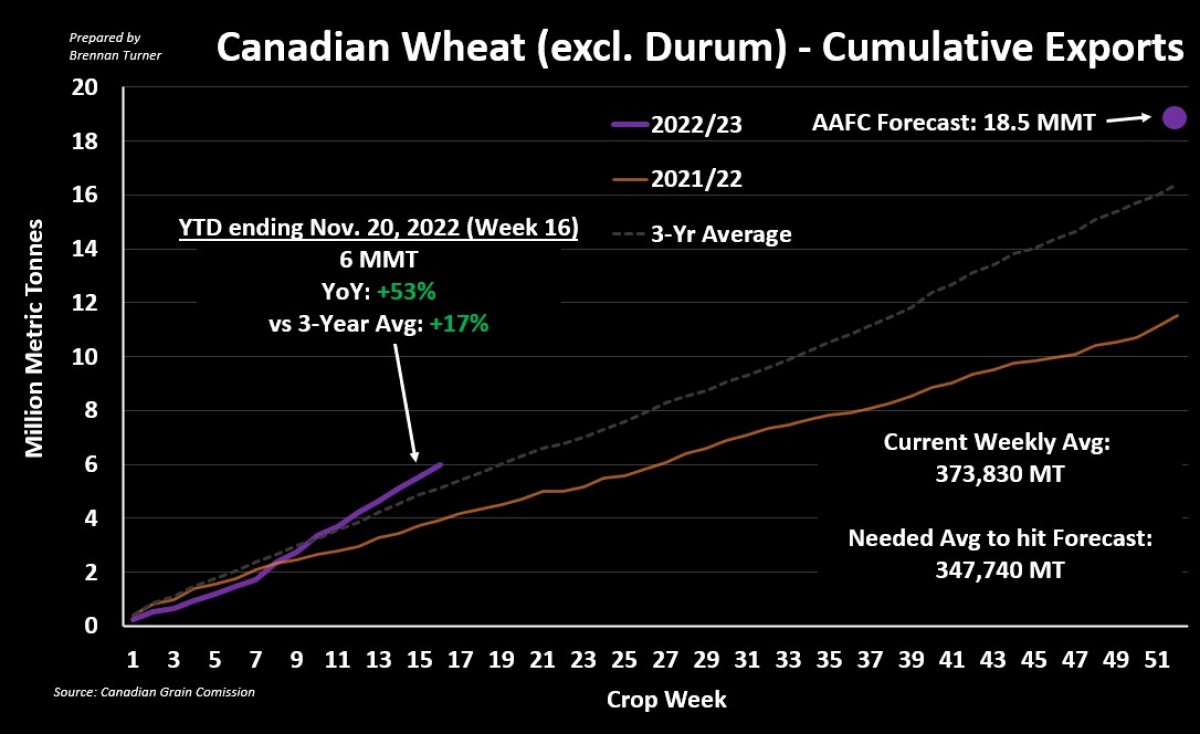

Therein, this has created an opportunity for Canadian wheat exports, something that I discussed the last two weeks at the regional Alberta Wheat Commission meetings. With more players going to the EU for wheat, that means that some buyers could be displaced and instead must look elsewhere for supplies, such as Canada. Add in a drought-riddled Argentine wheat harvest, there’s also some South American buyers likely looking for supply, expanding the game of musical chairs in terms of origination. That said, so far in the 2022/23 crop year, Canadian wheat exports have been one of the best performers with 6 MMT sailed through week 16, or November 20th. That’s more than 50% higher than where we were a year ago at this point, and to meet the current total year forecast of 18.5 MMT, weekly shipments are well above the average needed.

I expect this sort of international demand to remain for the next month and a bit, or as long as railroad movement continues to perform as well as it has thus far. We usually see a bit of a slowdown as we start the new calendar year, due to winter conditions, but all things being equal, the demand is currently there for Canadian wheat exports to take advantage of. This is especially true when over 90% of this year’s HRS wheat harvest is in the top 2 grades and protein is above average!

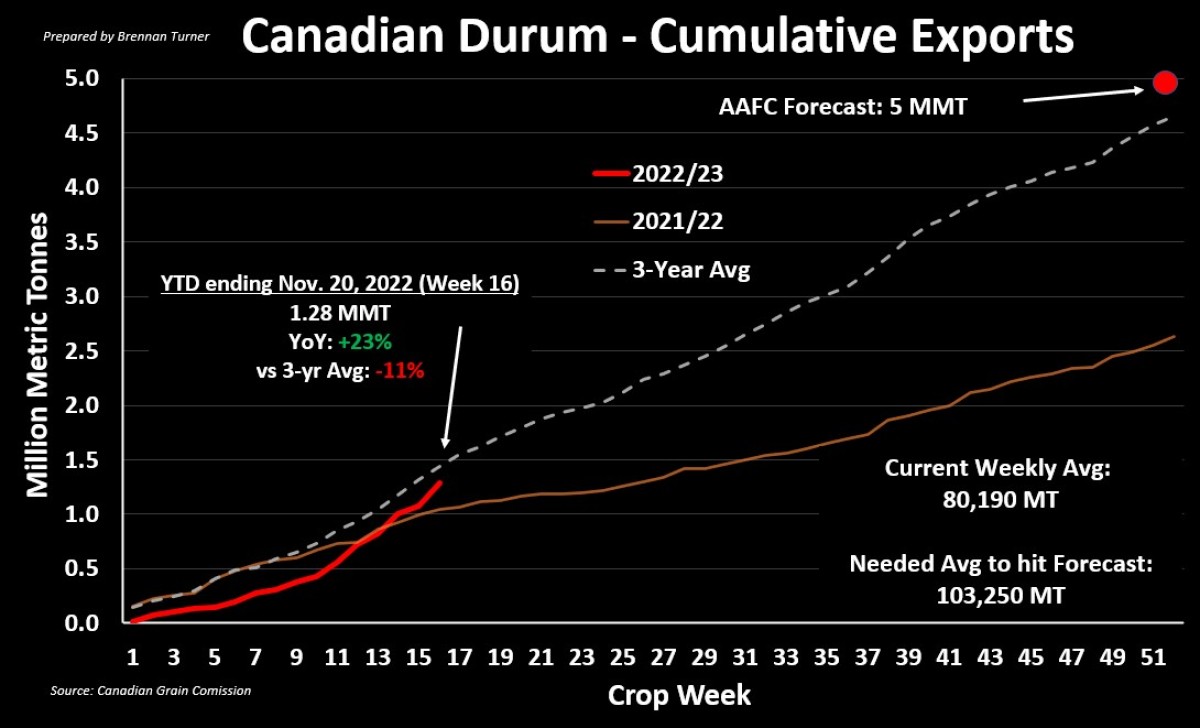

The same sort of demand function could theoretically be said for Canadian durum, as with a great harvest in terms of quality and solid rebound in production, the world is looking for this. Italy and North African nations continue to be big customers for Canadian durum, albeit we’ve had a bit of a slower start than what I’d like to see, with just under 1.3 MMT shipped out to date. We’ll need to pick up the weekly volume to meet Agriculture Canada’s target of 5 MMT, but as the chart below shows, we are starting to trend in the right direction with higher weekly averages than at the start of the year. Another feather in the cap for Canadian durum exports is that global demand is expected to increase yet again this year, up 2.4% to 33.6 MMT, suggesting durum prices will remain attractive.

Rounding things out, there is some expectation in the market that corn prices could turn weaker in the coming months, which could negatively impact feed wheat and barley prices. More than a few analysts are expecting the highs in corn prices to come over the winter, instead of the spring like we’ve seen the last few years as China is buying less corn, and South American and Ukrainian options are cheaper. AgResource noted last week that China imported 550,000 MT of corn in October, down 58% year-over-year, while barley and sorghum imports were down 74% and 34% from October 2021, respectively. This is likely a result of China allowing feed additives back into rations, like table scraps and restaurant waste, which at one point, topped 34 MMT a year (this practice was banned when African Swine Fever went through the Chinese hog industry).

Ultimately, as corn prices tend to lead the grain commodity complex, we might see some suppression in other commodity values, especially cereals, earlier than usually this crop year. This could be a result of, poor American exports (I’m looking at your record low levels, Mr. Mississippi River), and/or a bigger South American harvest that China opts to buy more of (rumours out of Brazil are that China will buy 5 MMT of Brazilian corn this year). With weaker demand, prices likely will fall a bit but the one caveat for corn is that this year’s EU harvest was a 15-year low, meaning their imports will be higher, which is probably the European Commission raised them by another 1 MMT to to 23 MMT. Therein, more musical chairs are expected at the international trade level, and with any disruptions, political or otherwise, risk premiums could quickly be added back into the market.

To growth,

Brennan Turner

Founder | Combyne Ag