Rain Driving the Grain Markets’ Bus

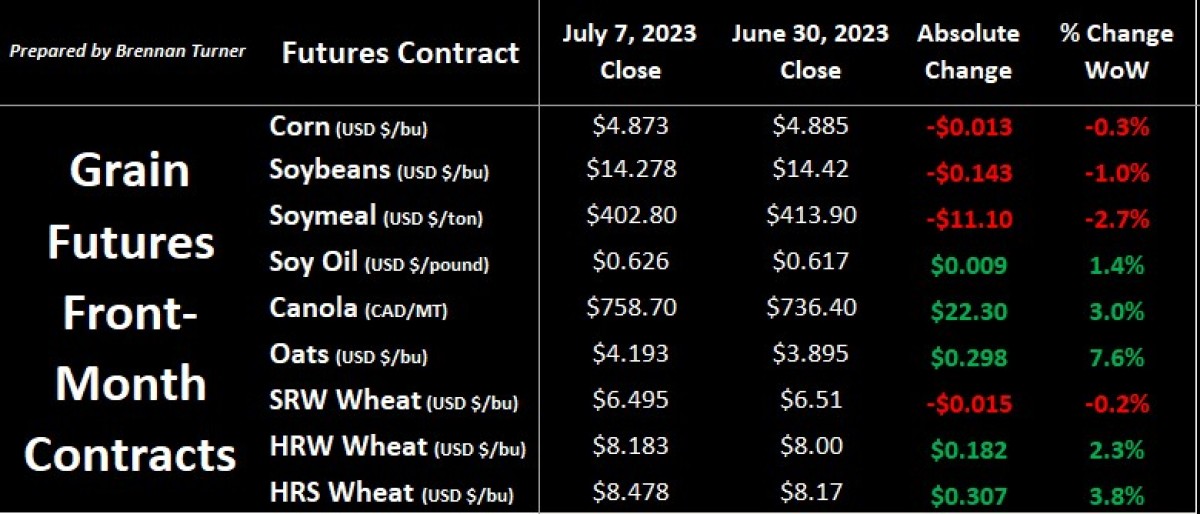

Grain markets traded mostly lower in a holiday-shortened trading week to start July, with Canadian crops and HRW wheat contracts being the main winners. These contracts were supported by, ironically, rains slowing down the wheat harvest in the U.S. Southern Plains (37 per cent complete last week, versus 52 per cent last year and the five-year average of 46 per cent) and dryness in Western Canada prompting production potential concerns. Corn and soybeans couldn’t build off any in-week rallies as mostly favourable weather forecasts, including rain, weighed on prices. Most eyes this week will be focused on this Wednesday’s July WASDE report as the next market-moving event.

The USDA usually doesn’t change much in the July WASDE, and so unless they move yields lower like the market knows they will in the August report, fundamental selling pressure may continue hang over the grain complex while weather is the main bullish variable. For wheat, there are not any major revisions expected either, and so the three wheat contracts will likely play follow-the-leader to corn and beans this week. Wheat contracts did get some fuel this past Wednesday from the bulls as there were rumours of increased military activity around in Ukraine. But the old adage of, “buy the rumour, sell the fact” rang true as most of the rally was given back by the end of the week.

Staying in the Black Sea, growing conditions have been largely favourable for the winter wheat crops, but harvest estimates range wide. In Russia, we’ve seen the Agriculture Ministry’s 78 MMT to private estimates closer to 87 MMT, while Ukraine’s wheat crop will likely land somewhere between 16 – 18 MMT. The bigger question mark for Ukraine’s crop will be movement though, as the European Union has banned Ukrainian wheat, corn, rapeseed, and sunflowers from getting imported by neighbouring countries like Bulgaria, Hungary, Poland, Romania, and Slovakia until Sept 15t This is on top of the reality that Russia is unlikely to renew the Black Sea Grain Deal next week, which I don’t think the market has fully priced in yet. Part of the reason for the lack of risk premium is the “Cry Wolf” nature of the past renewals, as wheat and corn prices rose in the weeks leading up to the last few agreement extension dates, just to see Russia capitulate, and thereafter, the risk premium erased.

Elsewhere, recent estimates from Argentina, where wheat seeding is slightly behind average with about 80 per cent of fields planted, suggest a wheat crop this year between 18 – 19 MMT. This is largely attributed to decent rains that have and should continue to fall. Back in Europe, the French wheat harvest is starting to pick up pace with 10 per cent in the bin, most of which is decent quality as over 80 per cent of the crop is in good-to-excellent (G/E) condition. Nearby in Italy, the crop also looks pretty good, especially durum, as Coceral believes the country will harvest over 4 MMT, which would be up 11 per cent year-over-year and one of the better crops in recent years. More broadly, Europe is likely to produce 7.1 MMT of durum (up 6 per cent year-over-year), which is good news to North African countries who will likely need to import a lot of durum again this year after another year of weak rains and below-average production.

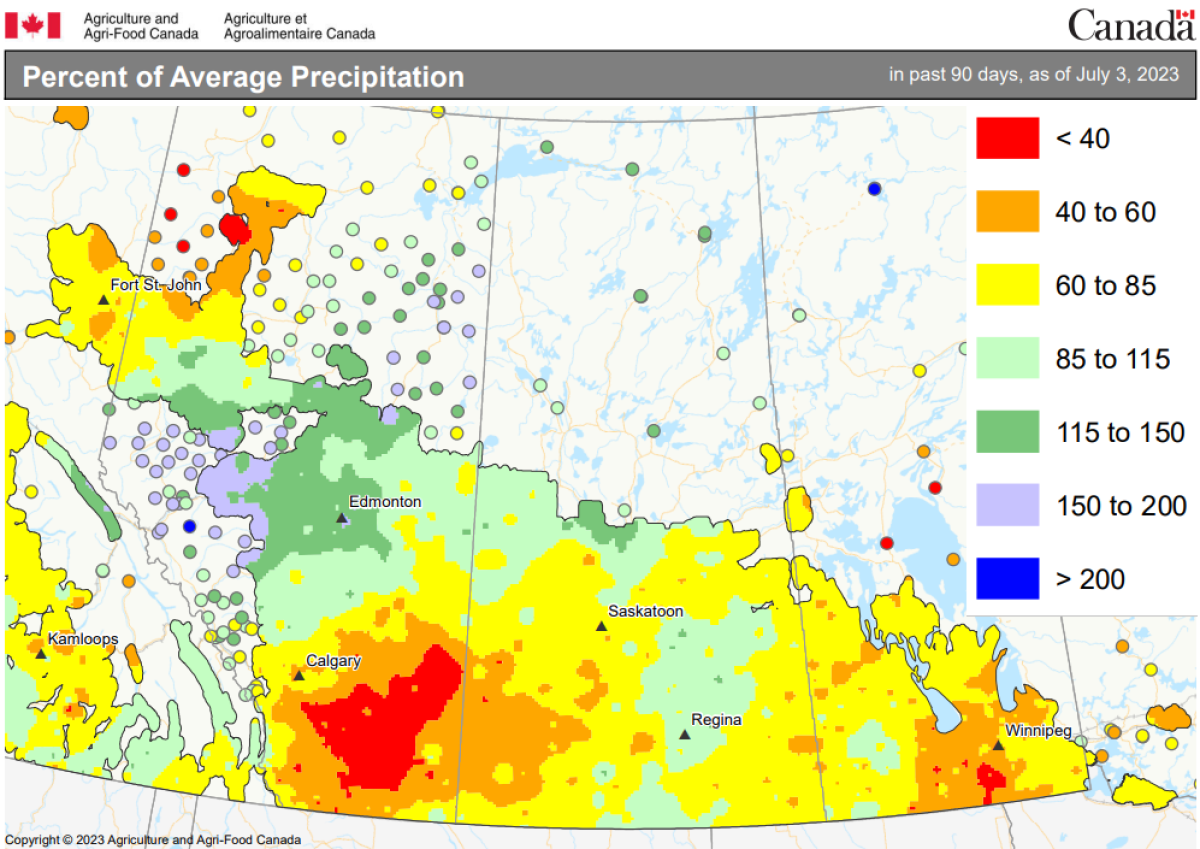

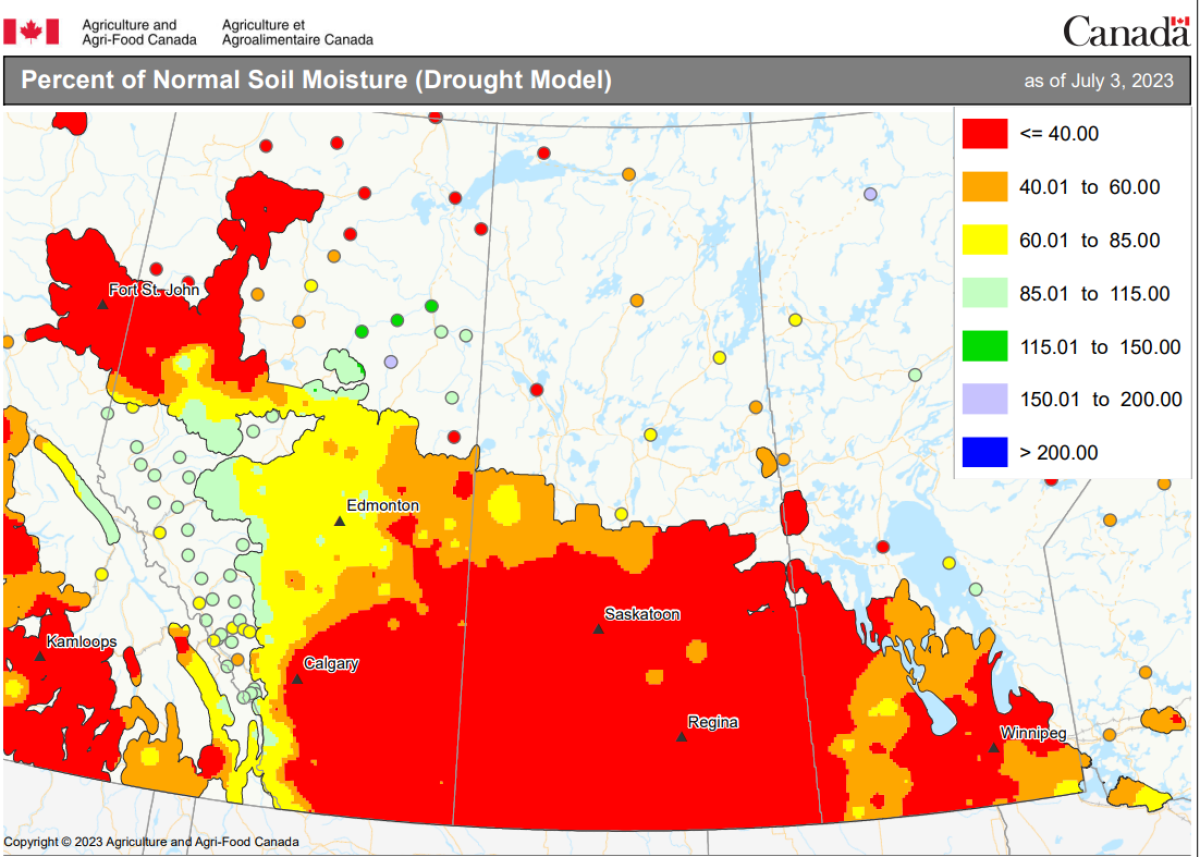

Obviously, Canadian durum should fill some of this demand, but yield concerns are mounting. Over the past 3 months, Western Canada has mostly received well-below-average precipitation, and as the below AAFC maps through July 3 show, this has a direct impact on soil moisture (NOTE: some healthy rains did fall in many parts of Western Canada last week or after July 3). West-central and southwestern Saskatchewan, as well as most of southern Alberta is now in a state of drought, and these are the regions where a lot of durum is produced. While Alberta’s crop reporting took a week off due to the Canada Day holiday, Saskatchewan’s crop report said that going into July, 44 per cent of the province’s durum fields were G/E, while 31 per cent was poor-to-very poor (P/VP). Compare this to the same time during the drought two years ago when 45 per cent of Saskatchewan’s durum crop was rated G/E and 18 per cent was considered to be P/VP. Spring wheat-wise, today, 70 per cent of Saskatchewan’s fields are in G/E shape, with just 9 per cent of the crop in P/VP condition.

What most meteorologists agree with is that this year’s transition from La Nina to El Nino has been pretty quick, and when that happens, moisture events are limited and temperatures stay elevated. Accordingly, most of July’s trading activity in grain markets should hinge on the weather, as a lot of focus remains on what U.S. corn and soybeans could produce. For example, with 17 out of the 18 top corn-growing states in America in a state of drought heading into July, there are lots of comparisons being made to 2012, when corn and soybean prices hit record highs in August and September, respectively. Rains last week certainly helped keep this bullish narrative at bay, as the percentage of U.S. corn and soybean fields in a state of drought each dropped three points week-over-year to 67 per cent and 60 per cent, respectively. However, should rains in July be limited, I’ll be watching for higher weekly closes to help determine if we’re going to rally 30 per cent - 40 per cent over the next three months, or if we’ll be 10 per cent lower by August.

To growth,

Brennan Turner

Independent Grain Markets Analyst