Rain Gives Farmers (and Bears) a Breather

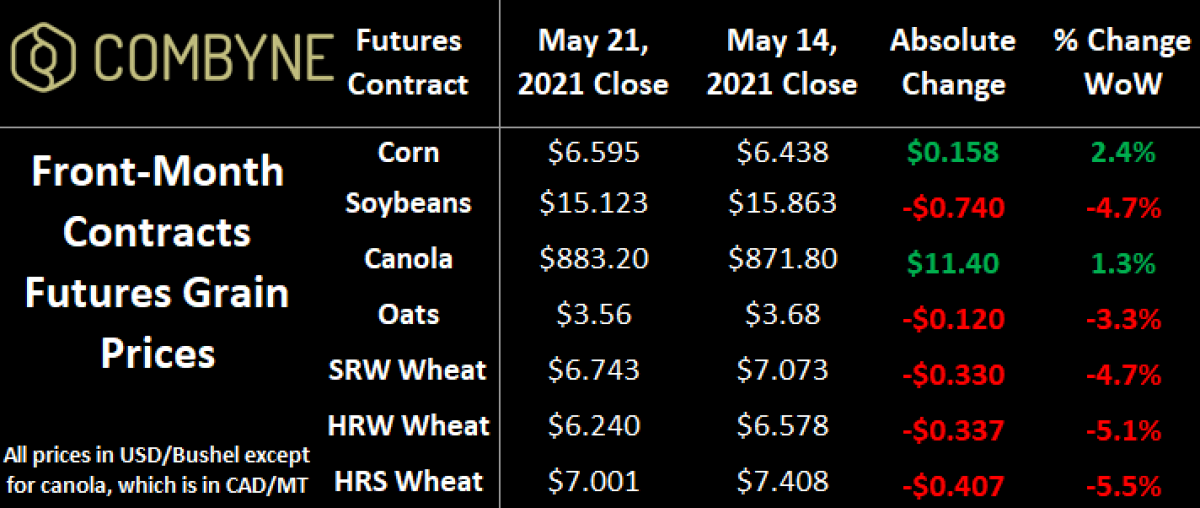

Grain markets continued their pullback on the futures board ahead of the Canadian long weekend as forecasted moisture events and managed money continuing to liquidate their positions, all pressured the market. Corn and canola bucked the trend on South American prospects and ongoing demand functions, respectively. Specifically for wheat markets though, most farmers and traders were looking for the rain and most received some moisture, which put pressure on both new AND old crop prices (the latter because, if the rain will ensure some level of new crop supplies, those old-crop supplies carrying over from one crop year to the next isn’t in as high demand as before the rains fell).

While most farmers in Western Canada and the U.S. Northern Plains have just finished up their Plant 2021 campaign (or will do so soon), farmers in the U.S. Southern Plains are getting their harvest equipment ready to take the winter wheat crop off there. In Kansas, the annual U.S. Wheat Quality Council tour took place last week, and despite the drought concerns, scouts estimated an average HRW wheat crop of 58.1 bu/ac, albeit with lower-than-average protein. Nonetheless, this would be a new record and well above the five-year average of 43.1 bu/ac, as well as much higher than the current USDA yield estimate for the Kansas wheat crop of 48 bu/ac!

Looking abroad, good weather is helping the EU’s wheat crop finish off nicely and updated production forecasts are reflecting that. In the bloc’s largest wheat-producing country, France, there were some concerns of below-freezing temperatures killing off a significant amount but it appears that losses will be minimal. Next door in Germany (the 2nd-largest wheat producer in the EU), the country’s main farm co-op, DRV, pegged their output at 22.7 MMT, about a 10% improvement from last year’s crop. Finally, French grain trade association, Coceral, increased its estimate of soft wheat (non-durum) production for all EU members to 130.9 MMT, up 12% from last year.

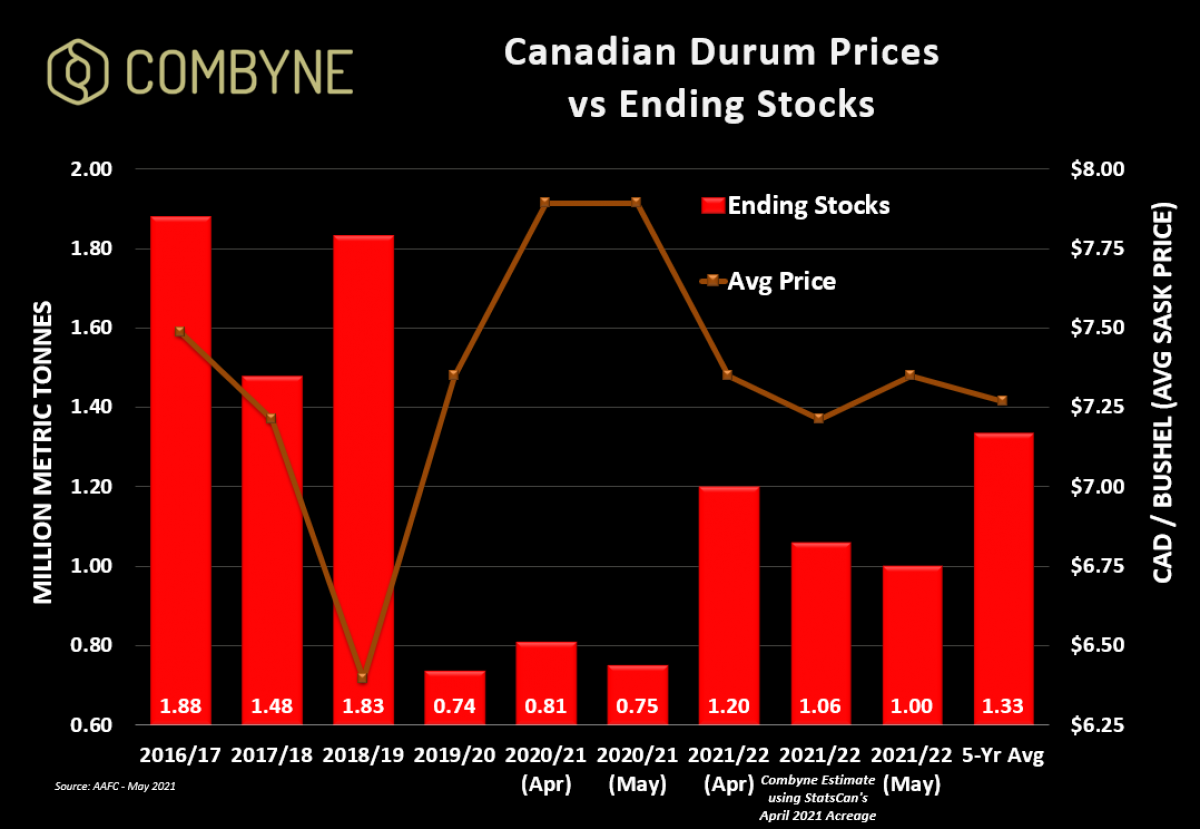

Coming home, it’s the opposite situation as Canadian wheat production is expected to fall, largely because of the decrease in planted acreage that I dove into in detail at the beginning of May. Last week, Agriculture Canada updated its own supply and demand tables, using StatsCan’s new acreage numbers, and while they acknowledge the smaller supply, AAFC suggests some tight carryout thanks to ongoing strong demand. Specifically for durum, 2020/21 ending stocks should fall to 750,000 MT, the 2nd-smallest carryout in the past decade, thanks to export and seed use both being increased. However, stronger competition in international markets in 2021/22 will reduce Canadian durum exports, pushing carryout back above 1 MMT.

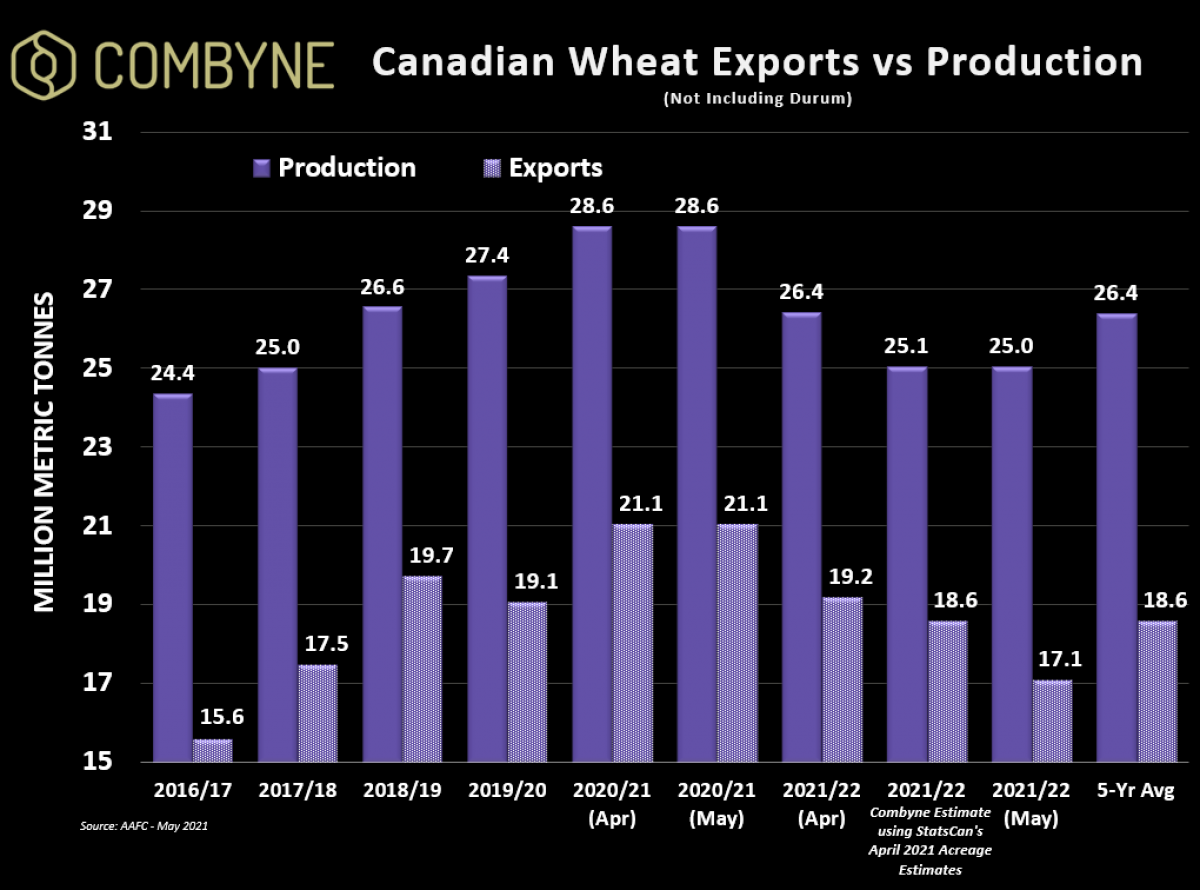

For non-durum wheat, AAFC is expecting a huge drop in 2021/22 exports. While 2020/21 is expected to finish with a record of nearly 21.1 MMT in out-of-country shipments, this upcoming crop year is estimated to only yield 17.1 MMT in exports, or a drop of 19% year-over-year and 1.5 MMT below the five-year average. Nonetheless, demand from the feed side of the balance sheet is expected to stay strong, which is why AAFC boosted their estimate of average prices by $35 CAD/MT in a single month to $275/MT (or $7.50/bu if converting metric tonnes to bushels). Therein, ending (non-durum) wheat stocks for the 2021/22 crop year are expected to land around the 4 MMT mark by AAFC.

Something to keep in mind that AAFC has also asterisked their estimates with the reality of, if rain doesn’t come, these demand numbers could drop even further. I’ll be digging into some different scenarios that could play out – including one with limited grain - this coming Thursday morning (May 27th), from 8 – 11 AM MST as the Alberta Wheat and Barley Commission is having a wheat and barley markets update call. I’ll be sharing my perspective on the milling wheat market, Chuck Penner from LeftField Commodity Research will be looking at the feed wheat and barley markets, while David Derwin of PI Financial will discuss trading and hedging strategies. Given the volatility and all the different happenings in today’s grain markets, hearing from some of these experts will certainly leave you better informed for the coming months.

To growth,

Brennan Turner

CEO | Combyne Ag