Rains Come with Bears, Not Bulls

The wheat complex was mixed moving through the middle of June as a slightly bullish monthly WASDE report was offset by a healthy amount of moisture falling over many dry areas across North America. Corn futures gained on a smaller crop in Brazil (lowered from 102 MMT to 98.5 MMT), as well as 150M bushels in new ethanol and export demand for American corn. However, there is lots of anticipation that the USDA will offset the increased demand by raising U.S. acreage numbers in their June 30th report. Nonetheless, U.S. ethanol production has climbed back above pre-pandemic levels and supported July 2021 corn futures actually topping out at $7.17 USD/bushel on Thursday. On the flipside, soybeans dropped as U.S. crush and soy oil exports were felled, which led to ending stocks being raised by 15M bushels, and this also contributed to higher global ending stocks.

Specific to U.S. wheat, exports, feed, and residual use were raised by a combined 30M bushels, which offset some production increases, but at 770M bushels, America’s 2021/22 wheat inventories are still 10% lower than 2020/21’s carryout. As a reminder, we won’t get a read on U.S. spring wheat and durum production estimates until the July WASDE report, but it’s worth mentioning that the dry situation in American spring wheat country have dropped good-to-excellent ratings below 40%, compared to 82% G/E at the same time a year ago. Bottom line: while the rain received this past week and weekend are appreciated, more will be needed.

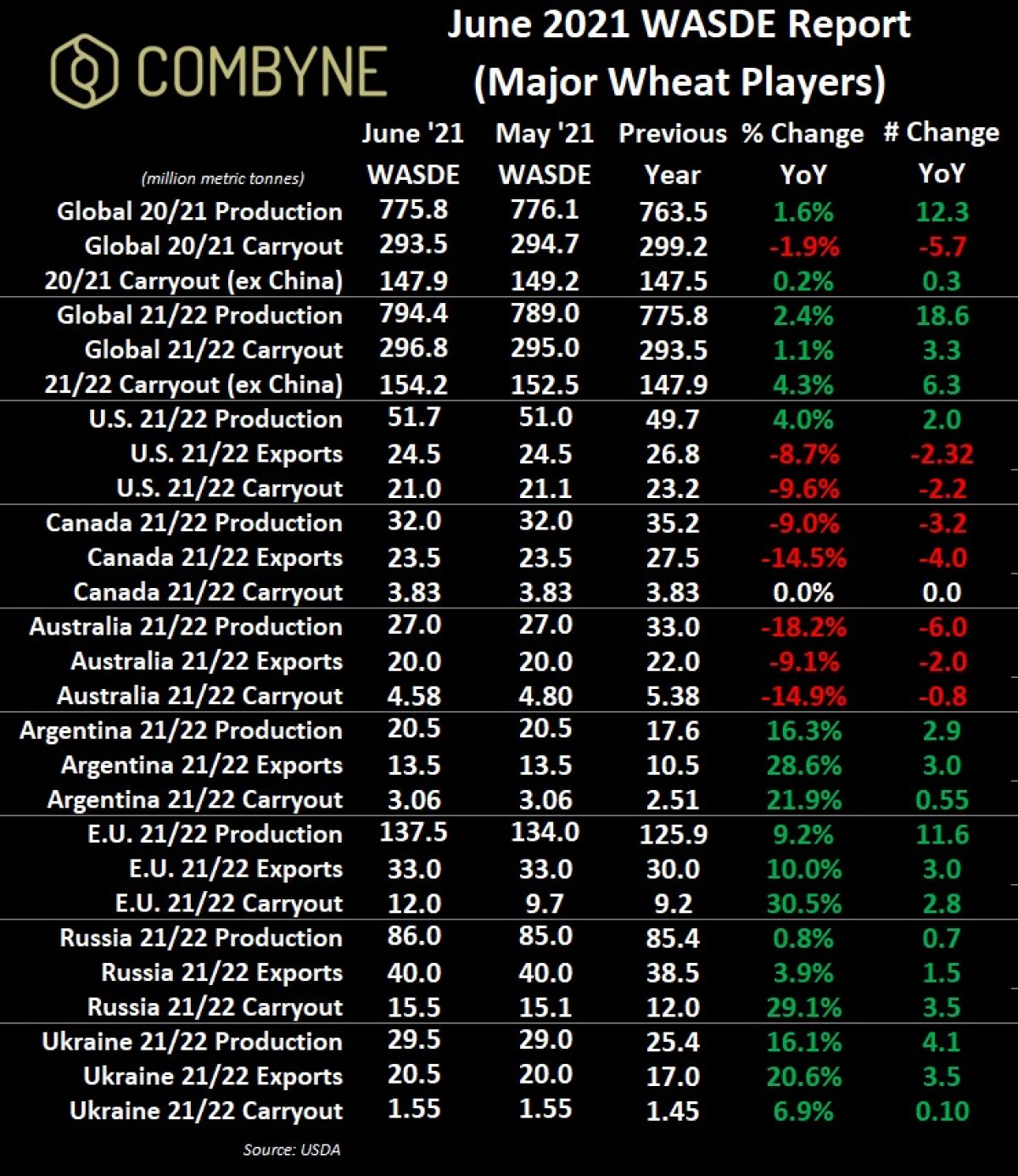

Globally, the market was expecting to see bigger crops out of Europe and the USDA delivered, raising their production number by 3.5 MMT to 137.5 MMT with the increase largely attributed to beneficial rains in Romania, France, and Germany. Meanwhile, Russian wheat output was raised by 1 MMT to 86 MMT, but private forecasts from the likes of SovEcon and IKAR suggest a harvest closer to 82 – 82.5 MMT. Ukraine’s production and exports were both also increased by 500,000 MT. Overall though, with record production AND record demand, worldwide 2021/22 ending stocks are also set to be a record of 794.4 MMT.

Speaking honestly, the June WASDE is usually a bit of a snore-fest anyways, as everyone already knows that whatever is printed in June usually changes by the July WASDE; this is largely because of the updated stocks and acreage report that the USDA puts out on June 30th (this year, that’s a Wednesday!). As you can tell from the table above, nothing was changed on the Canadian balance sheet, but again, we should expect some updates next month.

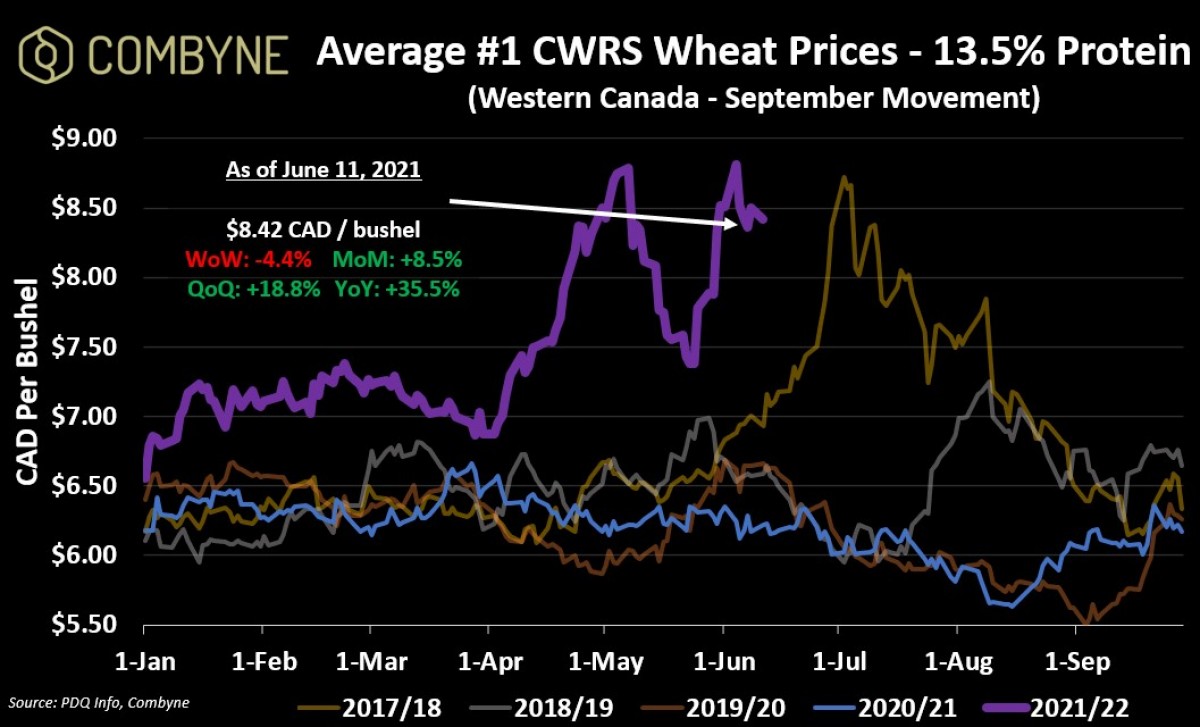

The more important takeaway though from this past week is the opportunities that weather volatility has presented us in the cash markets. As weather forecasts come and go, so do pricing opportunities. This is where a combination of using target pricing (such as Combyne’s multi-buyer Target Offer tool) and futures hedging can help not only capture the upside of the market, but also protect against any other moves on the futures boards. As you can tell from the chart below, we saw a healthy run-up in cash HRS wheat prices across Western Canada thru to the middle of May (largely thanks to demand and lower acreage estimates), and again into last week (largely attributed to weather).

Obviously, the devil is in the details as timing is the biggest question mark as to when to price things. My own personal approach is to gauge feedback from not only other farmers, but also grain buyers that I’m talking to and if the consensus is that everyone thinks it’s going to keep going up, the contrarian in me says the top must be close. Further, if there is rain in the 7 – 10 day forecast, the market will start to interpret that as bearish, and so again, an indication of pending downside risk. Now, these approaches largely apply to spring and summer markets so worth maybe bookmarking this post for next April to remind yourself of how to play your new crop pricing. Going forward though, I expect more rain to fall, and while there may be a jump here or there, I expect new crop wheat pricing to follow the downtrend we saw in 2017 (the gold line in the chart above) through to harvest time.

P.S. With new crop prices hovering around $8.50 - $9 CAD/bushel, these are some great opportunities to sell 5% or 10%, especially if you haven’t yet contracted anything. If you need any further consideration though, again, just look at the 2017/18 chart and how prices fell after the highs in the first week of July.

To growth,

Brennan Turner

CEO | Combyne Ag