Readying for Plant 2023 (and Sales?)

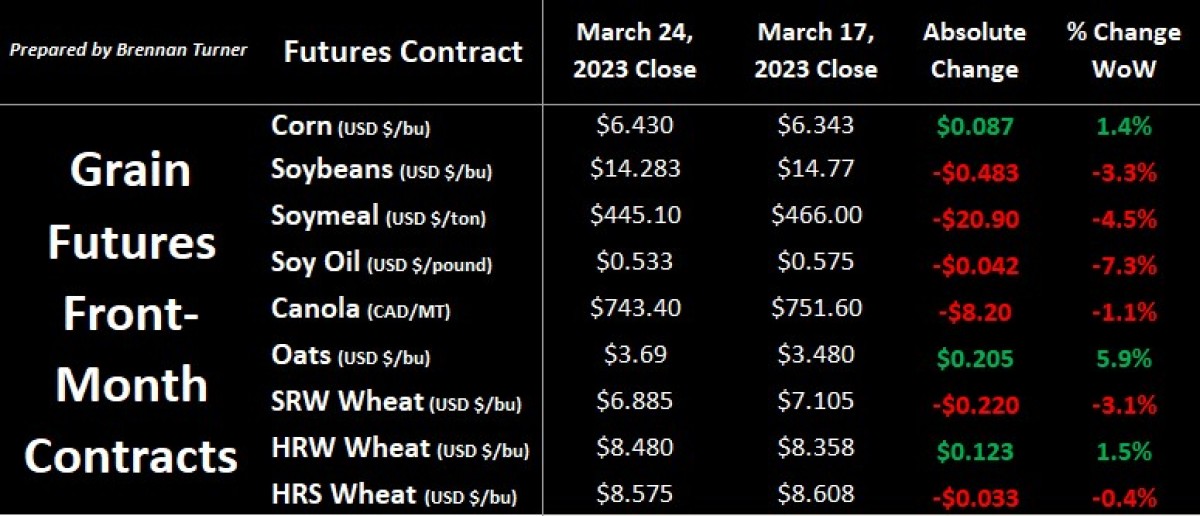

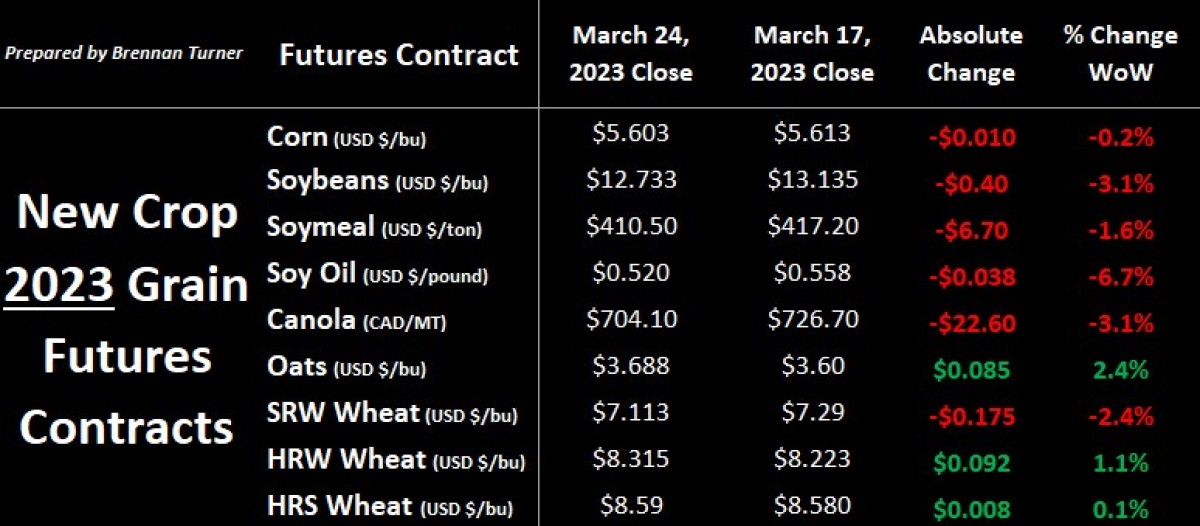

Grain markets were mostly lower in the third week of March trading, before a bit of a short-covering rally on Friday helped corn and wheat futures pare their losses. Corn found some buying interest based on China buying another 641,000 MT of U.S. corn this week, the highest weekly total from the People’s Republic since May 2021. It also took their total purchases since mid-March to 2.5 MMT (or 100.3M bushels). Soybeans cratered a bit on the re-acceleration of the record Brazilian harvest and the start of their export campaign. Meanwhile, wheat was all over the place on lingering drought conditions in the U.S. HRW wheat belt and Russia threatening to halt further wheat and sunflower exports. On top of this, the U.S. Federal Reserve raised U.S. interest rates by 25 basis points (or 0.25%) for the 9th straight meeting, bringing the federal funds rate to its highest level since September 2007! As we head into the last week of March (and the Q1 calendar quarter), one of the biggest market-moving reports will be printed by the UDSA on Friday: Plant 2023 U.S. acreage estimates.

Leaning into Russia first, just days removed from signing off on a 60-day extension to the Grain Corridor Deal in the Black Sea, the Kremlin was supposedly meeting with ag industry stakeholders to discuss an export ban, but then later decided that the export tax for wheat would instead be raised to $70 USD/MT (or nearly $100 CAD/MT or $2.61 CAD/bushel). This pushed wheat futures higher but many wheat market players believes it’s just smoke and mirrors, as Russia has already been selling and exporting a lot before the recent price regression. As such, there is many traders in the camp who believe Russia is just pressing pause to help raise global wheat prices to more attractive levels for exports.

Supporting the short-covering rally was market sentiment that, in next week’s first official USDA crop progress report, the quality of the U.S. winter wheat crop isn’t going to magically improve from what the state-level weekly reports have been suggesting. Last week, good-to-excellent (G/E) ratings were at 19% in Kansas, 23% in Texas, and 29% in Oklahoma. In Kansas alone, 50% of the winter wheat crop is considered poor-to-very poor and last week’s drought monitor showed over half the state is in either a state of exceptional or extreme drought. Therein, most agronomists agree that, in this half of the state, even with decent April showers, the impact of the dry conditions will continue to be felt. Therein, as the Mother Nature pendulum swings from La Nina back towards El Nino, Nutrien’s Eric Snodgrass believes that even if She gets stuck in between the two, this is would still be a net-positive as “spring rains can undo all of winter’s sins.”

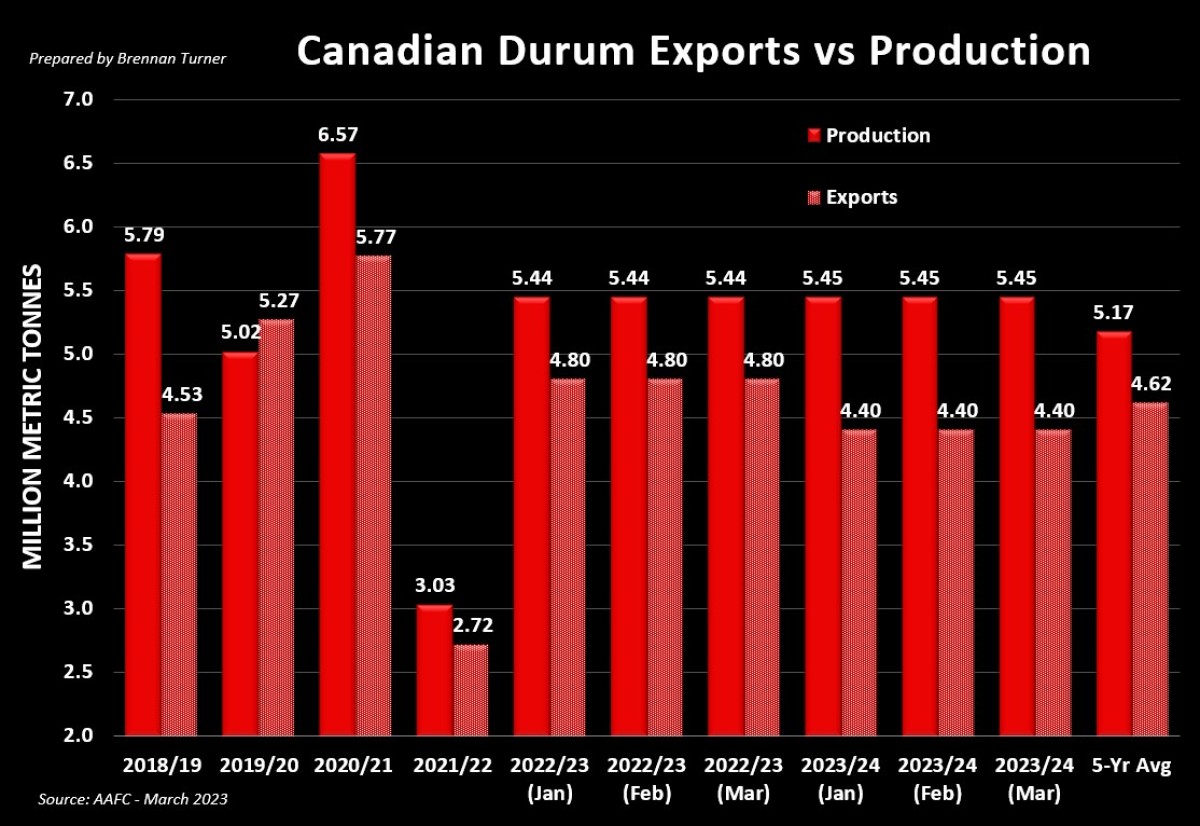

Moving across the border, there are definitely some dry pockets in the southern Canadian Prairies, but indeed, a good spring shower can be much more helpful than a big winter storm. We won’t get Statistic Canada’s first estimate of Plant 2023 until their report on Wednesday, April 26th, but Agriculture Canada has been saying for a few months now that they expect planted durum acres to fall by nearly 6%, or 334,000 acres to 5.67M. As the chart below shows, Canadian durum exports are also expected to pull back a bit next year on increased competition from Europe, given conditions remain favourable and they’re expected to produce 8 MMT, up from last year’s 7.1 MMT haul. Even durum harvests in North Africa are expected to rebound marginally to 3.5 - 4 MMT, but low global inventories are expected to keep prices elevated near current levels. After all, global supplies as of durum the current 2022/23 are forecasted at 5.9 MMT, the lowest in 15 years.

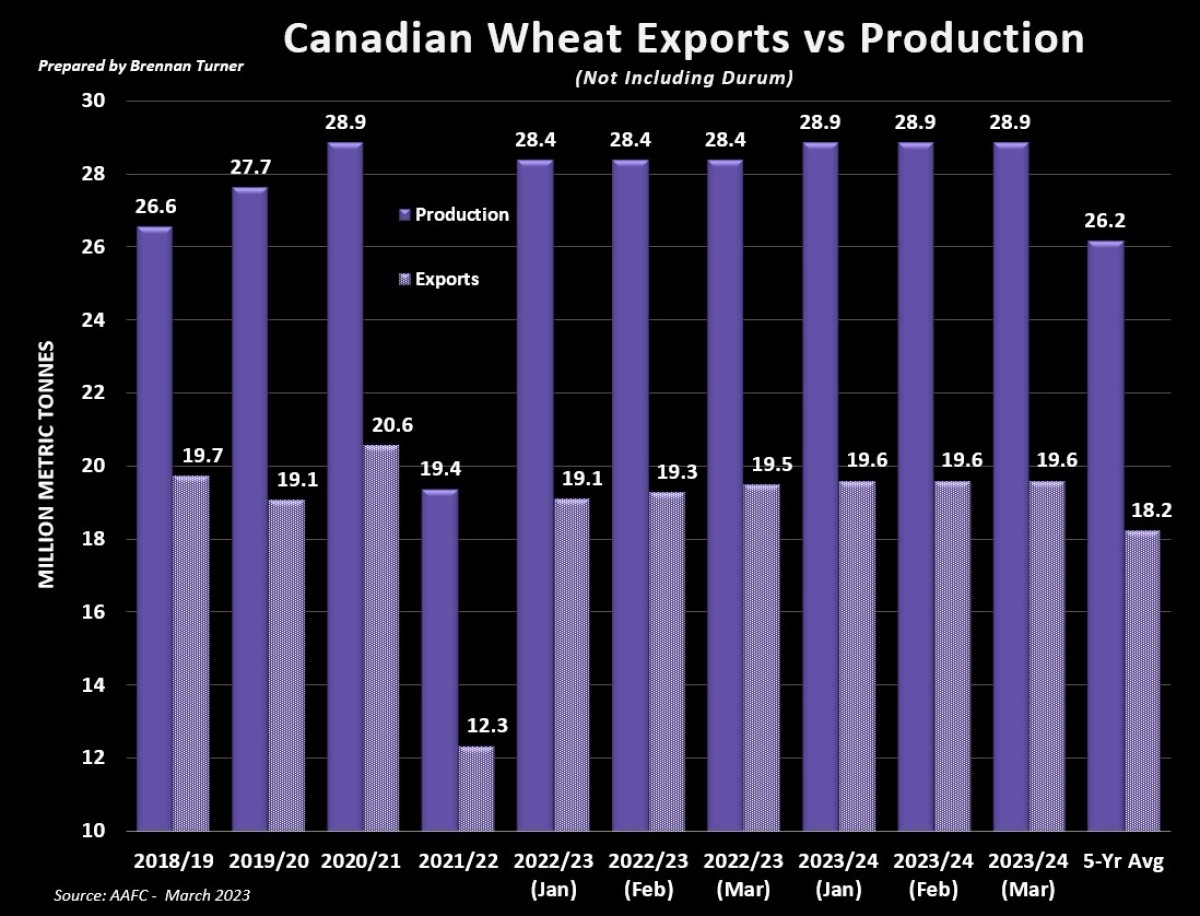

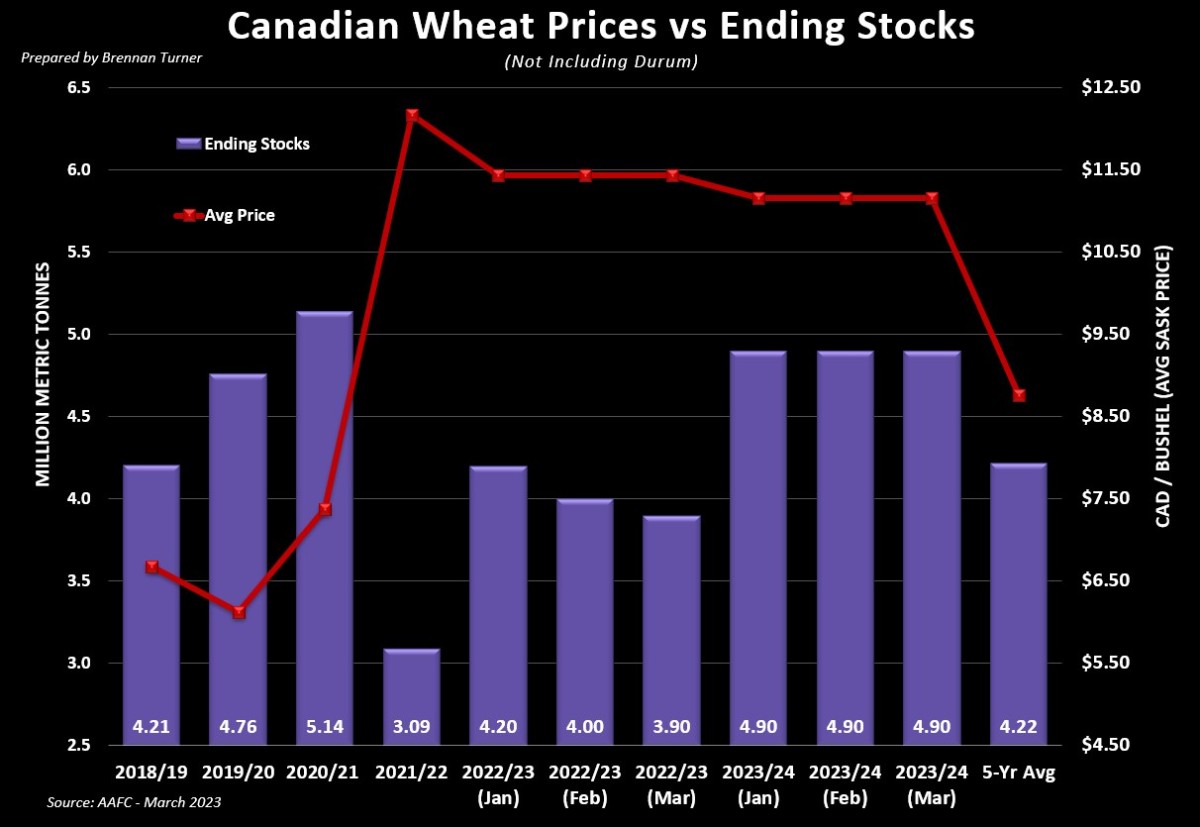

Non-durum wheat acres (including winter wheat remaining) are being forecasted to climb by over 4% from Plant 2022, or nearly 800,000, to almost 20.2M. If that level of area is realized, it would be the largest (non-durum) wheat seeding campaign in Canada since 2013/14’s 21.3M. Accordingly, combined with Black Sea export and U.S. drought issues, Agriculture Canada remains very optimistic that Canadian non-durum wheat exports will remain strong in 2023/24. This would be a continuation of the current strong pace of exports, with Ag Canada raising their forecast by another 100,000 MT this month to 19.5 MMT. For those counting at home, this would make it the 7th straight monthly increase in non-durum wheat exports by AAFC since the start of the marketing year!

Overall, as we head into April, this is usually a turning point in grain price direction, with any spring-time rallies jumpstarted by catalysts provided in the March 31st Acreage Report from the USDA. That said, considering some of the American and European banking concerns, there’s certainly some negative lingering sentiment that the U.S., and most likely, the global economy is headed for a recession. This usually translates into weaker commodity demand as you can’t expect demand to stay elevated, let along grow, when you print oodles of money, reduce purchasing power of consumers and nation-sates, then raise interest rates and again, reduce purchasing power further. Thus, unless you’re hell-bent on hoping for 2022 prices in 2023, a simple risk equation to keep in the back of your mind amidst the higher interest rate environment is your cost of storage. The simplest way to calculate the cost this is to:

1. Take your cash price (i.e. $10 / bushel wheat),

2. Divide it by 12 months (interest is measured annually), and

3. Multiply it by said interest rate (i.e. 6% or 0.06 on your calculator)

In this example, the cost of storage is 5¢ per bushel per month to store wheat in your bin, relative to what you could’ve possibly made in the bank with the cash from selling it today. So, if you’re willing to wait 4 more months to move something, using this example, the price needs to be at least 20¢ / bushel better than today’s price to a least break even on your storage costs.

To growth,

Brennan Turner

Independent Grain Market Analyst