Re-testing Trade Waters

Grain markets were mixed through the third week of October as demand and geopolitical issues seem to be enough to offset an accelerating U.S. corn and soybean harvest, as well as the planting campaign in Brazil. While we’re a month out from the Ukrainian “Grain Corridor” deal’s renewal date, political talking heads from both Russia and Ukraine continue to trade barbs, most recently the latter’s leader, President Volodymyr Zelenskiy accusing the former of intentionally delaying 150 ships from either getting loaded or passing through the Black Sea. Conversely, Russia’s UN ambassador says their concerns over grain movement (namely its destinations) and other matters aren’t being addressed, so why sign any renewal! All this suggests some greater trade risk might be moving into grain markets, namely that for corn and wheat.

However, one of the issues for both crops is that the U.S. market isn’t as competitive, namely because of the strong dollar, but also the Mississippi River’s depths are sitting at record low levels. Quite literally, barges are waiting their turn to not just move through the Mississippi and its connected waterways like the Ohio and Illinois Rivers, but they also are loaded with less grain so as not to sit too low in the water (and run aground). Therein, through last week, total U.S. corn export commitments of 13.8 MMT are the lowest in 3 years, and just 25% of the total crop year total, whereas normally, for this time of year, 37% of the total year volume has been contracted. For U.S. wheat exports, usually about 60% of the crop year’s total is sold by now, but just 54%, or 11.4 MMT, has been contracted, the slowest start since the government started tracking this data, back in 1990!

The good news is that the Midwest is expected to get some good rain this week, helping replenish some low water levels and soil moisture in parched areas. On the other side of the equator though, Brazil’s second-largest wheat-producing state, Parana, has been getting inundated with too much rain, and there’s more in the forecast! This is relevant because this is happening in the middle of their wheat harvest, so the quality is likely to be subpar with about half the crop still out. Top-producing state, Rio Grand du Sul may make up for some of these quality issues (acres were up 15% year-over-year), but it looks like Brazil will have to import more wheat.

Usually, Brazil imports most of its wheat from Argentina, but production estimates there also seem to be worsening. While the USDA lowered their forecast by 1.5 MMT to 17 MMT in their October WASDE report, local firms are now estimating a total wheat harvest that’s closer to 15 – 16 MMT. This is because of a lingering La Nina, leading to dry conditions in Argentina. As previously mentioned, the same La Nina is impacting Australia, but with heavy rains, prompting a state of emergency to be called in both New South Wales and Victoria due to flooding. As previously mentioned in this column, these areas are regions of the Land Down Under that both produce higher-quality wheat which competes with Canadian exports.

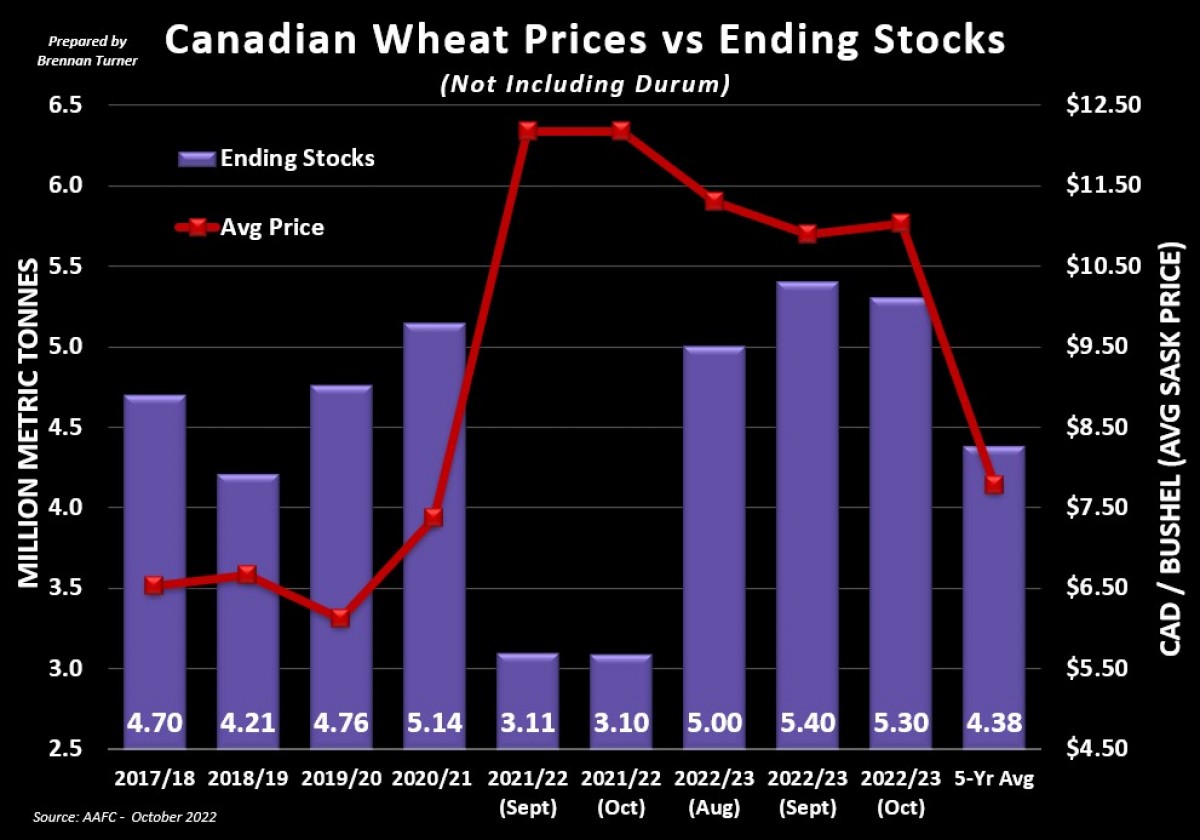

In perfect timing, last week we got Agriculture Canada’s updated supply and demand tables, but none of this quantity OR quality production shortfalls in other parts of the globe were accounted for (yet). While AAFC did increase non-durum Canadian wheat exports by 100,000 MT to now sit at 18.3 MMT, based on the size and quality of this year’s crop, and the quality issues elsewhere, this number might creep towards 19 MMT over the next few months. This sort of demand function would also be helped by the aforementioned strong U.S. Dollar, especially since average protein of this year’s no-durum Canadian wheat crop is pegged at 14.1%, well above the 13.5% average. Therein, prices should stay elevated, and ending stocks may pull back a little.

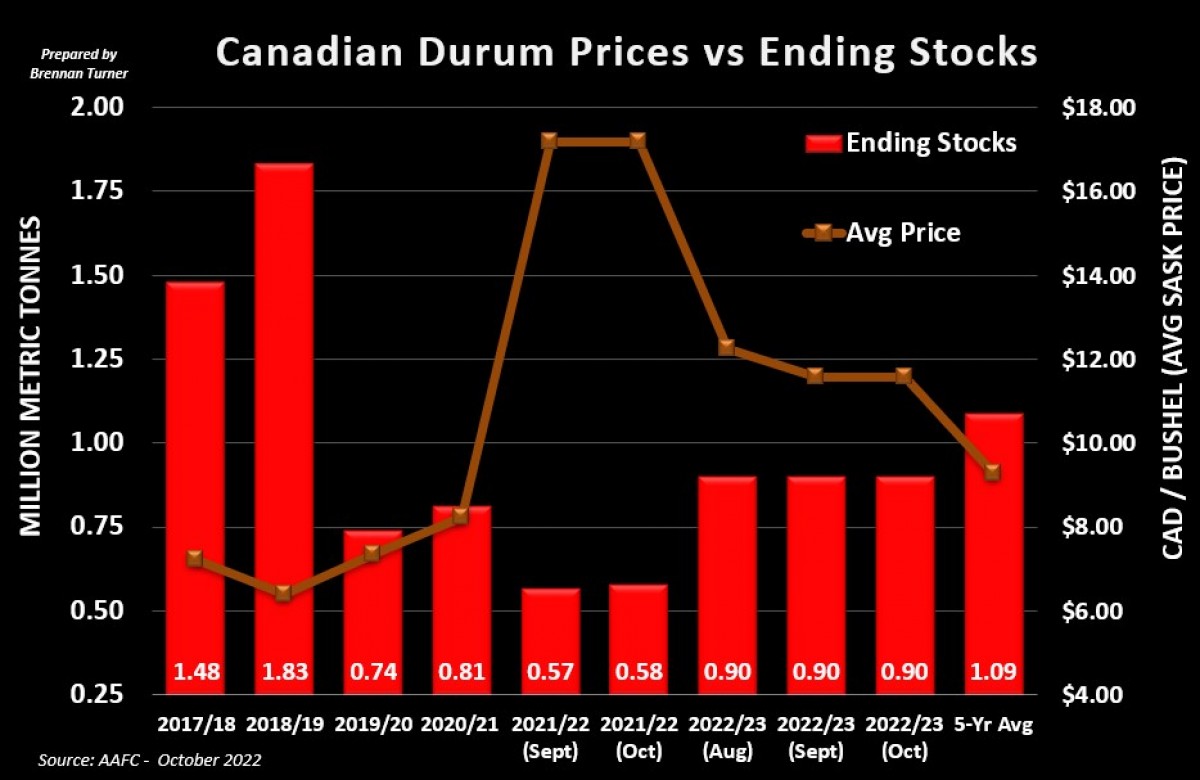

As for durum’s balance sheet, nothing was changed but AAFC did note that protein content is averaging 14.5%, which is slightly below last year, but still above the five-year average. Globally, durum production is estimated at 33.2 MMT, but usage is expected to grow 3% year-over-year to 33.8 MMT, thanks to stronger North American consumption. As a result of this, and greater imports by Europe and North Africa, namely drought-riddled Morocco, worldwide global durum inventories are expected to fall 10% year-over-year to 5.8 MMT by the end of the 2022/23 crop year, the lowest since 2007. With the U.S. durum harvest slightly smaller than initially expected, but still with good quality, the balance sheet for both sides of the border will likely remain tight.

To growth,

Brennan Turner

Founder | Combyne Ag