Risk Premiums Fade (But Not Gone)

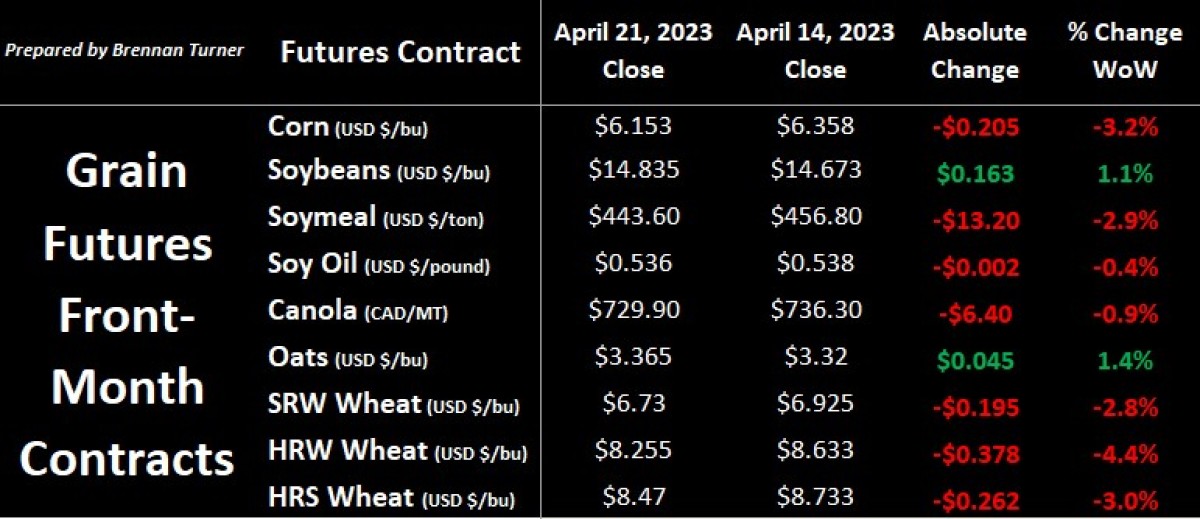

Grain markets saw a sell-off in the second half of last week as, weak U.S. export sales (read: overpriced U.S. grain), the rollover of contracts to July, and the expiry of May options helped fuel a technical sell-off. Further, Ukrainian grain ships started getting inspected again on Wednesday last week, easing traders’ fears of a stoppage to grain shipping activity in the Black Sea. Despite forecasts for colder temperatures for most of this coming week for the U.S. Plains and Midwest, the profit-taking couldn’t be ignored, albeit better moisture in these areas also forecasted isn’t exactly bullish anyways! There’s also been more buzz lately that traders are instead factoring the farmer’s ability to take off a decent crop, regardless of when the planting gets done, with most pointing to last year’s late spring as the case study. While I’m cognizant of my own recency bias, there’s certainly some merit to the reality that, if the window opens, farmers will go hard to get the crop in.

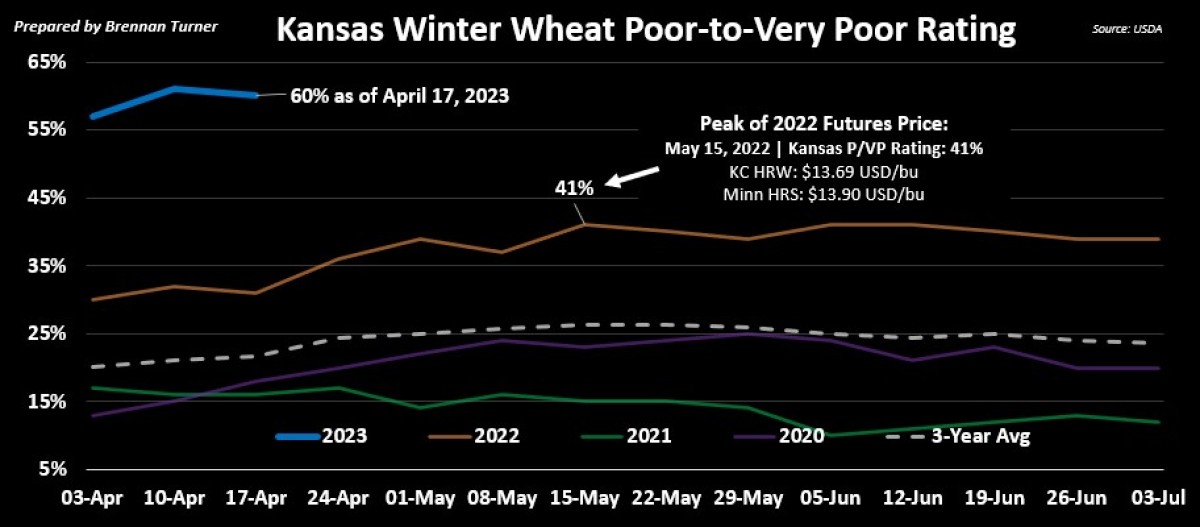

Arguably, the markets have been pricing in the threat of a late start to Plant 2023 since the beginning of April, as well as some frosty weather in the U.S. Southern Plains HRW wheat belt, but those premiums were essentially taken off the board last week. Part of the reason might be that most of the wheat in states north of Kansas isn’t far enough out of winter dormancy to be impacted by cooler temperatures. That said, in last week’s USDA crop progress report, the portion of the U.S. winter wheat crop rated good-to-excellent (G/E) was unchanged week-over-week at 27%, highlighted by South Dakota’s G/E number dropping by 13 points in one week to 16%. Therein, more markets’ talking heads have suggested that this week put wheat into oversold territory, and that any response to a bullish event would be quick and heavy.

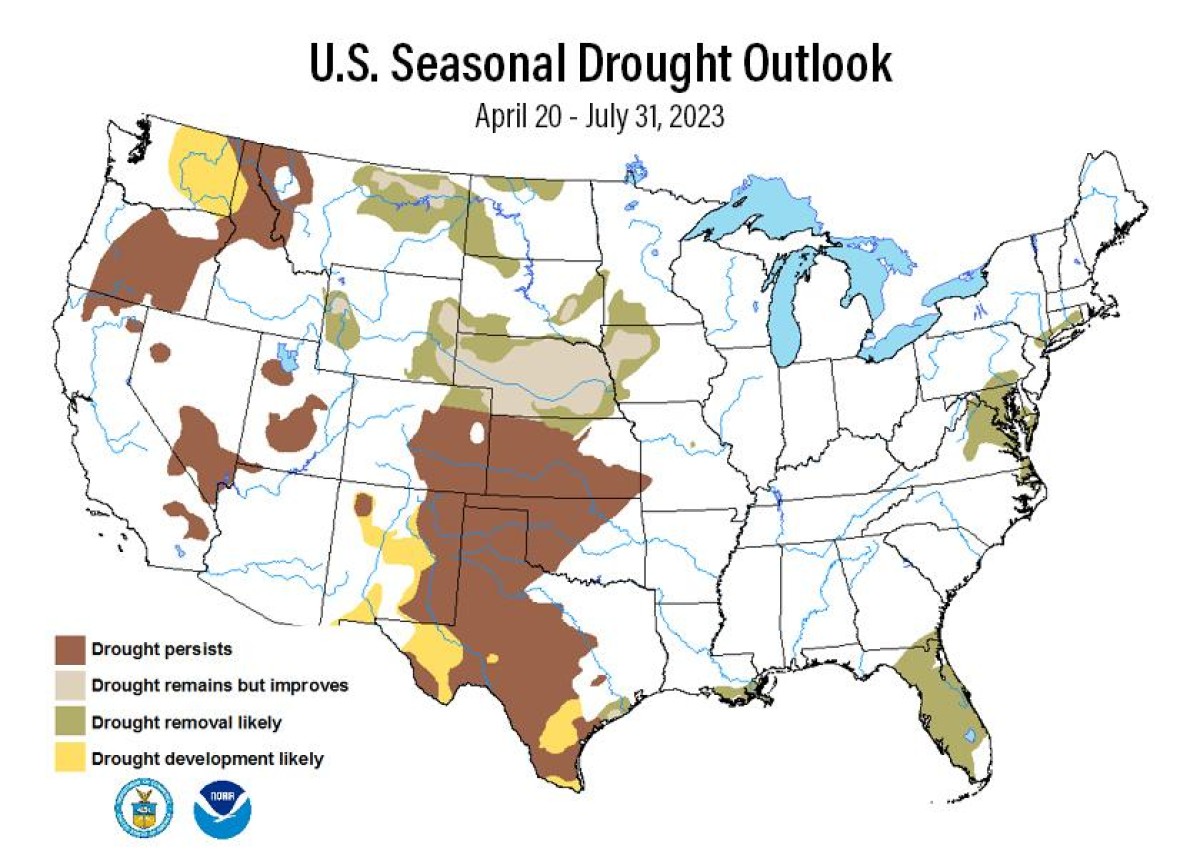

As shown above, as we enter the last week of April, and 60% of the Kansas winter wheat crop rated Poor-to-Very Poor (P/VP), it’s starting to be too late for any thirsty fields to be revitalized by spring rains. Combined with 2022/23 old crop U.S. HRW wheat stocks being relatively tight, the market is eventually going to have to reconcile the yield potential of wheat, but the timing now is the big question. My guesstimate is that winter wheat production risk premiums will start to build back into the market over the next two weeks, depending if moisture events show up or not. As it stands right now, the level of drought in the U.S. Southern Plains (Kansas, Oklahoma, Colorado, and Texas) is rivalling that 2012, 2011, the 1950s, and even the Dirty 30s, in terms of the doggedness of this now three year drought in the region.

Late last week, the NOAA suggested that Mother Nature’s pendulum swing from La Nina to El Nino isn’t happening as quickly as initially thought, meaning any drought-busting spring rains for the American Southern Plains are less likely (and as evidenced by their drought outlook above). Moving forward, the long-term outlook suggests more rain from late-summer into the winter for the region, but obviously by then, it would only help the 2024/25 crop which will get planted in the fall. Looking elsewhere, more analysts are stampeding around on how the Australian Bureau of Meteorology is forecasting below-average rains for most of Australia over the next four months, but again, I’m reminded of the last three years of ample moisture (and bin-busting harvests) so I don’t think this is much of a factor today.

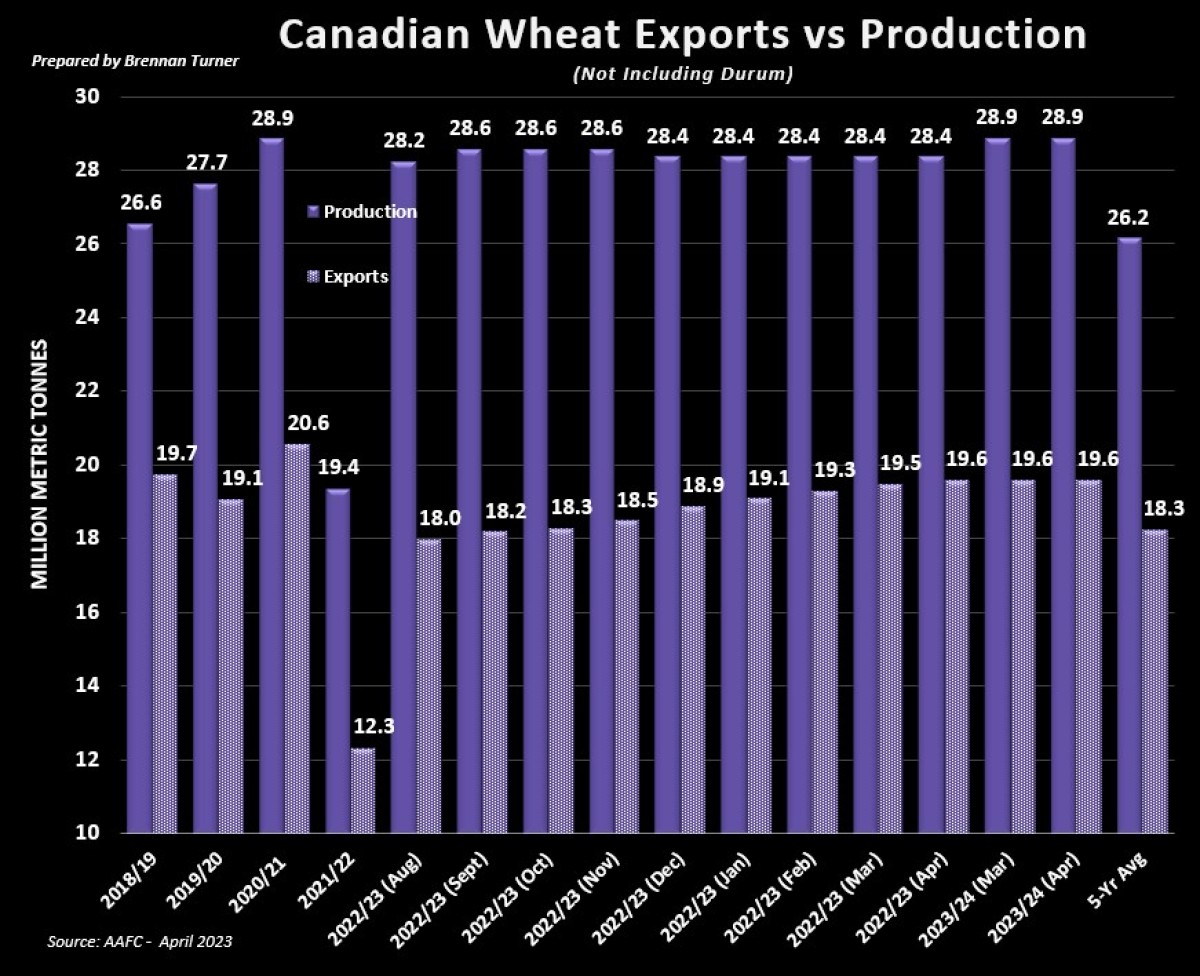

Here at home in Canada, the milder spring weather brought much of the Canadian Prairies some snow last week, which surely delays seeding activities by 5 – 10 days, depending where you are. Will that change any seeding plans? I doubt it and that’s why I will take whatever Statistics Canada publishes on Wednesday at 7:30 a.m. CST in their 2023 Acreage Estimates mostly at face value. Currently, Agriculture Canada is forecasting 5.67M acres of durum to get planted (-5.6% or -334,000 acres year-over-year), with 20.17M acres of non-durum wheat also going in (+4.1% or +788,000 year-over-year). Historically-speaking though, Statistics Canada’s April estimate for durum acres tends to be a bit bigger than AAFC’s, while non-durum wheat is usually a bit lower.

Accordingly, AAFC noted last week in their monthly update the continued strong pace of both Canadian durum and non-durum wheat exports, raised their outlook for the latter for the eighth straight month to now sit at 19.6 MMT for the year (as shown below). Nothing was changed on the durum balance sheet, but the International Grains Council did note that higher trade will put global 2022/23 ending stocks at 5.9 MMT, with major exporters (including Canada) owning just 2.4 MMT of that, their smallest inventory number since 2007/08. While global durum production should increase at bit in 2023/24, the IGC also notes that trade should remain robust and 2023/24 durum socks should fall even further to 5.3 MMT.

Overall, there seems to be air of “wait and see” in grain markets as, thanks to the last few years, it knows the capabilities of farmers to get the entire crop planted, if they can get into the field. From a macroeconomic lens though, the reality is that U.S. wheat is still about $2 USD/bushel more expensive than Black Sea wheat and so downward pressure on futures values will certainly trickle into cash markets. Ironically, as much as they talk about it not getting moved, Russia will reach a new record in 2022/23 for their wheat exports, while Ukraine will likely export somewhere around 11 MMT (while still a ~30% drop year-over-year, it’s still impressive). Certainly, the geopolitical risk in the Black Sea remains, with grain market tensions likely increasing the closer we get to mid-May. By then, we’ll also have seen how Mother Nature performs everywhere from the Southern Plains up to Canada, and if production premiums need to be added back in (I believe they will).

To growth,

Brennan Turner

Independent Grain Market Analyst