Rolling With the Weather Markets

Grain markets ended last week firmly in the red, but it could’ve been a lot worse had it not been for a sharp rebound on Friday from the sell-off we saw on Thursday. While strong demand continues to provide an underlying positive foundation, the weather is now firmly in the driver’s seat for market direction, namely because drought concerns are being weighed against forecasts of rain (including this past weekend). That wetter outlook mostly was the cause of the complex trading lower on Thursday, but it’s very clear that there are still a lot of dry areas.

In the Southern Plains, record temperatures are helping speed up harvest progress, as well as getting those crops not yet ready for a combine closer to the finish line. It’s the opposite situation in the Northern Plains though, where almost 90% of the American spring wheat crop is now experiencing some level of drought. Therein, last week’s USDA crop progress report suggested that just 41% of the country’s spring wheat crop is in good-to-excellent (G/E) shape, while 27% is considered to be poor-to-very poor (P/VP). While recent rains and further moisture in the forecast will certainly be appreciated, there is also concern about some very hot temperatures minimizing the impact of any rainfall events.

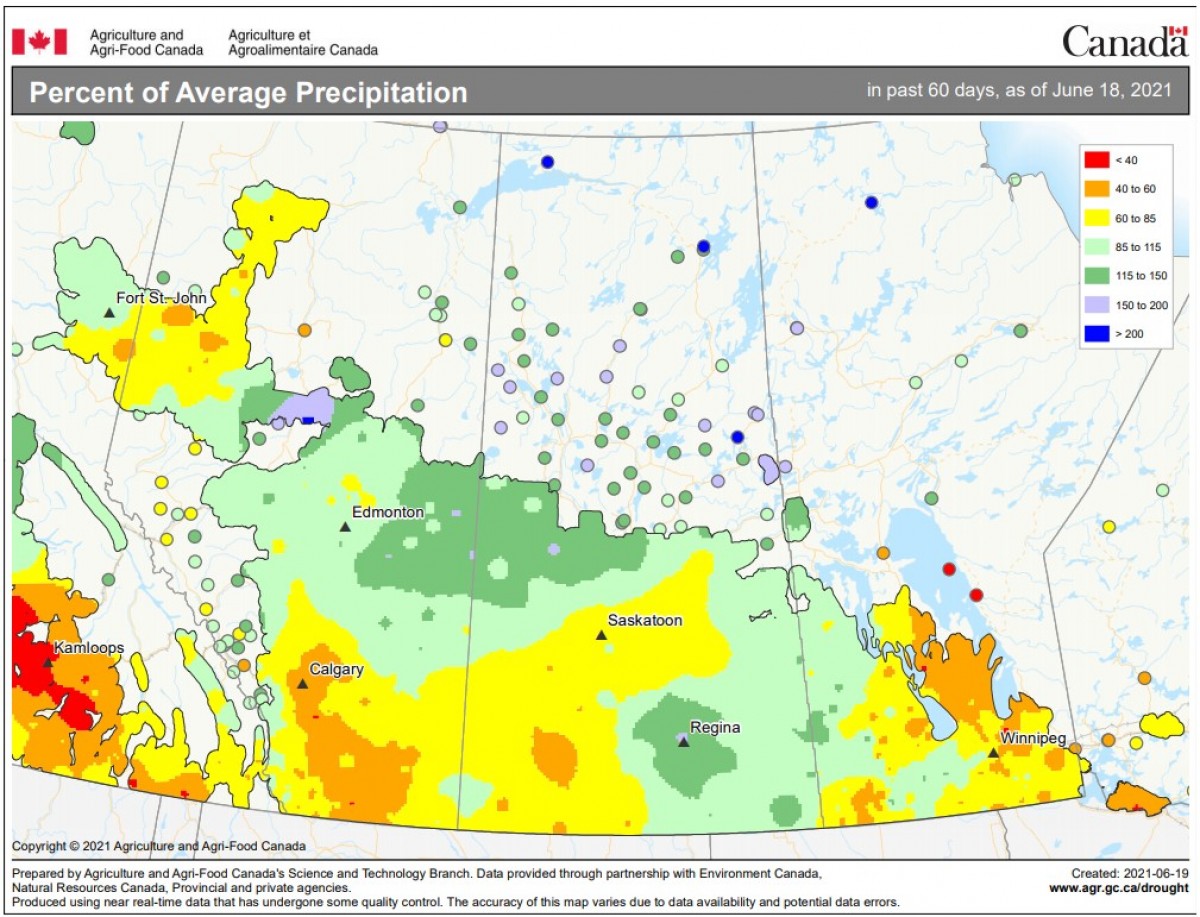

On the other side of the 49th parallel, the most significant drought concerns are in Manitoba and southern Saskatchewan. Worth noting is that both of these regions received significant rainfall this week albeit it wasn’t consistent across the whole region, meaning dry pockets certainly remain. Windy conditions have also prevented many farmers from getting in front of the emerging disease and insect pressure, which are accelerating thanks to the recent moisture but also very warm temperatures. The map below shows a lot of areas well below their average precipitation over the last 2 months, and so (Captain Obvious warning) it’s clear that more moisture will be needed to help the crop throughout the rest of the growing season.

Nonetheless, with the rain in mind, 77% of Saskatchewan’s spring wheat crop is considered to be in G/E condition as of last week, while 74% of the durum crop was rated G/E. Compare this crop conditions a year ago of 76% G/E for spring wheat and 69% G/E for durum. In Alberta, 84% of the spring wheat crop is in G/E condition, while 77% of the durum crop is said to be rated G/E, both fairly similar to what we saw at this time a year ago of 83% G/E for spring wheat and 86% for durum. Needless to say, wheat crops in the Canadian Prairies are holding on and are looking a lot better than what American spring wheat and durum crops are experiencing.

Switching gears, Agriculture Canada came out last week with its monthly update of their supply and demand estimates, but as many government reports in the middle of the growing season, I’m talking it with a serious grain of salt as the compiled information is a few weeks old. And while the Canadian government does acknowledge some dry conditions, they largely left their production estimates unchanged and will probably wait until the updated Statistics Canada seeded area estimates on Tuesday, June 29th (Note that the first production estimate from Statistics Canada doesn’t come until August 30, 2021!).

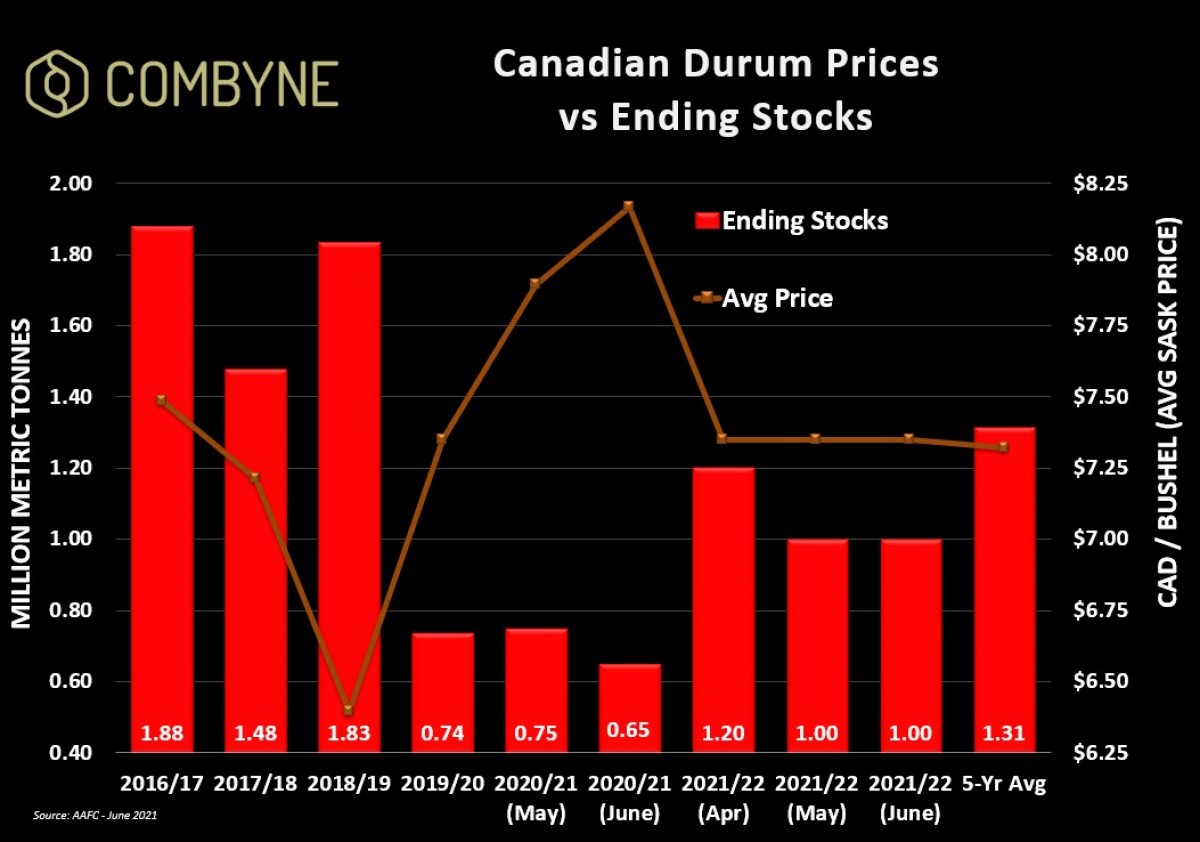

That said, AAFC did acknowledge that the drier conditions could impact a few crops, and so, while they did not change any of their production estimates, they did downgrade some 2021/22 export expectations, including for durum, it’s 3rd straight month of decline. However, because old crop durum exports were raised to another new record of 5.8 MMT, this lowered 2020/21 durum carryout to a record tight 650,000 MT. The net result of smaller carry-in and lower exports is that new crop 2021/22 durum ending stocks stayed at 1 MMT. On the international stage though, global production is set to increase year-over-year by 2.1 MMT, largely thanks to better yields in Europe and Northern Africa (especially Morocco). Thus, a larger global supply base could theoretically minimize any production shortfalls in North America, but as usual, any quality issues come harvest time could easily balloon prices in Canada closer to $10/bu.

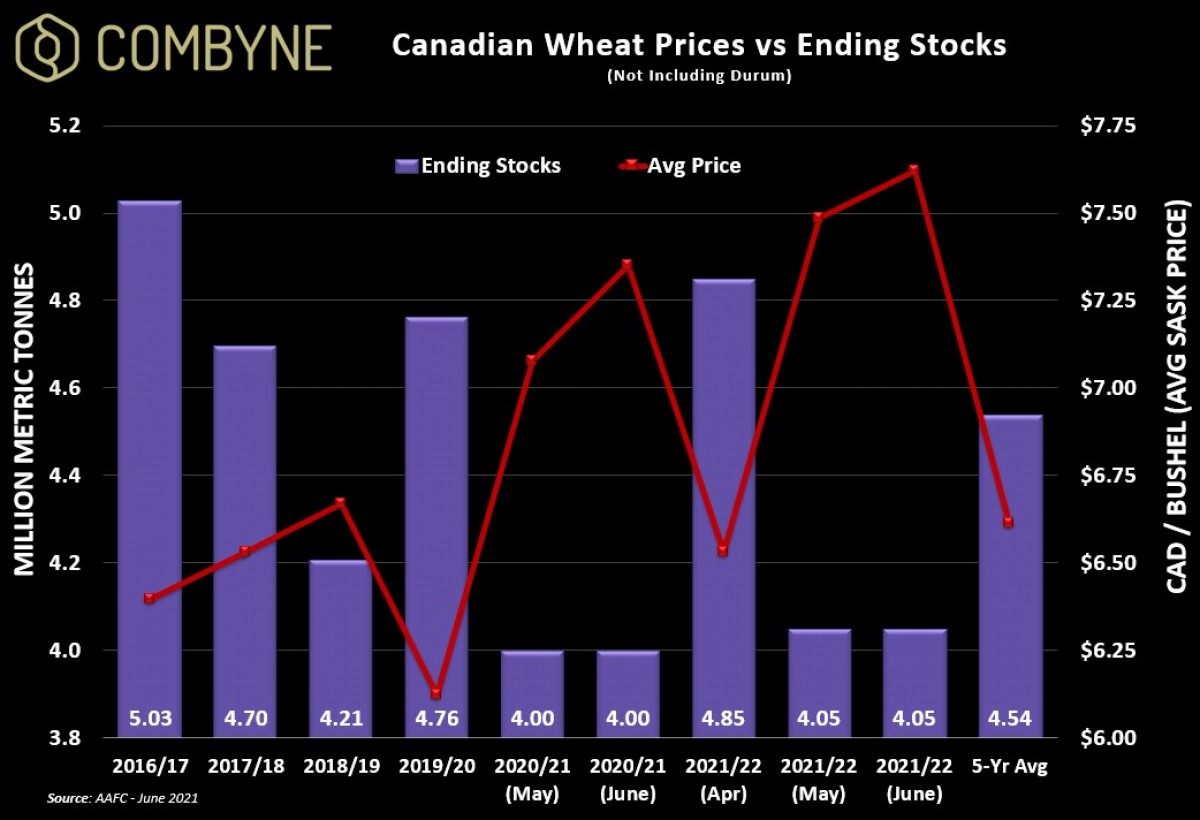

For non-durum wheat, the balance sheet was largely untouched but stronger demand for higher protein and a continued pace of strong exports pushed the AAFC to raise their expectations for average prices, both in old crop and new crop years. While we must continue to acknowledge the bigger crops in the EU and the Black Sea (as mentioned in last week’s Wheat Market Insider column), both international competition and smaller production numbers will inherently put pressure on Canadian wheat’s exportability. Nonetheless, I still think AAFC’s estimate of just 17.1 MMT of non-durum Canadian wheat exports in 2021/22 is on the low side, and if it increases, ending stocks will surely dip below 4 MMT. Overall, speculators, grain buyers and farmers alike are watching the weather closely, and so, expect this increased volatility in the markets to push into July until more potential of this year’s crop is understood.

To growth,

Brennan Turner

CEO | Combyne Ag