Russia Moving Wheat Markets for Wrong Reasons

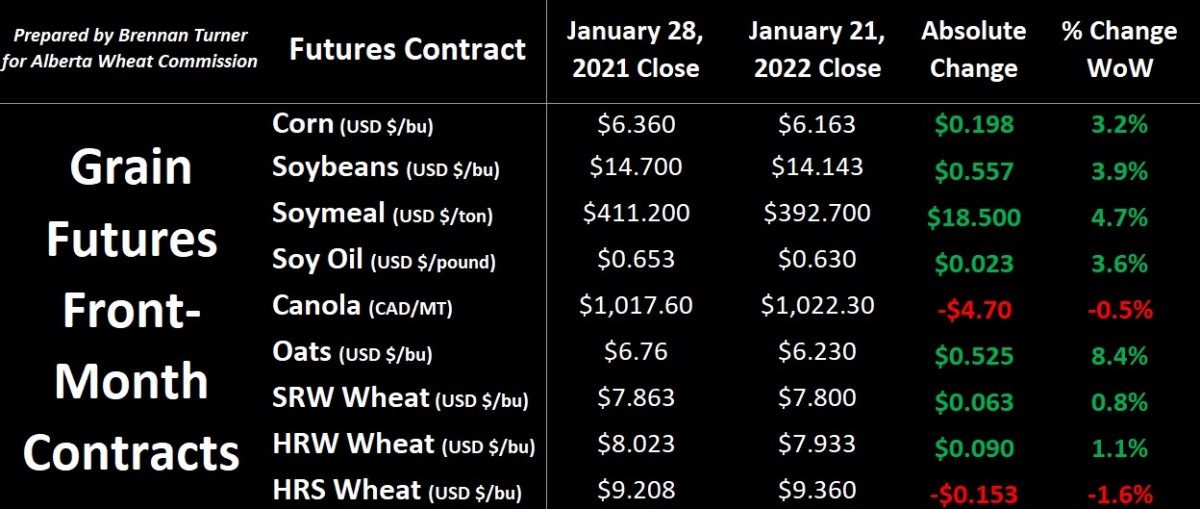

Grain markets found some legs again near the finish of January, thanks to ongoing tensions between Ukraine-Russia, worsening drought in the U.S. Southern Plains, and harvest reductions in South America. In Brazil, there’s buzz that the soybean and first corn crop likely won’t recover at this stage in their growing season and accordingly, more private estimates are routinely decreasing expectations for just how much will be harvested. Unsurprisingly then, corn futures’ front-month contract (March 2022) had its highest close in 18 months, nearing its all-time high, while soybeans are looking to re-acquaint themselves with their early January highs.

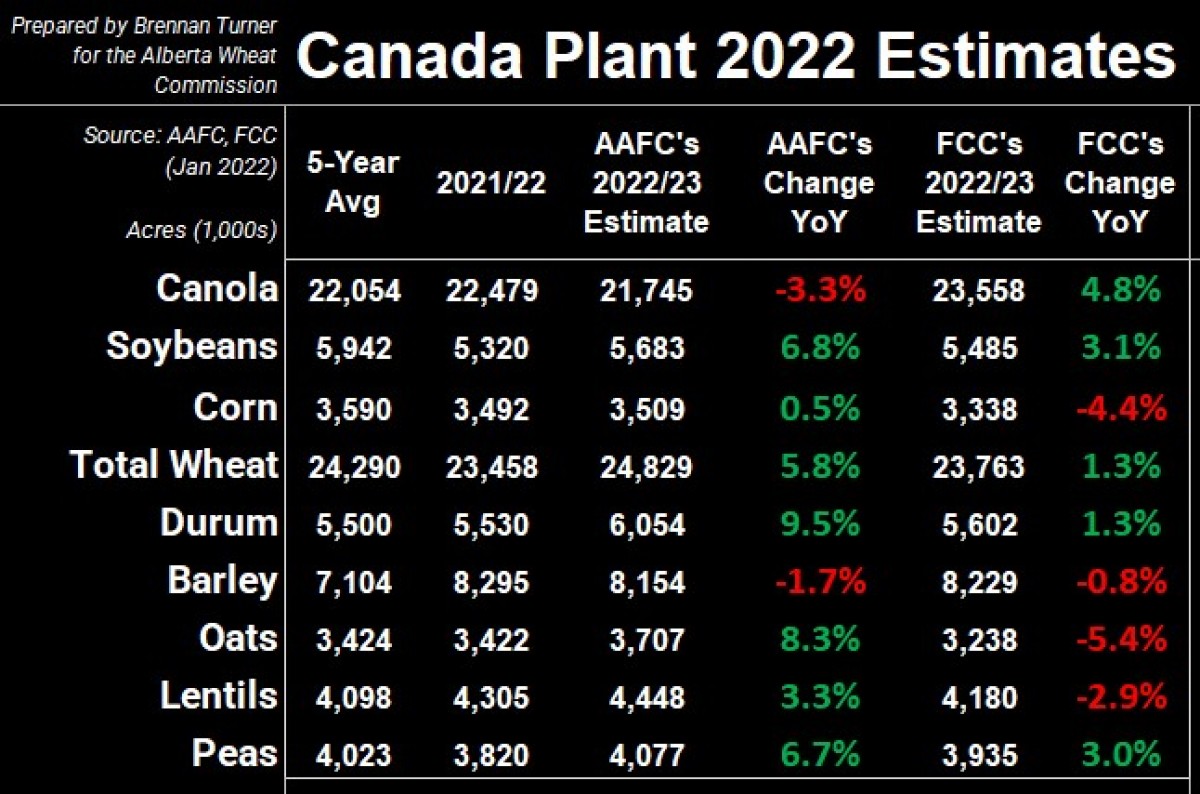

With prices fairly strong for almost every agricultural commodity today, Plant 2022 intentions are flip-flopping on a near-weekly basis. Farm Credit Canada came out this past week with their forecasts of what Canadian farmers will seed this spring, and as the table below shows, there are some significant differences between them and AAFC’s estimates, which came out the week prior.

Most notable for the wheat market was how AAFC is estimating about 450,000 more acres of durum than FCC, which would equate to 500,000 MT – 1 MMT in additional production, depending on yields. FCC’s Chief Economist, JP Gervais noted that the main differences between their forecasts and the government’s are (1) how futures are incorporated into their models, (2) fertilizer price forecasts, (3) accounting for soil moisture (AAFC does, but FCC doesn’t), and (4) how AAFC allows for larger assumptions in crop rotation changes.

Speaking of new crop production, in last week’s U.S. drought monitor report, it is estimated that 86% of Texas is in some state of drought, as is some 88% of Oklahoma, 60% of Kansas, and 35% of Nebraska. Further, topsoil moisture in Kansas – the country’s largest wheat-producing state – is now penciled in as 77% short or very short, and about one-third of its winter wheat crop is being rated at poor or very poor condition. Keep in mind that, as the crops emerge from winter dormancy, a few moisture events could help dramatically improve the crop; this includes some snow that fell in western Kansas last week (as well as some more forecasted for this week). Overall, traders are weighing production risk potential, and this can add a premium to markets, but said strength in wheat prices does tend to fade as we get closer to spring.

While the northern hemisphere supply/production question won’t be fully answered for another 7 - 8 months, demand remains steadfastly strong. According to the International Grains Council, global wheat flour trade this crop year (2021/22) is expected to rebound to a 3-year high, after trending lower for the past 5 years since the record set in 2016/17. And so, the supply question remains but demand is consistent, leaving me with the final factor that I tend to think about in market analysis, which is political risk. The one in most traders’ scopes is that on the Ukrainian-Russian border.

I’ve previously stated that I think the likelihood of a Russian invasion into Ukraine is about 5 – 10%; war, after all, is a pretty difficult decision to step back from. What was fanning the flames this week, however, was the rumors that medical supplies (equipment, blood reserves, etc.) were making their way to the frontlines, which is usually an indication of some level of impending activity. Despite this, I continue to think the likelihood of a fight breaking out to be very small. However, if there’s anything these past 2 years have taught us, we cannot too heavily discount the small probabilities.

Therein, should Russia mobilize its military, it could theoretically put them in control of a lot more resources than just agriculture products, namely mining and energy. For the latter, Russia could, theoretically, hold complete control of the flow of natural gas into most of Europe, which creates obvious humanitarian risks during colder months. Specific to agriculture though, should Putin move to control Ukrainian strategic ports at the Black Sea, this would massively disrupt global agricultural trade. This is especially accurate for corn, sunflowers, and wheat.

Should this type of activity transpire, sanctions being discussed amongst NATO countries include banning all trade with Russia, meaning that the world’s #1 and #3 wheat exporters, Russia and Ukraine respectively, aren’t as active in the daily global trade game anymore. AgResource Company notes that the world’s wheat exporters only have about 19 days worth of supplies, and so we’re already in a bit of a bull market, even before losing Russian and Ukrainian exports! Finally, as a benchmark, when Russia moved in and annexed Crimea, global wheat increased during the conflict by about $1.40 USD/bushel. The difference this time around though is that it is not a couple 100,000 acres at risk, but tens of millions, as well as the aforementioned trade ports. A a reminder though, these are just scenarios that occur IF a very unlikely event does occur.

To growth,

Brennan Turner

Founder | Combyne.ag