Scratching Dirt and/or Dust?

Grain markets generally saw selling to start April, as the complex doesn’t seem to believe the numbers that the USDA printed in their Prospective Plantings report on March 28th. The wheat complex got a bit of a short-covering rally this week on increased tension in the Black Sea, as well as some logistical delays in the Black Sea.

Forecasted corn acres of just 90M is a bullish surprise, as is the healthy usage last quarter (as per the stocks report, the same day), but many are pointing to limited participation in the USDA’s survey and that bullish March estimates can lead to a bearish surprise in the next estimate, released June 28th. While the report could still be considered bullish for most crops since there’s 6.3M less acres of major crops supposedly getting planted, the lesson continues to be that new crop contracts were better at the beginning of the year.

The other variable to watch with Plant 2024 is obviously weather, and with corn acres in the Corn Belt roughly equal to last year, some areas need moisture. Despite the healthy storm systems the last few weeks, it’s a similar situation for Western Canada as the map below over the last year of moisture events still shows a significant deficit for the Prairies. Timely rains will be needed this spring but we’ve heard that swan song many times before, and even when it doesn’t happen, today’s farmer seems to still be able to get a decent yield (especially relative to their parents’ or grandparents’ generations).

USDA’s Plant 2024 & March 1 Grain Stocks

- Total U.S. wheat inventories as of March 1 are pegged at 29.6 MMT, up 16% year-over-year (YoY) and slightly higher than the pre-market guesstimate.

- 47.5M acres of total wheat is slightly more than what the market was expecting but this is still a drop of 4% YoY.

- Slightly less winter wheat than January estimate; still 7% lower year-over-year (YoY).

- 11.34M acres of spring wheat is well above the 10.89M pre-report estimate and slightly higher than last year, despite North Dakota acres expected to drop 5%.

- Spring wheat supplies likely higher YoY as North Dakota’s and Montana’s stocks as of March 1 was up 13% and 33%, respectively.

- 2.03M acres of durum is also way higher than the 1.65M acres the market expected and a 21% jump YoY.

- If realized, this would be the biggest U.S. area seed to durum since 2012.

- Durum stocks totaling slightly less than 1 MMT is a 2% bump YoY.

- Barley acreage is expected to drop substantially, down 535,000 acres, or 17% YoY, to 2.57M.

- Record low areas are expected in Colorado and Idaho, while Montana, the largest barley-growing state, is expecting a 20% acreage drop YoY.

- Barley stocks as of March 1 pegged at 2.44 MT, up 26% YoY with on-farm inventories of 1.2 MMT up more than 50% YoY! (somewhat explains the reduction in acres!)

- U.S. canola acres expected to hit a record high of 2.37 MMT, even with North Dakota’s area dropping 7% from last year’s state record.

Renewed Black Sea Fears

- Increasing military attacks by both Ukraine and Russia on one another has added some premium to the wheat complex.

- Ukraine has shipped out 14 MMT of wheat and 1.96 MMT of barley so far in 2023/24, both tracking behind last year’s pace.

- There’s been some Russian wheat shipments helped up due to phytosanitary certificate issues (more of a “noise” variable with little impact on the market).

- Due to ongoing weather challenges, the EU is now projected a 4% decline in wheat acres this year, suggesting the bloc’s smallest wheat crop in 4 years.

- Those weather concerns continue to impact French wheat conditions / yields.

- In the U.S., 56% of the winter wheat crop is rated good-to-excellent, which is double the 28% G/E rating a year ago, 50% rating last November, and the highest springtime rating in the last 4 years!

- He anticipates strong demand for durum wheat in the upcoming year. It has been dry in Turkey and portions of Europe and North Africa, although Spain and Morocco just received a big dose of precipitation.

- But he still anticipates stiff export competition from Turkey, as well as Russia, Kazakhstan and Australia, where the demise of El Nino should boost production prospects.

Canadian Durum Exports Accelerating?

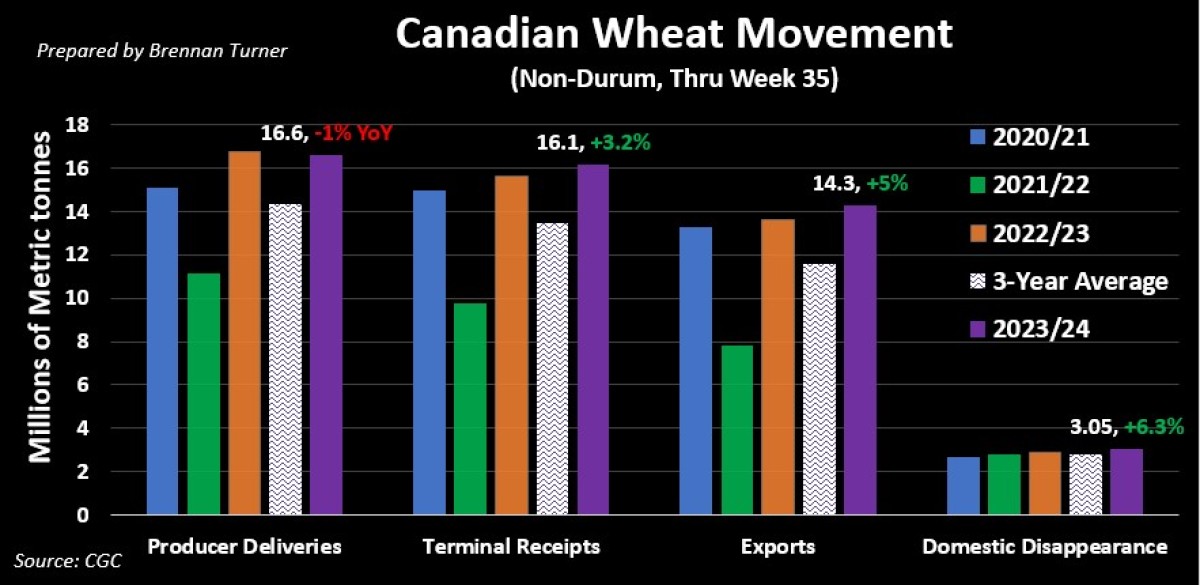

- With the 2024/25 crop year now two-thirds complete, non-durum wheat exports are averaging over 407,500 MT per week, needing just 352,180 MT to finish another strong year.

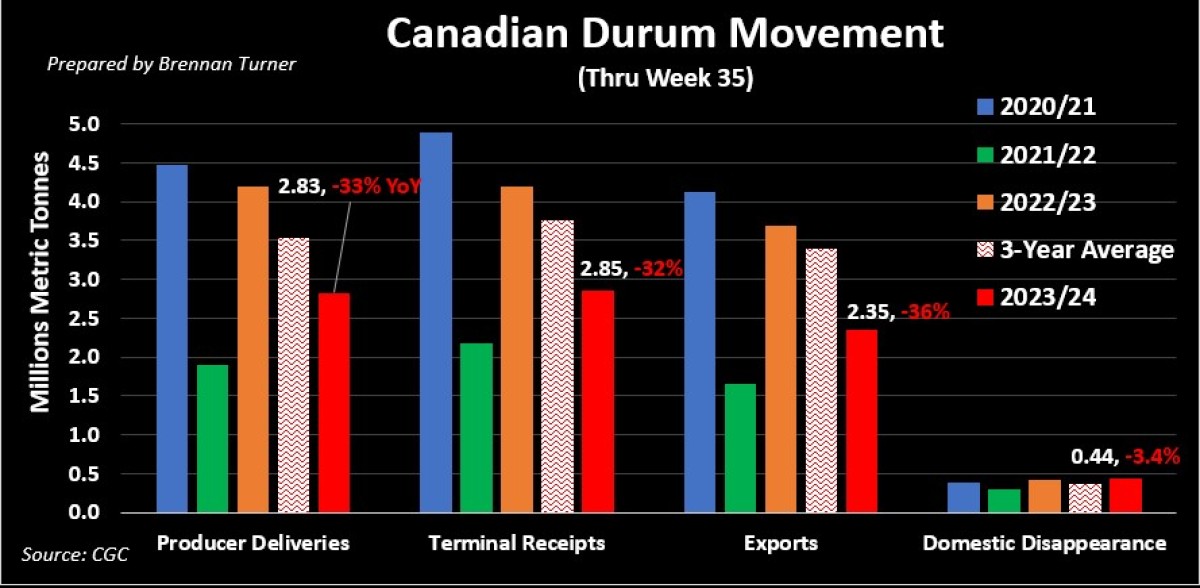

- Durum exports in the last month have seen 3 weeks with volume above 105,000 MT, helping boost the crop-year total.

- Suggests only need about 50,000 MT a week to meet the full-year target.

- Strong demand is expected for the next 6 – 12 months due to the dry conditions in North Africa and an overly wet winter and spring in France.

Is Barley a Contrarian Crop?

- With North American barley acres dropping by a combined 721,000 acres (186,200 in Canada and 535,000 in the U.S.), the market is indicating it’s relatively well supplied.

- One could also point to more alternatives to beer, but I think it’s impact is more muted compared to supply.

- Could suggest better premiums in early 2025 once the 2024/25 crop is worked through.