Seasonal Downturn for Wheat?

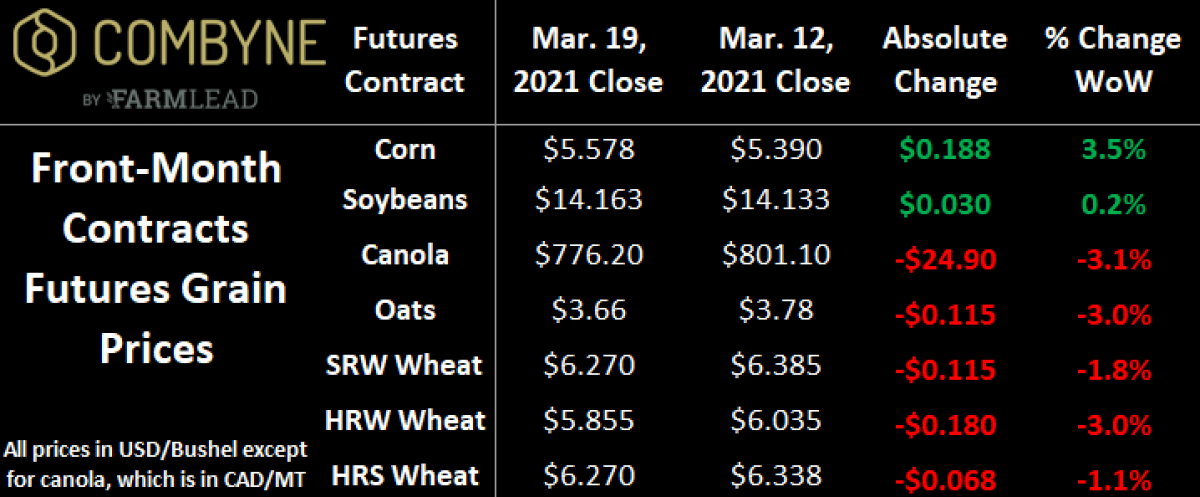

Corn and soybeans ended last week higher, thanks to some strong U.S. export demand, but everything else including the wheat complex saw some heavy technical selling. Also worth noting is the healthy precipitation last week across the U.S. Southern Plains that drove winter wheat prices lower – including Chicago SRW wheat prices to a 3-month low – but most of the Northern Plains (notably, the Dakotas) will need more moisture to lift the area out of any drought concerns.

With the export tax now firmly in place, Russian wheat prices continue to fall as demand weakens, as well as some better weather for their crop that’s nearing the exit of their dormant winter stage. Next door in Ukraine, 80%, or 14 MMT, of the 17.5 MMT wheat export quota has been used up, leaving about 3.5 MMT over the next 2.5 months before their new crop year starts on June 1, 2021. Meanwhile, Strategie Grains lowered its forecast of (non-durum) wheat exports from the EU to 25.2 MMT, down 900,000 MT from last month.

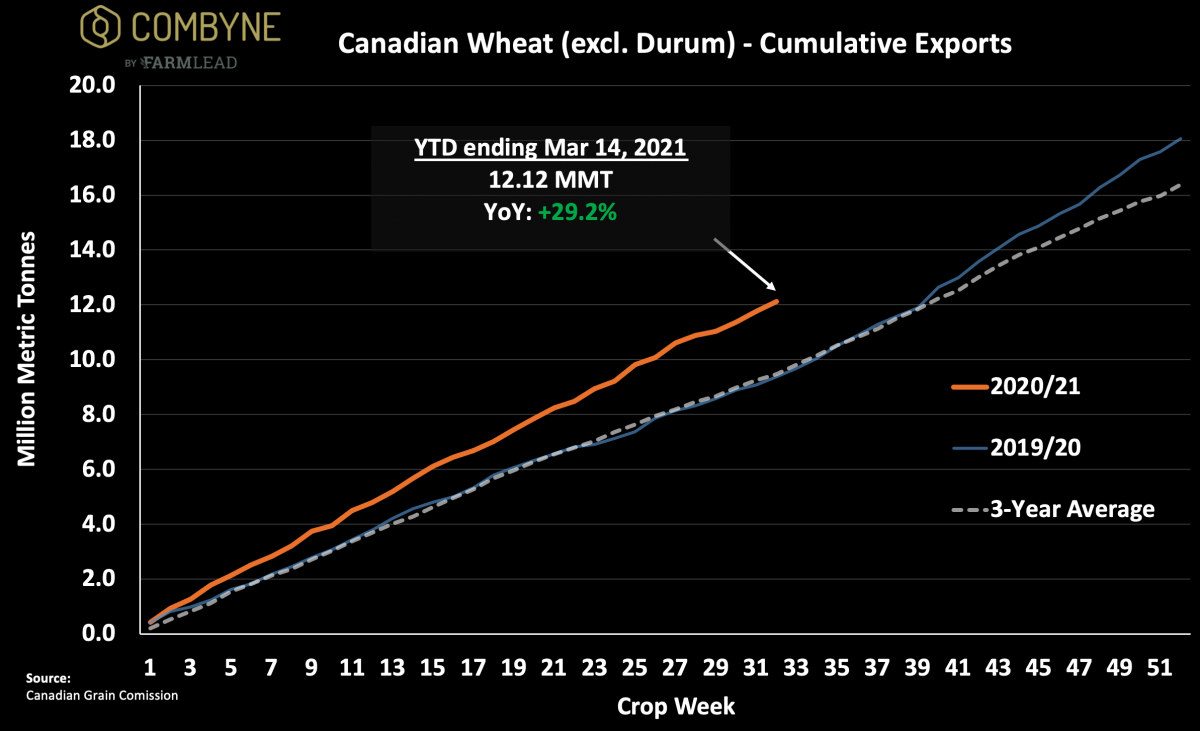

That said, while demand for European or Black Sea wheat may be softening ahead of their 2021/22 harvest, demand for Canadian wheat continues to be relatively strong. More specifically, with 20 weeks / 5 months left to go in the 2020/21 crop year, Canadian wheat exports continue to perform brilliantly, thanks to limited logistics competition on the railroad and at the ports. Of note, through Week 32, non-durum Canadian wheat exports have totaled 12.1 MMT, which is nearly one-third higher than this time a year ago!

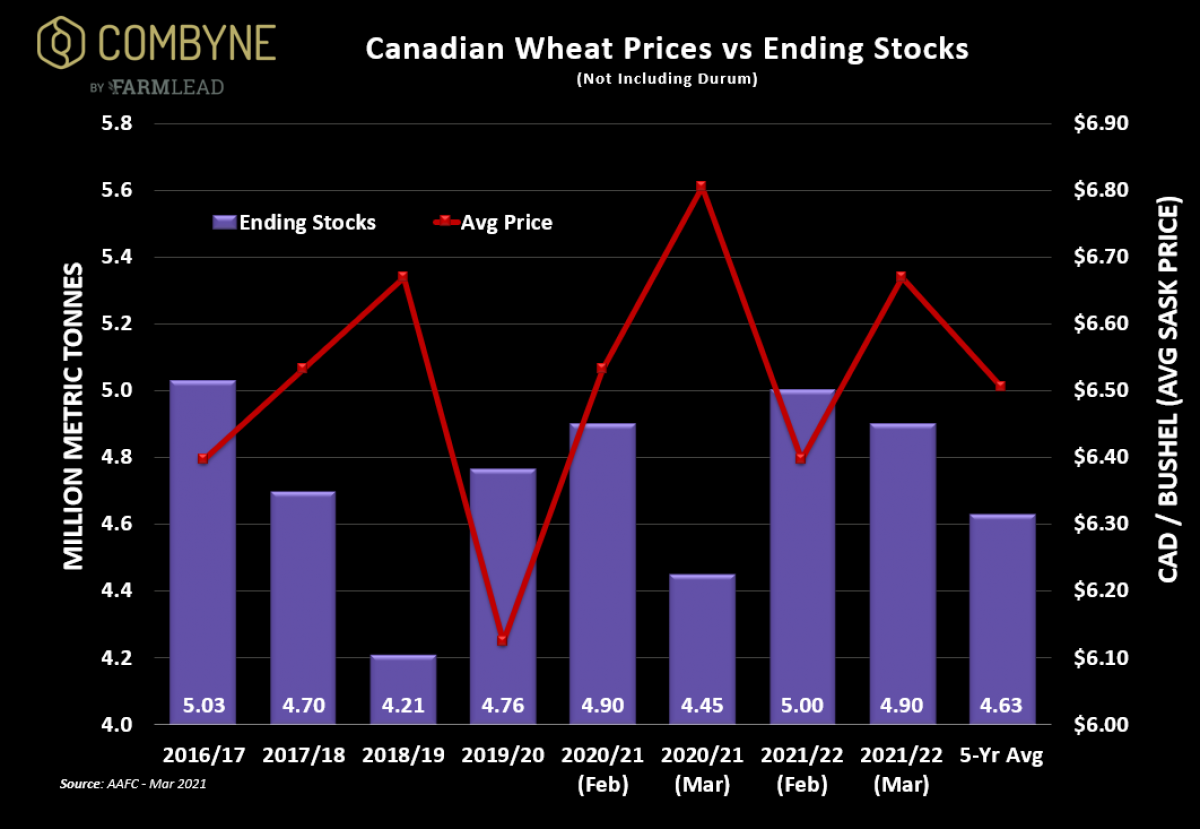

In Agriculture Canada’s monthly update last week, the government raised 2020/21 non-durum wheat exports by 100,000 MT to 21.1 MMT, a new record. AAFC is crediting the new export tax out of Russia and continued “aggressive Chinese demand” for the increase. Combined with higher feed usage, 2020/21 Canadian non-durum wheat ending stocks are expected to tighten to 4.5 MMT. Flipping attention to the new crop 2021/22 harvest, continued demand from China, and the impact of said Russian wheat export tax should keep exports elevated, but the smaller carry-in of supplies has the AAFC maintaining ending stocks below 5 MMT.

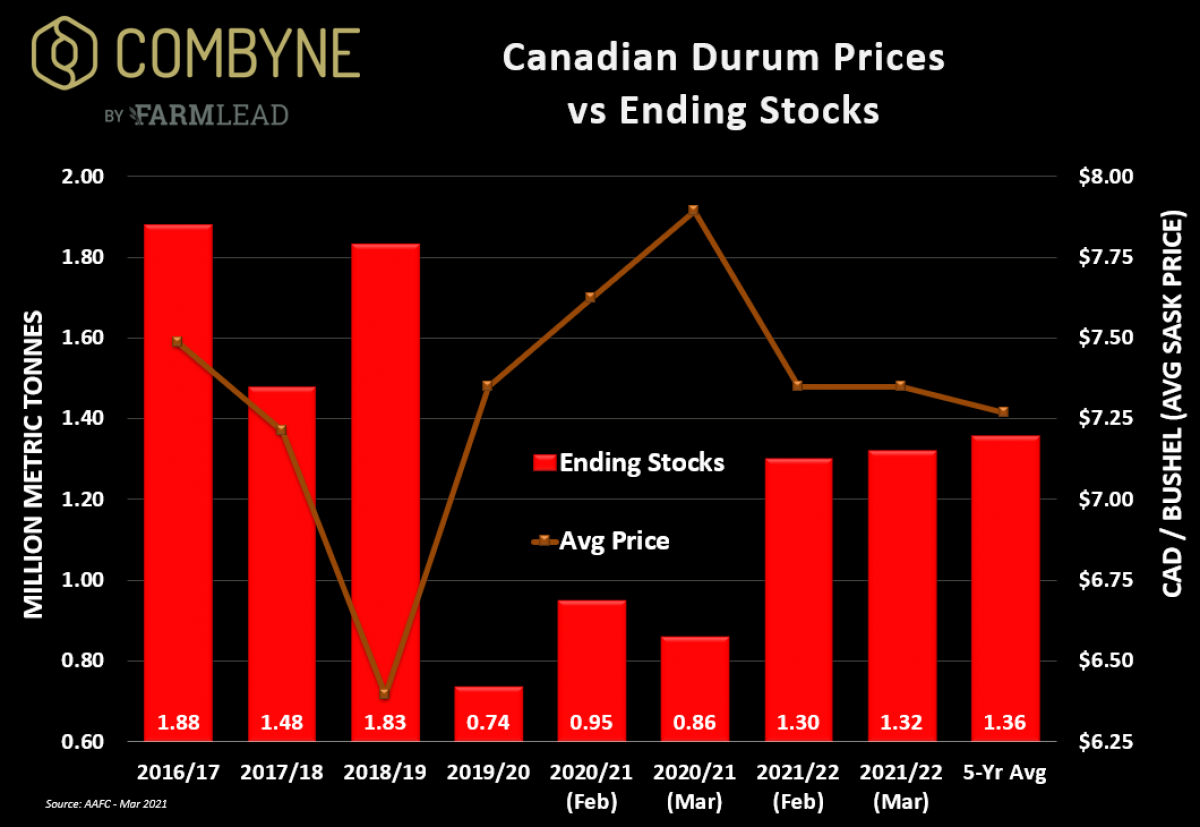

For durum, exports are similarly strong, tracking 26% higher year-over-year with 3.72 MMT moved out of the country so far in the 2020/21 crop year. Quite simply, thanks to disappointing 2020/21 harvests in Europe, Mexico, North Africa, Kazakhstan, AND Australia, demand for Canadian durum continues to be strong. Accordingly, Agriculture Canada raised its forecast for Canadian durum exports for the fifth consecutive month to yet again, a new record of 5.6 MMT. Intuitively, this international demand continues to push down 2020/21 durum ending stocks – now pegged at 860,000 MT – to the 2nd-lowest in the last decade (2019/20 was the lowest, as shown in the corresponding chart).

That said, favourable weather over the winter and through the spring in Europe, the Black Sea, and North Africa suggest a rebound in production from these countries, which is why AAFC lowered its forecast of 2021/22 Canadian durum exports by 200,000 MT this month to 4.8 MMT. Combined with a forecasted 6.3 MMT harvest here at home, Canada’s durum ending stocks for 2021/22 are expected to increase quite significantly to 1.32 MMT, a jump of 54% year-over-year.

Overall, market momentum seems to have stalled a bit in the wheat complex, which seems to align with historical seasonality. Wheat traders will continue to watch soil moisture conditions in the Northern Plains and parts of Western Canada, and if it continues to be less-than-ideal, you could start to see some weather/planting premiums pop back into the market by the end of April / early May. Therein, if you’re concerned about cash flow over the next 3 months, I would consider selling something now, and if you’re able to, cover said old crop cash sales with some call options.

To growth,

Brennan Turner

CEO | Combyne Ag

Combyne.ag