Second Largest Canadian Wheat Crop Ever?

Grain markets all added back some weather premium last week ahead of the Memorial holiday-shortened trading week and the end of May. While planting in North America is nearing the finish line in most places, including the Canadian Prairies, there’s still quite a bit of dryness around, with more hot temperatures in the forecast. The potential for 100-degree Fahrenheit weather in the Midwest helped corn close at its highest level in a month and with little else buzzing for it, wheat tagged along for the ride. Traders last week were mostly focused Friday’s weather forecast, which showed above-average temperatures but below-average rainfall for the next two weeks.

Therein, we’re starting to see comparisons to 2012 when we saw a similar healthy start to the planting campaign, but thereafter got smacked by El Nino conditions ramping up (read: dryness). When markets open back up for trading Tuesday this week, regardless of the updated forecasts, we’ll certainly see more volatility, either because of profit-taking due to milder conditions or short-covering due to confirmation of the hotter weather. One interesting variable to keep an eye on though is the excessive short position in Chicago SRW futures as, with only about 400M bushels expected to be produced this year in the U.S., there’s 594M bushels worth of net-short contracts!

Worth noting is that heading into the weekend, it’s estimated that 20 per cent of all U.S. soybean acres, one quarter of all U.S. corn acres, and nearly half of all American wheat acres are in an area facing some level of drought. Doomsday predictions aside, there’s still plenty of time for rain to fall and the recently-planted crops to get the moisture they need to fill pods and kernels. Take for example the U.S. Southern Plains, who in the last two weeks, has received about six times the normal amount of rainfall.

Heading north, about two-thirds of the U.S. spring wheat crop had been seeded as of last week, but in North Dakota, less than half of the state’s spring wheat fields have been planted, a bit behind the norm. Thanks to the cold and snowy winter there (lots of records were broken!), the delayed spring thaw has impeded field activity and so the North Dakota Wheat Commission thinks that spring wheat acres will likely come in near what the USDA forecasted, but more from Montana and less from North Dakota. However, the NDWC also believes that, because of the lingering wetness in some areas of the two northern states, not all the 1.78M acres of durum that the USDA has forecasted will get seeded.

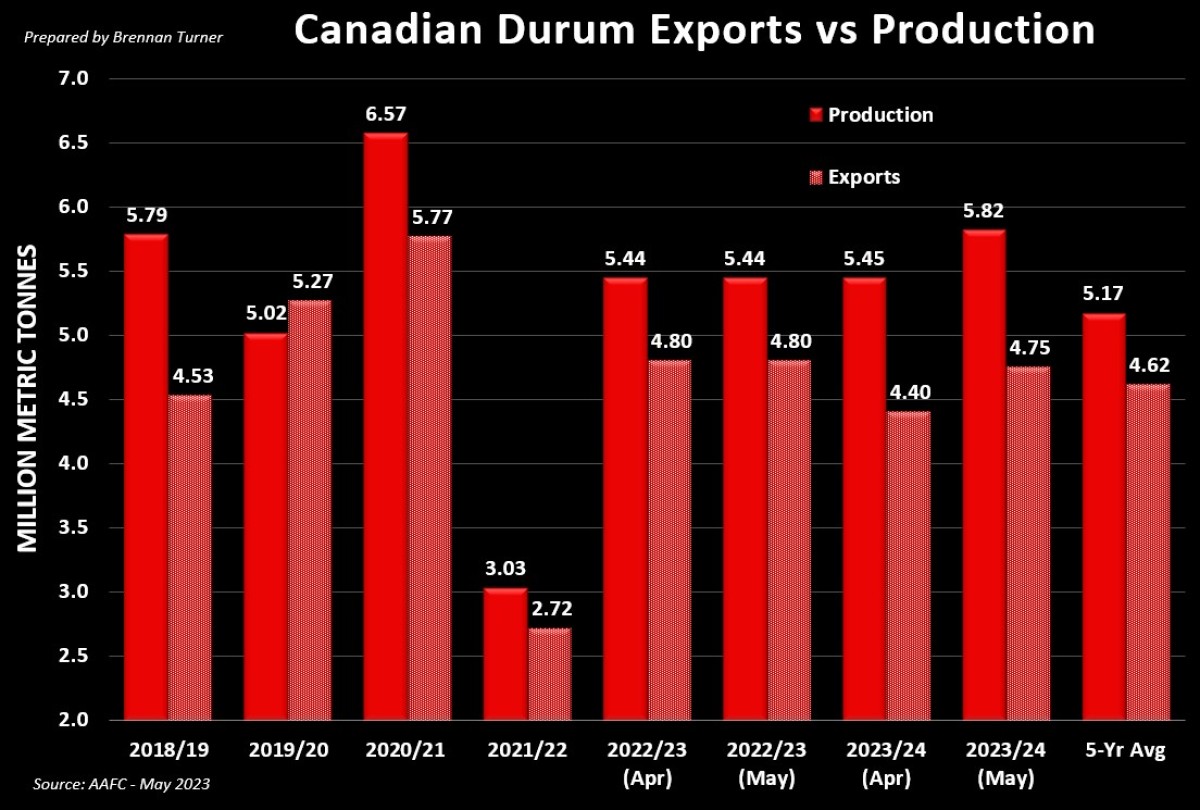

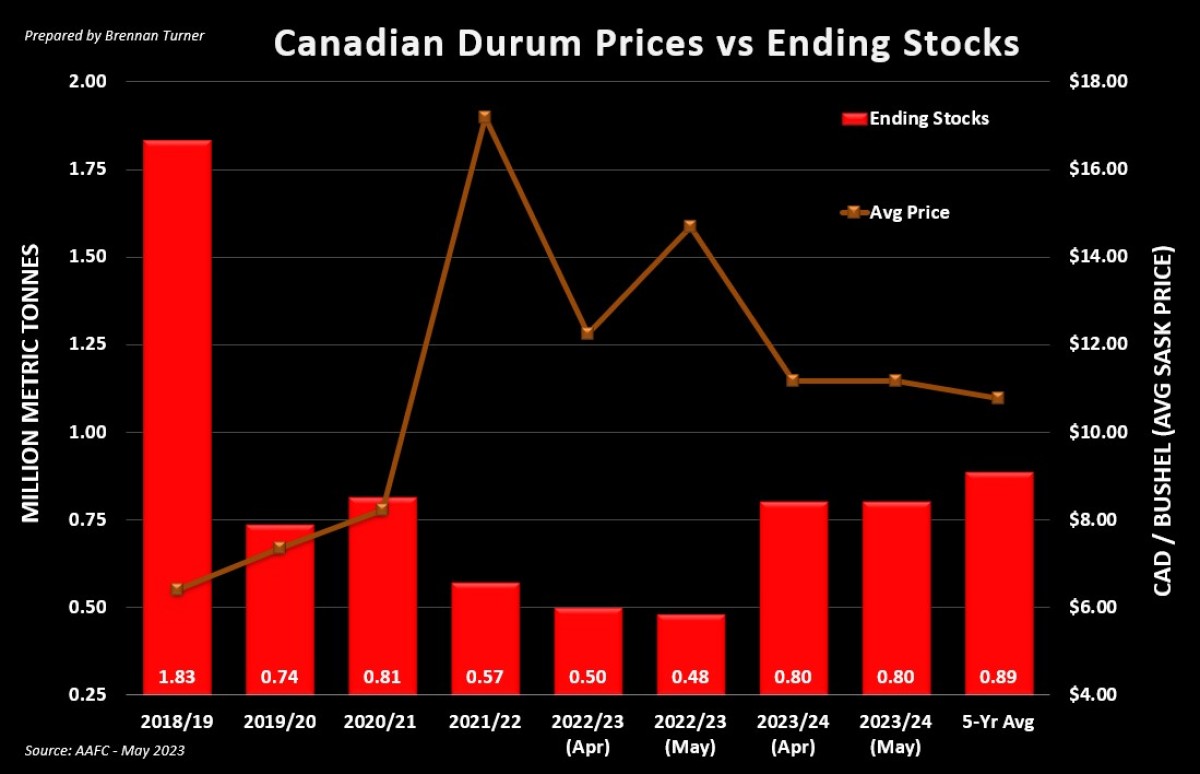

The potential for lower U.S. durum production in mind, last week Agriculture Canada revised its supply and demand tables, accounting for the new (albeit questionable) acreage estimates from Statistics Canada back in late April. For durum, Canadian production is pegged at 5.8 MMT, based on an average yield of 36 bushels per acre (bu/ac), but thanks to higher exports to the likes of the EU, Turkey, and Morocco, carryout is still pegged at 800,000 MT. Simply put, with global durum inventories sitting at 15-year lows, unless planted acres balloon higher by another couple 100,000, myself, AAFC, and many others believe Canadian durum prices will continue to trade at double-digit levels for the foreseeable future.

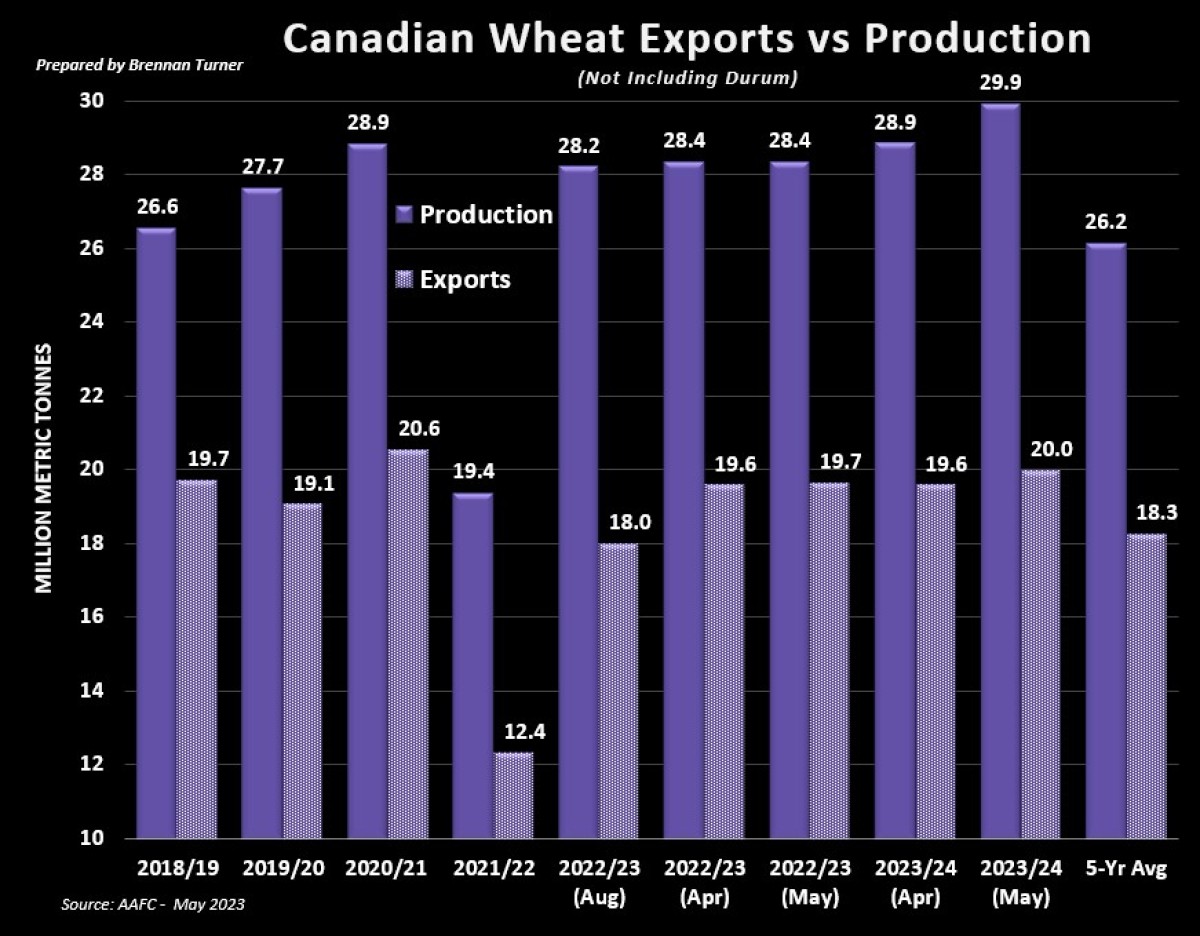

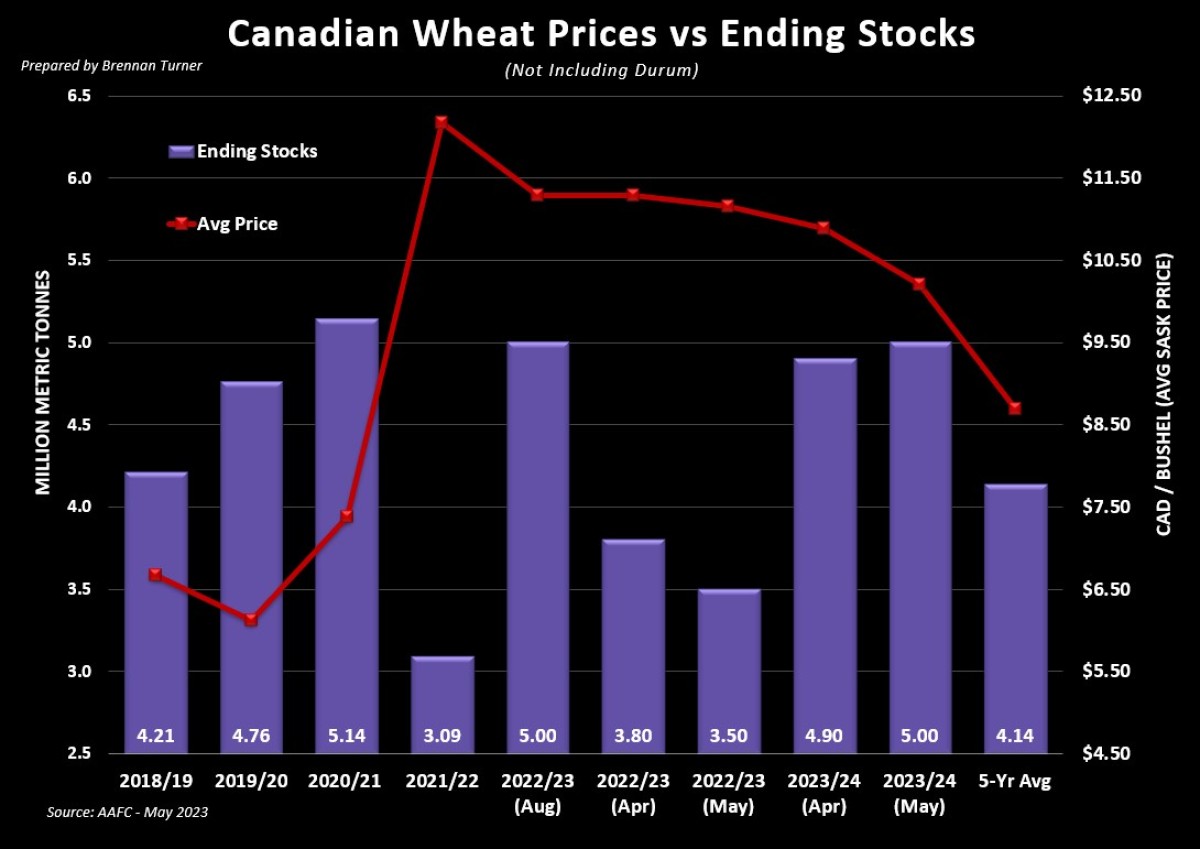

For Canadian non-durum wheat, the big question from Agriculture Canada’s revised estimates is whether or not Canadian farmers will plant 1.5M, or eight per cent more acres than they did last year. Assuming that all of the 20.9M acres get drilled, AAFC is forecasting that nearly 30 MMT will be produced. This, combined with the 5.8 MMT of durum, would total 35.75 MMT, the second largest wheat harvest ever in Canada (Harvest 2013 produced 37.6 MMT). The bigger story for me, however, continues to be the strength of the Canadian wheat export program, as Agriculture Canada raised its forecast for old crop for the ninth consecutive month. On the chart below, I’ve explicitly shown how AAFC’s non-durum wheat export forecast has climbed by 1.65 MMT since August. With the bigger acres though, AAFC is also expecting 2023/24 Canadian non-durum wheat exports to top 20 MMT for only the second time in history (the first was the 2020/21 campaign). I’m aligned with the AAFC on the wheat export front, as Canadian supplies remain affordable and secure, relative to the likes of the U.S. and/or the Black Sea.

Wrapping things up with an update from Eastern Europe, despite the two-month renewal of the Black Sea Grain Corridor Deal signed on May 18th, there’s yet to be a ship enter the Ukrainian port of Pivdennyi, one of three ports involved in the agreement (the others being Odesa and Chornomorsk). In fact, the port has not received any ships since May 2nd, and none have been even authorized to travel there since April 29th. Therein, with just six weeks left to go until yet another renewal deadline, it continues to be unlikely that Ukraine can be counted on for secure supplies. Thus, as grain prices have dipped back (at least relative to a year ago), and some production concerns already mounting, end-users may start to come to the table a bit hungrier as they need to secure their own supplies for fall delivery. Accordingly, I strongly believe that there’ll be opportunities to “sell the rumour and profit on the fact” where headlines of drought and extreme heat will push the market higher for a short time, before settling back lower.

To growth,

Brennan Turner

Independent Grain Market Analyst