Sell-Off Start to August

Grain markets saw heavy selling in the first few days of the new month as forecasts for rain and profit-taking took hold ahead of this month’s WASDE report, published on Friday, August 11. Rain did fall over much of the Midwest over the weekend, which should boost some crop prospects, but there’s still a fair amount riding on Mother Nature here in August. Many argue that the main factor traders are anchored to is the weak U.S. grain and oilseed export business, and it’s becoming clearer that, without an improvement in the demand outlook, rallies are having a hard time sustaining any higher highs. For example, China has only bought 3 MMT of new crop U.S. soybeans, whereas, at this time a year ago, they had bought 8.7 MMT. There’s some hope that China will buy more U.S. corn as increased military activity in the Black Sea might push them away from sourcing Ukrainian corn.

As it’s clearly shown above, the wheat complex saw the heaviest selling last week, led by Kansas City HRW futures. From my vantage point, the market seems focused on three factors. First, there are the issues in the Black Sea, where traders seem to be concerned about it one week, then not the next. For perspective, as Canadians were enjoying their August long weekend holiday Monday, Chicago SRW wheat traded 2 per cent higher as Ukraine claimed responsibility for attacking the Russian Black Sea port of Novorossiysk, where naval and grain ships are very active. Russia called it a “terrorist act” and said they would punish Ukraine so one would expect some level of response, suggesting weaker shipping activity. Second, traders are second-guessing any yield concerns with the recent North Dakota spring wheat crop tour results, despite quality ratings continuing to fall. Third, specifically for U.S. wheat, international demand remains slow and so, for export sales to pick up, prices need to come down to be more competitive.

Therein, lies the question: should wheat prices go lower? This may be a better question for the entirety of the grain, oilseed, and pulse markets as, with just a few weeks left to go in the growing season, the market seems to be sitting on a razor’s edge. While the geopolitical risk is hanging around in the background, the weather will ultimately win a lot of the day-to-day in the coming weeks, with the majority of the focus on the U.S. Corn Belt. August is the main month for soybeans to fill pods and so any conditions that impede a crop from reaching the USDA’s current forecast for a record national yield of 52 bushels per acre will add premium to current prices. On the flip side, if more rain like this past weekend shows up, then prices are certainly headed lower. Canola prices will surely follow soybeans closely as we move through each week in August.

Specific to Canadian wheat though, we’re mostly at the stage though where the crop is made, and any rains now will only likely help the late-seeded fields. This sentiment was confirmed to me in the last week, talking with farmers throughout the Prairies, as most noted that the moisture received over the winter and the beginning of the spring is likely what is helping them achieve average or just below-average wheat yields this growing season. Moreover, the best areas won’t fully compensate for the worst areas. That said, while quality will likely be there, we know that quantity won’t and so we’ll likely see ending stocks drop to historical lows, something that the market hasn’t really accounted for yet in my opinion.

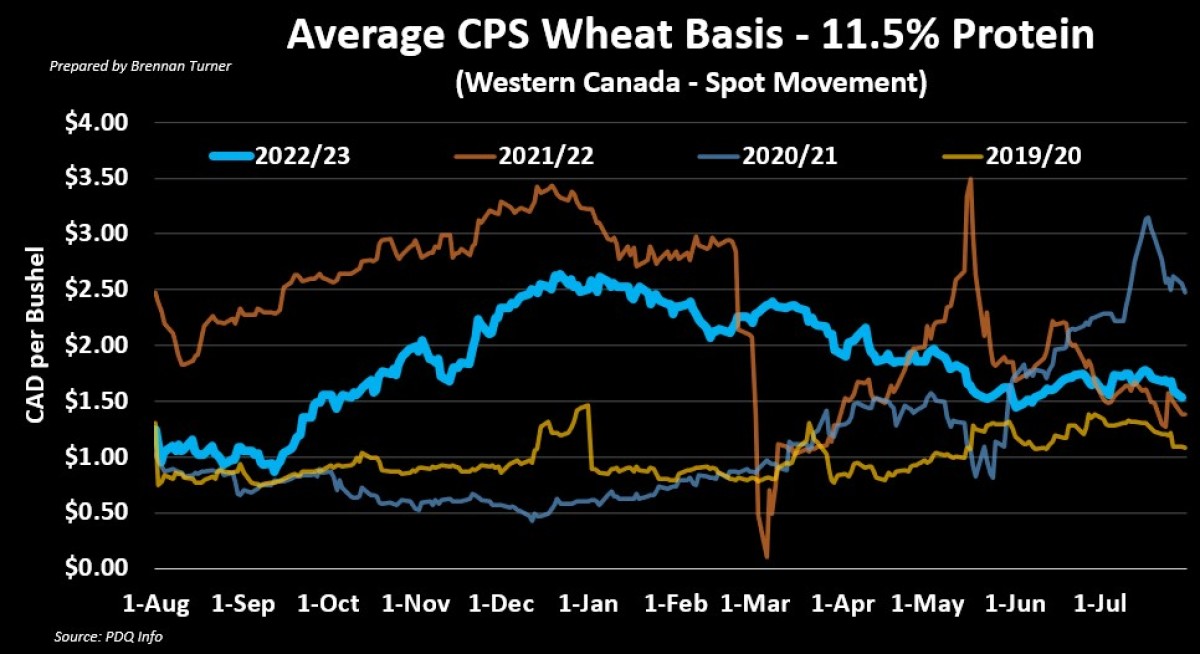

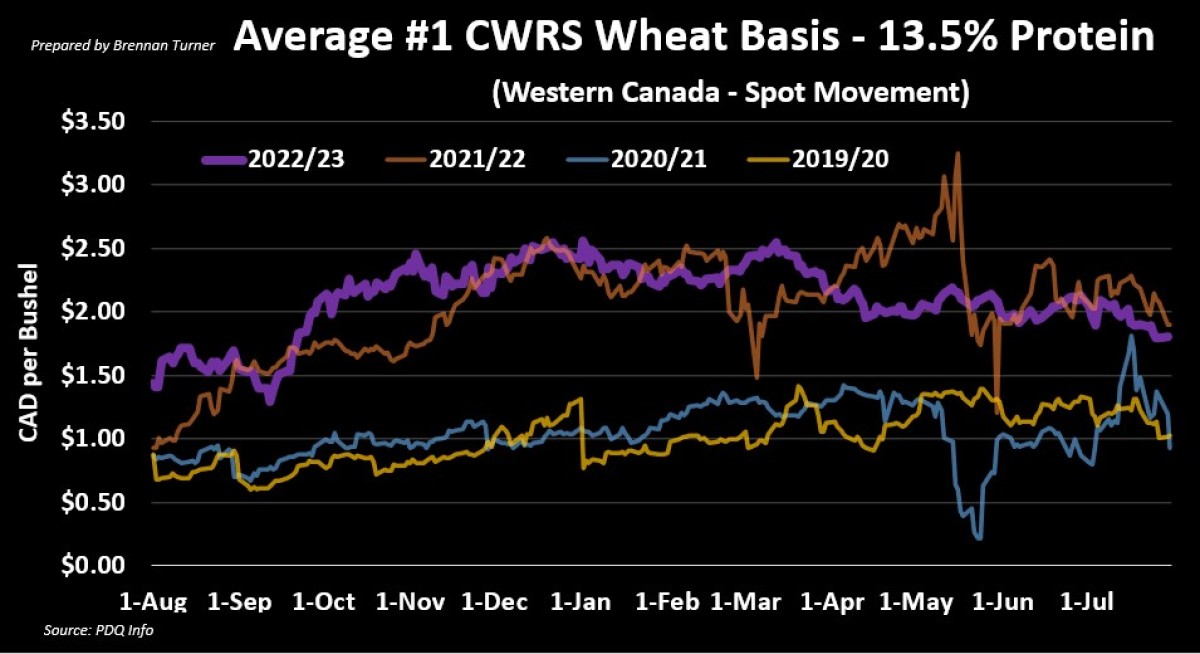

On top of that, there are other bullish factors that are certain for the wheat market, including quality issues happening in China, and smaller wheat harvests out of Australia, the E.U., and India, the latter of which could become an importer this year. Thus, I see many talking heads out there using the word “complacency” a lot when talking about where wheat prices currently are, with traders possibly just sitting and waiting out events before making any bets. Complacency might also be the name of the game for Western Canadian wheat basis levels as things have been trending down over the growing season with higher futures compensating.

That said, if you look at what basis levels did at the start of the 2021/22 crop year (the orange line in the charts below), Harvest 2021 showed the impact of the drought, and basis levels continued to creep higher until basically the end of December. Some points to lock in basis may include the end of September as, thereafter, things mellowed out for about a month or two (read: fall harvest deliveries coming to market so buyers weren’t as needy). Ultimately, the focus should be first on preparing for a safe and efficient harvest, filling existing new-crop contracts, and then looking to be an incremental seller through the late fall and winter months as wheat markets appear to have more upside than what traders are indicating to us today.

To growth,

Brennan Turner

Independent Grain Market Analyst