Sitting, Waiting, Wishing

Sitting, Waiting, Wishing

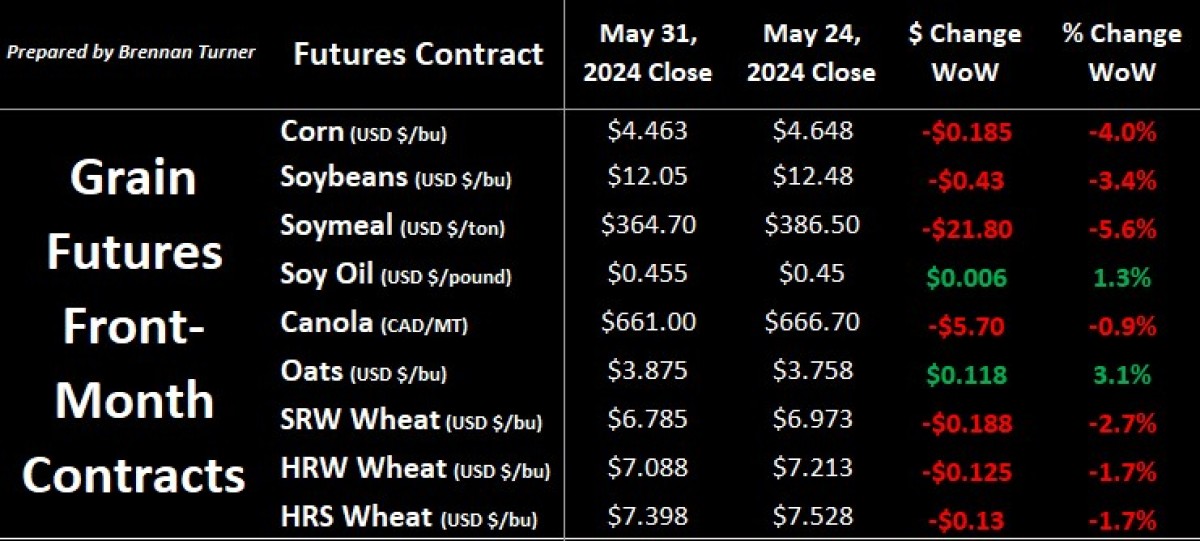

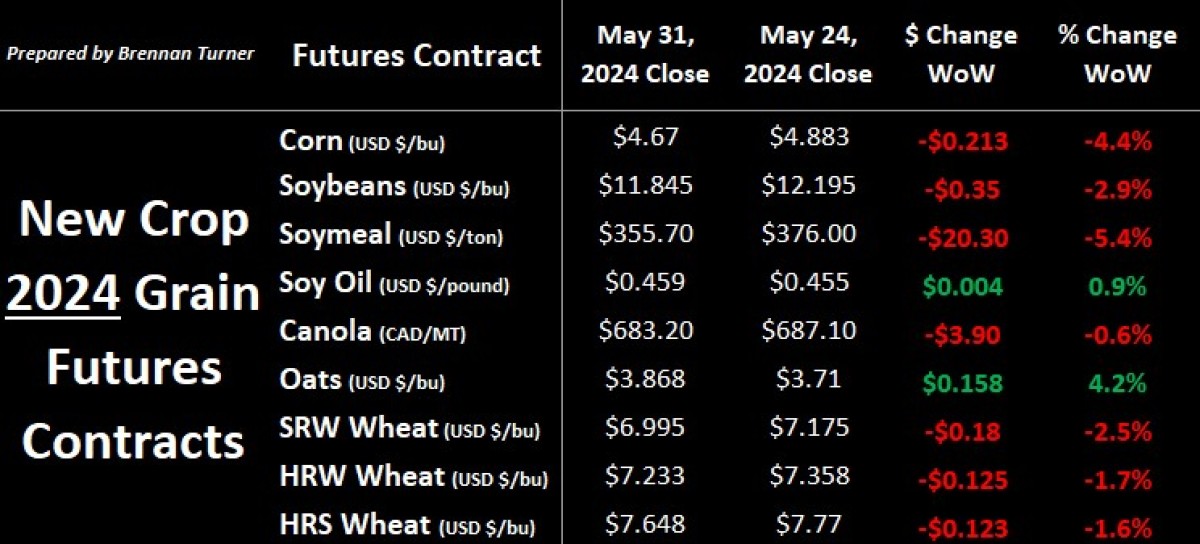

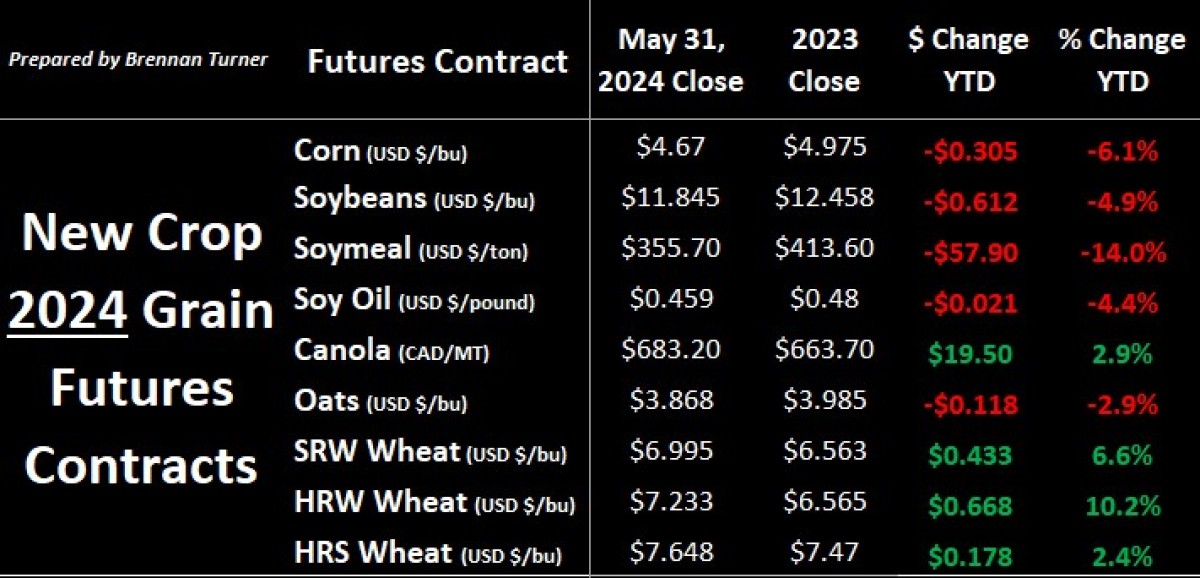

As we flip the calendar to June, grain markets saw profit-taking to finish the month after the complex rallied for a few weeks on weather-related production concerns in North America, South America, and Europe. The wheat complex enjoyed it's best levels since last late summer / early fall as frost and dry weather around the Black Sea catapulted the market higher, bringing most other grains and oilseeds with it. However, with sustained rallies being few and far between in the last 10 months, farmers rewarded themselves with sales in the cash market and traders took profits in the paper trade to close below the highs reached before the American Memorial Day long weekend. The next major reports that could move the market will be the USDA’s June WASDE (out Wednesday, June 12th) and updated acreage estimates from Statistics Canada and the USDA (Thursday, June 27th and Friday, June 28th, respectively). Until then, without a wishful, net-new bullish headline, grain markets will be sitting and waiting.

Generally, weather rallies are often short-lived, and as prices creep higher, technical momentum can help provide guidance. In this case, over a few tradition sessions, Chicago wheat couldn’t take out a key level of resistance and so the market seems to agree that any production losses in Russia and other parts of the Black Sea have been priced in. This would include more moisture for most of North America and so, using the last few years as a measuring stick, you can bet that fund managers are more cognizant of how well today’s farmer can produce a crop in challenging conditions from Mother Nature. That said, there’s an ongoing pendulum swing from El Nino to La Nina, which can often lead to further limited rainfall in places like the American Corn Belt and parts of Australia as the needle gets closer to full-on La Nina conditions.

Narrowing the focus, through the end of May, seeding is still ongoing for many farms in the Canadian Prairies, as recent heavy rains has slowed activity down in Manitoba (64% complete vs 75% 5-year average), Saskatchewan (77% complete vs 91% average), and Alberta (77% complete vs 84% average). Coming back to a high-level, absent any net-new bullish variables (of which, I don’t see many), I think the highs of the growing season could be in for wheat prices, but there are still attractive values on the table for new crop options, especially relative to where we started in the 2024 calendar year! Consider treating yourself to profitable sales, be it old crop, 2024 new crop, or even out to 2025.

Hurting from Hand to Mouth

- As La Nina makes its way to Australia, farmers in South and Western Australia are swapping some of their canola acres for more drought-resistant options, namely wheat and barley.

- Russia’s cereals harvest is starting up and their Ag Minister says, despite frost affecting nearly 2.5M acres of grain production, they’ll still export 53 MMT of wheat in 2024/25 (USDA’s forecast is 52 MMT.)

- International buyers, who’ve been buying from 1 – 2 months out (versus the usual 4 – 6 months), are buying less from Russia because of the production uncertainty.

- Reason behind the hand-to-mouth buying pattern is because of decent supply and cost of holding grain longer is expensive (higher interest rates = higher storage costs.)

- Worth also noting that Russia has increased trade with the likes of China, Iran, Venezuela, etc., which is helping sustain their economy despite the many Western sanctions.

- Some talk that more buyers will look to Europe for wheat supplies if Russian quality and quantity isn’t there.

- International buyers, who’ve been buying from 1 – 2 months out (versus the usual 4 – 6 months), are buying less from Russia because of the production uncertainty.

- The European Commission raised its 2023/24 soft wheat ending stocks by 1 MMT to now sit at 21.4MMT, largely because imports were raised by 2 MMT.

- They kept their Harvest 2024 estimate at 120.2 MMT (a 4-year low), but thanks to the larger carry-in from 2023/24, also raised new crop year’s ending stocks by 1 MMT to 13.5 MMT.

- Germany’s farmer co-op association says their wheat harvest will fall by 5.6% year-over-year to 20.3 MMT.

- France’s soft wheat conditions continue to sit at 4-year lows.

- They kept their Harvest 2024 estimate at 120.2 MMT (a 4-year low), but thanks to the larger carry-in from 2023/24, also raised new crop year’s ending stocks by 1 MMT to 13.5 MMT.

New Record for Canadian Wheat Exports?

- Canadian non-durum wheat exports continue to move well, with shippers in a position to potentially eclipse the record of 20.61 MMT exported in the 2022/23 crop year.

- Through Week 43, exports topped 18 MMT on a weekly average volume of 419,520 MT. With 9 weeks left to go in the 2023/24 crop year, if we average at least 290,000 MT of weekly exports, a new record will be set.

- Frankly, just a few months ago, I had my doubts that this pace could continue, especially since we know exports to China, our largest customer, are down about 11% year-over-year. Impressive work!

-exports-domestic-demand-thru-week-43-large.jpg)

- Agriculture Canada didn’t raise its forecast for 2023/24 exports, keeping it at 20.25 MMT, but did raise their estimate for 2024/25 exports to also 20.25 MMT.

- AAFC recognized the increased domestic demand (as indicated by StatsCan’s March stocks report) by reducing 2023/24 ending stocks by 600,000 MT to a record tight 2.5 MMT.

- Even if assuming AAFC’s Harvest 2024 production forecast of nearly 29 MMT is realized (a 4% increase YoY), total demand will remain strong enough to keep 2024/25 ending stocks at 3 MMT (the 2nd lowest on record, after 2023/24’s current showing.)

- AAFC recognized the increased domestic demand (as indicated by StatsCan’s March stocks report) by reducing 2023/24 ending stocks by 600,000 MT to a record tight 2.5 MMT.

-prices-stocks-exports-production-aafc-estimate-may-2024-large.jpg)

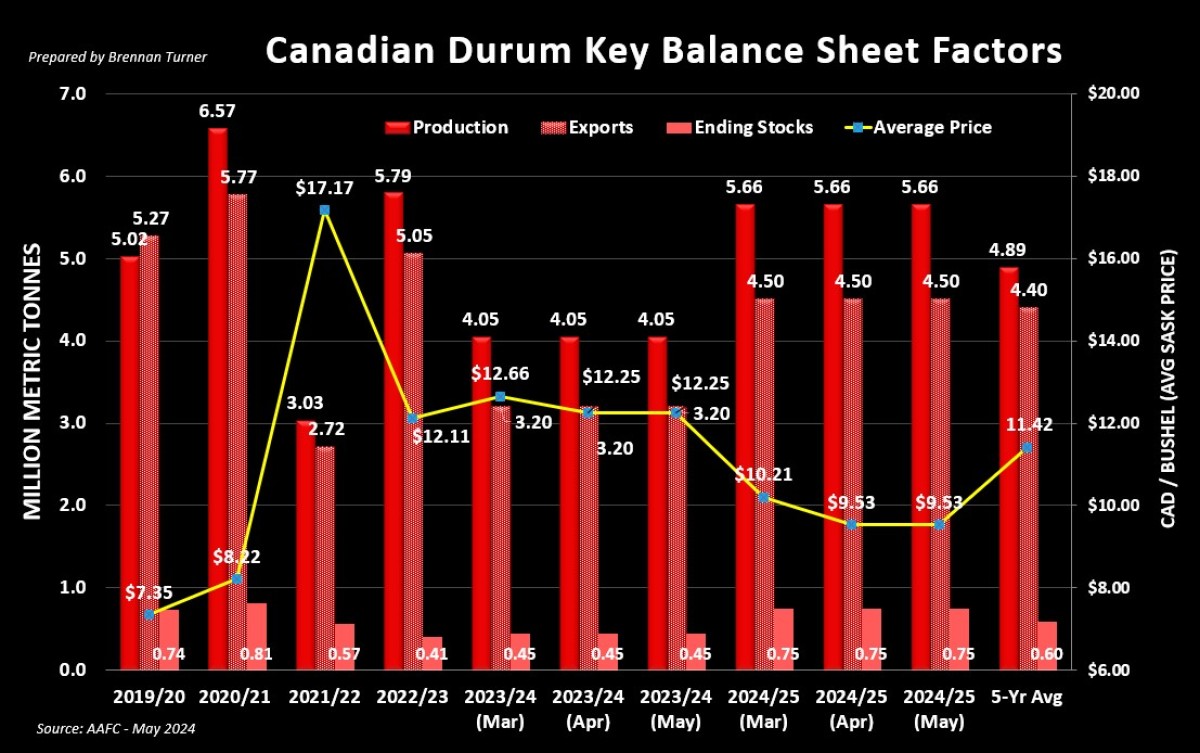

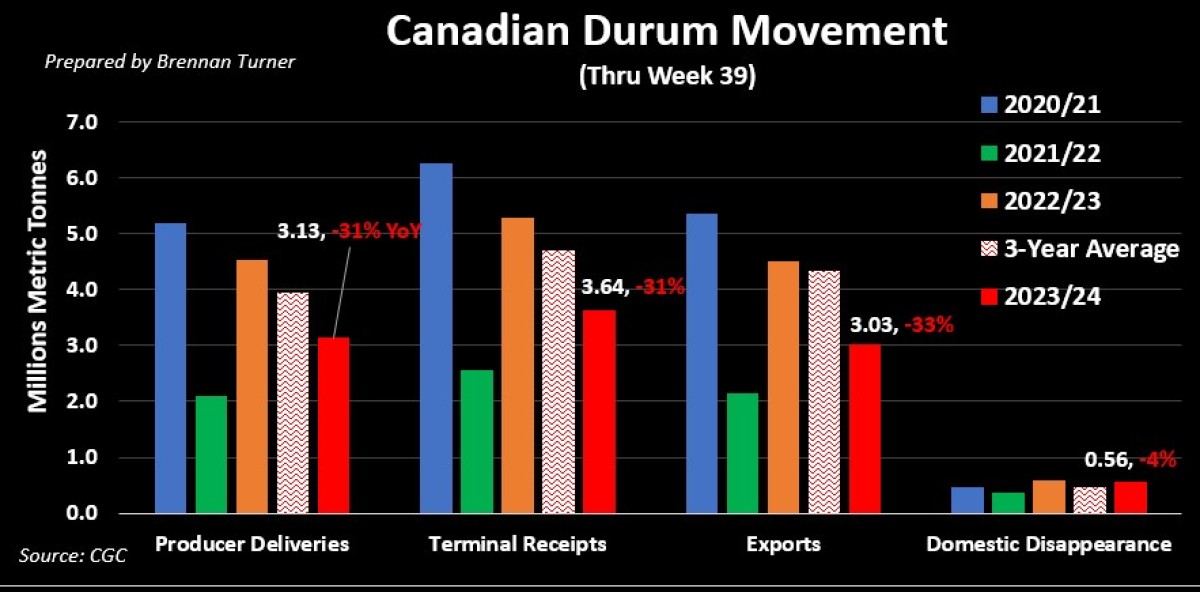

Offsetting Durum Trade Updates

- AAFC didn’t touch the durum balance sheet in their latest update. This means it’s possible that Canadian durum exports could surpass the 3.2 MMT forecast, after passing the 3 MMT level in Week 43.

- Weekly durum exports in the last 3 months of the crop year are usually one-third lower than the previous 42 weeks, but even if that materializes, we still might end up closer to 3.3 MMT.

- Forward-looking to 2024/25, Tunisia and Morocco are likely going to be in the market for more durum, while Europe and Algeria will enjoy a rebound in their own production.

- Durum production in Morocco is estimated to be 25% below the five-year average, due to very dry conditions from December to February.

- Algeria’s durum harvest should be about average, as some production areas received good rains while others did not.

India: The Next Great Beer Market?

- Carlsberg, AB-InBev, and United Breweries (a Heineken subsidiary), operate 36 breweries in India and, combined, own 85% of the beer sales in the country. Last week, they announced the formation of the Brewers Association of India (BAI), and its partnership with the World Brewing Alliance.

- This is notable as the Indian beer market has been stagnant the last few years, despite one of the fastest-growing consumerism economies.

- The two main reason behind the slow growth (and likely something that the BAI will lobby for) is restrictive retail licensing rules and the general taxation of liquor, which is by volume, not alcohol content like most other countries. This makes beer more expensive than spirits in relative terms.

- Despite 17.5% of the world’s population living in India, beer sales in India total less than 1% of global sales, meaning a very large upside if the BAI can effectively promote “innovation, responsible drinking, and sustainable practices” like they say they will.

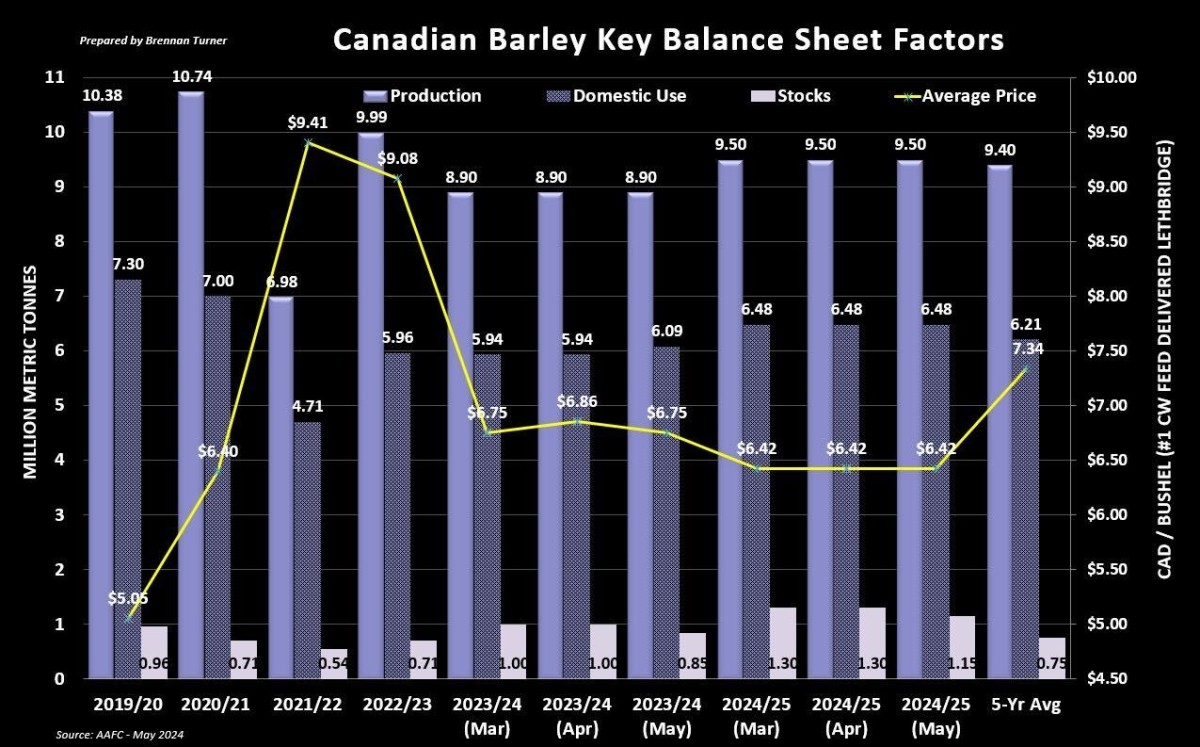

- As per the International Grains Council, global barley supplies in 2024/25 are expected to be the lowest in 5 years.

- Corn and other feedstuffs are replacing barley in rations, and so global demand for feed barley is estimated at a five-year low.

- Demand for barley from a feed, seed, and industrial standpoint though should hit a record high.

- The European Commission raised its barley 2024/25 production forecast by 300,000 MT to 53.9 MMT.

- The large majority of Europe’s fall-seed barley crop looks okay, but planting of spring barley has been delayed because of the wet conditions, namely in western and northern countries, including the United Kingdom.

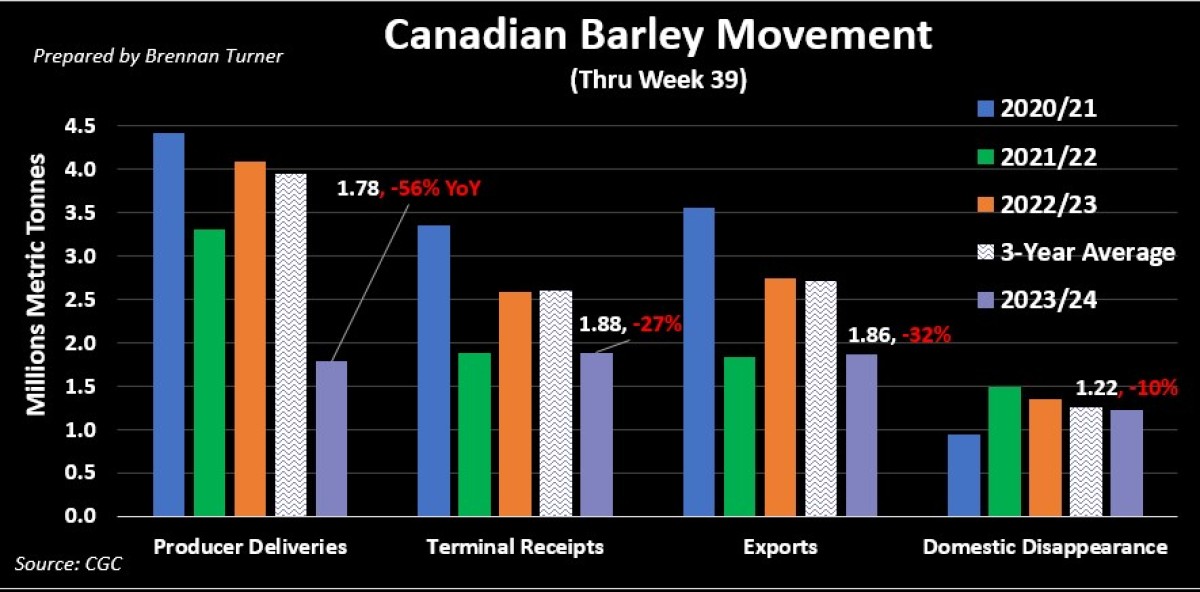

- All of this is notable for Canadian barley as the cereal looks for new demand opportunities since we’re set to only export 2.75 MMT of combined barley and related products (i.e. malt) this year, versus the 3.9 MMT shipped last year.

- China remains the largest destination (86% of all grain exports) as do the U.S. (11% of all grain, 57% of all grain equivalent exports), and Japan (4% of all grain, 22% of all product equivalents).

- Agriculture Canada did raise 2023/24 old crop feed use by 150,000 MT, essentially matching the year prior, but that still keeps ending stocks at a healthy 850,000 MT.

- This 150,000 MT reduction was passed through to the 2024/25 balance sheet, with its ending stocks now sitting at 1.15 MMT, which, if realized, would be the largest since 2017/18.

To growth,

Brennan Turner

Independent Grain Market Analyst