Sliding Weather, Feed Demand and Prices

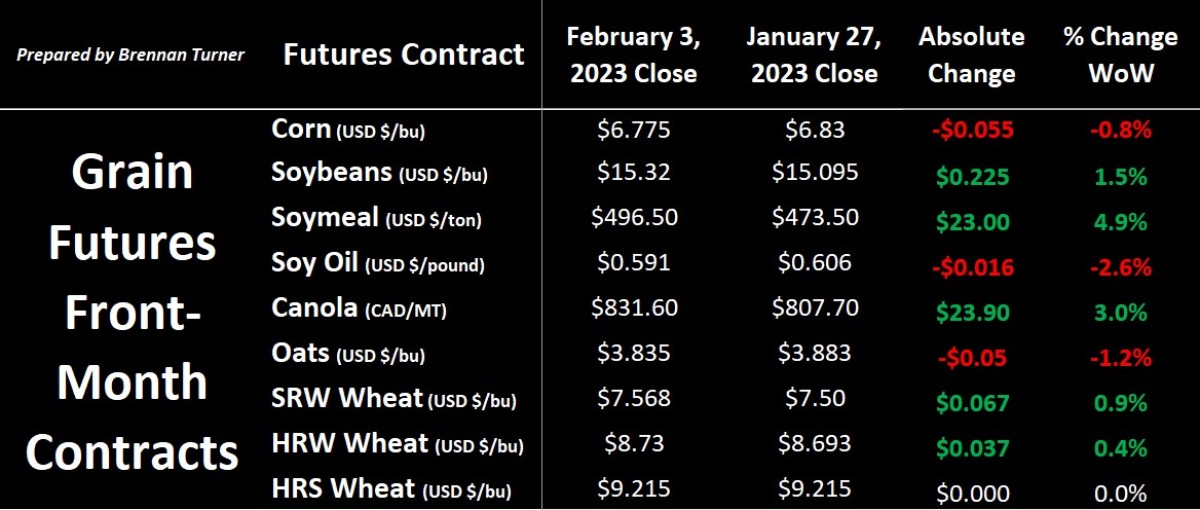

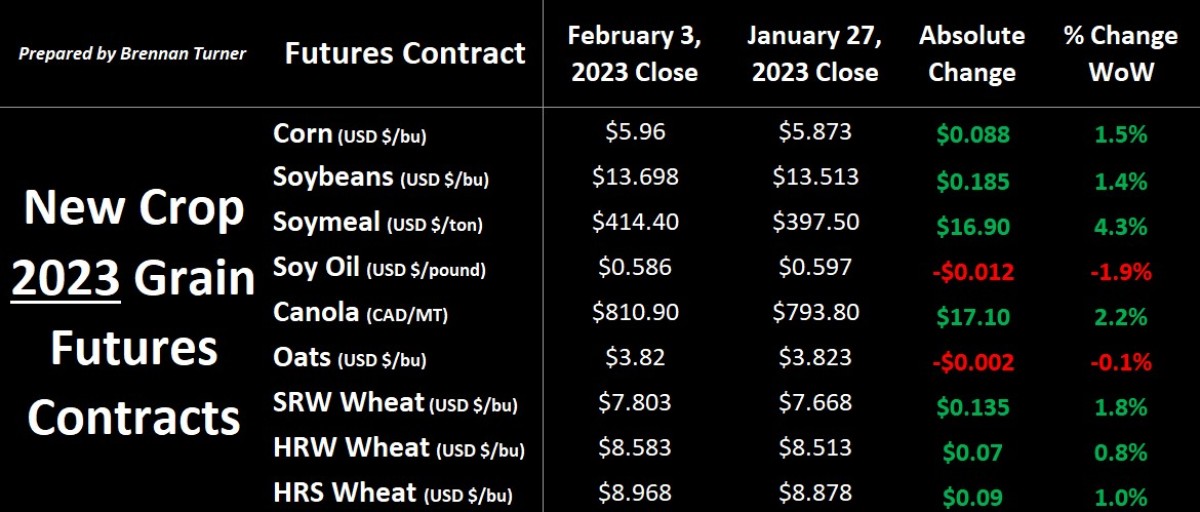

Grain markets were mixed as the calendar flipped to February, thanks to some better moisture forecasts in the Americas and less volatility ahead of the USDA’s monthly WASDE report, published this Wednesday. Soybeans gained some ground on news that, despite a record 153.5 MMT crop, Brazilian farmers are harvesting it slower than usual, and that they haven’t forward contracted nearly as much as usual (31% versus the average of 45%). As a result of the slow harvest, this also means a slower start to the planting campaign for Brazil’s second / safrinha corn crop, which supported new crop corn futures up in the U.S. Old crop corn prices didn’t fare too well, however, as buzz continues to build for smaller demand from both China and the U.S. livestock industry. Old and new crop winter wheat ended the week in the green, on some fresh crop ratings updates, but only new crop hard red spring wheat was able to find some gains.

While I’ll be watching updated wheat export numbers from the USDA for the likes of Russia, Australia, Canada, the U.S., and the E.U. (as well as the Bloc’s carryout), the rest of the market will be focusing on what corn and soybean production numbers get printed for South America. Some good rains recently have helped the parched areas of southern Brazil and Argentina, but the potential yield upside seems to be fairly limited at this point in the growing season. Thus, barring some massive bullish surprise on Wednesday from the USDA, the market is likely closer to pricing in the true size, which means the South American growing season premiums are fading away.

Part of the reason we’re seeing such a fade is also because the conditions seen lately continue to support the notion that La Nina is starting to fade. Along that line of thinking, World Weather Inc. is suggesting that there could be more frequent rainfall and cool conditions in the U.S. Southern Plains and Midwest this spring. This would certainly be appreciated by these regions, not just for the replenishing river water levels (would help improve grain-by-barge logistics), but also soil moisture levels. On that note, the January crop progress reports for U.S. winter wheat crop suggest the portion of the crop in Kansas and Texas rated good-to-excellent inched higher, but Oklahoma’s had a noticeable drop.

However, the forecast from World Weather also suggests that the changing weather patterns could mean the moisture events may not make it to the U.S. Northern Plains and Canadian Prairies in the spring. Given the ongoing dryness issues the region has experienced the last few years, we could start to see some weather premiums come into new crop bids for the likes of durum earlier than usual. That said, speculating at this point about the size of Canada’s Harvest 2023 is just as easy as hitting a bullseye while wearing a blindfold. Suffice to say, with high crop prices remaining across the board, acreage intentions are still somewhat in flux.

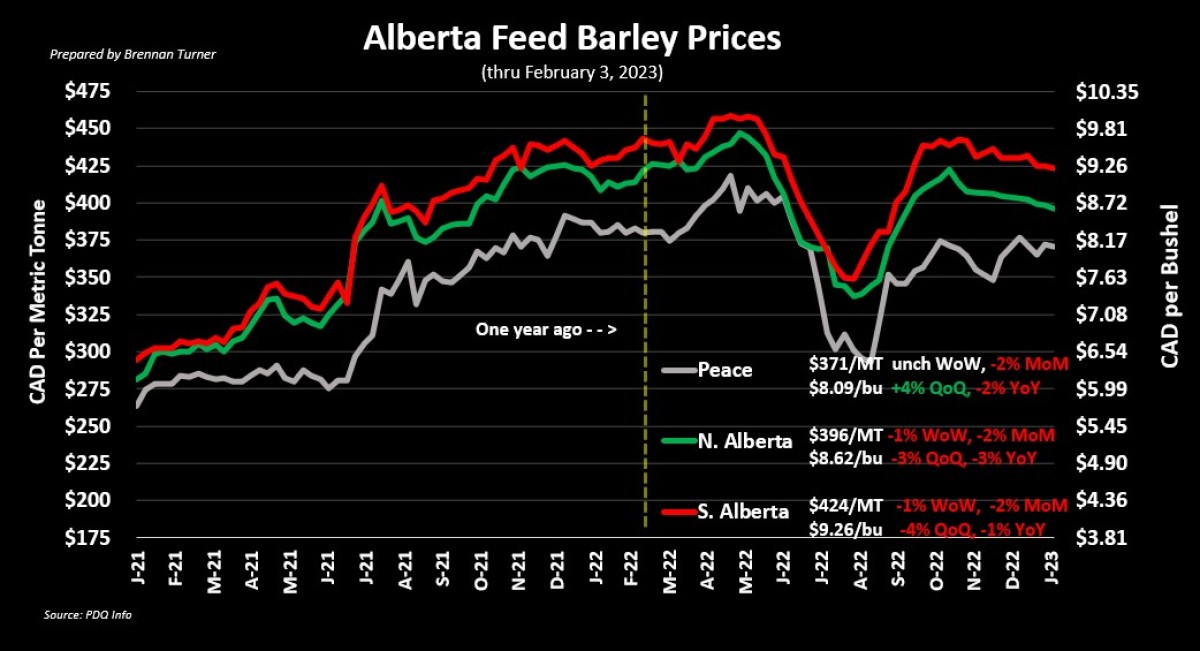

Therein, focusing your attention on the known variables, demand may also be in flux for a few crops like wheat and barley as China has started renewing its interest in corn for its feed rations. Given that the Chinese market has been supportive for Canadian wheat and barley, and especially U.S. corn in recent years, their move to source more from Brazil comes as other feedstuff values stay elevated. While high prices are pushing wheat, barley, sorghum, and even peas away, the origin substitution effects are very real as well since China’s purchases of U.S. corn is about 70% less than it was at this time a year ago.

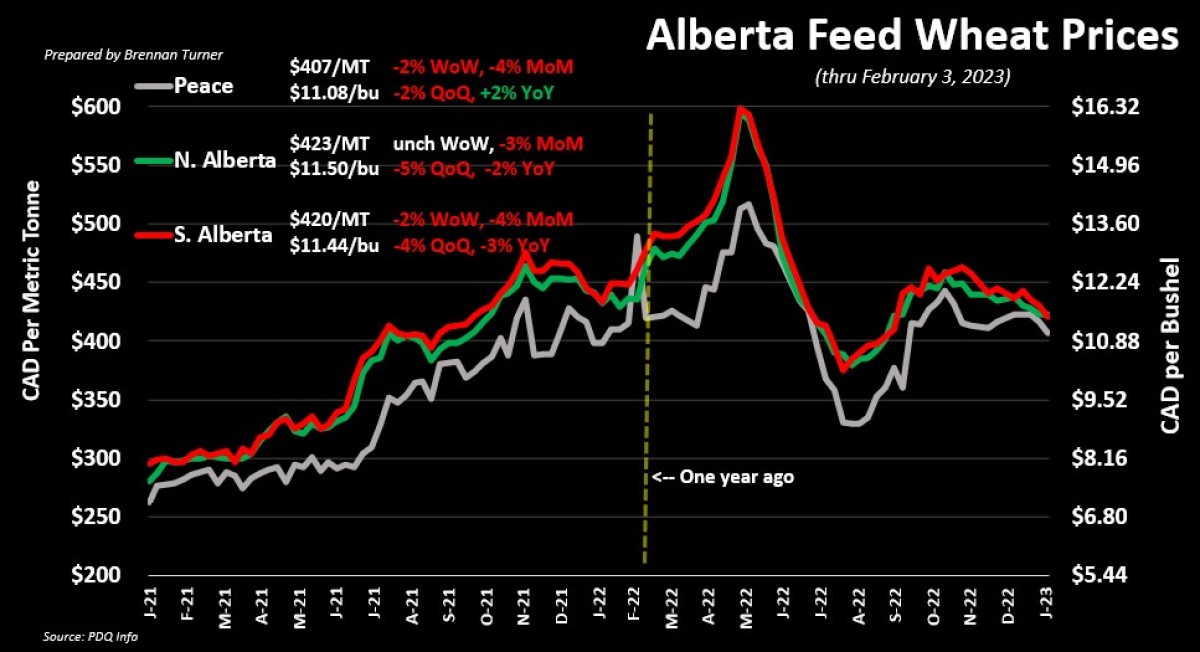

That’s not the only market though where U.S. corn is seeing less demand though; last week’s USDA cattle inventory report as of January 1, 2023 suggested a 4% decline year-over-year to 28.9M head, with total inventory reaching its lowest supply level in over 50 years. Accordingly, less animals means less corn (or wheat) being needed in troughs, thereby improving carryout numbers and likely putting some pressure on prices. Combined with the demand from China for non-American corn, there’s suddenly more feedstuffs to go around on this continent! This would include Canadian feed wheat and barley, and so, as this demand momentum shifts, prices for these crops are more likely to come down than to spike higher. Adding weight to this theory is that, even despite some colder temperatures recently, feed grain prices are continuing their trend of sliding lower.

To growth,

Brennan Turner

Independent Grain Market Analyst