Southern Hemisphere Watch Amidst USDA Surprises

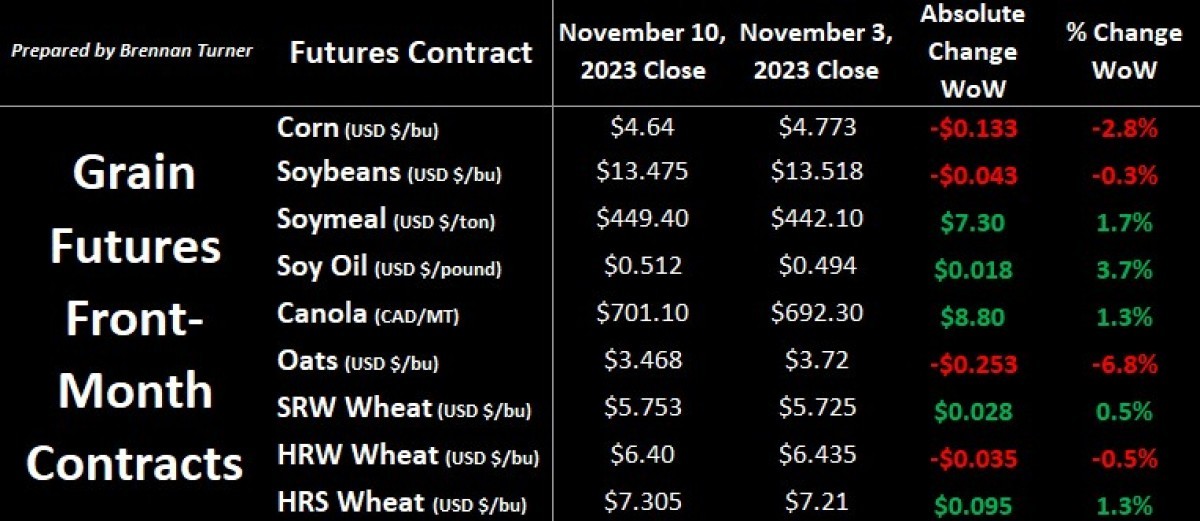

Grain markets had a mixed week as the complex started strong before sputtering into the USDA’s November WASDE last Thursday and seeing mostly a sell-off thereafter.

On November 9, the UDSA surprised the market by raising both U.S. Corn and Soybean yields, whereas the pre-trade estimation suggested a further reduction from the October numbers. Frankly, there is not much historical precedent for yields being lowered in October and then raised in November. The market reacted negatively, especially to corn which saw its lowest weekly close in almost three years! Wheat prices ended the week mixed as some changes to the global balance sheet led to some re-positioning but mostly followed corn lower in the second half of the week.

Before digging into the wheat side of the report, the USDA shocked grain markets by raising average U.S. Corn yields by 1.9 bushels per acre (bpa) from last month to 174.9, when the trade was expected to see 173.4. Similarly, soybean yields were upgraded by 0.3 bpa to 49.9, when the expectations were for no changes. The market likely would’ve sold off more had it not been for U.S. domestic corn demand being raised by 125M bushels in this report and the South American weather story that’s starting to create some bullish tailwinds for soybeans. That said, a lot of commentary I saw post-WASDE noted that the U.S. corn balance sheet is starting to look heavier at 2.16 billion bushels (or 54.75 MMT), which would be nearly a 60 per cent jump over last year. If corn acres continue to compete with soybean and anywhere close to 90M acres are planted next spring, some reports believe the 2024/25 U.S. Corn ending stocks could surpass three billion bushels (or 76.2 MMT).

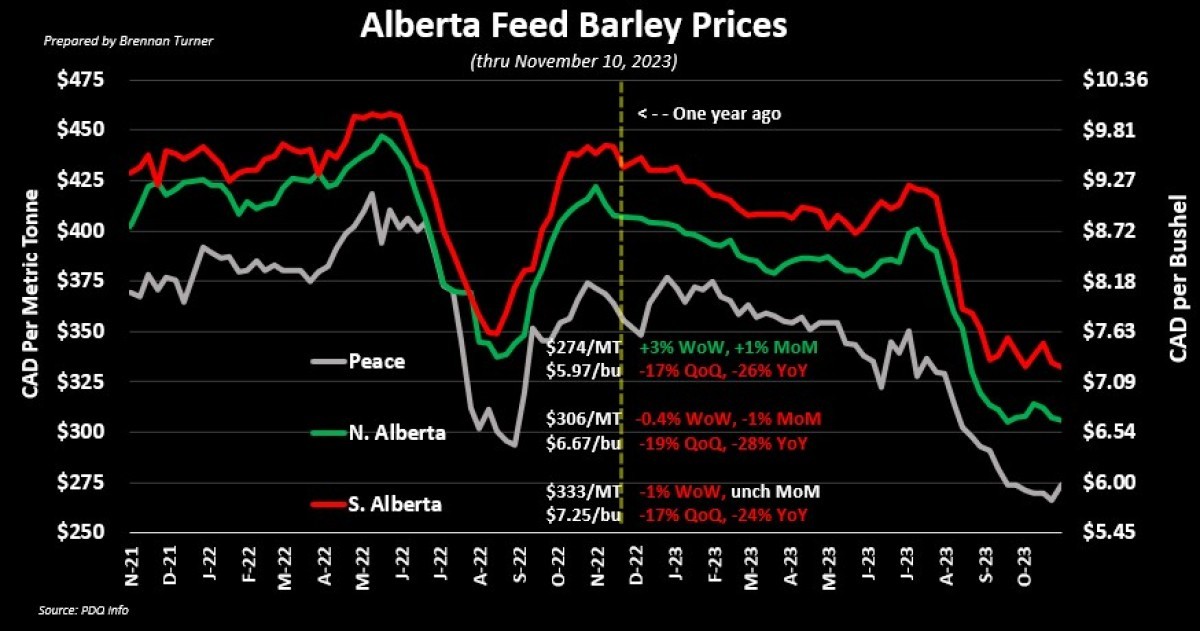

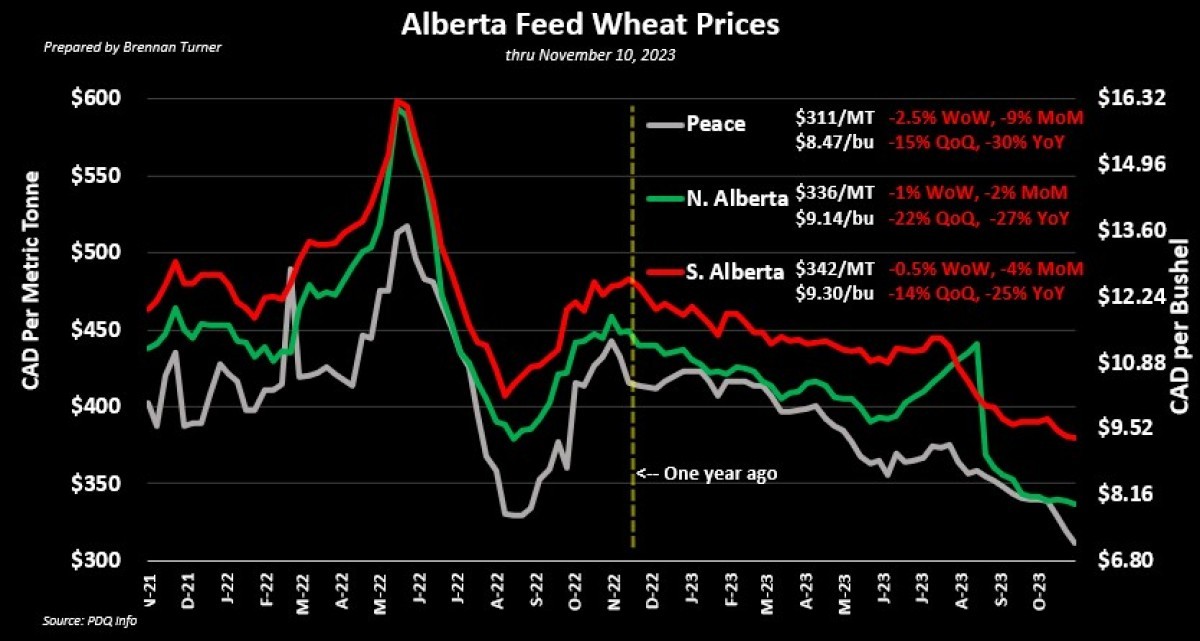

Should U.S. Corn supplies balloon to that level, I wouldn’t be surprised if there was a low $3 handle on the futures board and the impact would certainly be felt domestically. In fact, the larger U.S. Corn supplies are already putting a dent in the Western Canadian feed market, as it’s been suggested that buyers are basically covered through the end of the calendar year. With more U.S. Corn guaranteed to make its way into Canada this winter, the substitution effect of this cheaper feed option is real. Combined with there being just more sellers than there are buyers, we’ve seen feed wheat and barley values continue to decline. With that, we have seen values start to level out a bit after the heavy plunge through September. If I need to make a sale, I’m looking for upside opportunities to pull the trigger between now and the end of January 2024.

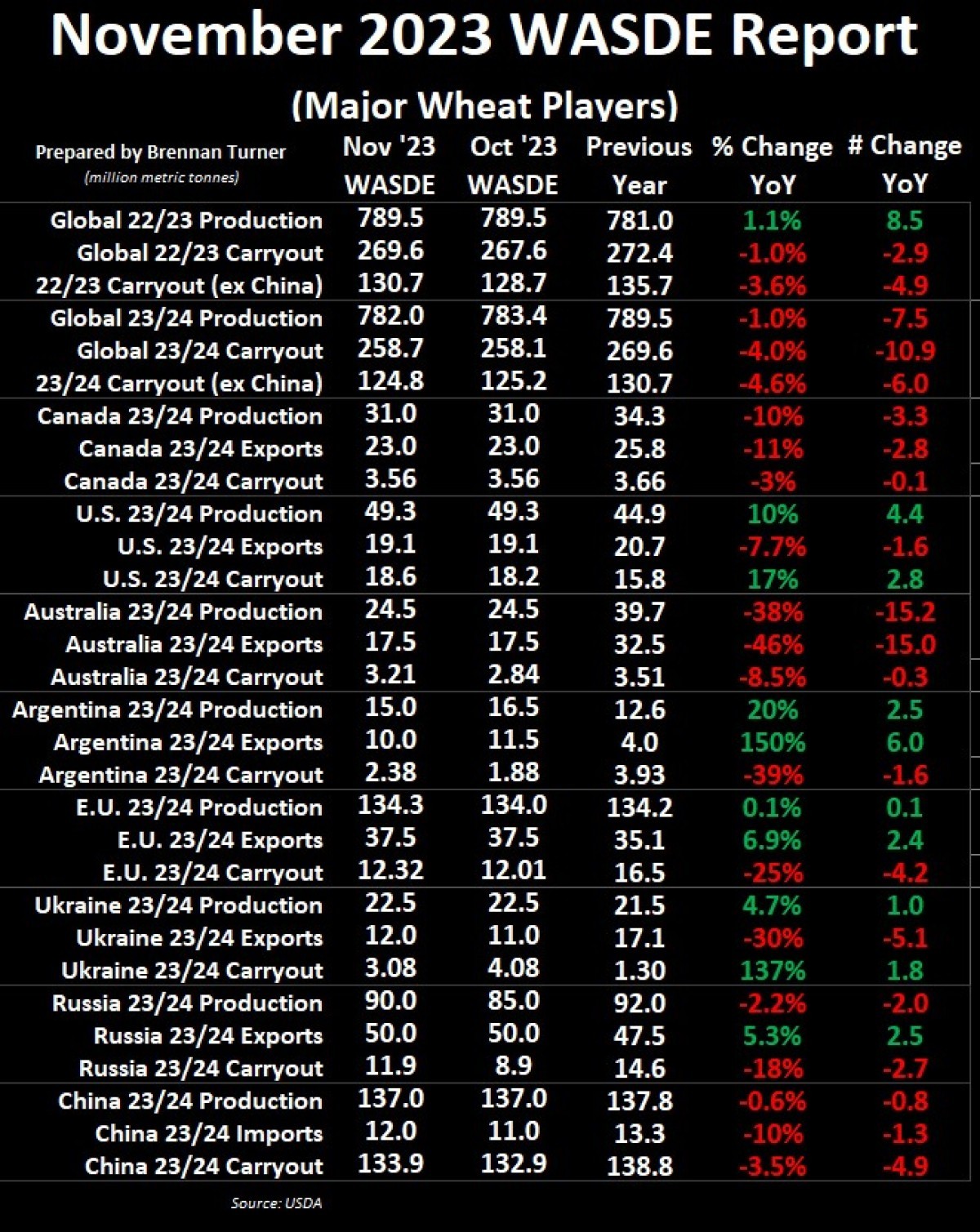

Back to the WASDE report, the USDA noted slightly larger wheat imports by the United States, and combined with lower food use, U.S. Wheat ending stocks were raised by 14M bushels to 684M (or up 380,000 MT to 18.6 MMT). In fact, in the July-September quarter, wheat used in the milling market was the smallest for this summer calendar quarter since the data started to get tracked a decade ago. It’s unclear if this is a general trend yet, but it’s also worth noting from a demand standpoint that U.S. wheat exports in September totalled 67.6M bushels (or 1.84 MMT), which would be a five-year low for this specific month.

Globally, given the time of year, most of the balance sheet changes continue to come from the southern hemisphere. In Australia, old-crop wheat exports were lowered by 700,000 MT, which helped push their 2022/23 crop year-ending stocks by the same amount. Combined with an extra 300,000 MT of domestic wheat feed use in Australia and some other subtle balance sheet changes, ending stocks for the current crop year were raised by 370,000 MT to 3.21 MMT (still pretty tight!).

The bigger news for wheat was likely from Argentina, where old-crop wheat exports were lowered by 500,000 MT, which pushed their old-crop ending stocks up by the same amount. However, this was more than offset by the 1.5 MMT drop in production that the USDA said, suggesting that Argentine farmers will only produce 15 MMT this year (compare this to local estimates of 15.4 MMT from the Buenos Aires Grain Exchange and 13.5 MMT from the Rosario Grain Exchange). It’s estimated that about 15 per cent of Argentina’s wheat harvest has been completed, but there continues to be concerns of late frosts damaging the remainder of fields not yet threshed. As it stands today, because of the production reduction, the USDA also lowered Argentina’s wheat exports this month by 1.5 MMT to now sit at 10 MMT (they shipped out just 4 MMT last year after a drought-riddled harvest).

The Canadian wheat balance sheet wasn’t changed, but Russia’s production was increased by a substantial 5 MMT, and with exports stayed at 50 MMT, ending stocks only climbed by 3 MMT (domestic use accounted for the other 2 MMT). Meanwhile, European Union wheat harvest was raised by 300,000 MT, which went straight into the ending stocks category. Something to note for next year is that rains in France have delayed the fall wheat seeding campaign, as only two-thirds of fields were planted through last week, well behind the 83 per cent five-year average. On the demand side of things, it’s worth noting that the USDA increased China’s imports by 1 MMT to now sit at 12 MMT, something Canadian exporters are targeting.

Overall, right now, the market seems to be mostly focused on what weather South American fields will receive over the next two to three months, and for obvious reasons. For example, the state of Mato Grosso in west-central Brazil produces as much soybeans as Iowa, Illinois, and Minnesota combined, but the region is expected to see hot, dry conditions for the next ten days, a time when most seeds are trying to germinate. Arguably, some of this weather premium could already be priced in. However, if weather in Brazil does not help the crop there, soybean prices should climb, which would force corn prices to climb here in North America, as they try to compete for Plant 2024 acres. If corn prices climb, wheat prices should also rally, given corn and wheat being interchangeably used in feed rations (but depending on the price!)

To growth,

Brennan Turner

Independent Grain Market Analyst