Springing Into Seasonal Swings

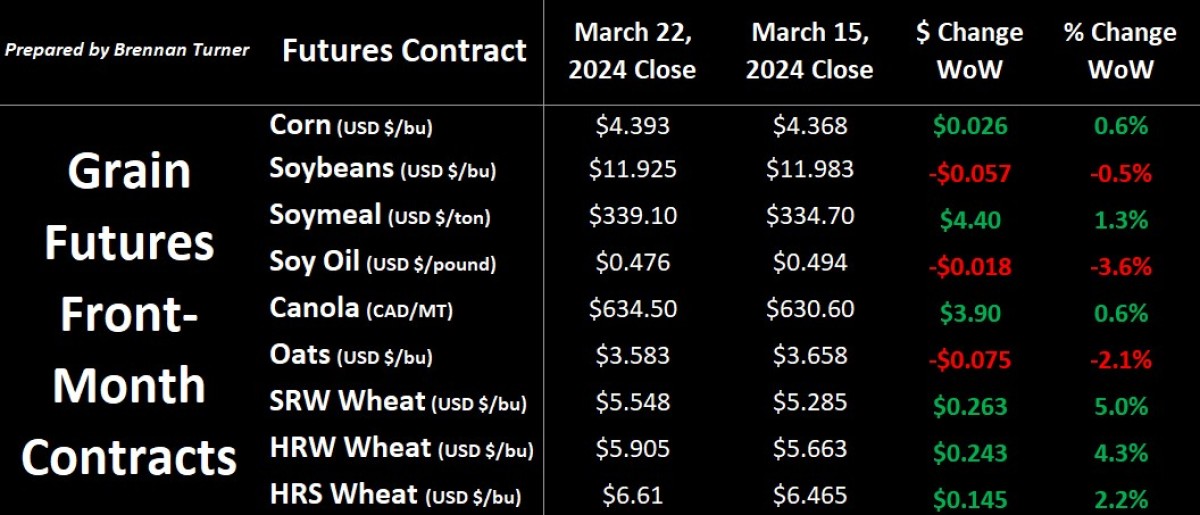

Grain markets were primarily green last week being led by the wheat complex, mainly due to technical positioning ahead of the USDA’s Plant 2024 forecast update. This report will be released Thursday, March 28. The market has adjusted to the expectations shared over a month ago at the USDA’s Ag Outlook Forum, namely a 4M-acre increase year-over-year in U.S soybean area to 87.5M, and a 3.6M acre decrease in corn to 91M. There’s some buzz going into the report that more corn could get planted than initially thought, so it would be fairly bearish should the report come in anywhere close to 93M acres.

Returning to the wheat complex, despite expected U.S. export cancellations bringing total sales to a marketing-year low, short-covering helped inflate futures higher across all three exchanges. This week is the end of the month and the end of the quarter. With the USDA Prospective Plantings report, we should expect to see some big volatility, especially with the record short position held by managed money in corn and near-records in soybean and wheat.

More Wheat Eyes on the Black Sea

- The big headline last week was that the EU is proposing to put a €95/MT tariff (or $140 CAD/MT) on Russian and Belarusian grain imports, but most market participants believe this will have little impact on the market.

- Russia expects to see another big wheat harvest in 2024 with Institute for Agricultural Market Studies (IKAR) estimating 93 MMT and SovEcon at 94 MMT.

- Conversely, Ukraine will see a smaller wheat harvest in 2024/25, with the Ukraine Grain Association (UGA) forecasting 20 MMT. If realized, it would be the smallest in two decades, and 15 per cent lower year-over-year (YoY).

- Ukrainian wheat exports in 2024/25 are expected to fall similarly, down 3 MMT YoY to 13 MMT. For perspective, with two months left to go in the current crop year, Ukrainian wheat exports have totalled just under 13 MMT.

- European wheat production forecasts continue to fall, due to the record rains received over the last two months.

- India says that it will import 33.5 MMT of wheat in 2024/25, up nearly 30 per cent year-over-year. The announcement comes as wheat inventories in the country sit at seven-year lows.

- Expectations are that more wheat will get planted in Australia for the 2024/25 crop year as margins turn more favourable, relative to other options in Australia.

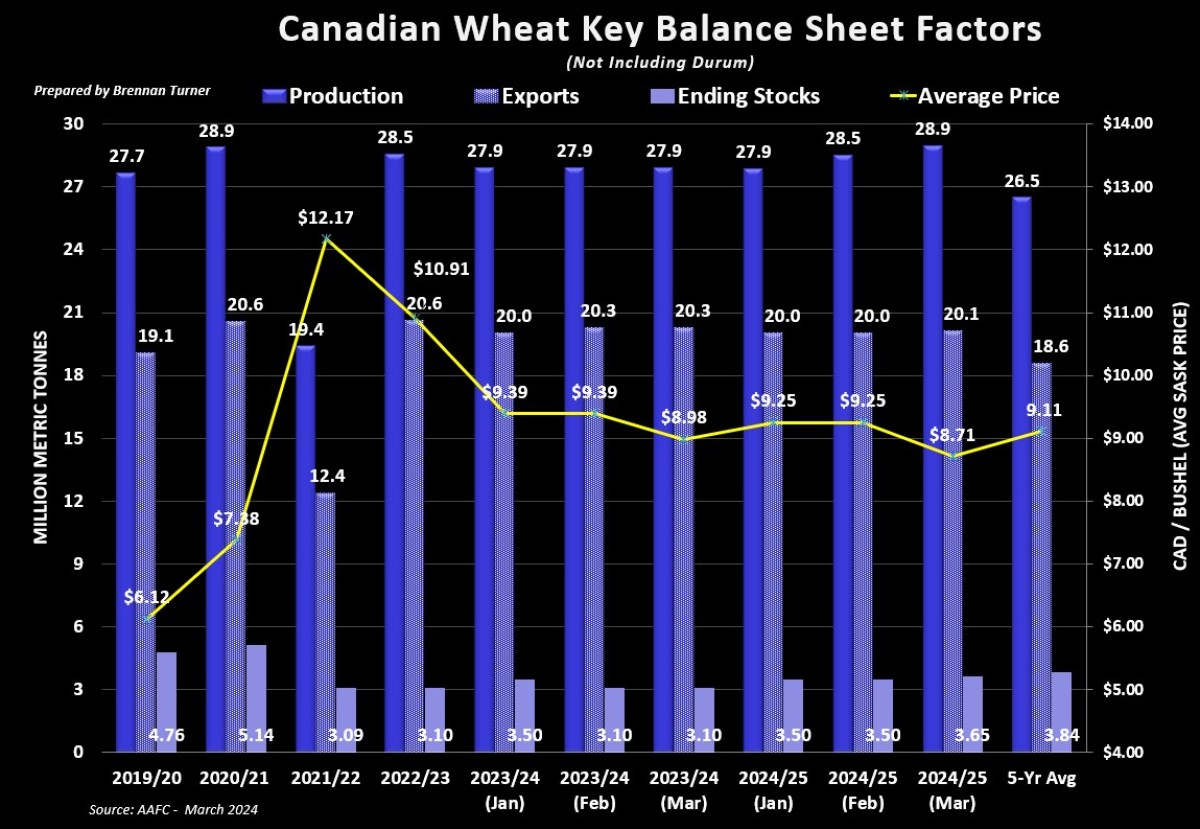

More Canadian Wheat Acres = More Supply

- Agriculture Canada took in Statistics Canada’s March 11 seeding intentions data and raised its estimate for non-durum wheat to just under 29 MMT. If realized, it would be the second-largest harvest since Harvest 2013’s 31 MMT crop.

- Exports weren’t raised all that much, and so ending stocks were raised slightly to 3.65, which, outside of the last two years, still remains historically tight.

- All of this is based on more average growing conditions, and while the recent snowfall events have been helpful, soil moisture remains well below the average in the Prairies.

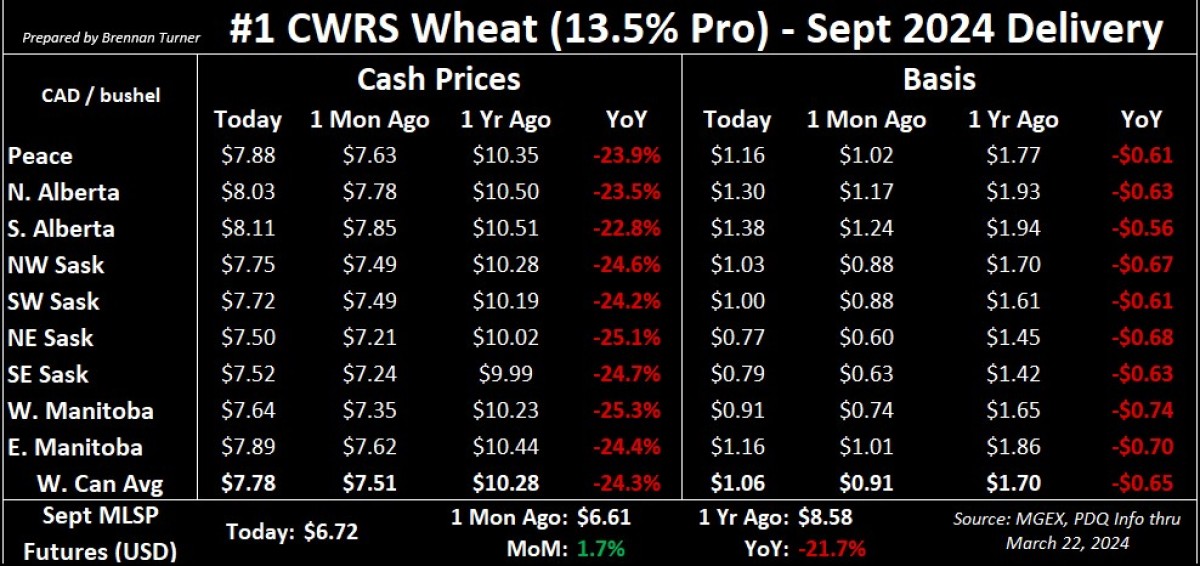

- New crop wheat prices in Western Canada have improved marginally over the past month, thanks to a mix of futures and the basis climbing higher.

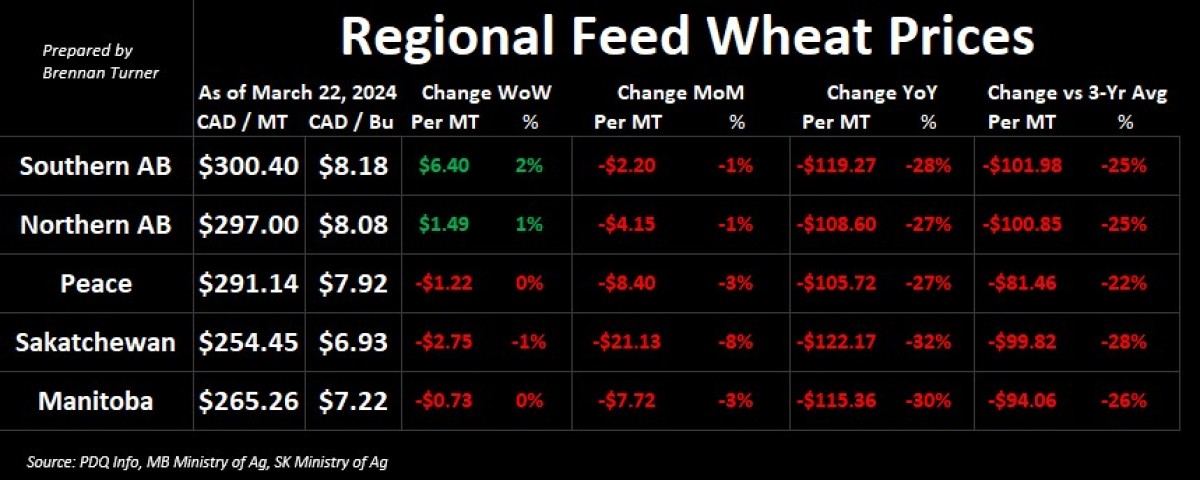

- Feed wheat prices have started to level off and if seasonality comes into play, then we could see some premiums built back into the market over the next four to eight weeks.

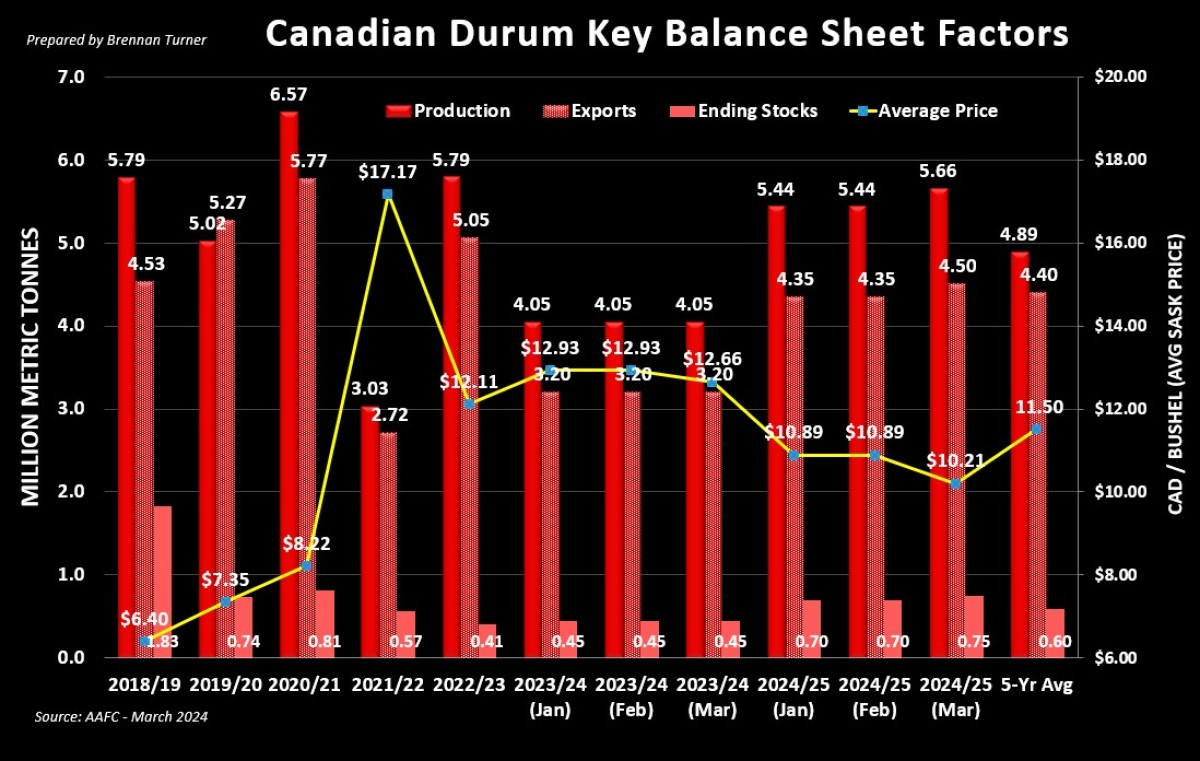

Tight Global Durum Balance Sheet?

- The International Grains Council lowered its estimate of European Union durum production in 2024/25 to now sit at 7.5 MMT.

- Persistent drought conditions are going to limit yield potential in Italy and Spain, while France’s good-to-excellent rating is just 74 per cent (it was 92 per cent a year ago).

- North Africa will again be a net importer, thanks to similarly poor weather in Morocco and Algeria. Tunisia has enjoyed some timely rains and so the durum harvest is now projected to be more average.

- The big cloud hanging over the durum market continues to be production and exports from Turkey, Russia and Kazakhstan.

- With expanded acreage and production, it seems unlikely that we’ll hit AAFC’s full-year export target of 3.2 MMT. It would be similarly doubtful to reach 4.5 MMT next year.

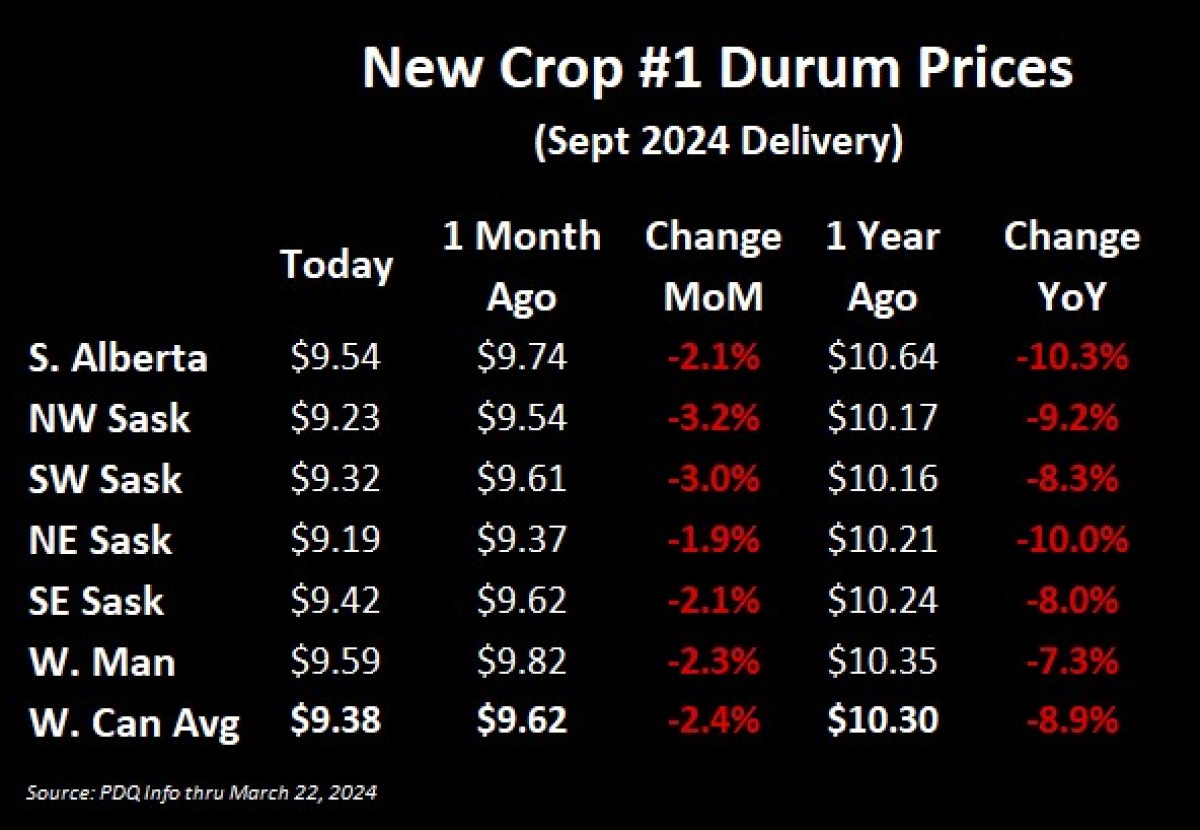

- The bigger domestic production and international competition is largely why we continue to see new crop prices trickle lower. If weather premiums do pop up, expect the best opportunities in mid-May or late July.

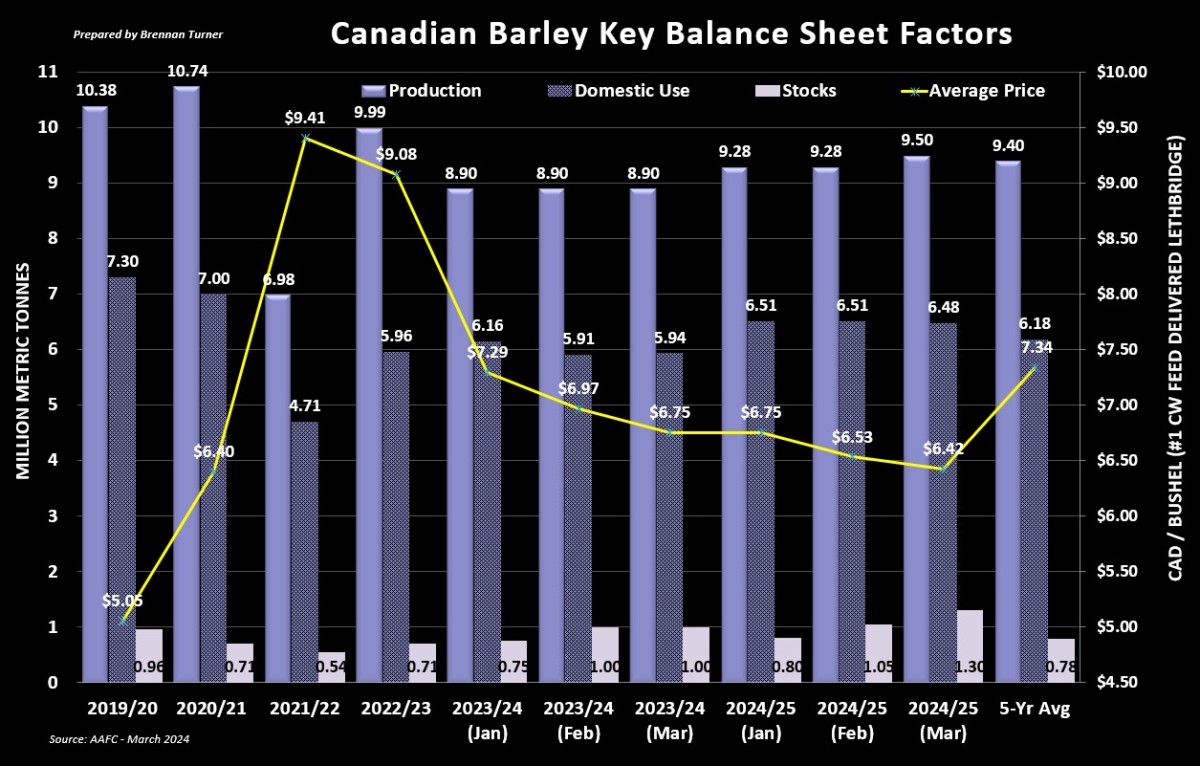

Barley Prices Levelling Out

- The USDA is forecasting that world barley supply in 2023/24 will be the lowest in five years.

- They’re also estimating global demand for animal feed to be at a five-year low, with above-average food, seed, and industrial use balancing things out a bit.

- Nonetheless, world barley stocks are projected to end 2024/25 at an all-time low.

- The UGA says Ukraine barley exports will fall by 20 per cent in 2024/25 to 2 MMT, due to reduced acreage and logistics challenges.

- The lower global production and smaller exports from Ukraine could help the Canadian balance sheet, but Agriculture Canada is keeping their forecast of 2.75 MMT in 2024/25 (the same as 2023/24) because of the slowdown in shipments to China, Japan, Mexico and the U.S.

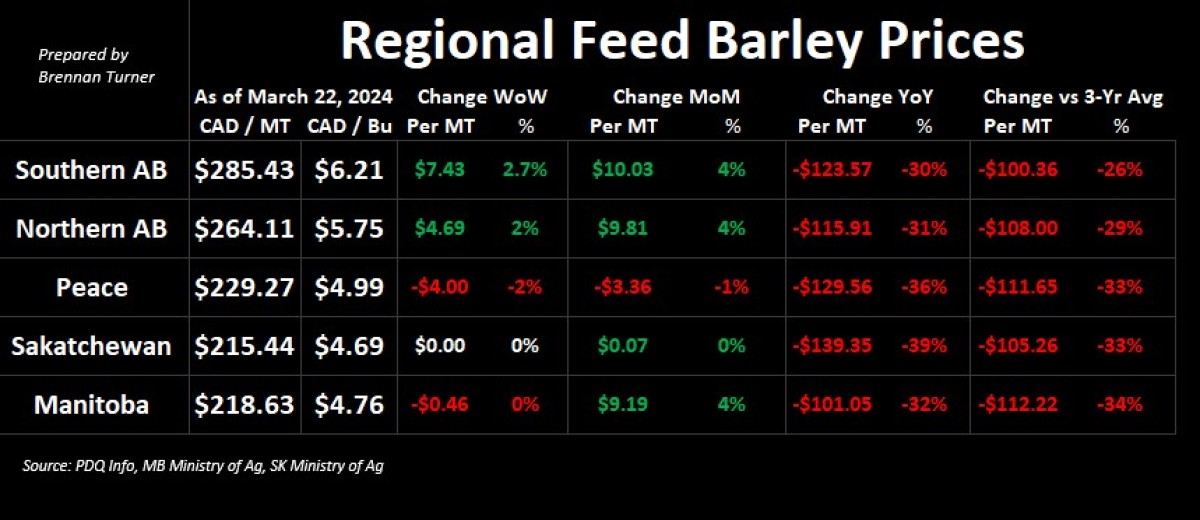

- The good news is that feed and malt barley prices seem to be levelling off, and so we may see a seasonal bounce.

To growth,

Brennan Turner

Independent Grain Markets Analyst