Start of a Weather Market?

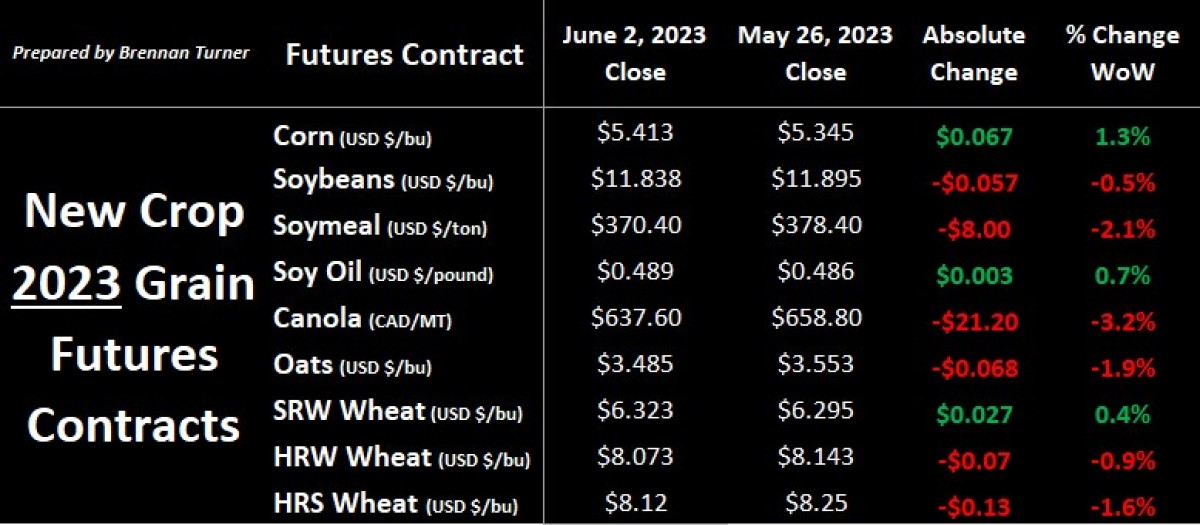

Grain markets saw some heavy selling the last few days of March (read: profit-taking), before bargain buying and weather market bullishness rallied the complex for a mixed close. Dry conditions expanded across the Midwest last week, and with the 10-15 day forecast suggesting more of the same, traders bought the volatile dip. With the weather premium starting to get built in, the week closed higher suggesting that there’s some momentum here, as yield potential does decline a bit, should dryness persist into the middle of June. While the wheat complex saw gains later in the week as well, the early week selling could not be made up for, as well as sentiment that the U.S. and Canadian spring wheat crops look like they’re having a pretty good start. For the month of May, only old crop corn, new crop oats, and old and new crop HRW wheat found a positive gain.

Before looking deeper at North America, tension remains in the Black Sea about Russia executing the Grain Corridor Deal to the terms agreed upon a few weeks ago. In the last few remaining few days of May, Russia registered only one ship for inspection, despite the fact there’s currently 50 waiting in Turkish waters, including some that have been there for more than three months. Russia has admitted they are purposefully limiting the ship registrations, namely to the port of Pivdennyi (one of three that ships are allowed to load from), until the transit of Russian ammonia through the port is unblocked. Ukraine says they’d only be open to this if a wider range of commodities was added to the agreement, as well as more Ukrainian ports to load ships through. Should the inspection tally remain small, the Ukrainian government says they have a Plan B, using nearly $550M USD to help cover the exorbitant insurance premiums and guarantee coverage for shippers not willing to pay the high cost of transport.

Moving further west, China has received some heavy rains in the major northern wheat growing regions, and just as they’re in the middle of harvesting it. The provinces of Henan, Shandong, and Hebei are responsible for nearly two thirds of an expected harvest of 137 MMT in the People’s Republic this year, but rainfall the last week of May was 200% – 600% above normal. Thus, with the crop ripe for cutting, it’s been estimated that at least 30 MMT of production could be affected, with 10 – 20 MMT unsuitable for human consumption due to fusarium, sprouting, and other quality issues. Even more rain was expected over the weekend and into this week. With China expected to surpass Egypt as the world’s largest wheat importer in 2023/24 with 13.5 MMT shipped into country, and the fact that China is already Canada’s largest wheat buyer (literally double the next country), it’s likely more high protein wheat from the U.S. or Canada will be needed to blend with their SRW-type quality.

Therein, the start for this year’s wheat crop looks to be pretty good. In the U.S., the dry weather has helped dry up soils and allow activity to kick into high gear. It’s expected that the American spring wheat planting campaign will be nearing the finish line this week, whereas, in Western Canada, it’s virtually complete. In Manitoba, spring cereals planted are above 95%, while the winter wheat crop there is in mostly good-to-excellent (G/E) condition, with very little winterkill. In Saskatchewan, albeit seeding was slowed at the start a bit, almost all spring wheat and durum fields are seeded by now, and thanks to the timely rains, the crops are starting off nicely with both varieties showing 87% of the crop in G/E shape. Finally, it’s a similar dynamic in Alberta with the wheat planting campaign virtually completed, all with better soil moisture now, albeit the north east and north west regions still have some drier pockets.

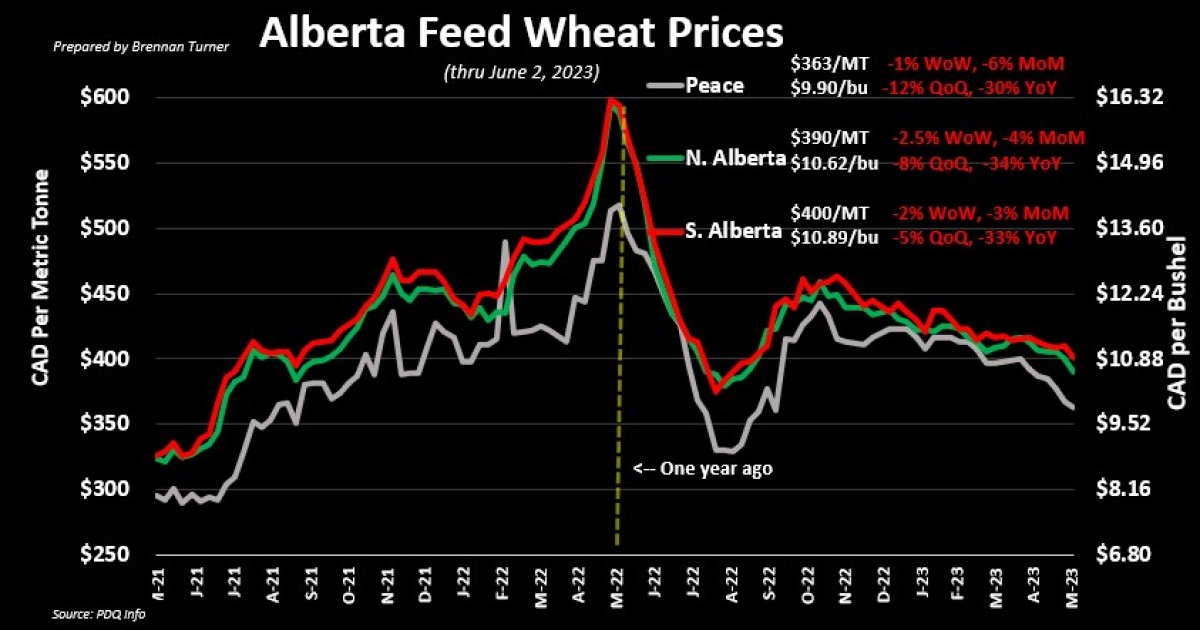

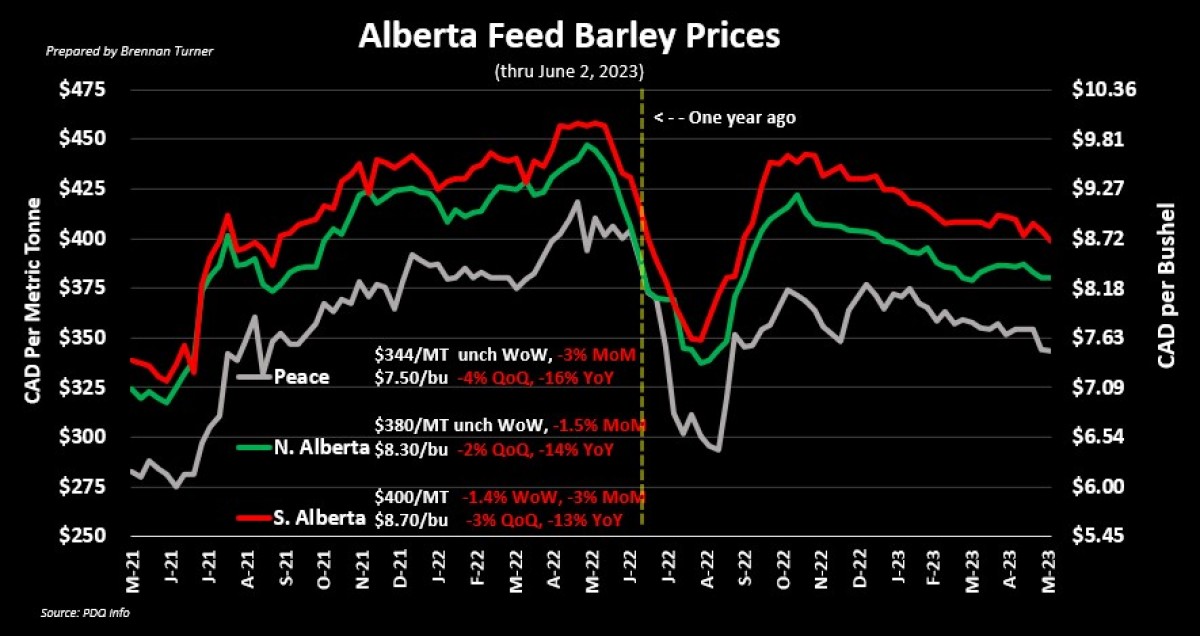

Ultimately, last week’s buying is an indication we’re at the start of a weather market, and accordingly, given the time of year, we may see buyers continue to buy hand-to-mouth. By the middle of June, we should have a sense of weather conditions and if grain markets are going to go higher or lower from here. That said, with the better conditions to start in Western Canada, from my vantage point, cash markets are likely to trend lower. Accordingly, if you’re sitting on any feed wheat or barley, we’re nearing the lows seen at this time a year ago, and given the ongoing market theme this year of posting lower highs, I expect this summer’s lows to be closer to the $250 CAD / MT level for both feed wheat and barley (if not lower, should conditions remain benign). Next week, we’ll dig into the milling wheat market and where prices may head through the summer and post-harvest.

To growth,

Brennan Turner

Independent Grain Market Analyst