Strong Exports in Second Half of 2022/23?

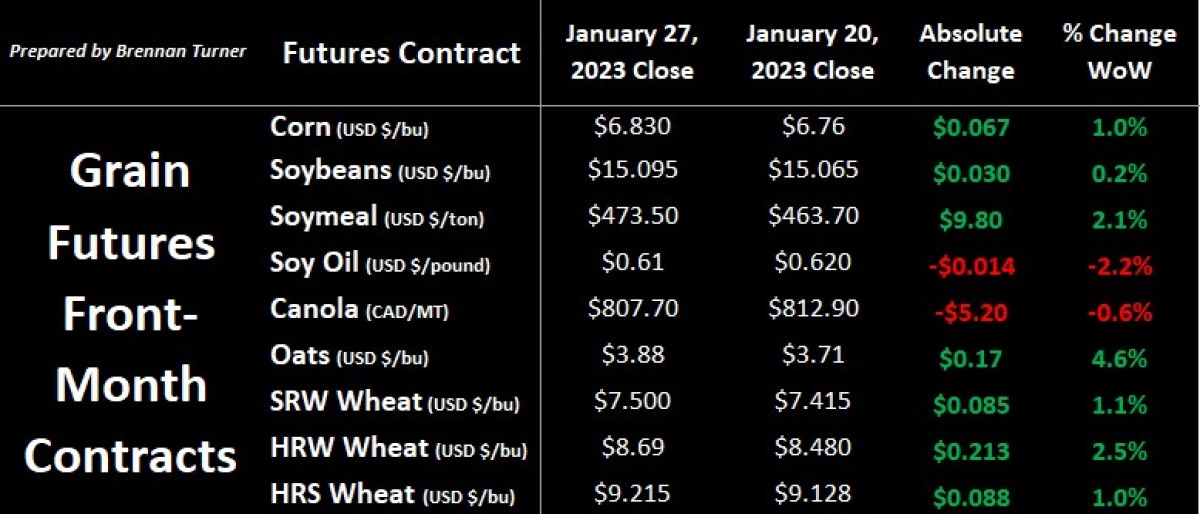

Grain markets were mostly green to finish the last full trading week of January with decent U.S. export sales, another cold snap in the U.S. Southern Plains, and a little premium coming into the market as tensions in the Black Sea are rising again. While rains have been appreciated in super-dry Argentina, the percentage of their corn crop rated good-to-excellent (G/E) climbed just 7 points to 12%, while their soybeans’ G/E rating climbed 4 points to just 7% (still not great). On the geopolitical front, Germany and America are set to supply a couple dozen tanks to Ukraine, alongside the 14 already pledged by the United Kingdom, a sign that Ukrainian forces aren’t going to just play defence anymore and re-pursue Russian-occupied areas in the east. Conversely, Russia is said to be readying its own new offensive within the next month or two, before the foreign tanks from these NATO nations make it to Ukraine. Also, worth noting this past week was the spread between old and new crop futures values widening.

Strong U.S. export sales helped buoy any bearishness from the just-started soybean harvest and better moisture events in Argentina. While U.S. soybean international demand is slightly higher compared to this time a year ago, American corn exports are down 45% year-over-year while U.S. wheat shipments are 7% behind last year’s pace, largely because of the strength of the U.S. Dollar. Perhaps that’s why speculators brought their net-short position Chicago SRW wheat to its largest since May 2019. Meanwhile, Kansas City HRW wheat futures have seen positive gains in 3 straight weeks and 6 of the last 7, but the speculators continue to be bearish, holding a net-short position there as well.

While managed money is betting that the price of wheat will fall, commercials are piling onto the other side of the trade, which could prove profitable, should speculators start to cover their short positions and prices rise. One of the main catalysts for this would be Russia re-igniting their military operations in Ukraine, which could negatively impact grain exports out of the region again. This comes as there is more confirmation that Ukraine’s Harvest 2023 will be even smaller than this past year, something I started flagging as a bullish wheat variable back in June 2022.

This past week, UkrAgroConsult offered an estimate for the Ukrainian wheat harvest of 15.8 MMT, a 16% drop from Harvest 2022 and basically half of Ukraine’s pre-war average wheat harvest. This is a result of not just seeded area dropping 40% year-over-year to 9.3M acres, but also the result of crop input, labour, and fuel shortages, and limited access to affordable working capital (key word here being “affordable”). On the flipside, Ukrainian farmers are expected to harvest more oilseeds, simply because the financial return is greater than wheat or corn, and therefore the cost of logistics is lower per truck, railcar, or boat. Aggregately, the Ukraine Grain Association is predicting its country will produce just 50 MMT of all crops in 2023, down from 67 MMT last year, and the 106 MMT taken off in 2021, before Russia invaded.

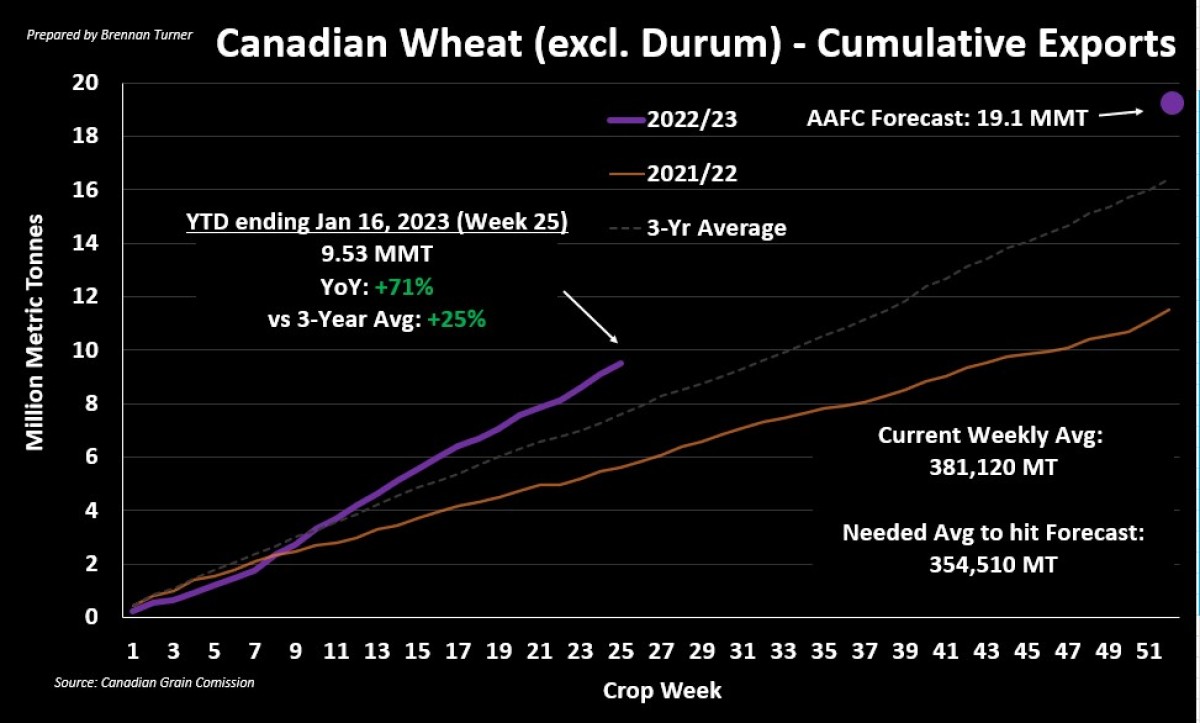

Therein, there’s lots of speculation that even if Russia doesn’t ramp up its military activities in eastern Europe again, there’ll be less wheat flowing out of Ukraine in the 2023/24 crop year and net-exporters like Australia, Canada, and the U.S. would profit. Even Russia could benefit, despite disputes about the size of Russia’s Harvest 2022, and obstacles in shipping it, like financing and insurance. Nonetheless, thanks to the export musical chairs, Canadian wheat has benefited, with 10 MMT in sailings likely achieved by the halfway point of the 2022/23 crop year. Further, as the chart below shows, we’re already averaging more than what’s needed to hit Agriculture Canada’s target of 19.1 MMT of shipments this season.

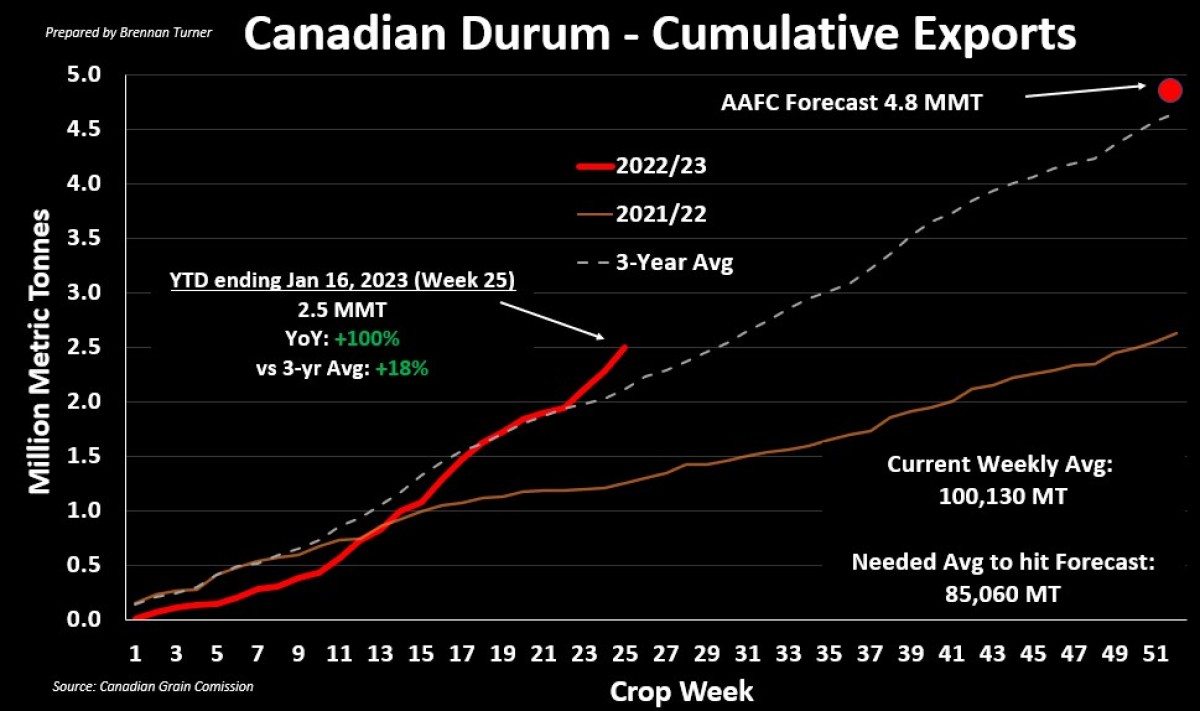

Canadian durum exports have also picked up steam over the last few weeks, thanks to limited supplies in Europe and North Africa, in addition to the U.S. importing what could be their largest program in 5 years at 1.22 MMT. While North American and European durum yield potential in 2023/24 looks to be promising, North Africa continues to be dry, and so it’s likely we’ll continue to see strong demand from the likes of Algeria, Tunisia, and especially Morocco. That said, with the current pace of Canadian durum exports, might ending stocks drop below the 500,000 MT that Agriculture Canada is currently forecasting? It’s certainly a possibility that a new record tight carryout (previous record is 499,000 MT, set in 1984/85) could help old crop durum prices and new crop values as well, given the current forecast from AAFC is for seeded acres to drop by nearly 6%, or 334,000 acres to 5.67M.

To growth,

Brennan Turner

Independent Market Analyst