The Ins and Outs of Shipping

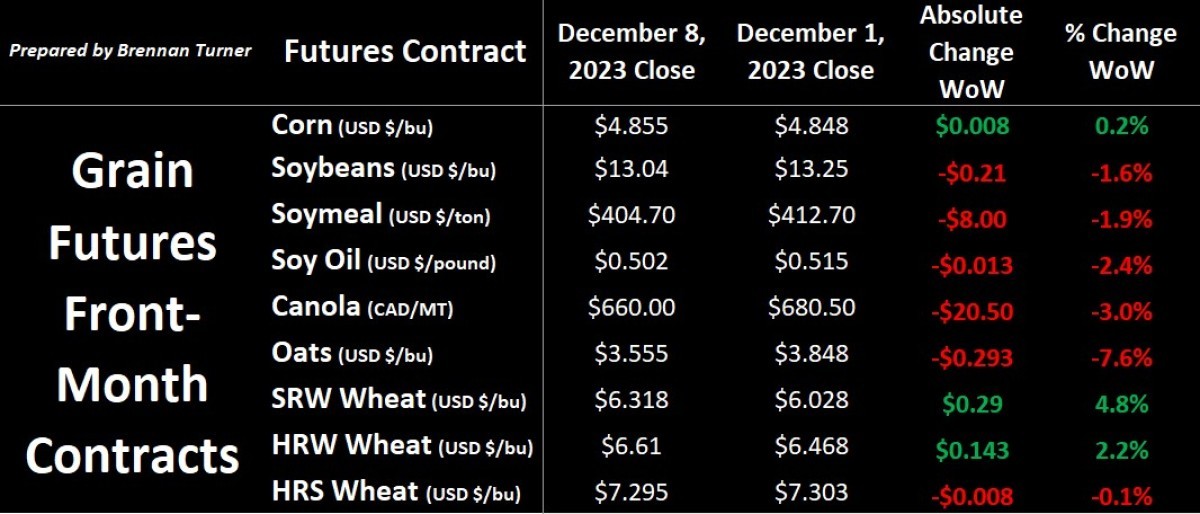

Grain markets faded to end the week after a neutral WASDE report from the USDA on Friday, but winter wheat futures boards were the big winners, thanks to the recent surge in international demand.

U.S. Wheat exports raised by 25M bushels in the most recent WASDE, a reflection of the 1.12 MMT of export sales booked last week, which, assuming there’s no cancellations, would be the first week since July 2022 that U.S. wheat exceeded more than 1 MMT in export sales. The USDA also increased U.S. Corn exports by 25M bushels, thanks to Mexico and China increasing their purchasing, which was likely supported by the U.S. Dollar falling a couple points over the past few weeks Overall, both wheat and corn saw their crop year ending stocks come in below expectations, which led to some short-covering and why they were the only crops to squeak out a green performance.

Going into the December WASDE, the market’s attention was focused south of the equator as the USDA doesn’t generally alter northern hemisphere production numbers until the final report in January. Despite Brazilian government agency, CONAB lowering their estimate for the country’s total corn crop to 118.5 MMT last week, the USDA left their forecast unchanged at 129 MMT, which likely points to a downgrade of some level by the USDA in their January report. They also left the Argentina corn harvest unchanged at 55 MMT but did lower their Brazilian soybean forecast by 2 MMT to 161 MMT (which would still beat the previous record set just last year at 160 MMT). Despite the buzz that weather issues still are impacting Brazilian and Argentine crops, there’s actually more talk that the USDA will raise U.S. Corn and soybean production in the January WASDE, setting up the potential for a washout of respective downgrades and upgrades between the two regions.

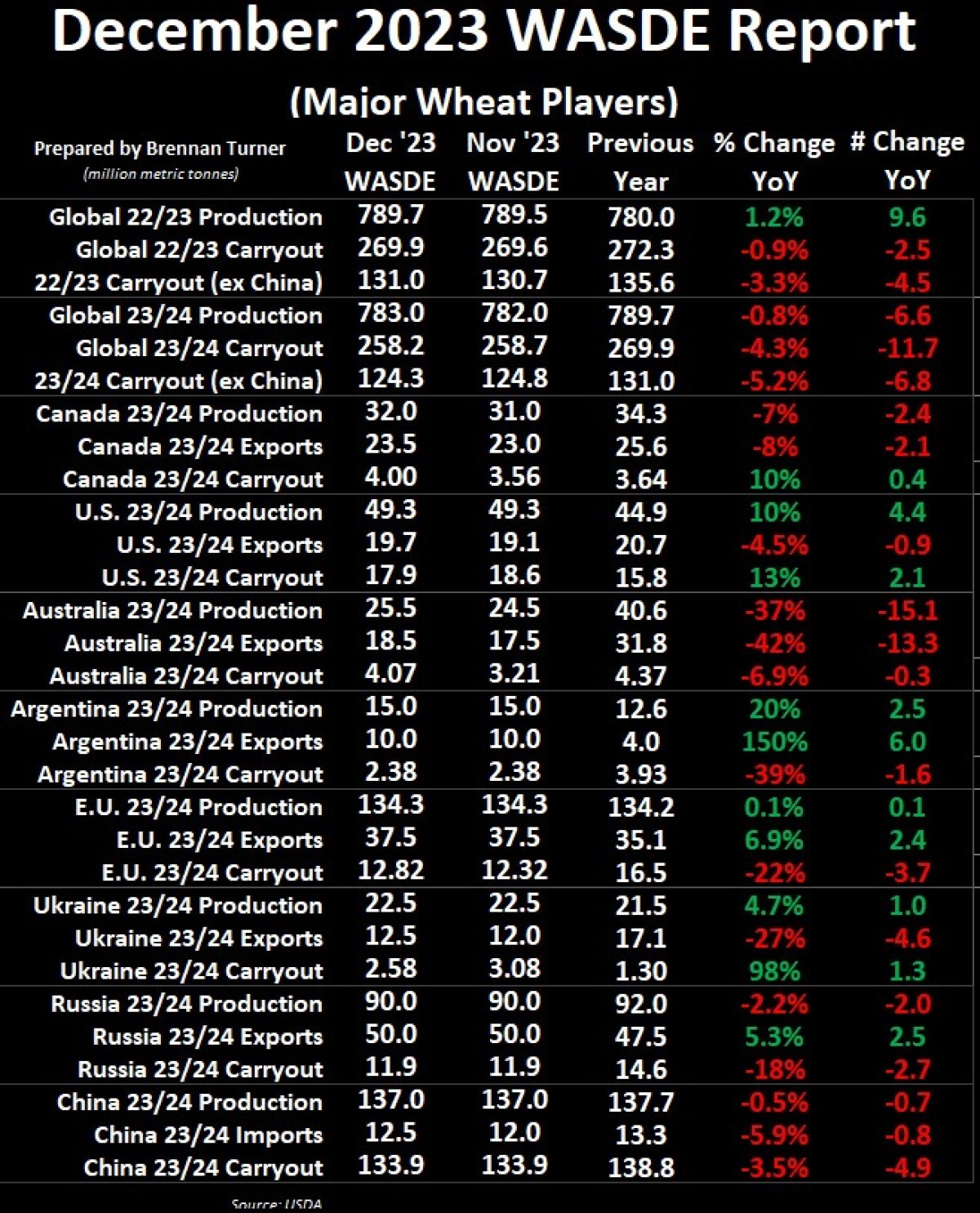

Coming back to the wheat balance sheet, the USDA raised Chinese wheat imports by 500,000 MT, which is largely a reflection of the quality issues with their own harvest. Given that U.S. Winter Wheat prices have fallen by about $1.50 USD/bushel in the last three months, China likely looked at what they were getting locally and chose to do some bargain buying. Theoretically, state-buying grain agencies from the People’s Republic might have looked elsewhere but there’s still lingering trade tension with Australia and everyone seems to be waiting to see what Argentina’s newly-elected libertarian President is going to do with their export tax.

Speaking of Australia though, their 2022/23 old crop wheat harvest was raised by 855,000 MT to a new record total of 40.55 MMT but exports were lowered by nearly the same amount. Combined with some other demand musical chairs, Aussie 2022/23 ending stocks were raised by over 800,000 MT, which just means this surplus supply gets carried over into the 2023/24 balance sheet. That table got updated, too, as Australia’s new crop wheat harvest also increased, this time by 1 MMT to a 25.5 MMT harvest, which matched the domestic estimate from local Aussie government forecaster ABARES from earlier in the week. However, the increase was entirely passed by the USDA into the export column, which was also increased by 1 MMT. Net-net, the Land Down Under saw their ending stocks still jump by nearly 860,000 MT month-over-month to now sit at just over 4 MMT.

Elsewhere, European Union wheat imports were raised by 1 MMT, but feed usage accounted for half of that increase in supply, meaning the bloc’s crop year carryout climbed higher by 500,000 MT month-over-month. Ukraine’s exports were raised by 12.5 MMT, a positive sign that grain is moving through the Black Sea, but the market remains acutely aware that this could change at any time and so some of this risk premium remains priced in.

The U.S. Wheat balance sheet didn’t change greatly, save for U.S. Soft Red Winter Wheat exports being raised by 30M bushels, reflecting the recent increase in buying. However, white wheat shipments were lowered by 5M bushels, accounting for the net 25M bushels / 680,000 MT increase in American wheat exports.

Overall, with global ending stocks falling by 500,000 MT to now sit at 258.2 MMT, this is the lowest since 2015/16. Here at home, the USDA raised total Canadian Wheat production by 1 MMT to 32 MMT, reflecting Statistics Canada’s own revision to nearly the same amount last week. They also increased exports by the same amount, pushing that up to 23.5 MMT, which we know will be entirely attributed to non-durum wheat, given its shipping season so far. Through 18 weeks, or the first 4 months of the 2023/24 crop year, non-durum Canadian Wheat exports have totaled just over 7.5 MMT, up 13% from the same time a year ago and 14% above the 3-year average. Moreover, the last two weeks (Week 17 and 18) have seen weekly shipments of over 600,000 MT, including last week’s 641,500 MT, the largest one-week total of Canadian non-durum wheat export since Week 40 in the 2019/20 crop year when 755,000 MT was exported in a single week. I think that Agriculture and Agri-Food Canada, in their update next week, will raise Canadian wheat exports from the current 18 MMT forecast to something around 18.8 MMT, and so with just under 2/3s of the crop year left, I’m confident we can hit the full-year target (even if the official estimate gets pushed even higher than mine).

-large-large.jpeg)

Overall, this WASDE Report showed ending stocks for some of the major wheat exporters grow, which is relative, given how much they’ve been falling the past few months. Next week, we’ll do a recap of what wheat prices have done for the 2023 calendar year before taking holiday break and returning in the first week of January with an outlook for the first half of 2024.

To growth,