The Ukraine Invasion: One Year Later

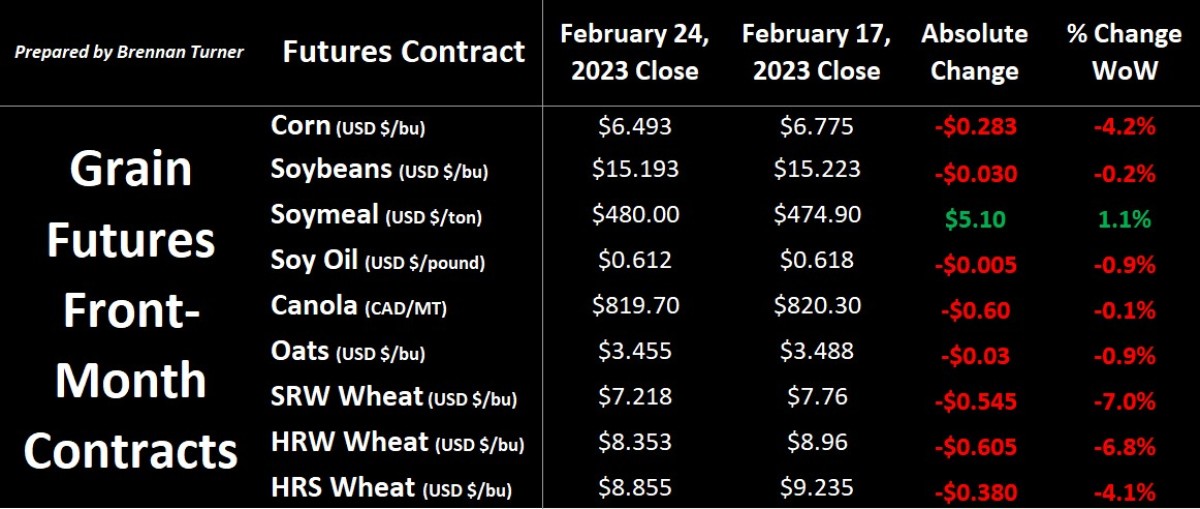

As we passed the one-year anniversary of Russia invading Ukraine, grain markets slid hard and fast last week as updated Plant 2023 acreage estimates from the USDA and March contracts and options expiring helped push the complex lower. Wheat markets took the biggest tumble as acreage estimates from the USDA Outlook Forum last week suggested 49.5M acres of American ground will be seeded with wheat for the 2023/2024 crop year, an increase of 3.8M acres, or 8.2% year-over-year and the largest area for the cereal since 2016/17. This also includes winter wheat acres up 11% year-over-year to 37M, the largest area since 2015/16 as, despite slow export demand, U.S. farmers are responding to the higher global prices amidst relatively tight supplies and the ongoing war in Ukraine. Also weighing on the wheat complex was Texas’ winter wheat good-to-excellent ratings climbing 3 points to 14%; we’ll get some other states’ winter wheat ratings this week with the end of the month.

Weighing on the broader grain complex, despite their harvest being relatively priced in, a lot of attention is still being given to Brazil but because last week it announced a case of BSE and would be suspending beef shipments to China. This in turn potentially opens the door for the People’s Republic to have to look to the US to meet its beef import needs. It’s worth noting that Brazil’s last mad cow disease event was in 2021, and like then, China closed its doors, but both then and this time around, the USDA has not suspended Brazilian beef shipments. Perhaps this is also the reason why, the USDA at their Outlook Forum last weekend, increased U.S. corn feed and residual use by 250M bushels, despite the fact that the American cattle herd is at a 50-year low?

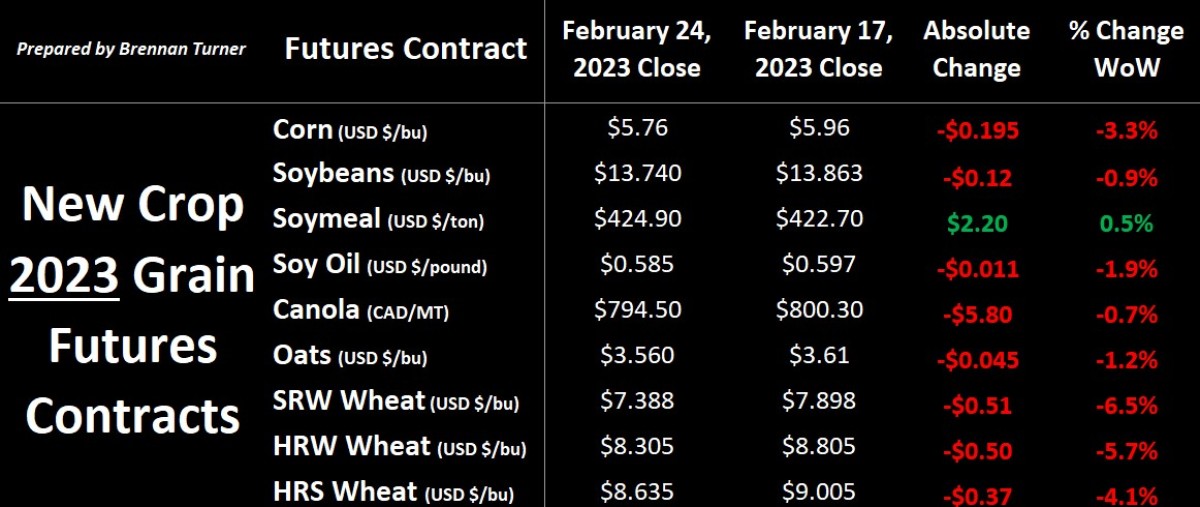

Digging into said USDA Outlook Forum numbers, the USDA said American farmers will plant 91M acres of corn, up 2.4M acres year-over-year with an average yield of 181.5 bu/ac. On the demand side, dropped corn-for-ethanol usage and kept exports fairly constant to produce a 2023/24 carryout of nearly 1.9 billion bushels. This would be an increase of 620M bushels, or nearly 50% year-over-year and at 13%, the highest stocks-to-use ratio since 2019/20. Soybeans acreage was unchanged at 87.5M acres, with an average yield of 52 bu/ac, but with the large Brazilian harvest coming online, average prices for the upcoming crop year were lowered by 10% year-over-year to $12.90 (which is 85¢ less than where new crop soybean futures are today).

All things being equal, the sell-off last week suggests that the more focus is starting to get put on Plant 2023, and not necessarily what trade and supply issues we have to deal with for the rest of the 2022/23 crop year. All the fund selling last week pushed Chicago wheat to a 4-week low, and pulled corn with it to a 6-week low, as traders are weighing the competition in the global grain marketplace, the aforementioned prospects for a decent Harvest 2023, and broader macroeconomic concerns (read: recession). Needless to say, the bullish sentiment felt a year ago as Russian tanks and troops crossed the border into Ukraine is seemingly starting to fade.

While there’ll likely be a day or two of fireworks before the current Grain Corridor deal in the Black sea is either renewed or reneged on in mid-March, currently, wheat prices are more than $2 USD per bushel lower than where they were a year ago when Russia tanks and troops crossed the border into Ukraine! While the impact on the global agricultural landscape has been significant, especially for sunflower, wheat, and corn, I think it’s important to remember that this war is still not over, and the toll has been very heavy (thanks to Iurii Mykhaylov on Agriculture.com for the reminder):

- More than 100,000 Ukrainian civilians, including 1,000s of children, have been killed;

- Over 5M Ukrainians became refugees and while most are now living somewhere in Europe, 80% want to return but will not have a house or apartment building to go back to;

- Inclusive of Ukraine’s harvest falling by over 40% year-over-year, Ukraine’s GDP dropped by over one-third in 2022;

- The total estimated losses by Ukrainian agribusinesses in Ukraine in 2022 is about $50 Billion USD, including about 6 MMT of grain stolen from occupied territories.

All the above in mind, and amidst calls for peace from even the likes of China, Russia military activities are expected to ramp up again, which could easily catapult the grain complex higher. Any delays in the renewal of the Grain Corridor deal could do the same – after all, about 200 ships are currently stalled at Ukrainian ports waiting for inspection, yet Russian grain vessels continue to move without delay. Nonetheless, if there are any more 30¢ - 50¢ one-day moves like we saw this past week in the grain markets, it’ll likely happen in the next few weeks, inclusive of the next WASDE report from the USDA published on Wednesday, March 8th.

To growth,

Brennan Turner

Independent Grain Market Analyst